In the fascinating world of crypto, the phenomenon of uni trading whale profits has caught the attention of investors and analysts alike. One prominent whale has skillfully executed strategic trades, leading to staggering gains of $23.415 million since September 2020. By navigating the volatile market, this cryptocurrency trader has revealed effective crypto investment strategies that yield impressive blockchain trading profits. Recent data shows this whale sold 662,605 UNI, reaping a significant profit amid fluctuating prices like the Aave UNI price and contributing to essential UNI price analysis. As the landscape of crypto whale trading continues to evolve, understanding the tactics used by such influential traders is crucial for anyone looking to maximize their returns in the cryptocurrency market.

Exploring the realm of cryptocurrency trading, we encounter the impressive profits amassed by significant market players, often referred to as crypto whales. These entities are capable of executing large-scale trades that can lead to substantial financial gain, as demonstrated by a specific trader who has optimized their approach to UNI, resulting in noteworthy returns. This whale’s adept execution of buying and selling UNI tokens offers valuable insights into current market dynamics, especially regarding the Aave UNI price fluctuations and broader crypto investment strategies. For those analyzing UNI price movements, it’s clear that tracking the activities of major players can provide critical angles for future investments. Overall, it underscores the importance of understanding not just market trends, but also the tactics employed by those capable of influencing the market significantly.

Understanding Crypto Whale Trading Strategies

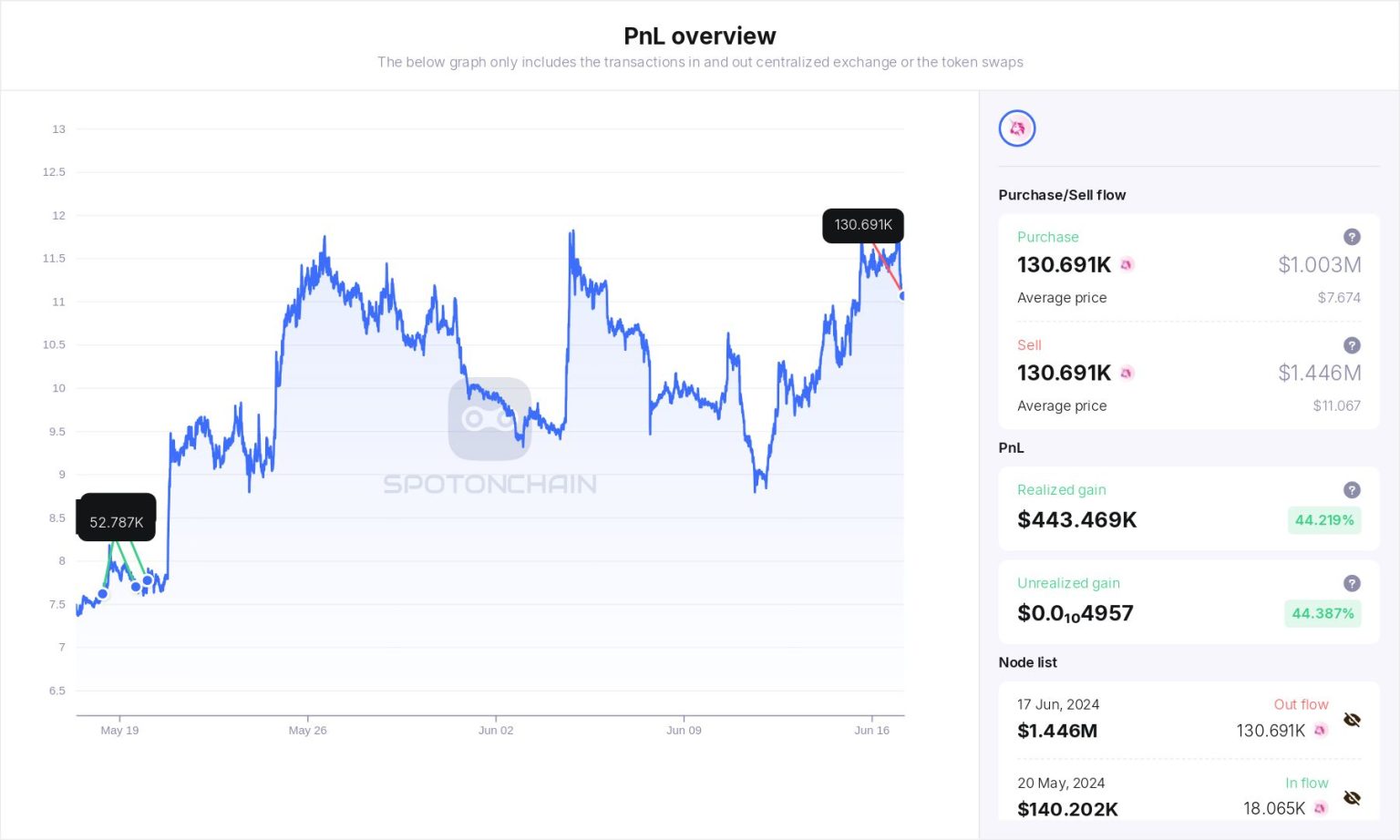

Crypto whale trading has become a focal point in the blockchain investment world, as these large holders often wield the power to sway the market significantly. A prime example is the whale identified as 0x4B0d…c9f8, who has successfully used wave trading strategies on UNI since September 2020, achieving unprecedented profits amounting to $23.415 million. These whale traders don’t just employ basic trading tactics; instead, they analyze price trends and market dynamics intricately, which can inform other traders about potential market movements. Understanding these strategies can help novice investors craft better crypto investment strategies that align with market behavior.

