The proposed unrealized gains tax in the Netherlands has raised significant concerns among investors and cryptocurrency users, who fear that it could incite capital flight. This tax seeks to impose levies on not just realized gains from stocks, bonds, and cryptocurrencies, but also on paper profits, even if assets remain unsold. By potentially taxing unrealized capital gains, lawmakers are navigating a delicate balance, especially in light of the ongoing Netherlands tax reform. Many in the financial community regard this development as a catalyst for investor concerns Netherlands, whereby individuals and businesses might seek to relocate their assets or even their operations to more accommodating jurisdictions. With the implications of such policies resonating deeply within the economic landscape, it is essential to monitor how the Box 3 asset tax reform unfolds and its effect on both local and international investments.

The discussion surrounding this new taxation measure, often referred to as a tax on paper profits or unrealized investment returns, has ignited various debates in the financial sector. Many stakeholders are worried that such a levying system would create a chilling effect on investment activity in the Netherlands. Critics argue that by taxing wealth that has not yet been converted into cash, the government risks driving away both established and emerging investors. In addition to fears of capital exodus, there are broader questions about the implications for the country’s economic health and attractiveness as a hub for innovation, especially in the burgeoning cryptocurrency market. As parliament deliberates on this significant shift in tax policy, the real test will be whether the benefits outweigh the potential for significant capital flight.

| Key Points | Details |

|---|---|

| Proposed Unrealized Gains Tax | The Netherlands plans to tax unrealized capital gains on stocks, bonds, and cryptocurrencies. |

| Potential Capital Flight | Investors warn that the tax could lead to an exodus of capital and talent from the country. |

| Legislative Support | A majority of lawmakers are in favor of the new tax regime despite acknowledging its flaws. |

| Financial Impact | The government estimates a loss of 2.3 billion euros per year if the tax implementation is delayed. |

| Favorable Terms for Real Estate | Real estate investors are expected to benefit from new deductions that aren’t applicable to stocks and crypto holders. |

| Criticism from Investors | Critics, including crypto analysts, argue the tax raises burdens and could push residents to leave. |

Summary

Unrealized gains tax represents a significant shift in the Netherlands’ tax policy, putting pressure on investors by taxing potential profits even if assets remain unsold. The proposed legislation, supported by a majority in the Dutch parliament, aims to address budgetary shortfalls but has raised concerns about accessibility and economic prosperity. Critics warn that this could lead to capital flight, where investors seek to relocate to more favorable jurisdictions, highlighting the challenges of implementing such tax reforms without stifling growth and investment in the country.

Understanding the Unrealized Gains Tax in the Netherlands

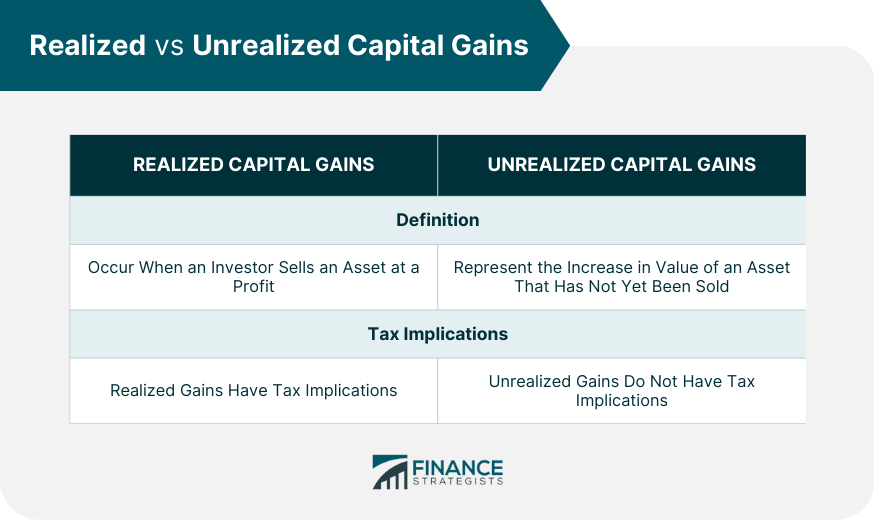

The proposed unrealized gains tax in the Netherlands represents a significant shift in the taxation of investments. This new policy would levy taxes on gains that have yet to be realized, meaning investors would need to pay taxes on paper profits without actually selling their assets. This approach marks a departure from traditional taxation methods, where taxpayers were only taxed on profits realized from the sale of investments. Proponents argue that implementing an unrealized gains tax can increase revenue and improve tax equity, while critics warn that it may deter investment and drive capital flight, as those looking to protect their profits might seek more tax-friendly jurisdictions.

Critics have pointed to the potential negative consequences of this tax, including the risk of capital flight from the Netherlands. Wealthy investors and those involved in cryptocurrencies have expressed concerns that this tax regime could discourage investment in Dutch markets. They fear that rather than incentivizing growth within the national economy, this tax could lead to a significant exodus of talent and capital. The growing investor concerns underscore the need for a more nuanced approach to taxation that balances revenue needs with economic growth.

