The US national debt has surged past an astonishing $38.5 trillion, a stark milestone that coincided with the celebration of Bitcoin Genesis Block Day. This astounding figure highlights an ongoing financial trend defined by soaring national debt statistics and increasing concerns about fiat currency inflation. Market experts warn that the relentless growth of government debt could serve as a precursor to a potential US debt crisis, raising alarms about the sustainability of current economic practices. In contrast, Bitcoin presents a compelling alternative for those seeking robust financial security as it positions itself against the backdrop of traditional currency failures. As attitudes shift and more individuals seek to understand the implications of debts and currency values, the debate over Bitcoin vs fiat continues to intensify.

The overwhelming burden of federal borrowing, often referred to as the national fiscal deficit, has reached alarming levels in the United States, prompting discussions about the looming risk of a debt crisis. With rising national debt metrics, experts are increasingly scrutinizing the implications of the expanding money supply and its potential to devalue purchasing power amid high fiat currency inflation. As the financial landscape evolves, many are turning to alternative assets like Bitcoin, which offers a finite supply and acts as a hedge against traditional monetary instability. This pivot towards cryptocurrencies highlights a growing awareness of the need for financial resilience in the face of unsustainable government spending practices. The discourse surrounding US national debt and emerging digital currencies is crucial for understanding our economic future amid these unprecedented challenges.

