Weekly Technical Outlook – USDJPY, EURUSD, AUDUSD

As we enter a new trading week, investors and traders alike are keenly monitoring the technical outlook for major currency pairs including USDJPY, EURUSD, and AUDUSD. Each pair tells a different story of macroeconomic influences, central bank policies, and market sentiment. This article provides a deeper insight into the potential price movements based on the recent technical setups.

USDJPY: Consolidating with an Upside Bias

The USDJPY pair has been showcasing a consolidation phase after a significant uptrend, primarily driven by the divergence in monetary policies between the U.S. Federal Reserve and the Bank of Japan. As of the latest, the pair is navigating around the 139-140 zone. The support seems firm at 138.50, a level confirmed by the upward trend line from previous weeks.

On the upside, resistance is apparent near the 141.00 mark, a breakout of which could extend the bullish momentum towards 142.50. On the chart, the 50-day Moving Average (MA) is maintaining above the 200-day MA, indicating a continued bullish trend. However, traders should watch for the Relative Strength Index (RSI) hovering near 70, which could suggest potential overbought conditions that might slow the ascent.

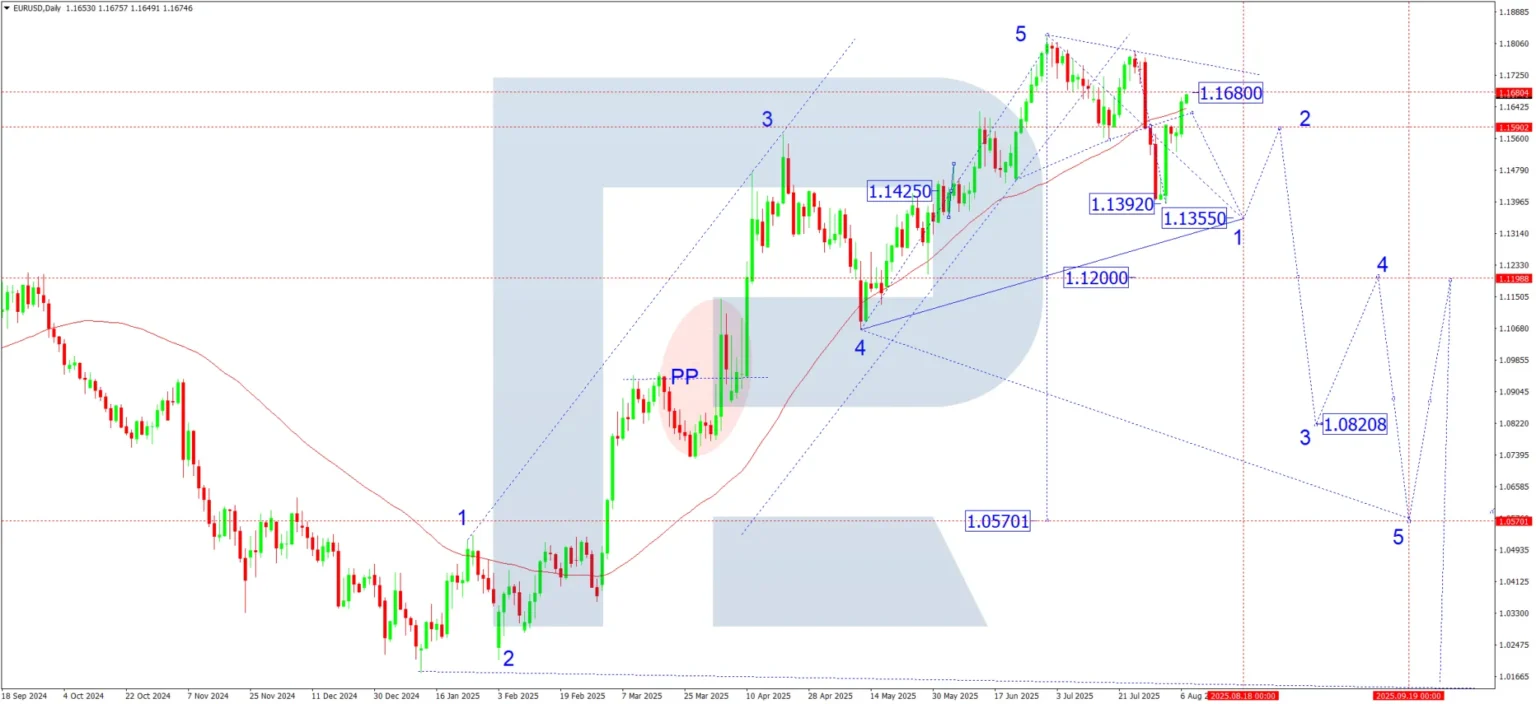

EURUSD: Testing Key Support Levels

EURUSD has faced considerable downward pressure, mainly due to the stronger dollar and ongoing concerns about economic recovery in the Eurozone. Currently, the pair is testing the crucial support level at 1.0800. A breach below this could lead to a further drop towards the 1.0700 or even 1.0650 levels in the forthcoming sessions.

The technical indicators, including MACD and RSI, are leaning towards bearish signals with the MACD line below the signal line and RSI just around 40, indicating a potential continuation of the downward trend. Resistance is seen at 1.0920 and 1.1000, which previously acted as key psychological levels. A break above these could prompt a corrective rally towards 1.1100.

AUDUSD: Bullish Reversal on the Cards?

AUDUSD presents a slightly more optimistic picture compared to the previous weeks. After reaching lows around 0.6380, the pair witnessed a slight rebound, pushing towards the resistance at 0.6500. The Australian dollar’s resilience could be attributed to the stabilization of commodity prices and a dovish tone from the US Federal Reserve hinting at slowing rate hikes.

If the pair breaks above the 0.6500 level, the next target could be set at 0.6580 which aligns closely with the 100-day MA. On the flip side, should the rebound falter, the support at 0.6400 holds critical importance. The MACD histogram shows decreasing negative momentum, and an upward cross in MACD lines could suggest that the bulls are gradually gaining ground.

Conclusion

The technical analysis for USDJPY, EURUSD, and AUDUSD elucidates varied dynamics and potential trade setups based on recent price actions and indicators. As always, while technical setups can provide valuable insights, they should be complemented with proper risk management and an awareness of upcoming economic events that could significantly impact market volatility and currency valuations. Investors should keep an eye on central bank announcements and economic indicators from the respective economies to better gauge the potential direction of these currency pairs.