US Government Acquires More Bitcoin – What Are Their Plans?

In a surprising turn of events, the U.S. government has recently and proactively increased its holdings of Bitcoin, an unexpected move that has sparked widespread speculation and curiosity in both financial and technology circles. This article explores the implications of the government’s purchase and its potential impacts on policy, the cryptocurrency market, and global finance.

Strategic Acquisition of Bitcoin

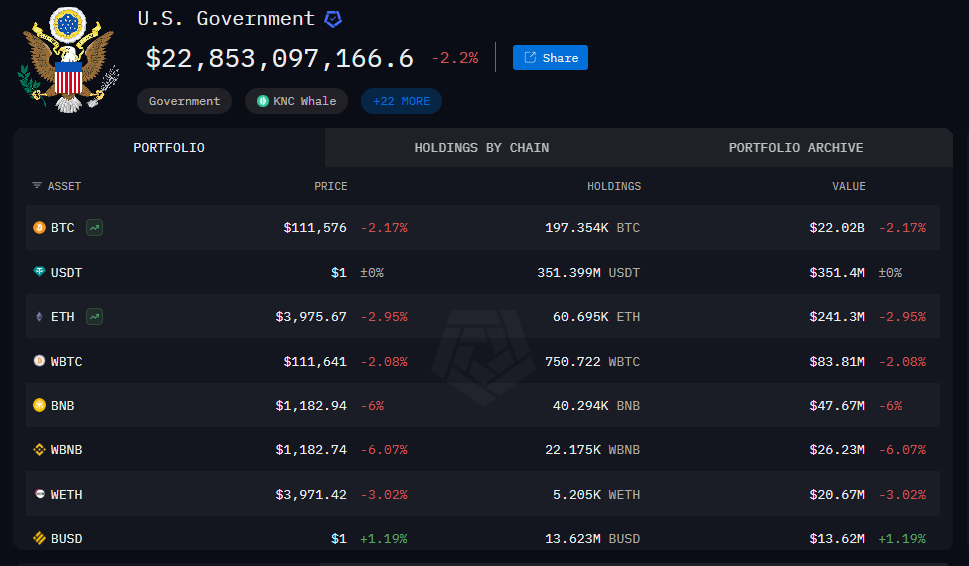

The U.S. government, through various federal departments, has been known to acquire Bitcoin and other cryptocurrencies, primarily through seizures related to criminal activities. However, recent reports indicate that the government has not only acquired Bitcoin through seizures but has also started purchasing it strategically. According to sources from within the Department of the Treasury, these acquisitions are part of a broader strategy to integrate digital assets into the U.S.’s financial portfolio.

Possible Motives Behind the Acquisition

-

Monetary Policy Influence: By acquiring significant amounts of Bitcoin, the U.S. government could be aiming to gain a strategic foothold in the rapidly evolving digital currency landscape. Bitcoin’s capped supply makes it a potentially valuable hedge against inflation, much like gold. This could be seen as a move to diversify reserves and have more influence over a technology that is increasingly seen as pivotal to the future of finance.

-

Regulatory Framework Preparation: Engaging more directly with Bitcoin could be a forward-thinking step towards developing a more robust regulatory framework for cryptocurrency usage. This would not only involve creating rules that ensure the security and legality of digital transactions but also potentially pave the way for a government-backed digital currency.

-

Innovation and Leadership: As nations worldwide begin to acknowledge the importance of blockchain and cryptocurrencies, holding Bitcoin might be part of an initiative to drive technological innovation and maintain economic leadership on the global stage. It’s a recognition that to lead in technology, engagement with emerging tools and currencies is necessary.

- Cybersecurity Measures: In the realm of cybersecurity, possessing Bitcoin can be strategic for government agencies like the NSA or the Cybersecurity and Infrastructure Security Agency (CISA). These holdings could be used in operations to track criminal activities and understand the security challenges associated with cryptocurrency transactions.

Implications for the Crypto Market

The U.S. government purchasing Bitcoin in large quantities could have mixed effects on the crypto market:

- Market Stability: Government participation might lead to greater market stability and legitimacy, attracting more institutional investors.

- Price Volatility: Initially, this move could cause price fluctuations. However, over time, it may contribute to a stabilization effect as the market adjusts to the government’s role as a major player.

- Regulatory Clarity: With the government’s direct involvement in the crypto market, clearer regulations might follow, reducing uncertainty and potentially boosting investor confidence.

Policy Considerations and Future Prospects

With the U.S. government stepping into the Bitcoin arena, policy makers will need to consider the implications carefully. This includes addressing privacy concerns, ensuring that digital asset management aligns with national economic goals, and creating frameworks that support technological advances while preventing misuse.

Moreover, the move positions the U.S. at a pivotal point in the future financial landscape. Whether this gamble will pay off in terms of monetary control, technological prowess, or economic stability remains to be seen. However, one thing is clear: the U.S. government’s acquisition of Bitcoin marks a significant endorsement of digital currency’s potential power and permanence in global finance.

As this situation evolves, all eyes will be on the unfolding strategies and outcomes of this ambitious foray into the world of cryptocurrencies. This could either be a masterstroke in economic strategy or a high-stake risk in an increasingly digital world, only time will tell.