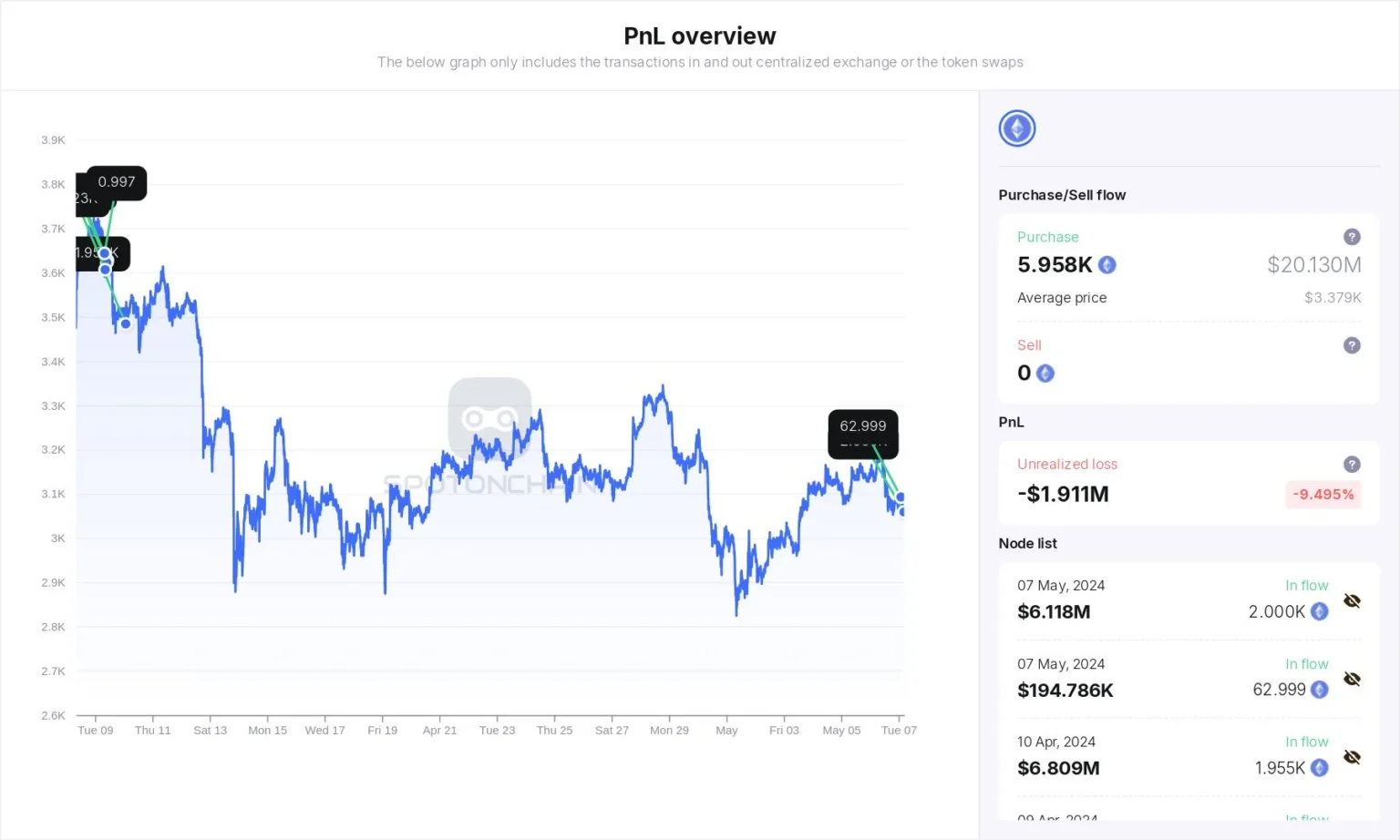

A whale invested in both Ethereum and XRP is currently facing an unrealized loss amounting to $21.5 million. This substantial loss highlights the volatility and unpredictable nature of cryptocurrency investments. The terms “unrealized loss” refer to the potential losses that have not yet been crystallized through the sale of the assets. Until the whale decides to sell their holdings, the loss remains on paper.

The cryptocurrency market can fluctuate significantly, leading to sharp rises and falls in asset values. This has been especially true for Ethereum and XRP, which have experienced various price shifts recently. Investors often hold onto their digital assets, hoping for market recoveries that might offset such losses.

For this whale, the current situation underscores the risks involved in cryptocurrency trading. Holding onto assets during market downturns can result in steep losses, yet many investors choose to retain their positions in anticipation of future price increases. This strategy is part of a broader investment approach that some investors adopt in high-risk markets.

While the whale’s current position appears challenging, the cryptocurrency landscape is known for its changing dynamics, and market conditions may improve. Investors are continuously evaluating their strategies in light of market performance to protect against further losses or find opportunities for gains.