Moreover, crypto whale trading isn’t merely about moving large amounts of capital but also about timing and understanding market psychology. The actions of whales are often mirrored by the smaller investors, meaning that when a whale like this one make significant trades, the ripple effects can lead to increased volatility in the market. For instance, the whale’s transaction history with UNI serves as a template for potential future trades by smaller investors who monitor such activities. This observation can lead to an intense reliance on whale actions, impacting Aave UNI pricing as the market absorbs these strategic moves.

Analyzing Aave UNI Price Through Whale Activities

The price of Aave UNI has shown intriguing trends, especially in the wake of significant trading activities from notable whales. This particular whale’s history of wave trading has resulted in a remarkable win rate of 100%, an impressive feat that warrants close examination. By analyzing the price movements around the whale’s actions, investors can glean insights that may predict future price fluctuations. For example, the whale sold 662,605 UNI at a price of $8.82, purchasing at $5.99, which highlights the importance of price analysis in maximizing profitability in crypto investments.

Currently, with recent data showing the price of UNI hovering around $6, it becomes crucial to consider how whale trading impacts these numbers. The destruction of 100 million UNI also plays a vital role in supply dynamics, which can create a scarcity effect that might push prices upward. For the investor interested in UNI price analysis, understanding how whale actions correlate with broader market movements is essential. This knowledge will help them assess the potential headwinds and tailwinds that could affect future investment decisions.

The Impact of Blockchain Trading Profits from Whale Trading Operations

Whale trading in the blockchain ecosystem has demonstrated its potential to generate substantial profits. In the case of the aforementioned whale who accumulated $23.415 million, it becomes evident that strategic crypto investment strategies can lead to significant financial rewards. Such profits not only highlight the opportunity blockchain trading offers but also emphasize the risks associated with it. As whales navigate through varying market conditions, their trading patterns can provide a blueprint for emerging investors on how to handle volatility within the crypto markets.

Moreover, the profitability from whale trading activities fosters a deeper interest in the dynamics of blockchain technology. Observers note that the significant profits amassed by whales can influence the adoption and overall sentiment toward specific cryptocurrencies. More participation and analysis of whale trading leads to richer information flow within the investment community and can guide new investors toward making informed decisions based on historical precedence and current trends. As these whales navigate the intricacies of the market, understanding their strategies can empower smaller investors in securing their own trading profits.

Developing Effective Investment Strategies Based on Whale Behavior

When devising effective crypto investment strategies, studying whale behavior is paramount. Whales like the one trading UNI reveal patterns that can guide smaller traders in optimizing their portfolio management. By observing the transactions, especially the volume and timing, traders can adopt practices that either mimic successful whales or strategically diverge from trends that appear hazardous. Given that this whale operates with a near-perfect win rate, analyzing their approach can benefit investors looking to penetrate the often tumultuous crypto waters.

Additionally, understanding whale behavior enables smaller market participants to anticipate potential market shifts and react accordingly. By integrating insights gained from whale trading activities into their investment strategies, traders can position themselves to benefit during price transitions, resulting in a more robust trading portfolio. The synergy between whale activities and smaller trader responses creates an interconnected realm in crypto investments that can lead to informed decision-making and improved market outcomes.

The Risks and Rewards of Whale Trading in Crypto Markets

The allure of whale trading lies in the substantial rewards that can come from successful investments. However, it’s essential to recognize that there are inherent risks present. While the whale in question has seen a success rate of 100%, no trading strategy is devoid of risk, especially in the volatile crypto space. New investors must navigate these risks carefully, understanding that what works for a large-scale trader may not necessarily yield similar outcomes for smaller investors.

Moreover, market manipulation is a risk often linked to whale trading activities. When a whale sells or buys massive quantities, it can lead to price swings that adversely affect the market. Therefore, smaller investors must be vigilant and not solely follow whale movements without their own thorough analysis. Ensuring a balance between the risks and potential rewards is crucial in developing a sustainable approach to crypto investment that respects market dynamics while seeking profitability.

Leveraging On-Chain Data for Investment Insights

In the fast-evolving landscape of crypto trading, on-chain data has emerged as a powerful tool for investors. The whale’s recent transactions and trading patterns, captured through on-chain analytics, provide a rich source of information for those seeking to optimize their strategies. By examining the moves of high-profile traders, investors can gain insights into market psychology and potential future trends.

Additionally, as on-chain analysts like Ai Yi monitor whale activities, they help democratize access to crucial trading information that was once only available to elite traders. This transparency allows all investors, regardless of their size, to make informed decisions based on the actual trading behaviors and market data rather than speculation. Thus, leveraging on-chain data becomes an essential aspect of successful crypto investment strategies.

