Venezuela gold reserves are a pivotal asset in the nation’s economic landscape, showcasing a notable 161 tons in total. As the holder of the largest gold holdings in Latin America, Venezuela’s gold reserves have garnered attention amid ongoing economic challenges. According to a recent Whales Insider report, these precious metals play a crucial role in stabilizing the Venezuela economy during turbulent times. The strategic importance of these gold reserves in Venezuela cannot be overstated, as they offer potential leverage in international markets. With growing interest in gold reserves in Venezuela, investors are keenly observing developments that could impact Latin America’s gold dynamics.

The gold assets of Venezuela, often referred to as the nation’s gold hoard, represent a significant factor in its financial framework. Holding a substantial quantity puts Venezuela at the forefront of Latin America’s gold sphere, attracting global attention. Recent insights from Whales Insider highlight how these gold assets can influence the overall economic strategies employed by the government. Discussions surrounding Venezuela’s precious metal holdings reflect deeper financial intricacies that underline the importance of resources like gold in economic recovery. As the nation navigates through its economic landscape, the implications of having rich gold reserves continue to resonate within both local and international contexts.

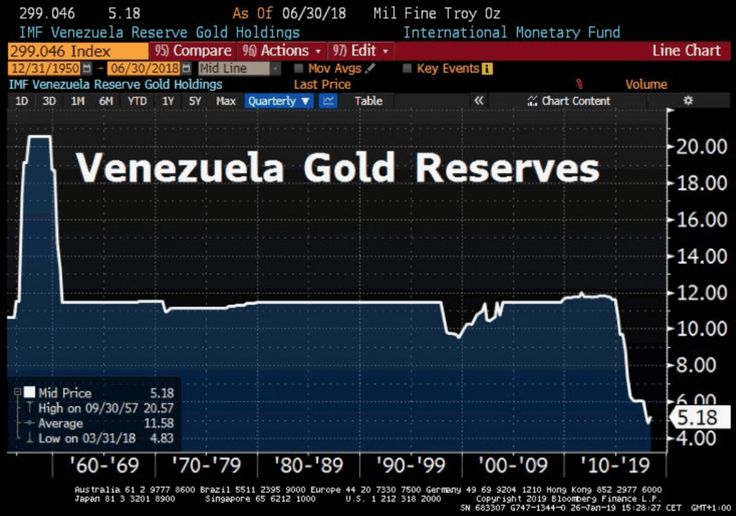

Overview of Venezuela’s Gold Reserves

Venezuela stands as a leader in gold reserves in Latin America, boasting an impressive total of 161 tons. This significant amount of gold not only highlights the nation’s potential for wealth but also showcases its strategic position in the global gold market. As the country grapples with economic challenges, the gold holdings become a vital asset, symbolizing both resilience and the potential pathway towards financial recovery.

The value of Venezuela’s gold reserves is accentuated by the global demand for gold, particularly in times of economic uncertainty. This reality is reflected in the growing interest in Latin America’s gold, with many speculators and investors turning their eyes to the region. Thus, Venezuela’s gold reserves not only serve local interests but also attract international attention seeking safe-haven assets.

Impact of Gold Reserves on the Venezuelan Economy

Gold reserves play a crucial role in stabilizing the Venezuelan economy amidst various crises. As inflation skyrockets and traditional revenue sources dwindle, the government aims to leverage its gold holdings to secure loans and international partnerships. This move not only aids in enhancing the nation’s overall economic framework but potentially restores investor confidence in the country’s fiscal policies.

Additionally, the extraction and management of gold reserves in Venezuela have significant implications for employment and local communities. By focusing on gold mining, the government could generate jobs and boost local economies, creating a ripple effect that supports business ventures related to gold trade and utilities.

Venezuela’s Position in the Global Gold Market

Venezuela’s gold reserves position it strategically in the global gold market, where Latin America is increasingly perceived as a vital player. According to the Whales Insider report, the growing interest from international markets underscores the potential for Venezuela to become a key contributor to global gold supply chains. The strategic management and auctioning of its holdings could lead to more significant revenue inflows, essential for the nation’s recovery efforts.

As global demand for gold surges, especially due to geopolitical tensions and economic instability, Venezuela could capitalize on its robust quantities of gold. This situation might encourage foreign investments and partnerships, enriching both the mining industry and the broader economic landscape within the region.

The Role of Gold in Venezuela’s Economic Strategy

Integrating gold into Venezuela’s economic strategy can serve multiple functions: it acts as a safeguard against hyperinflation, attracts foreign investments, and provides a solid base for international trade agreements. The country’s proactive approach to utilizing its gold reserves could reshape policies that have historically favored petroleum production over diverse resource management.

