In the world of cryptocurrency trading, a notable player known as a “whale” has made headlines with a significant short position worth $109 million. This strategy highlights the risk and reward dynamic that defines the volatile market, especially when one considers the whale’s current unrealized loss of over $1.8 million. By employing a 10x leverage on 751.38 Bitcoin and a 15x leverage on 12,909.15 Ethereum, this whale is betting against the market, potentially capitalizing on an anticipated decline in prices. Such moves not only reflect individual strategies but also indicate broader market sentiments, influencing how others in the community respond. Understanding the implications of whale short positions can provide crucial insights for traders looking to navigate the currents of cryptocurrency markets successfully.

In financial circles, particularly in cryptocurrency investing, the actions of large holders or major investors—often referred to as ‘whales’—are closely monitored. One such whale has recently escalated their bearish stance by increasing their short position significantly, now totaling $109 million. This move involves leveraging substantial amounts of Bitcoin and Ethereum, raising questions about future price trends. The losses currently unrealized stand at over $1.8 million, which can serve as a cautionary tale for smaller investors. By analyzing these high-stakes decisions, market participants can better understand the landscape and adjust their strategies accordingly.

Understanding Whale Short Positions in Cryptocurrency Trading

In the realm of cryptocurrency trading, a whale is typically defined as an individual or entity that holds a large amount of digital assets. These players have the capacity to influence market dynamics significantly, particularly when it comes to trading strategies such as short selling. A whale’s short position can indicate a bearish sentiment about the market or specific cryptocurrencies, as seen in the case of this particular whale who holds a short position of $109 million.

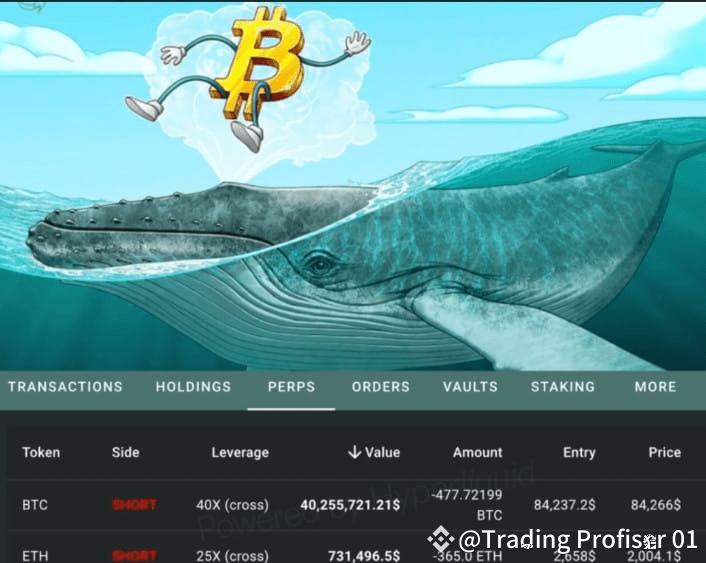

This whale’s strategy is notably aggressive, utilizing 10x leverage on a substantial short of Bitcoin (BTC) and 15x leverage on Ethereum (ETH). Such leveraged positions amplify both gains and losses, presenting a high-stakes environment where the whale’s unrealized loss exceeds $1.8 million. Such figures prompt other investors to analyze their own positions and consider the larger implications of massive short positions within the cryptocurrency ecosystem.

The Mechanics of Leverage in Cryptocurrency Shorts

Leveraging in cryptocurrency trading allows investors to control larger positions than their available capital would ordinarily permit. The whale in question exemplifies this with a 10x leveraged short position of 751.38 BTC and a 15x leveraged short of 12,909.15 ETH. While leverage can enhance profitability, it also increases exposure to risk, which is reflected in the whale’s current unrealized loss of over $1.8 million. Understanding the mechanics behind such leveraged positions is essential for anyone engaged in crypto trading.

Utilizing leverage effectively requires a comprehensive grasp of market movements and risk management strategies. In a volatile market like that of Bitcoin and Ethereum, leveraged trading can quickly turn against the investor, as it does for this whale when price fluctuations lead to significant unrealized losses. As such, traders must remain vigilant and informed about market trends and indicators to safeguard against excessive risk.

