U.S. Cryptocurrency Update: Predicting Winter’s Peak in Gold Prices

In the ever-evolving landscape of financial markets, the intersections of cryptocurrency and traditional assets like gold are becoming increasingly significant. As we approach the winter season, market analysts are keenly observing trends to predict potential peaks in gold prices, prompted by various economic factors. Notably, the influence of cryptocurrency dynamics on traditional assets has become a fascinating aspect to consider.

Cryptocurrency Influence on Market Behavior

Cryptocurrencies, especially Bitcoin, often referred to as “digital gold,” have introduced a unique dimension to asset valuation and investor behavior. Their inherent volatility, coupled with increasing institutional acceptance, has caused ripples across financial markets. As we’ve observed in recent years, the correlation between cryptocurrency market trends and traditional assets like gold can vary significantly, ranging from direct to inverse relationships depending on broader economic sentiments and regulatory news.

Factors Driving Gold Prices in Winter 2023

Winter often brings with it a heightened interest in gold, traditionally seen as a safe harbor during economic uncertainty. As 2023’s winter approaches, several factors are hypothesized to influence the peak prices of gold, including:

-

Economic Uncertainty and Inflation: With global economies still recovering and adjusting post-pandemic, inflation remains a critical concern. Gold is traditionally viewed as an inflation hedge. An increase in inflationary pressures could drive more investors towards gold, pushing the prices up.

-

Interest Rates and Monetary Policies: The Federal Reserve’s stance on interest rates significantly affects gold prices. Typically, lower interest rates result in weaker yields on treasury bonds and other fixed-income investments, making gold an attractive alternative.

-

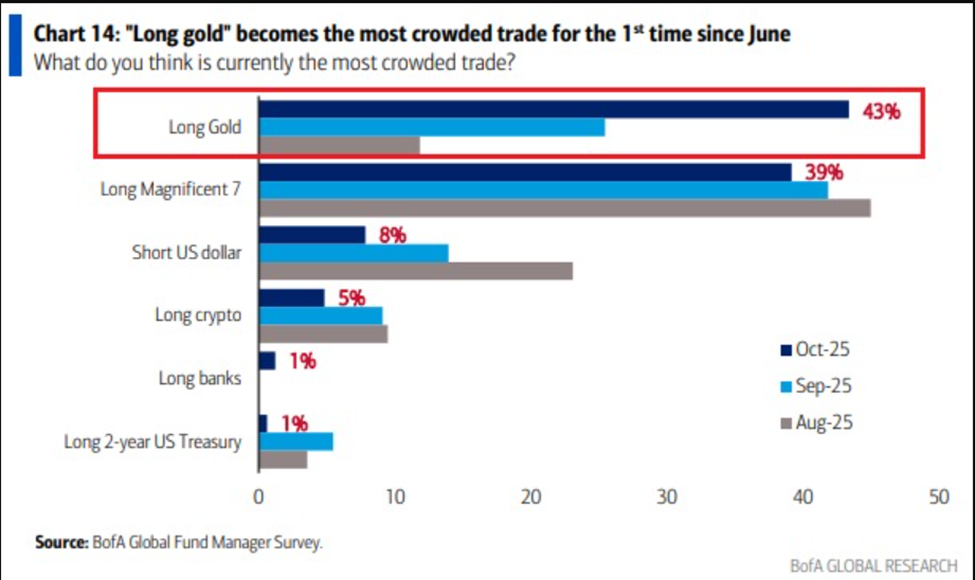

Cryptocurrency Market Trends: Although cryptocurrencies are relatively new, their impact on gold as an investment alternative is being closely watched. A significant slump or surge in major cryptocurrencies like Bitcoin could lead investors to reallocate funds between digital and traditional safe havens like gold.

- Political and Geopolitical Developments: Ongoing tensions and unresolved conflicts around the world, including trade wars and sanctions, could lead investors to seek refuge in gold.

Winter 2023 Predictions

Predictions for gold prices in Winter 2023 suggest a bullish trend, driven by a combination of higher inflation expectations and continued economic uncertainties. Analysts are monitoring the U.S. dollar’s strength, interest rate decisions, and cryptocurrency volatility as immediate factors that could sway gold‘s valuation. Additionally, seasonal buying during cultural festivals and holidays typically increases demand, potentially pushing prices higher.

Cryptocurrency’s Role in Gold Pricing Dynamics

The interaction between cryptocurrencies and gold remains complex. While some investors treat cryptocurrencies as a modern-day equivalent to gold, others view them as distinct assets with different risk profiles. As regulatory frameworks around cryptocurrencies continue to develop, their impact on traditional assets will likely become more predictable.

Ultimately, for those closely watching the markets, the end of 2023 offers a unique vie into how traditional investment strategies are adapting to the digital age. Cryptocurrencies might not only influence but could potentially align more closely with patterns seen in traditional safe havens such as gold.

Conclusion

Predicting exact peak prices in such a dynamic environment remains challenging. However, by understanding the multifaceted factors influencing gold, from economic indicators to emerging markets like cryptocurrencies, investors can make more informed decisions. As the landscape evolves, staying updated with both traditional economic indicators and developments in the digital currency space will be vital for anyone looking to optimize their investment strategy this winter.