Ether Eyes $3,900 as Whales Accelerate Buying Pressure

In a remarkable demonstration of bullish momentum, Ethereum’s native token, Ether (ETH), is making significant strides toward the $3,900 mark. This upward trajectory is primarily fueled by intensified buying pressure from cryptocurrency “whales,” who appear to be accumulating ETH at an accelerating rate.

Whales Lead the Charge

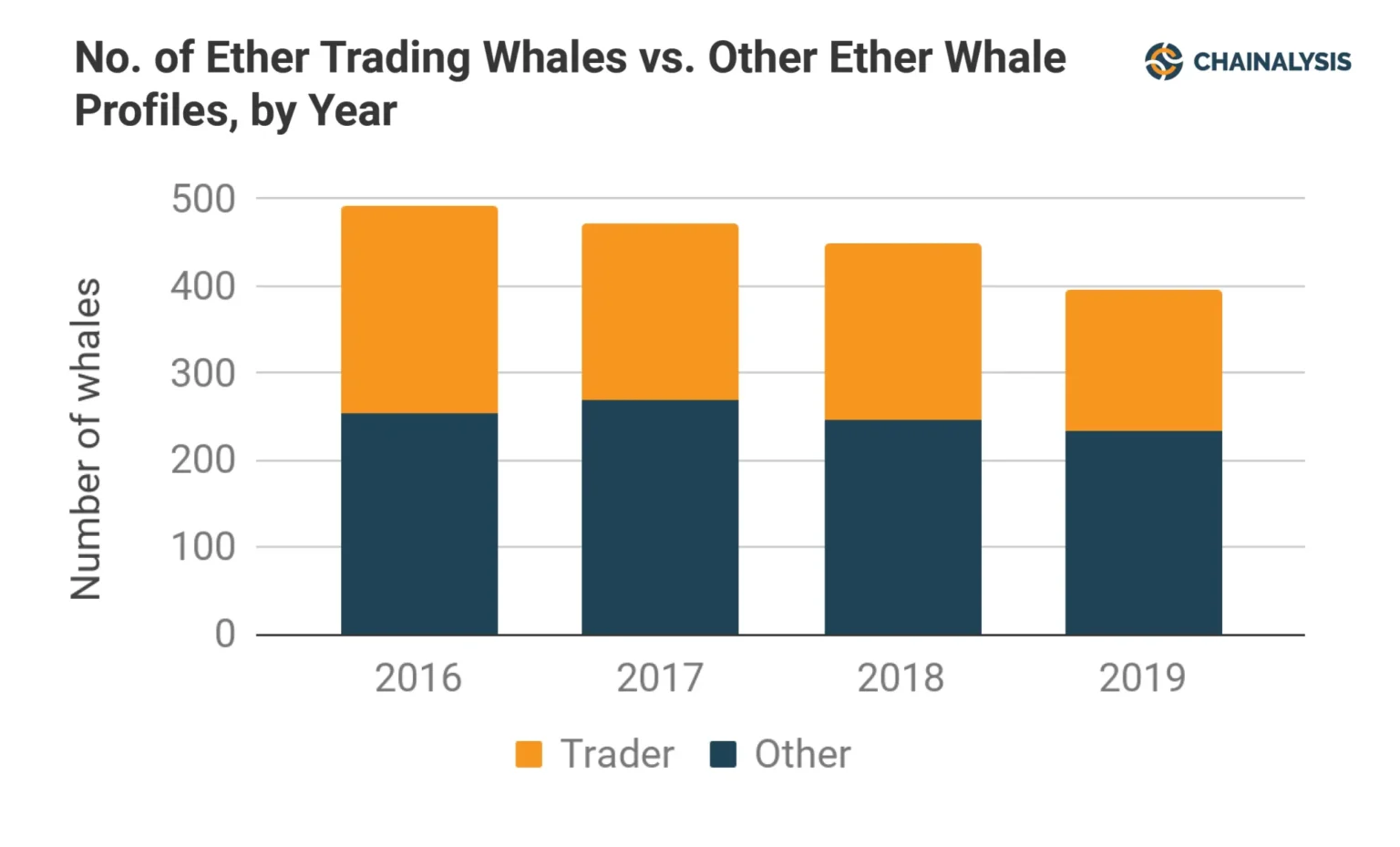

Cryptocurrency whales, typically defined as entities or individuals that hold a large amount of a particular cryptocurrency, have been notably active in the market. Recent blockchain data indicates a surge in the accumulation of Ether, specifically by addresses holding substantial amounts of this digital asset. These major players are perceived as market movers due to their potential to sway the price direction through large-scale transactions.

Market Dynamics

As of now, trading volumes and the influx of new market participants remain high, partly driven by broader economic indicators and the increasing perception of Ethereum as a durable investment amidst the flux of the broader crypto markets. Psychological factors are at play as well; the nearing of the $3,900 price level may trigger both excitement and apprehension among investors, potentially increasing market volatility.

The buying spree by these whales seems to suggest a strong confidence in the long-term prospects of Ethereum, especially considering the recent upgrades and the much-anticipated transition to Ethereum 2.0. These upgrades promise increased scalability, security, and sustainability, possibly making the network more attractive not only for investors but also for developers and end-users.

Implications of Whales’ Activities

The activities of whales can have mixed implications for average investors. On one hand, if whales are accumulating and not selling, it reduces the available supply, potentially driving the prices up if the demand remains constant or increases. On the other hand, large scale selloffs by these entities can lead to sudden price drops, affecting smaller investors adversely.

Ethereum 2.0: A Game Changer

A key factor playing into the current bullish sentiment around Ether is the ongoing development of Ethereum 2.0, which aims to transition the network from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. This shift not only aims to drastically reduce Ethereum’s environmental footprint but also significantly increase its transaction throughput via sharding.

The successful implementation of Ethereum 2.0 could solidify its position not just as a platform for decentralized applications (dApps) but also as a leader in the burgeoning field of decentralized finance (DeFi), which has already been a significant catalyst for Ethereum’s earlier price increases.

Looking Forward

Market analysts remain cautiously optimistic, keeping a keen eye on both technical indicators and fundamental developments. Some suggest that reaching and sustaining beyond $3,900 could open the gates for Ether to test even higher resistance levels. However, the cryptomarket is notoriously volatile, and influenced by factors ranging from regulatory news to technological advancements.

As Ethereum continues to evolve and attract attention from both large-scale investors and the broader public, it will be interesting to see how the interplay between technological advancements and market dynamics will shape its path forward in the competitive crypto landscape.