In the ever-evolving landscape of digital currencies, the recent USDC circulation decrease has captured the attention of investors and analysts alike. Over the past week, data reveals that Circle issued approximately 4.6 billion USDC while redeeming around 5.7 billion, resulting in a significant drop of 1.1 billion in circulating supply. This fluctuation is pivotal considering the cryptocurrency‘s overall circulation now stands at 75.9 billion. As the market reacts to the Circle USDC update, understanding these dynamics is crucial for informed trading and investment strategies. Furthermore, accompanying USDC reserves reports shed light on the structural integrity of the currency, highlighting assets that back this popular stablecoin.

The recent changes in the circulation of USDC, a prominent stablecoin, have raised eyebrows in the cryptocurrency community. In the past week, fluctuations have caused a notable reduction in available supply, provoking discussions regarding the stability and backing of such digital assets. As we dive deeper into the USDC market analysis, it becomes clear that these shifts can have profound implications for both liquidity and trust in the cryptocurrency ecosystem. Critical to this discussion are the reserve reports, revealing the financial health supporting USDC. Understanding these elements aids stakeholders in navigating the complexities of digital currency investments.

Understanding the Recent USDC Circulation Decrease

In the past week, the cryptocurrency market has faced significant fluctuations, which have been carefully analyzed in recent USDC news. Data reveals that Circle issued approximately 4.6 billion USDC but simultaneously redeemed around 5.7 billion, resulting in a worrying circulation decrease of about 1.1 billion USDC. Such dynamics in the market not only highlight the volatility of cryptocurrency circulation but also reflect broader trends affecting digital assets globally. Investors and users are advised to stay informed about these fluctuations to better navigate the changing landscape.