Understanding the US National Debt Crisis

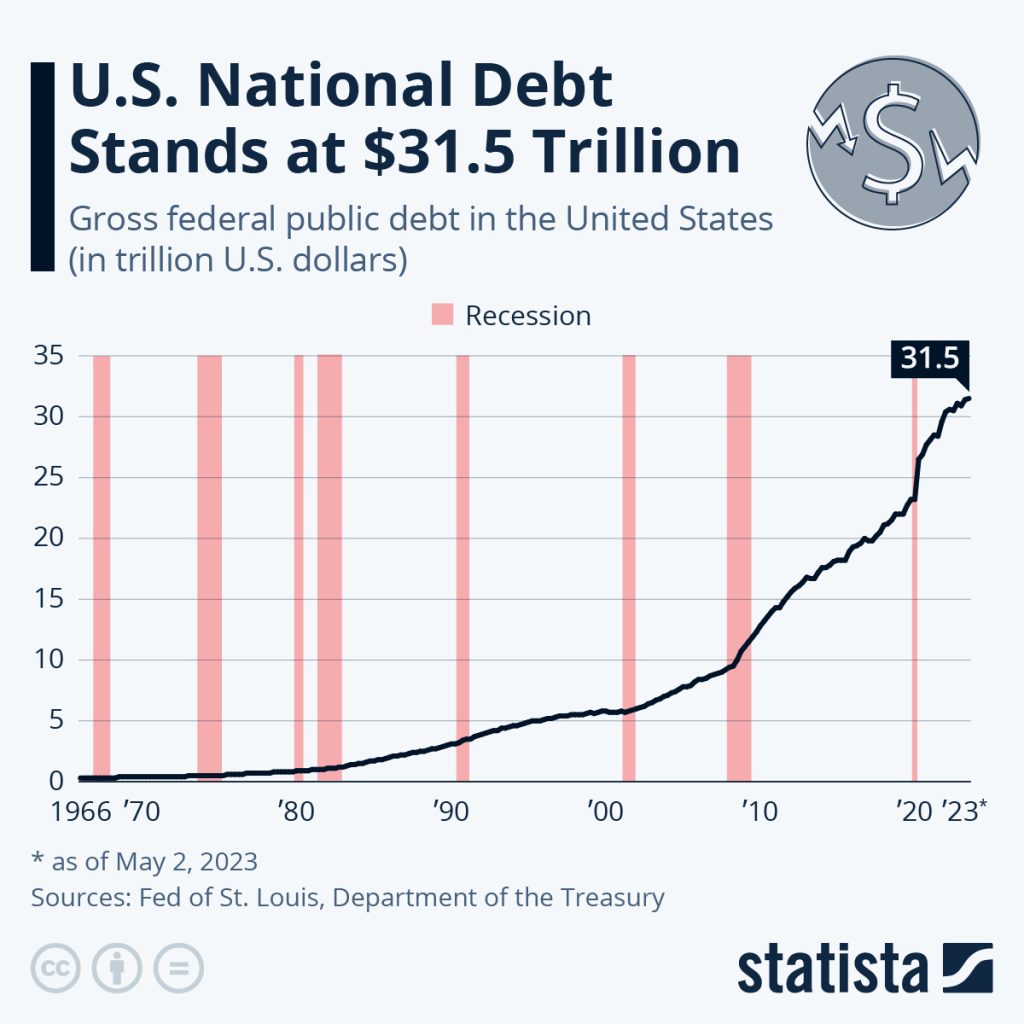

As the US national debt has surpassed a staggering $38.5 trillion, it raises critical concerns about the sustainability of such levels of borrowing. Each passing day sees an addition of about $6 billion to this debt, leading to an alarming projection of $2.2 trillion added annually by 2025. Historical context reveals that it took over two centuries for the national debt to reach its first trillion in 1981, highlighting the rapid acceleration of borrowing in recent years. This unsustainable trajectory poses questions regarding fiscal policies and the long-term implications for the US economy.

The US debt crisis is further fueled by the Federal Reserve’s monetary policies, which have led to the expansion of the M2 money supply reaching $22.4 trillion. Such inflationary measures can diminish the purchasing power of the dollar, making debt repayment increasingly difficult. The rising national debt is not just a statistic; it signifies potential economic instability, as it reflects a government reliant on continuous borrowing rather than sound financial management. Understanding these dynamics is essential for grasping the broader implications on both the economy and individual finances.

The Impact of Fiat Currency Inflation on National Debt

Fiat currency inflation plays a significant role in exacerbating the national debt situation. As the government prints money to cover its expenses, the value of the dollar diminishes, leading to a vicious cycle where more currency is required to satisfy outstanding debts. This inflation reduces the purchasing power of consumers while simultaneously increasing the burden on future generations who will be responsible for repaying these debts. Consequently, the correlation between rising national debt and inflating fiat currencies becomes increasingly evident.

The implications of this inflation extend beyond mere numbers; they manifest in a higher cost of living and reduced savings for individuals. With the dollar losing its value, citizens find themselves in a precarious position, struggling to maintain their financial stability. Critics of the current fiat system argue that it is fundamentally flawed, suggesting that the reliance on fiat currencies without a limiting mechanism on supply leads to inevitable economic collapse. The national debt thus serves as a stark reminder of the consequences of mismanaged fiat policies.

Bitcoin as an Alternative to Fiat Currency

Amidst the ongoing US national debt crisis, Bitcoin emerges as a compelling alternative to traditional fiat currency. With a capped supply of 21 million coins, Bitcoin presents an opportunity to mitigate the effects of inflation that plagues fiat systems. Unlike currencies that can be printed without limit, Bitcoin’s scarcity is designed to enhance value over time, making it an appealing store of wealth. Advocates argue that this characteristic positions Bitcoin as a safeguard against the erosion of purchasing power, providing individuals with a viable option during economically turbulent times.

Moreover, the decentralization of Bitcoin further reinforces its appeal as a hedge against government instability and financial mismanagement. Supporters contend that Bitcoin’s underlying technology offers a transparent and secure method of conducting transactions without the meddling of central authorities. This is particularly pertinent in light of the current US debt situation, as individuals seek financial assets that are not subject to the devastating effects of fiscal irresponsibility. As Bitcoin continues to gain traction, it stands poised to reshape the landscape of personal finance and investment.

Bitcoin Genesis Block and Its Symbolism

The Bitcoin Genesis Block, mined on January 3, 2009, symbolizes the inception of an economic revolution aimed at challenging the status quo of fiat currencies. The block’s embedded message, highlighting a governmental bailout for banks, serves as a reminder of the failures associated with traditional monetary policy and the pitfalls of reliance on fiat money. This historic moment not only marked the birth of Bitcoin but also ignited a global dialogue about alternative monetary systems and the future of currency.