The Impact of Unrealized Loss on Whale Trading Strategies

When it comes to trading cryptocurrencies, unrealized losses can pose a significant psychological and strategic challenge for investors, especially for whales holding large positions. The current situation for the whale with a short position valued at $109 million, and an unrealized loss of over $1.8 million, exemplifies how adverse market movements can impact confidence and decision-making. Unrealized losses do not reflect a realized loss until the positions are closed, but they can influence trading behavior significantly.

Given the volatility characteristic of cryptocurrencies such as Bitcoin and Ethereum, this whale’s unrealized losses may affect future trading strategies. Some traders might choose to double down on their position, anticipating future price corrections, while others might exit their positions entirely to mitigate further losses. The decision-making process of whales can provide critical signals to the broader market, mirroring the anxiety or confidence of other investors.

Market Reactions to Whale Short Positions

The actions of whales in the cryptocurrency market often have a ripple effect that influences the sentiment and trading decisions of smaller investors. When a whale increases its short position, as this one has with $109 million currently in open shorts, it can lead to speculation regarding the overall market trend, often resulting in a bearish outlook among retail traders. Their decisions may be swayed by observing such significant whale activity, as they may fear further price drops.

Conversely, whales can also serve as market stabilizers; should they begin to close their positions or shift towards long positions, it may indicate a bullish market shift. The current situation with an unrealized loss could motivate this whale to reassess their strategy, which, in turn, could provoke market reactions either through further selling pressure or potential buying activities, depending on how market sentiment evolves.

Short Selling: Risks and Rewards in the Crypto Market

Short selling in the cryptocurrency market presents both significant opportunities for profit and substantial risks. In the case of the whale holding a $109 million short position on Bitcoin and Ethereum, the potential for profit is tied to their ability to predict market downturns effectively. However, the current unrealized loss exceeding $1.8 million serves as a stark reminder of the risks associated with betting against a volatile market.

For many traders, particularly those employing high leverage, the challenge lies in balancing potential gains against the rapid market movements that can occur in cryptocurrencies. Effective risk management strategies are imperative to navigate the complexities of short selling, as one wrong market movement can lead to devastating losses. The dual nature of potential rewards and risks makes short selling a complicated yet alluring strategy for traders in the cryptocurrency landscape.

Analyzing the Whale’s Market Influence

Whales possess the power to shape the market dynamics through their trading behavior, and this is especially true when they engage in short selling. The case of this whale, with a short position of $109 million and an unrealized loss of over $1.8 million, raises important questions about market responsiveness and volatility. Other investors often monitor the actions of whales as indicators of market trends, which can lead to reactive trading behaviors among retail investors.

Market analysts often study whale transactions and positioning to gain insights into future movements. For instance, the whale’s increased short could signal declining confidence in certain assets or may indicate broader market trends, prompting a reevaluation of portfolio strategies among other traders. The interconnectedness of whale activities with market dynamics illustrates the complex relationship between large-scale trading and market psychology.

Strategies for Retail Traders Observing Whale Positions

For retail traders, understanding whale activity is crucial in forming effective trading strategies. As seen with this whale’s short positioning and its associated unrealized loss, the decisions of large investors often have significant implications for market sentiment. Retail traders can leverage this information to adjust their strategies, opting to align with or counteract the trends set forth by whale activity. Keeping a close eye on whale movements can thus provide strategic entries and exits for smaller traders.

Moreover, implementing risk management and analysis techniques can help retail traders mitigate potential losses that may arise from following whale trends. Utilizing tools such as stop-loss orders, diversifying portfolios, and employing conservative leverage can ensure that traders maintain their capital while navigating the unforeseen fluctuations often spurred by whale activities. Understanding the nuances of whale short positions can enhance retail traders’ ability to participate effectively in the volatile cryptocurrency market.