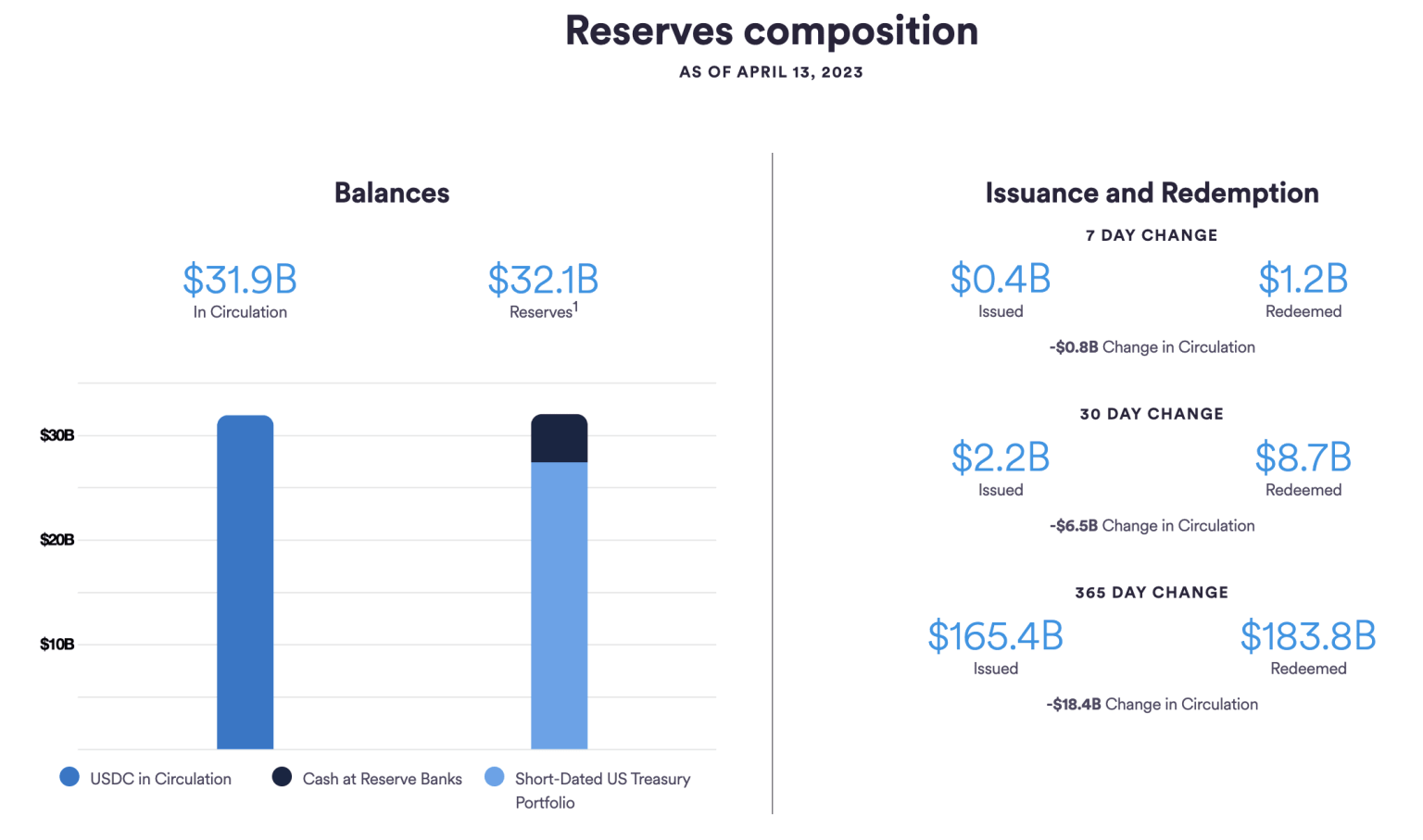

This decrease in USDC circulation is indicative of the shifting sentiments among cryptocurrency investors and users. The market analysis suggests that while USDC remains stable, the recent actions by Circle raise questions about the future trajectory of the stablecoin. With the total circulation currently at 75.9 billion USDC and reserves at approximately 76.3 billion USD, understanding these figures is crucial for stakeholders aiming to strategize in light of recent trends.

Impact of Market Activity on USDC Reserves Report

Recent transactions in the USDC market provide a valuable lens through which to view the current reserves report by Circle. With 51 billion USD tied up in overnight reverse repos of government bonds, it’s evident that the liquidity management strategy plays a significant role in USDC’s stability. As the reserves continue to serve as a backbone for the circulating tokens, any significant redemptions can directly influence market confidence, thus affecting the broader cryptocurrency ecosystem.

Moreover, the reserves comprise 14.6 billion USD in government bonds maturing in less than three months and around 10 billion USD in deposits from key financial institutions. This diverse approach to reserves emphasizes the importance of maintaining robust liquidity within the USDC framework, especially during periods of significant issuance and redemption. Investors should keep a close eye on how these reserves react to the ongoing market conditions.

Analyzing the broader implications of the USDC reserves also reveals a strategic response from Circle aimed at enhancing trust among its users. With robust reserves, the focus is clearly on ensuring that USDC remains a viable option in the crowded cryptocurrency arena. This backward planning is vital, especially as the market matures and competition increases.

Circle’s Strategic Approach to USDC Issuance

Circle’s recent USDC issuance of 4.6 billion highlights a strategic initiative to reinforce liquidity in the market, even as overall circulation plunges. This contrasts sharply with the redemption activity, which prompts questions regarding user confidence and market stability. Issuance versus redemption can be viewed as a litmus test for a cryptocurrency’s stability, where successful liquidity provisions play a critical role in enhancing investor sentiment.

By maintaining a well-balanced approach to USDC issuance, Circle demonstrates its commitment to fostering a resilient digital economy. The company’s ongoing efforts to adapt to current market conditions exemplify its proactive stance amidst changing user behaviors. For the cryptocurrency market to recover and grow, consistent issuance aligned with market needs is imperative, making Circle’s actions even more critical in the coming months.

Analyzing the Current USDC Market Trends

The recent decrease in USDC circulation has sparked extensive analysis regarding market trends. Experts in cryptocurrency circulation are closely monitoring these developments, which affect not only USDC but also overall crypto market sentiment. As redemptions surge and issuances fluctuate, understanding these trends is essential for predicting future market behavior. Observers note that a decline in USDC could signal a temporary cooling in the market, which many investors need to prepare for.

Additionally, the ongoing trend of decreased circulation could push Circle to adapt its strategies further. Keeping abreast of USDC news is paramount for stakeholders who aim to make informed decisions. The analysis suggests that a thorough understanding of current market conditions, tied closely to USDC’s operational strategies, will remain key in navigating the complexities of the cryptocurrency landscape.

Investor Outlook on USDC Amid Decreased Circulation

With the recent circulation decrease of USDC, investor sentiment is at the forefront of discussions within the cryptocurrency community. Many investors are now evaluating their positions in USDC, which has historically been appreciated for its close ties to USD reserves. The current environment prompts both caution and opportunity, as stakeholders assess the implications of the ongoing circulation dynamics.

Investors are encouraged to look beyond immediate statistics and consider the longer-term outlook of USDC and Circle’s strategies. As analysts reinforce the importance of understanding USDC market analysis trends, there remains an optimistic belief that strategic adjustments will enhance USDC’s reputation as a reliable stablecoin. Ultimately, guidance from market experts will be crucial in informing investors’ decisions.

The Role of USDC in the Broader Cryptocurrency Ecosystem

USDC plays a pivotal role within the broader cryptocurrency ecosystem, often acting as a benchmark for stablecoins due to its pegged nature and transparency. As the market adjusts to the recent circulation decrease, USDC’s relevance becomes even more pronounced as a trusted medium for transactions and a vehicle for liquidity. Its operational mechanisms resonate with cryptocurrency users seeking stability amidst volatility.

Furthermore, understanding USDC’s position in the market context helps stakeholders navigate various investment strategies while considering its correlation with fiat and other digital currencies. The implications of USDC’s dynamics are far-reaching, influencing not only individual investment decisions but also shaping the future development of cryptocurrency oversight and regulation. A focus on this stablecoin is essential for those looking to strategize in this ever-evolving landscape.