Celebrated annually as ‘Genesis Day’ by the Bitcoin community, this date signifies more than just a technological milestone; it encapsulates the philosophy of financial freedom and the need for a decentralized currency that operates independently of governmental control. As the US national debt continues to rise, the relevance of the Bitcoin Genesis Block grows, embodying the quest for economic systems that resist inflation and foster greater individual ownership of wealth. The contrast between Bitcoin and fiat currencies is illustrated clearly, creating a platform for discussions about monetary reform and innovation.

Evaluating National Debt Statistics

Analyzing national debt statistics reveals alarming trends that underscore the gravity of America’s fiscal challenges. Current estimations suggest that the US national debt stands at about $38.5 trillion, a figure that seems insurmountable to many analysts. This level of indebtedness translates into a heavy burden for taxpayers and raises serious questions about the government’s ability to manage financial obligations responsibly. With projections suggesting an addition of $6 billion daily to the national debt, the real implications of these statistics call for immediate action and reform.

Understanding national debt statistics is critical to evaluating the economic landscape of the United States. It assists policymakers in making informed decisions and informs citizens about the realities of fiscal health. Moreover, comprehending these statistics can help individuals and businesses prepare for economic downturns that may arise from excessive national borrowing. By fostering transparency and encouraging discourse around these figures, stakeholders can push for solutions that address the root causes of the debt crisis.

The Rise of Bitcoin vs. Fiat Debate

The conversation surrounding Bitcoin vs. fiat currency is intensifying as the US national debt escalates. Proponents of Bitcoin argue that its deflationary properties offer a solution to the infinite inflation generated by fiat currencies. Unlike traditional financial systems that are prone to manipulation and devaluation, Bitcoin’s protocol ensures that its supply is limited and predictable, allowing it to maintain value over time. This fundamental difference positions Bitcoin as a long-term financial strategy amid the growing instability associated with fiat currencies and their inflationary characteristics.

Critics of the current fiat system frequently highlight how the US national debt threatens economic stability and growth. They contend that while fiat currencies have the advantage of established acceptance and regulatory oversight, they remain vulnerable to fluctuations driven by government debt levels and monetary policy decisions. This has sparked an argument for Bitcoin as a realistic alternative, as its decentralized nature offers protection against the economic mismanagement that can lead to financial crises. As more individuals explore their options, the Bitcoin vs. fiat debate will continue to shape the future of personal finance.

The Connection Between US Debt Crisis and Bitcoin Adoption

The rising US debt crisis has a direct impact on the adoption of Bitcoin as individuals and investors seek alternatives. With traditional fiat currency showing signs of distress due to soaring national debt statistics, many are turning to Bitcoin as a hedge against economic instability. The appeal of a decentralized currency that is not subject to government inflationary policies is prompting a shift in perception regarding digital assets. As a result, Bitcoin adoption is witnessing an unprecedented surge, particularly among those who are concerned about the implications of an ever-growing national debt.

Additionally, the connection between the US debt crisis and Bitcoin adoption underscores a growing trend of financial education that empowers individuals to take control of their wealth. As citizens become more aware of the risks associated with fiat currency inflation and national debt, they are exploring cryptocurrencies as viable investment options. This growing sentiment further validates Bitcoin’s role in providing a financial foundation that can withstand the adverse effects of national economic challenges, making it increasingly popular among those looking for financial security.

Implications of Rising National Debt on Economy

The implications of rising national debt on the economy are far-reaching and concerning. As the US national debt climbs past the $38 trillion mark, the potential for economic instability grows significantly. The government’s ability to finance interest payments on this debt becomes more precarious, risking downgrades in credit ratings and increased borrowing costs. Such scenarios could trigger broader economic turbulence, affecting everything from public services to social welfare programs, and ultimately leading to stricter fiscal policies.

As policymakers grapple with these challenges, the importance of addressing national debt cannot be overstated. Strategies that prioritize fiscal responsibility and economic growth are essential to mitigate the negative impacts of soaring debt levels. This context creates an increasingly urgent need for innovative solutions, potentially including frameworks that integrate cryptocurrencies like Bitcoin into the financial ecosystem as a means of diversifying and stabilizing finances at both the personal and national level.

Exploring the Future of Currency: Bankruptcy or Bitcoin?