Future Trends in UNI Trading and Price Predictions

Looking ahead, the future trends in UNI trading show promise, influenced significantly by whale trading behaviors. Given the historical data of successful whale operations leading to substantial profits, investors are keen to predict the direction of UNI prices. As the supply shrinks with substantial burns and transaction shifts, potential bullish trends could emerge, provided investors remain informed about whale activities and market sentiment.

Moreover, understanding the cyclical nature of crypto asset prices can offer insights into potential future movements in UNI valuation. As whales continue to employ effective trading tactics, sustained speculation around the asset may lead to increased interest and investment, buoying its market presence. Attention to both whale actions and broader market indicators will be key for stakeholders looking to capitalize on future opportunities within the UNI trading ecosystem.

How Whale Transactions Affect Market Sentiment

Whale transactions hold significant weight in shaping market sentiments, influencing both confidence and trading strategies among smaller investors. The recent activities of the 0x4B0d…c9f8 whale have demonstrated precisely how large trades can set the tone for market reactions. When a whale executes a trade, it often triggers a chain reaction, causing smaller traders to either follow suit or react based on perceived momentum.

This phenomenon underscores the psychological aspect of trading in the crypto market. As market participants assess the trading volume and direction undertaken by whales, they may alter their positions accordingly. Such behavioral finance considerations paint the broader picture of how crypto market dynamics fluctuate due to the influence of whale transactions, emphasizing the need for traders to stay alert and responsive to these powerful market players.

Optimizing Trading Strategies with Whale Insights

In the realm of crypto trading, insights derived from whale behavior can enhance trading strategies significantly. Investors observing whales like the UNI trader can refine their approaches, learning not only from their successes but also from market reactions to whale activities. Incorporating these insights allows traders to forecast potential price movements and optimize entry and exit points in their trades.

Moreover, utilizing whale insights equips traders to adjust their risk management strategies effectively. Understanding when and why a whale enters or exits a position can enlighten smaller investors about potential market shifts. By blending traditional technical analysis with insights gained from whale activities, traders can create a more nuanced investment strategy that accounts for the complex nature of the crypto market.

Frequently Asked Questions

What are UNI trading whale profits and how do they impact the cryptocurrency market?

UNI trading whale profits refer to the significant earnings made by large investors or ‘whales’ in the market for Universal Basic Income (UNI) cryptocurrency. These profits can affect market trends and price movements as whales tend to execute large transactions that can lead to price volatility. Monitoring the activities of these whales is crucial for understanding broader market dynamics.

How did the whale’s three wave trading operations on UNI result in $23.415 million in profits?

The whale in question successfully executed three wave trading operations on UNI, resulting in accumulated profits of $23.415 million since September 2020. This strategy likely involved buying UNI at lower prices and selling at higher prices, showcasing effective crypto investment strategies that capitalized on market fluctuations.

What is the significance of a 100% win rate for UNI trading whale profits?

A 100% win rate in UNI trading whale profits signifies that the whale has successfully made profitable trades without incurring losses. This high level of success suggests a deep understanding of UNI price analysis and market trends, which other traders may aim to replicate to enhance their own trading strategies.

How do blockchain trading profits relate to the UNI price analysis?

Blockchain trading profits can be significantly influenced by UNI price analysis. By examining historical price trends and conducting technical analysis, traders can identify potential entry and exit points for profits. The whale’s operations demonstrate how informed trading decisions based on price analysis can lead to substantial financial gains in the cryptocurrency space.

What strategies are used in crypto whale trading to maximize UNI profits?

Crypto whale trading strategies often involve timing the market, leveraging technical analysis, and understanding market sentiment to maximize UNI profits. These strategies may include wave trading, where whales buy and sell based on predicted price movements, aiming to capitalize on price fluctuations effectively.

What was the impact of the whale selling 662,605 UNI at $8.82 on the overall market?

The sale of 662,605 UNI at a price of $8.82 by the whale can have a notable impact on the overall market, potentially leading to temporary price declines as large amounts of UNI are introduced into circulation. Such actions are monitored closely by traders looking to understand the effects of whale trading activities on UNI price movements.

| Key Points | Details |

|---|---|

| Whale Trading Activity | A certain whale executed three major wave trading operations on UNI since September 2020. |

| Total Profit | The whale has accumulated a total profit of $23.415 million from these trades. |

| Recent Trade | Five months ago, the whale sold 662,605 UNI at $8.82, having purchased them at $5.99. |

| Profit from Recent Trade | This transaction resulted in a profit of $1.875 million. |

| Win Rate | The whale has a remarkable win rate of 100% across all trades. |

| Current Situation | Currently, 100 million UNI have been destroyed, and the price of UNI is at $6. |

Summary

Uni trading whale profits have significantly impacted the market, as demonstrated by the actions of a prominent whale who has amassed $23.415 million in profits since September 2020. This particular whale has shown not only a strategic prowess in trading but also a flawless win rate of 100%. Such trading success reflects the dynamics of the UNI market and highlights the potential for substantial gains in cryptocurrency investments.