Potential Impact on Investor Behavior

The announcement of the unrealized gains tax has sparked considerable debate among investors about their future in the Netherlands. With the prospect of being taxed on assets that haven’t been sold, many Dutch investors are re-evaluating their portfolios, and some are contemplating relocating to countries with more favorable capital gains tax structures. This sentiment is particularly palpable within the cryptocurrency community, which has seen its enthusiasm dampened by tax initiatives perceived as punitive. Investors fear that these measures will reduce the attractiveness of the Netherlands as an investment hub, prompting many to seek more favorable environments abroad.

This change could also reshape the landscape for new investments in the Netherlands. As investor concerns rise, it may lead to a more cautious approach to investing in the local market. Entrepreneurs and start-ups may find it more challenging to secure funding as investors become wary of potential tax liabilities on unrealized gains. The anticipated shift in investor behavior could ultimately impact economic growth and job creation, raising questions about the long-term viability of such a tax policy.

The Implications of the Box 3 Asset Tax Reform

Revisions to the Box 3 asset tax system are aimed at streamlining tax collection for the Dutch government, especially in response to previous court decisions that deemed the existing model inadequate. By taxing both realized and unrealized gains, the government hopes to collect an estimated 2.3 billion euros annually. While proponents argue that the reform will ensure that wealthy individuals contribute their fair share, critics fear it fails to consider the real economic burden it places on investors, especially in high-volatility markets like stocks and cryptocurrencies.

The proposed reform is particularly beneficial for real estate investors, as deductions for various costs are permitted. This creates a disparity in the treatment of asset classes, potentially skewing investment decisions toward real estate at the expense of equities and crypto. Such inequities may fuel further unrest among investors who feel their interests are sidelined. As the tax reform progresses through parliament, it remains to be seen how lawmakers will balance the need for fiscal revenue against the economic implications of potential capital flight.

Investor Concerns Over Capital Flight

Concerns about capital flight have been underscored by commentary from notable investors and analysts following the announcement of the unrealized gains tax. Many believe that the tax could significantly raise the annual tax burden for individuals and corporations, leading them to consider relocating their financial assets, or even themselves, to other jurisdictions that offer more favorable tax conditions. This fear is not unfounded; historical precedents show that abrupt tax changes can often prompt high-net-worth individuals to move their wealth abroad.

Furthermore, as the debate evolves, there is growing anxiety within the investment community that the Netherlands may lose its competitiveness as a favorable location for financial activities. Countries with established crypto-friendly policies and more lenient capital gains tax regimes might attract investors who seek to mitigate their risks. If left unaddressed, these investor concerns may spark a significant outflow of capital, impacting the Dutch economy’s overall health and innovation prospects.

Comparative Analysis with Other Jurisdictions

As the Netherlands debates the unrealized gains tax, investors are increasingly looking to other jurisdictions as potential options for relocation. Countries like Portugal and Switzerland have tax systems that are far more favorable for investors, particularly in the realm of cryptocurrencies. This comparative analysis presents significant challenges for the Dutch government as it seeks to balance its tax policy while remaining competitive on the global stage. Understanding how other jurisdictions manage their capital gains tax can inform Dutch policymakers on how to refine their proposed reforms.

Additionally, the motivations for moving capital outside the Netherlands are not solely financial. Many investors are also concerned about the political and economic stability associated with tax reforms. Countries that maintain robust legal protections for investors and offer predictable tax environments are likely to draw interest. Consequently, the Dutch government must carefully consider how its tax policies will affect its standing in the eyes of global investors and respond accordingly to mitigate the risk of capital flight.

How the Unrealized Gains Tax Aligns with the Netherlands Tax Reform Goals

The introduction of the unrealized gains tax is positioned as a vital component of the broader Netherlands tax reform initiative, which aims to modernize the country’s tax framework. The government’s rationale is rooted in the necessity for comprehensive tax reform that addresses inequities in wealth distribution. By introducing taxes on unrealized gains, the goal is to create a more balanced taxation system that captures gains before they manifest as liquid assets, potentially increasing government revenue without raising the tax rates on already realized profits.

However, while the intention aligns with reform goals, the implementation raises questions about fairness and feasibility. Critics argue that taxing unrealized gains may disproportionately affect investors in volatile markets like stocks and cryptocurrency, who could face uncertain financial burdens. The government’s challenge will be to ensure that the new tax system is not only efficient in generating revenue but also equitable in its treatment of all asset classes, thereby preventing any unintended consequences that might counteract the desired reform objectives.

Public Response to the Proposed Unrealized Gains Tax

The public response to the proposed unrealized gains tax has been a mix of concern, criticism, and outright opposition among various stakeholder groups. Invested parties, including individuals in the stock and crypto markets, have expressed alarm over a policy they deem could stifle growth and discourage investment in the Netherlands. This unease reflects broader anxieties about the government’s approach to taxation and economic policy, leading to intensified discussions on both social media platforms and public forums.