The future of currency is under scrutiny, with debates intensifying around potential scenarios involving either economic bankruptcy due to unsustainable national debt or a shift towards Bitcoin as a mainstream currency. As inflation undermines the value of fiat money, the very foundation of traditional currencies is becoming increasingly unstable. This reality prompts financial experts and citizens alike to consider alternatives that Bitcoin puts forth, particularly for those looking for reliable stores of value into the future.

This exploration into the future of currency encapsulates broader sentiments regarding financial freedom and security. Bitcoin’s decentralized nature offers an appealing escape route from the risks of government control and inflationary practices associated with fiat currencies. As economic conditions evolve, the notion that Bitcoin could supplant traditional currencies becomes less far-fetched, inviting critical discussions on how society will navigate this transformative period. The path forward will inevitably influence personal finances, investment strategies, and overall economic policies.

Frequently Asked Questions

What is the current US national debt and how does it relate to Bitcoin Genesis Block?

As of now, the US national debt has surpassed $38.5 trillion, notably coinciding with Bitcoin Genesis Day, which celebrates the mining of the first Bitcoin block. This staggering debt figure highlights ongoing concerns regarding fiat currency inflation and its potential impact on economic stability.

How does US national debt statistics affect the economy?

US national debt statistics indicate that the country is projected to add around $6 billion daily to its debt by 2025. This continuous increase can lead to concerns about fiscal responsibility and inflationary pressures on the economy, prompting discussions about alternative currencies like Bitcoin.

What are the implications of fiat currency inflation related to US national debt?

Fiat currency inflation diminishes the value of US dollars, exacerbating the effect of the rising national debt. This erosion of purchasing power raises questions about the viability of relying solely on traditional currencies and invites comparisons with Bitcoin’s deflationary model.

How does Bitcoin compare to fiat in the context of the US debt crisis?

Bitcoin is often positioned against fiat currencies, particularly during a US debt crisis. With a fixed supply cap of 21 million coins, Bitcoin offers a deflationary alternative that could protect purchasing power, contrasting sharply with the inflationary trends observed in fiat systems driven by rising national debt.

What role does Bitcoin play amid concerns over US national debt?

In light of increasing US national debt, Bitcoin serves as a potential safeguard against the systemic risks associated with inflation and currency devaluation. Advocates argue that Bitcoin’s decentralized nature and capped supply can provide stability and confidence that fiat currencies may lack.

What historical context is important to consider regarding the US national debt?

Historically, it took over 200 years for the US national debt to reach $1 trillion in 1981. In contrast, recent trends have seen trillions added in mere years, emphasizing the urgency of the current national debt situation and fueling interest in alternatives like Bitcoin.

How does the Federal Reserve’s M2 money supply affect the US national debt?

The Federal Reserve’s M2 money supply, currently at $22.4 trillion, is connected to US national debt as it influences inflation. Increasing the money supply can lead to more debt accumulation, impacting the economy and encouraging comparisons with Bitcoin’s fixed supply and potential price appreciation.

| Key Points | Details |

|---|---|

| National Debt Amount | The US National Debt surpassed $38.5 trillion. |

| Date of Milestone | The debt milestone occurred on Bitcoin’s Genesis Day, January 3, 2009. |

| Market Analyst Comments | James Lavish criticized fiat currency practices, highlighting the loss of confidence in such currencies. |

| Projected Debt Increase | The government is expected to increase the debt by approximately $6 billion per day in 2025. |

| Historical Context | The US national debt took over 200 years to reach $1 trillion (1981), but trillions are now being added yearly. |

| M2 Money Supply | The Federal Reserve’s M2 money supply has reached $22.4 trillion, indicating a rising amount of US dollars in circulation. |

| Bitcoin’s Solution | Bitcoin is seen as a deflationary alternative with a capped supply of 21 million coins. |

| Inflation Impact | Inflation reduces the value and purchasing power of fiat currency, which Bitcoin aims to counter. |

Summary

The US national debt has surged past $38.5 trillion, prompting critical discussions about the sustainability of fiat currencies. This unprecedented increase raises concerns about inflation and the purchasing power of the dollar, leading some to explore alternatives like Bitcoin, which offers a fixed supply to combat the currency devaluation faced by traditional money.