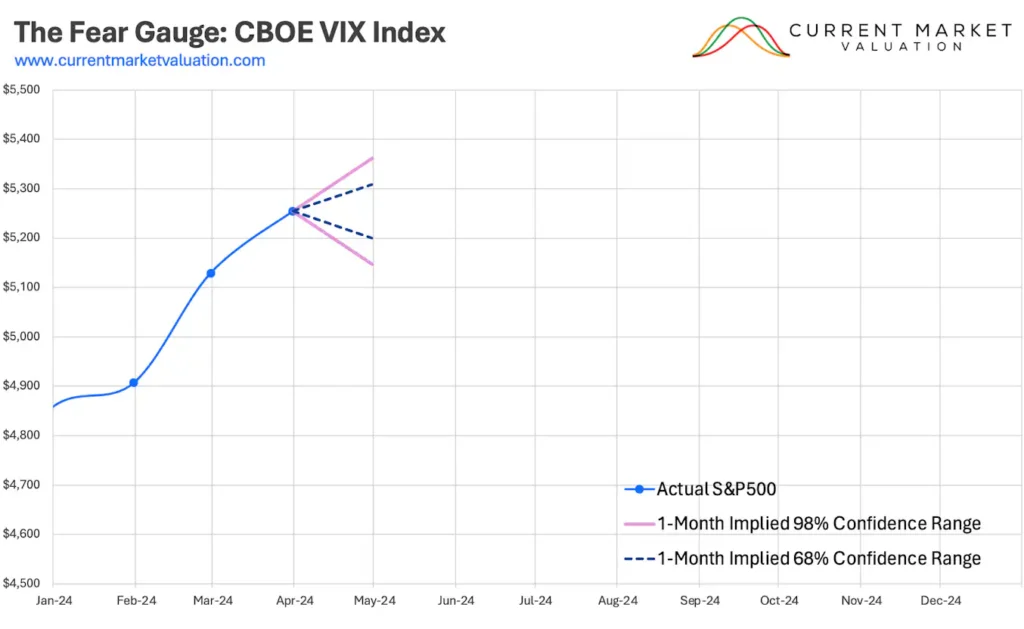

The VIX fear index increased significantly, reaching a nearly two-week high as it gained 2.4 points, rising to 19.61 points during intraday trading. This movement reflects heightened market volatility and investor sentiment. The VIX, often viewed as a gauge of market fear, indicates the level of expected volatility in the stock market. A rise in the index typically suggests that investors are anticipating greater fluctuations in stock prices. Monitoring the VIX can provide insights into market dynamics and investor behavior.

This update was auto-syndicated to Bpaynews from real-time sources. It was normalized for clarity, SEO and Google News compatibility.