The Future of Cryptocurrency Trading with Whale Influence

As cryptocurrency trading continues to evolve, the influence of whale activity will likely remain a key factor shaping market dynamics. Observers noted that with major players like the whale holding a $109 million short position, the cryptocurrency market exhibits characteristics of both traditional financial markets and unique behaviors intrinsic to the crypto environment. The potential for quick gains and losses, amplified by factors such as leverage and speculative trading, will continue to drive interest and volatility in this space.

Additionally, increased regulatory attention surrounding cryptocurrencies may affect how whales and retail investors engage with the market. As legislation evolves, whales may adjust their trading strategies and influence the market in new and unforeseen ways. The interplay between large investors and smaller market participants will define the future landscape of cryptocurrency trading, with whale behavior remaining a focal point for risk assessment and investment strategies.

Frequently Asked Questions

What is a whale short position in cryptocurrency trading?

A whale short position refers to the significant amount of cryptocurrency a large investor or ‘whale’ bets against, expecting the price to decline. For example, recent data shows a whale holding a $109 million short position, indicating a substantial bearish outlook on the market.

How does a whale short position affect the market?

A whale short position can significantly impact the market, particularly when substantial amounts are involved, like the $109 million short position held by one whale in Bitcoin and Ethereum. Such positions can trigger fear and influence selling pressure among smaller investors.

What are the risks associated with holding a whale short position?

Holding a whale short position carries risks like potential price surges, which could lead to significant unrealized losses. For instance, the whale mentioned has already incurred an unrealized loss of over $1.8 million, highlighting the volatility of cryptocurrency trading.

What does it mean to take a 10x leverage on a whale short position?

Taking a 10x leverage on a whale short position means that the investor borrows funds to short sell ten times their capital. In this case, the whale has a 10x leveraged short of 751.38 BTC, significantly amplifying both potential gains and losses.

Are short positions common in cryptocurrency trading?

Yes, short positions, including whale short positions, are common in cryptocurrency trading as they allow traders to profit from falling prices. However, they require a good understanding of market movements and risk management, especially considering the potential for rapid price increases.

What does an unrealized loss indicate for a whale short position?

An unrealized loss indicates that the current market value of the assets in a short position is higher than the entry price. For instance, the whale’s unrealized loss of over $1.8 million suggests that the market is not moving in their favor, impacting their investment valuation.

How do whales decide to increase their short position in volatile markets?

Whales increase their short position in volatile markets based on market analysis, sentiment, and trading indicators. The whale’s decision to increase its $109 million short position likely reflects a bearish outlook on Bitcoin and Ethereum, as indicated by current market trends.

What is the significance of the particular whale 0x94d…3814 in current market analyses?

The whale 0x94d…3814 is significant in current market analyses due to its large short position of $109 million, reflecting a strong bet against the market. Their activities can serve as a signal for trends in cryptocurrency trading, especially regarding Bitcoin and Ethereum short strategies.

How can small traders learn from whale short positions?

Small traders can learn from whale short positions by analyzing the market activity and trends that influence these larger positions. Observing moves like the whale’s $109 million short position can provide insights into potential market downturns and offer lessons on risk management and strategy.

What strategies can be implemented alongside a whale short position?

Strategies alongside a whale short position may include using stop-loss orders, diversifying investments, and closely monitoring market conditions. For instance, understanding the implications of the current $1.8 million unrealized loss can guide future trading decisions and risk assessments.

| Key Points |

|---|

| Whale Wallet Address: 0x94d…3814 |

| Current Short Position Value: $109 million |

| 10x Leveraged Short: 751.38 BTC worth $68.67 million |

| 15x Leveraged Short: 12,909.15 ETH worth $40.79 million |

| Current Unrealized Loss: Over $1.8 million |

Summary

The whale short position reveals significant trading activity, highlighting the risks associated with leveraged investments. As of now, the whale’s strategy has resulted in an unrealized loss that amounts to over $1.8 million, underscoring the volatile nature of the market. With a total short position valued at $109 million, the whale is betting against the market with substantial leverage. This scenario reflects a cautious yet aggressive stance in the current crypto landscape.

Related: More from Market Analysis | Kaspa KAS Price Forecast: Why $0.03 Crucial for Bulls | Barclays Looks at Blockchain for Payments, Deposits