Moreover, the government’s focus on gold as a national asset reflects a shift in economic philosophy, potentially marking a new era in resource management. By fostering relationships with foreign investors, Venezuela could build crucial economic links that also promote technological advancements in gold extraction and processing.

Challenges Facing Venezuela’s Gold Sector

Despite its rich gold reserves, Venezuela faces significant challenges that threaten the potential of this vital sector. Issues such as corruption, outdated mining practices, and environmental concerns hinder effective management of gold resources. Addressing these challenges is critical to ensuring that the nation can fully utilize its gold reserves to boost economic stability.

Additionally, international sanctions aimed at the government complicate the scenario by limiting foreign investment and technology transfer necessary for modernizing the gold industry. These obstacles underscore the need for comprehensive reforms that not only prioritize efficient gold extraction but also emphasize sustainable practices.

The Future of Venezuela’s Gold Industry

Looking forward, the future of Venezuela’s gold industry hinges upon strategic reforms and international cooperation. If the government can navigate the complexities of sanctions and corruption while embracing sustainable mining practices, the gold industry could significantly contribute to revitalizing the economy. This transformation could enhance the country’s competitiveness in the Latin American gold market.

In the long run, incorporating innovative technologies and methodologies in gold mining could elevate Venezuela’s status not only within Latin America but on the world stage. By effectively harnessing its gold reserves, Venezuela could emerge as a leading nation in gold production, redefining its economic landscape and asserting its role in global markets.

Venezuela Gold Holdings: A Comparative Analysis

In comparison to other Latin American countries, Venezuela’s gold holdings are substantial, but they also reflect a complex interplay of economic conditions and management strategies. Countries like Peru and Chile have developed robust mining industries that attract significant foreign investment, while Venezuela’s potential remains untapped due to existing challenges. This comparative perspective highlights the need for Venezuela to reassess its policies to fully unlock the benefits of its gold reserves.

Additionally, the effectiveness of gold as a national resource can be bolstered through partnerships with international mining firms that bring expertise and capital into the local industry. Such collaborations could greatly help in matching Venezuela’s gold holdings with the operational efficiency seen in neighboring countries.

International Perceptions of Venezuela’s Gold Reserves

The international perception of Venezuela’s gold reserves is mixed, with some viewing it as an opportunity for investment while others are cautious in light of the country’s political climate. Many global investors recognize the potential value of Venezuela’s gold holdings, especially amid rising gold prices. However, concerns over governance and economic management pose risks that may deter broader investment.

Furthermore, reports like those from Whales Insider play a vital role in shaping narratives around Venezuela’s economic prospects, emphasizing both challenges and opportunities associated with its gold reserves. The mixed sentiments reflect a broader understanding that while Venezuela’s gold resources are significant, their realization depends on substantial political and economic reforms.

Venezuela’s Gold Reserves and Global Economic Trends

Venezuela’s gold reserves are not only a critical national asset but also reflect the dynamics of global economic trends. As the world grapples with inflation and economic instability, gold has regained its stature as a safe-haven asset. The increased global focus on gold presents Venezuela with a unique opportunity to leverage its resources for economic recovery and growth.

The interplay between Venezuela’s gold reserves and the broader economic landscape highlights how nations are increasingly looking towards precious metals as protective measures against volatility. In this context, how Venezuela manages and promotes its gold holdings could significantly influence its economic destiny.

Frequently Asked Questions

What are the current Venezuela gold reserves?

As of the latest reports, Venezuela has gold reserves totaling 161 tons, positioning it as the country with the largest gold holdings in Latin America.

How do Venezuela’s gold holdings compare to other Latin American countries?

With 161 tons of gold reserves, Venezuela surpasses all other countries in Latin America in terms of gold holdings, according to recent data.

What is the significance of gold reserves in Venezuela’s economy?

Gold reserves in Venezuela play a critical role in the country’s economy, providing a valuable asset that can help stabilize its financial situation amid challenges.

Where can I find information about Venezuela’s gold holdings?

Information regarding Venezuela’s gold holdings can be found in reports from financial analysts like Whales Insider, which provide insights on the country’s resources.

What does the Whales Insider report say about Venezuela gold reserves?

The Whales Insider report on the X platform indicates that Venezuela holds 161 tons of gold reserves, emphasizing its status as the leading country in Latin America for gold holdings.

| Key Point | Details |

|---|---|

| Gold Reserves | 161 tons |

| Ranking in Latin America | Largest gold holdings |

| Source | Whales Insider on the X platform |

Summary

Venezuela gold reserves are significant, with the nation holding a total of 161 tons of gold. This remarkable quantity positions Venezuela as the leader in gold holdings within Latin America. The information comes from Whales Insider on the X platform, highlighting the importance of these reserves in the context of the country’s economic resources. Venezuela’s extensive gold reserves not only showcase its wealth but also its strategic importance in the global gold market.