In the volatile world of cryptocurrency, recent news surrounding WBTC liquidation has captured the attention of traders and analysts alike. A notable large holder has liquidated another 100 units, highlighting the risks involved in the cryptocurrency market. With this transaction, the total unrealized loss for the holder now stands at an alarming 30.91 million dollars. The on-chain data reveals that this selling activity took place at an average price of $91,333.4, resulting in additional crypto trading losses of approximately 2.517 million dollars. As WBTC price analysis continues to evolve, the implications for the broader Ethereum liquidation atmosphere remain significant for investors seeking to navigate these turbulent waters.

The recent developments involving the liquidation of Wrapped Bitcoin (WBTC) reflect the intense fluctuations within the digital asset space. Significant movements by major holders can lead to sweeping changes in market sentiment, affecting not only WBTC but also associated cryptocurrencies. This scenario highlights the necessity for traders to stay attuned to market indicators and on-chain activity, especially during periods of heightened volatility. As the landscape continues to shift, the analysis of WBTC trading positions and associated losses is crucial for understanding broader market trends. Such insights serve as valuable tools for anyone involved in crypto trading, especially as traders adapt to the complexities of Ethereum-related investments.

Understanding WBTC Liquidation and Market Implications

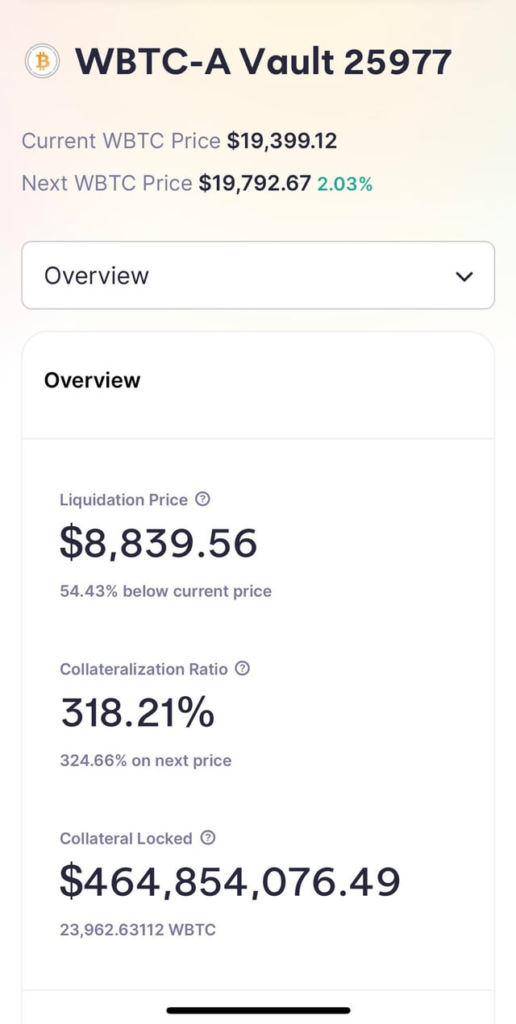

WBTC liquidation has become a significant talking point in the cryptocurrency market, especially as large holders adjust their positions amidst price volatility. Recently, a major WBTC address liquidated another 100 units at a considerable loss, which is indicative of broader trends affecting crypto assets. Liquidation events like these not only reflect individual trading strategies but also impact overall market sentiment and can lead to further price fluctuations.

On-chain data reveals that liquidations typically occur when large holders seek to cap their losses, suggesting that continued instability in the WBTC price may create fear among investors. With the current economic landscape affecting cryptocurrencies, traders must assess their risk tolerance and the potential for crypto trading losses, especially in light of recent events involving substantial liquidations.

Frequently Asked Questions

What does WBTC liquidation mean in the cryptocurrency market?

WBTC liquidation refers to the forced sale of Wrapped Bitcoin (WBTC) by holders when they can no longer maintain their positions, often due to significant price drops. In the context of the cryptocurrency market, this process can exacerbate price declines, potentially leading to further losses for investors.

How do recent WBTC liquidation events affect WBTC price analysis?

Recent WBTC liquidation events provide valuable insights for WBTC price analysis, as they indicate market sentiment and trading behavior among large holders. Analysts use on-chain data to assess how these liquidations impact overall price movements and the potential for future volatility.

What are the implications of WBTC liquidation on crypto trading losses?

When large amounts of WBTC are liquidated, it can lead to increased crypto trading losses among investors still holding the asset. These liquidations can trigger panic selling, resulting in a downward spiral in prices and heightening the risks associated with WBTC trading.

How does WBTC liquidation relate to Ethereum liquidation trends?

WBTC liquidation and Ethereum liquidation trends are interconnected as both involve the selling of substantial crypto assets during bearish market conditions. As traders liquidate WBTC, it may lead to a chain reaction affecting Ethereum values, given the interdependence of various cryptocurrencies in trading volumes and market sentiment.

How can on-chain data help identify WBTC liquidation risks?

On-chain data is crucial for identifying WBTC liquidation risks, as it provides transparent transaction records and wallet activities. By analyzing on-chain metrics, traders can gauge the selling pressure from large holders and anticipate potential liquidation events that may impact the WBTC market.

What should investors consider during WBTC liquidation scenarios?

During WBTC liquidation scenarios, investors should consider the overall market conditions, the reasons behind large sell-offs, and potential recovery patterns. Understanding the motivations and on-chain data related to WBTC liquidations can help investors make informed decisions and potentially mitigate risks.

How do large holder liquidations influence the overall WBTC market sentiment?

Large holder liquidations significantly influence overall WBTC market sentiment by heightening fear and uncertainty. When prominent investors liquidate their positions at a loss, it can signal a lack of confidence in the asset, prompting other investors to reassess their holdings and possibly lead to more liquidations.

| Key Point | Details |

|---|---|

| Large Holder Liquidation | Another 100 units of WBTC liquidated at a loss. |

| Total Unrealized Loss | Approximately 30.91 million dollars. |

| Amount Liquidated | The address sold 100 WBTC for approximately 9.13 million dollars. |

| Average Sale Price | Sold at an average price of $91,333.4. |

| Previous Losses | Previously sold 17,497 ETH incurring a loss of 18.4 million dollars. |

| Current Holdings | Now holds 1,210 WBTC valued at approximately 11 million dollars. |

Summary

WBTC liquidation has become a significant concern as large holders continue to face substantial financial losses. The most recent liquidation of 100 units by a significant investor at a loss exemplifies the volatility within the crypto market. With the current unrealized losses reaching approximately 30.91 million dollars, it highlights the risks associated with investing in Wrapped Bitcoin. Investors should remain cautious as the market fluctuates, and monitor large transactions closely.