Additionally, the frontline communication from prominent figures in the investment community sheds light on the potential repercussions of the proposed tax. Analyst Michaël van de Poppe’s critique highlights the general sentiment that the unrealized gains tax could drastically increase the financial pressure on citizens, which may incentivize them to pursue more tax-friendly environments elsewhere. This shift in public opinion serves as a crucial indicator for lawmakers as they contemplate the implementation of the reform and its long-term implications.

Future of Investment in the Netherlands with Box 3 Reforms

As the Netherlands embarks on implementing reforms to the Box 3 asset tax, the future of investment within the country hangs in the balance. If the unrealized gains tax goes through, it is anticipated that the investment landscape will shift, particularly as investors reassess their portfolios and strategies in light of new taxation rules. Some may opt to invest in foreign markets where taxes on unrealized gains are nonexistent or minimal, leading to decreased domestic investment levels.

Additionally, the response from the government to ongoing criticisms will be pivotal in shaping public perception and investor confidence. Policymakers may need to provide reassurances and outlines of potential adjustments to mitigate issues that arise from the implementation of the unrealized gains tax. Thus, the future of investment in the Netherlands will heavily rely on the government’s ability to balance fiscal obligations with investor satisfaction, ensuring that the economic environment remains conducive to growth while also addressing revenue needs.

Reassessing the Viability of the Netherlands as an Attractive Investment Hub

Continuing discussions about the proposed unrealized gains tax have raised fundamental questions about the Netherlands’ viability as an attractive investment hub. The ongoing debate underscores the necessity for the government to ensure its tax policies do not alienate investors. While some see the new tax as a progressive measure, others perceive it as a potential barrier to economic engagement within the nation, prompting calls for re-evaluation of the overall tax strategy.

As investors consider their options, the long-term ramifications of sustaining a taxing environment perceived as aggressive could isolate the Netherlands from significant capital inflows. The insistence on unrealized gains taxation may need to be tempered with considerations for maintaining the allure of the Dutch financial landscape. A clear dialogue between the government and investors will be critical to shaping a sustainable future, where revenue generation meets economic vitality without the specter of capital flight looming large.

Frequently Asked Questions

What is the unrealized gains tax proposed in the Netherlands?

The unrealized gains tax in the Netherlands is a proposed tax on unrealized capital gains from various investments, including stocks, bonds, and cryptocurrencies. This means investors would be taxed annually on paper gains, even if they haven’t sold their assets, effectively expanding the current Box 3 asset tax system.

How could the unrealized gains tax lead to capital flight in the Netherlands?

Investors, especially in the crypto sector, are concerned that the unrealized gains tax could significantly increase their annual tax burdens, prompting them to relocate their investments or even leave the country altogether. This potential capital flight raises alarms about the Netherlands’ attractiveness as a destination for investment and talent.

What are investor concerns regarding the Netherlands’ unrealized gains tax?

Investor concerns center around the idea that the proposed unrealized gains tax will unfairly tax them on gains that have not been realized, potentially discouraging investment and leading to capital flight from the Netherlands. Many fear that this could stifle innovation and drive away talent, particularly in sectors like cryptocurrency.

How does the proposed unrealized gains tax affect the Box 3 asset tax regime?

The proposed unrealized gains tax seeks to reform the Box 3 asset tax regime in the Netherlands by implementing taxation on unrealized gains, requiring investors to pay tax annually on their assets’ market value. This is a shift from the current system that taxes only realized gains, which has raised concerns among taxpayers.

What is the stance of Dutch lawmakers on the unrealized gains tax?

A majority of Dutch lawmakers seem supportive of the unrealized gains tax proposal despite acknowledging its flaws. They believe that the tax is necessary to address budget shortfalls and prevent an estimated loss of 2.3 billion euros per year in tax revenue, thereby indicating a commitment to reforming the Box 3 asset tax system.

What are the implications of the unrealized gains tax for cryptocurrency investors in the Netherlands?

Cryptocurrency investors in the Netherlands are particularly worried about the implications of the unrealized gains tax, as it would impose taxes on gains even if they have not liquidated their investments. This could lead to a heavier tax burden and potentially drive crypto investors to seek more favorable regulatory environments abroad.

Will real estate investors benefit from the unrealized gains tax modifications?

Yes, under the proposed changes, real estate investors may see improvements with deductions for costs and taxes only applicable upon realizing profits. However, there will be additional levies on second homes used for personal purposes, creating a differentiated approach within the revised Box 3 framework.

What alternatives were suggested to the unrealized gains tax in the Netherlands?

Some lawmakers have suggested that taxing only realized gains might be a better alternative to the unrealized gains tax. However, the government currently views this option as unworkable before 2028, primarily due to public finance pressures.