USDCAD Technical Analysis: Navigating the Gentle Retreat

The USD/CAD currency pair, which measures the strength of the US dollar against the Canadian dollar, has recently shown signs of retracement following a period of sustained ascendancy. Traders and market analysts are keenly observing the factors and trends that could be guiding this movement.

Recent Performance

The USD/CAD has been experiencing a significant uptrend over the past weeks, driven primarily by divergences in the monetary policy outlook between the Federal Reserve and the Bank of Canada, alongside fluctuations in crude oil prices, a critical export for Canada. However, over the recent days, the pair has seen a slight decline from its peak, suggesting a cooling off of bullish momentum or a possible reversal in trend.

Technical Analysis

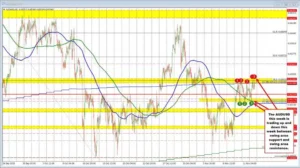

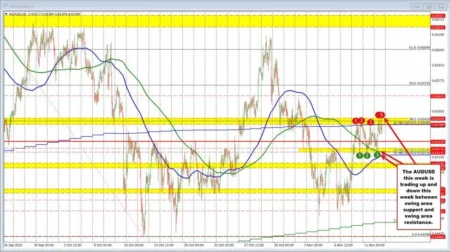

Resistance and Support Levels

The pair recently faced resistance near the high mark, prompting a consolidation phase that might find support at various strategic levels. From a technical viewpoint, initial support might be forming near the 1.3400 psychological mark. A further slide could see the next support zone around 1.3320 tested, which previously acted as both support and resistance.

Moving Averages and Indicators

The 50-day and 200-day Moving Averages remain critical indicators viewed by analysts. Currently, with the USD/CAD trading above both these averages, the general long-term outlook might still favor the bulls, albeit the recent slide adds caution to this perspective.

The Relative Strength Index (RSI) appears to be retreating from the overbought territory, signaling that the bullish run could be overstretched and that a readjustment in the form of either a consolidation or a correction might be due. Meanwhile, the MACD (Moving Average Convergence Divergence) histogram shows diminishing upward momentum.

Fundamental Influences

Economic data from both the US and Canada will continue to be a driver behind the pair’s movements. Key indicators include inflation rates, employment data, and most importantly, the central banks’ stance on interest rates. Recent dovish remarks from the Federal Reserve compared to a more hawkish tone from the Bank of Canada may lessen the gap between the policies of the two banks, potentially bolstering the Canadian dollar.

Geopolitical and Commodity Price Factors

The USD/CAD pair is also particularly sensitive to changes in oil prices due to Canada’s substantial dependency on crude oil exports. Any significant uptick in these prices could lend support to the Canadian dollar. Conversely, geopolitical tensions, particularly those influencing doubt in global economic growth or international trade, tend to strengthen the US dollar as a safe-haven asset.

Moving Forward

Looking ahead, traders should keep an eye on pertinent economic announcements and developments in oil prices. The pair might continue to experience volatility, with traders potentially capitalizing on swings between key resistance and support levels. The approach of understanding both technical and fundamental factors will be paramount in navigating the USDCAD effectively in this phase of uncertainty.

As the USDCAD retraces from its peak, market participants are reminded of the complexities involved in currency trading where both global dynamics and finer technical details paint the broader picture.

🟣 Bpaynews Analysis

This update on USDCAD Technical Analysis: A Slight Retracement in USDCAD Prices sits inside the Forex News narrative we have been tracking on November 5, 2025. Our editorial view is that the market will reward projects/sides that can show real user activity and liquidity depth, not only headlines.

For Google/News signals: this piece adds context on why it matters now, how it relates to recent on-chain moves, and what traders should watch in the next 24–72 hours (volume spikes, funding rates, listing/speculation, or regulatory remarks).

Editorial note: Bpaynews republishes and rewrites global crypto/fintech headlines, but every post carries an added value paragraph so it isn’t a 1:1 copy of the source.