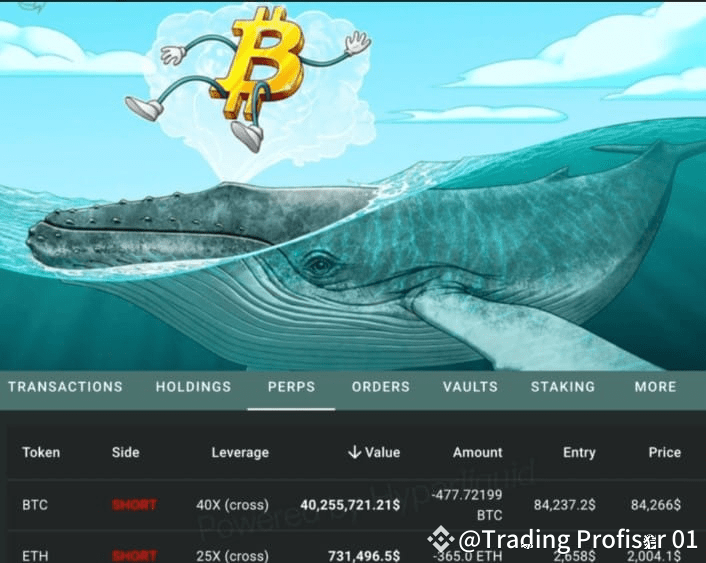

In the volatile world of cryptocurrency, a particular whale’s short position concerning Ethereum (ETH) is drawing significant attention. With 21,820.69 ETH in short contracts, the unrealized loss for this large holder has surged to an astonishing 1.244 million USD, raising concerns among traders and investors alike. The liquidation price, crucial for evaluating the risk of this position, stands at 3,496.31 USD. Recent insights from on-chain analysis highlight how this position could influence Ethereum price updates and the broader crypto market. As traders monitor the evolving landscape of crypto trading positions, understanding the implications of such significant whale short positions becomes increasingly vital.

The dynamics surrounding significant bets against Ethereum, often referred to as short positions, reveal crucial insights into market sentiment. A recent report showcased a prominent investor, or whale, holding 21,820.69 ETH which has plummeted substantially in value, leading to a considerable unrealized loss of over 1.2 million USD. This scenario underscores the importance of tracking liquidation prices, especially when they match the average opening price of 3,496.31 USD. Analysts frequently turn to on-chain data for a clearer picture of such trends, which are pivotal during Ethereum price analyses. As the market continues to fluctuate, the strategies employed by large holders will play a significant role in the future of crypto trading.

Understanding the Whale’s Short Position in Ethereum

In the world of crypto trading, understanding the dynamics of short positions is crucial for investors. A notable example is a whale’s short position of 21,820.69 ETH, which recently has escalated into an unrealized loss exceeding 1.244 million USD. This significant position highlights the volatility and risks associated with trading Ethereum, especially considering the ongoing fluctuations in its market value. With sharp price swings, traders need to be vigilant about their liquidation price, which in this case remains at 3,496.31 USD. If the Ethereum price surpasses this threshold, the whale could face forced liquidation, thereby amplifying potential losses.

The implications of a significant short position extend beyond individual trading strategies. It reflects market sentiment and can influence Ethereum’s overall price structure. As highlighted by the on-chain analysis carried out by Ai Yi, monitoring such positions can provide valuable insights into market trends and potential reversals. Traders should consider how whale movements—especially large short positions—might trigger bullish sentiments among retail investors or elicit bearish trends that affect Ethereum’s price trajectory.

Frequently Asked Questions

What is a whale short position in Ethereum trading?

A whale short position refers to a significantly large short position in a cryptocurrency, such as Ethereum. In this context, it indicates that a large holder, or ‘whale’, has borrowed ETH to sell at a price higher than the current market value, betting that the price will fall. This strategy can yield substantial profits if the price decreases, but it also comes with high risks, particularly regarding liquidation thresholds.

How does unrealized loss affect a whale short position in Ethereum?

Unrealized loss in a whale short position represents the potential loss that would occur if the position were closed at the current market price. For instance, if the whale’s short position of 21,820.69 ETH has an unrealized loss of 1.244 million USD, this means the current Ethereum price is above their average open price of 3,496.31 USD, indicating potential risk for liquidation if prices do not drop.

What is a liquidation price, and how does it relate to whale short positions?

The liquidation price is the price at which a trader’s position will be automatically closed by the exchange to prevent further losses. In the case of a whale short position, the liquidation price is critical, as it is set at 3,496.31 USD. If Ethereum’s price reaches this level, the whale’s position of 21,820.69 ETH could be forcibly liquidated, realizing their unrealized loss.

How can on-chain analysis provide insights into whale short positions?

On-chain analysis allows analysts to track and monitor large transactions and positions within the blockchain, providing insights into whale behaviors, including short positions. For example, on January 2, 2026, on-chain analyst Ai Yi reported the growth of a whale short position in Ethereum, detailing its unrealized loss and liquidation conditions, which can inform traders about market movements and potential risks.

What factors should traders consider when monitoring Ethereum price updates related to whale short positions?

When monitoring Ethereum price updates, traders should pay attention to whale short positions, such as unrealized losses and liquidation prices, as these can significantly impact market sentiment. For instance, a whale’s increasing unrealized loss or proximity to liquidation may indicate broader market trends or potential volatility in the Ethereum price.

Why is understanding unrealized loss important for traders with whale short positions?

Understanding unrealized loss is crucial for traders in whale short positions because it helps assess potential market risks and future price movements. For example, a whale holding a short position of 21,820.69 ETH facing a high unrealized loss of 1.244 million USD must be aware of the implications on their trading strategy, including the risk of liquidation if Ethereum prices rise.

What strategies can whales use to manage risks associated with their short positions in Ethereum?

Whales can manage risks associated with their short positions in Ethereum by employing several strategies, such as setting stop-loss orders to protect against unexpected price spikes, diversifying their positions, and conducting thorough on-chain analysis to track market trends. By doing so, they can mitigate potential liquidations and reduce the impact of unrealized losses.

| Key Point | Details |

|---|---|

| Whale’s Short Position | 21,820.69 ETH |

| Unrealized Loss | 1.244 million USD |

| Liquidation Price | 3,496.31 USD |

| Average Opening Price | 3,496.31 USD |

| Date of Report | January 2, 2026, 15:18 |

Summary

The whale short position refers to a significant bet taken against the price of Ethereum (ETH), which in this instance totals 21,820.69 ETH. The current status reveals an increasing unrealized loss of 1.244 million USD, indicating heightened risk for the investor involved. As of January 2, 2026, the liquidation price remains critical at 3,496.31 USD, coinciding with the average opening price. This situation highlights the volatility of the cryptocurrency market and underscores the risks associated with such substantial short positions.