U.S. Bitcoin Payments Are Getting Real: Retail Rails Could Push $2M a Day On-Chain

As the digital era continues to evolve, Bitcoin is increasingly becoming part of the mainstream economic fabric in the United States. Recent developments suggest that retail infrastructure for Bitcoin transactions is not only expanding but could potentially handle up to $2 million in transactions daily. This shift could mark a significant milestone in Bitcoin’s journey from a speculative investment to a viable currency option for everyday transactions.

The Rise of Bitcoin in Retail

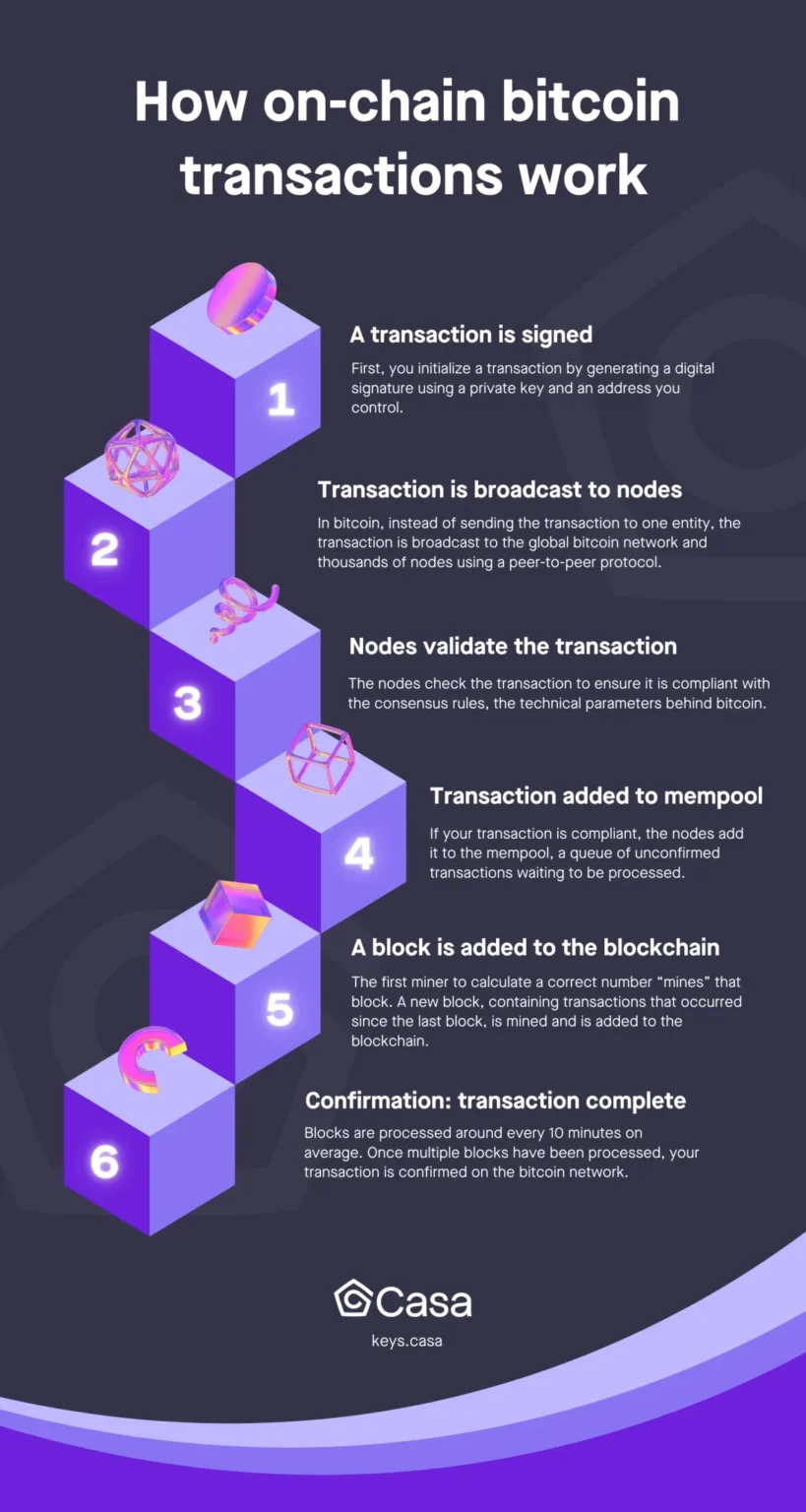

Bitcoin’s inception as a peer-to-peer electronic cash system has long promised disruptions in traditional financial transactions. However, its volatile nature and regulatory challenges have somewhat stalled its adoption as a currency for daily transactions. This picture is rapidly changing as technology and regulatory environments evolve, and as both consumers and retailers warm up to cryptocurrency.

Retail giants in the U.S. have started to experiment with Bitcoin payments. Companies like Starbucks, Whole Foods, and Home Depot have explored cryptocurrency payment systems. The infrastructure provided by third-party payment processors like BitPay and CoinBase Commerce has made this transition smoother, addressing both ease of use for consumers and the volatility risks for retailers.

Technological and Infrastructure Improvements

The key to Bitcoin’s successful integration into retail is the improvement of payment infrastructure and transaction efficiency. Lightning Network, a second layer technology applied to Bitcoin, enables faster transactions that are crucial for the kind of quick exchanges required in retail environments. This technology significantly decreases transaction times while reducing costs, making it feasible for everyday purchases.

Enhanced security measures and user-friendly interfaces in both hardware and software wallets are also lowering barriers for consumers and retailers alike. These wallets can now convert Bitcoin into fiat currencies instantaneously, protecting merchants from price volatility—a major concern in using Bitcoin as a payment method.

Economic Impacts and Future Prospects

With retail transactions potentially pushing $2 million a day on-chain, the economic implications could be profound. For one, this increased usage signifies a shift from Bitcoin as primarily an investment asset to a legitimate medium of exchange. It could also catalyze further investments into cryptocurrency infrastructure and services.

For consumers, the expansion of Bitcoin into retail could provide alternatives in a market increasingly receptive to digital and contactless payments, particularly highlighted by the safety concerns during the COVID-19 pandemic. Furthermore, it broadens financial inclusion, presenting a decentralized form of money to those with limited access to traditional banking.

Retailers stand to gain from lower transaction fees compared to credit card payments and potentially faster payment settlements. Embracing Bitcoin can also enhance their brand as forward-thinking and tech-savvy, appealing to a growing demographic of cryptocurrency users.

Regulatory and Market Considerations

While the trajectory suggests a bright future for Bitcoin in U.S. retail, significant hurdles remain. Regulatory clarity is one of the most pressing needs. The U.S. government and various state agencies have been cautiously optimistic but expect to draft concrete regulations that ensure consumer protection without stifling innovation.

Moreover, the overall stability and public perception of Bitcoin will continue to influence its adoption. Market volatility, while lesser than in Bitcoin’s early days, still presents a risk for both consumers and businesses.

Conclusion

The potential for Bitcoin payments in U.S. retail to reach $2 million a day signifies a tipping point for cryptocurrency. It combines technological advancements with growing market acceptance. As retailers and consumers increasingly find common ground in Bitcoin transactions, the future of retail could be on the cusp of a digital currency revolution, redefining the nature of money and transactions in the digital age. Bit by bit, Bitcoin is moving from the fringes of the internet to the cash registers of America.