Future Implications of USDC’s Circulation Trends

The trends surrounding USDC’s circulation are indicators of future developments in the cryptocurrency space. With a noticeable decrease in circulation, it raises important questions about how this will affect its position as a leading stablecoin. Investors and market analysts are examining how these trends may influence regulatory perspectives and market acceptance of stablecoins moving forward.

Moreover, as Circles’ reserves remain robust, the emphasis on strategic management highlights an essential element in preserving confidence among users. The outlook suggests that understanding these trends will prove crucial, not just for USDC but for the entire cryptocurrency market as it transitions through various stages of growth and potential regulatory scrutiny.

The Importance of Transparency in USDC Transactions

Transparency has always been a critical feature in the cryptocurrency realm, particularly concerning USDC transactions. With the recent decrease in circulation, Circle aims to maintain trust by ensuring clear communication regarding its issuance and redemption activities. This transparency helps in alleviating concerns regarding liquidity and the overall health of the USDC ecosystem.

Building trust through transparency allows users to engage more confidently with USDC, positioning it favorably against other cryptocurrencies. The emphasis on maintaining open and informative channels not only aids in stabilizing USDC’s circulation but also strengthens its role as a key player in the digital currency market. Ultimately, fostering a transparent environment may encourage broader adoption and resilience in tumultuous market conditions.

Navigating USDC Market Challenges Ahead

As USDC faces challenges with circulation decrease, the market must navigate these waters carefully. Market participants are increasingly alert to factors that could further influence the stability of USDC, from regulatory changes to macroeconomic fluctuations. Preparing for potential challenges, including shifts in user behavior, is crucial for stakeholders hoping to safeguard their investments.

Circle’s proactive management strategies ensure that it adapts to changing market conditions, although the burden of navigating these challenges ultimately falls on the users and investors. Awareness of the evolving landscape is necessary for constructive engagement with USDC and surrounding assets. Future developments must be monitored closely as this stablecoin seeks to reclaim its strong footing in a competitive market.

Frequently Asked Questions

What caused the USDC circulation decrease of 1.1 billion this week?

The recent USDC circulation decrease of approximately 1.1 billion was primarily due to Circle issuing about 4.6 billion USDC and redeeming around 5.7 billion USDC within one week. This indicates a net outflow of USDC, reflecting current trends in the cryptocurrency market.

How does the current USDC market analysis reflect the recent circulation decrease?

In the latest USDC market analysis, the circulation decrease aligns with overall market dynamics, where increased redemptions suggest that holders are converting USDC back to fiat or other assets. The total USDC circulation now stands at 75.9 billion, further emphasizing the impact of market conditions on liquidity.

What is the latest Circle USDC update regarding reserves amid the circulation decrease?

The latest Circle USDC update indicates that despite the circulation decrease, USDC reserves remain robust at approximately 76.3 billion USD. This includes reserves such as overnight reverse repos and government bonds, which help maintain USDC’s stability amid fluctuating market conditions.

What are the implications of the USDC reserves report on its decrease in circulation?

The USDC reserves report demonstrates a healthy backing for the circulating supply, even with a decrease of 1.1 billion USDC. The reserves consist of various assets, which reassure users that the USDC maintains its peg and reflects good financial health despite the circulation reductions.

How does USDC circulation decrease impact the broader cryptocurrency circulation?

The USDC circulation decrease could signify changing demand for stablecoins within the cryptocurrency circulation ecosystem. As USDC represents a significant portion of the stablecoin market, fluctuations in its supply can influence trading volumes and liquidity across various crypto assets.

What factors influence the fluctuations in USDC circulation based on recent trends?

Recent factors influencing USDC circulation fluctuations include market demand for liquidity, trading activities driven by speculation, and overall sentiment in the cryptocurrency market. The recent redemption of over 5.7 billion USDC suggests that many investors may be seeking alternative investments or cashing out.

What steps is Circle taking in response to the USDC circulation decrease?

In response to the USDC circulation decrease, Circle is actively monitoring market trends, adjusting its issuance strategies, and ensuring reserves are adequately maintained to support the circulating supply. These measures are crucial for maintaining trust and stability in the USDC ecosystem.

How has USDC’s performance been affected by the recent circulation decrease?

USDC’s performance following the circulation decrease reflects its ability to maintain its peg to the US dollar. Despite the outflow, USDC remains a trusted stablecoin, with adequate reserves backing its circulation, ensuring its position in the cryptocurrency market.

| Key Metric | Value |

|---|---|

| Total USDC Circulation | 75.9 billion |

Summary

The recent USDC circulation decrease is significant, highlighting a 1.1 billion drop over the past week. This trend reflects changes in market demand and transaction activity, emphasizing the importance of monitoring stablecoin dynamics in the crypto economy.