Understanding the Impact of October 15 on OpenSea SEA Airdrop Participants

October 15 represents a pivotal moment for participants in the OpenSea SEA airdrop, marking a significant day that carried financial implications and strategic decisions for those involved. Understanding the impact of this day requires a detailed look into the context of the airdrop, the mechanics behind it, the market’s response, and the subsequent results on that particular date.

Background of the OpenSea SEA Airdrop

OpenSea, a leading player in the Non-Fungible Token (NFT) marketplace, aimed to leverage the airdrop as a strategy to boost user engagement, reward its community, and potentially decentralize its governance structure. The SEA token was introduced as part of this initiative, creating both excitement and speculation across the NFT and broader crypto communities.

An airdrop in the cryptocurrency world is a distribution of tokens to existing wallet holders, typically used as a means to incentivize participation and loyalty. Airdrops can significantly affect the token’s price and the recipient’s financial strategy depending on the conditions attached to the disbursement and the broader market dynamics.

What Happened on October 15?

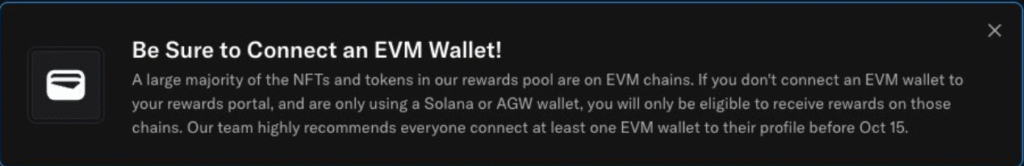

The specific date of October 15 was crucial for the SEA airdrop for several reasons. First, it marked the end of a lock-up period, where tokens distributed to users became fully tradable. Leading up to this date, recipients could not sell or transfer their SEA tokens, creating a period of speculation and value estimation largely founded on market sentiment and future use cases of the token.

Secondly, the ability to trade these tokens often leads to a significant increase in market activity. Participants had to decide whether to hold on to their tokens in anticipation of potential future growth or to sell them to realize immediate gains. This decision was influenced by prevailing market conditions, OpenSea’s platform strategies, and general trends in the crypto and NFT sectors.

Market Reaction and Participant Impact

When the SEA tokens became tradable on October 15, there was a notable spike in volume on exchanges where SEA was listed. This initial rush often leads to a sharp swing in prices due to the sudden increase in liquidity. Participants witnessed a significant fluctuation in the value of SEA, influenced by a combination of early sell-offs by those looking to capitalize quickly and purchases by those more optimistic about long-term prospects.

The impact on participants was mixed. For those who sold their SEA tokens upon them becoming tradable, the primary concern was maximizing immediate returns. Depending on the selling price, early movers could capitalize on potentially high post-lockup demand. Conversely, users who held onto their tokens might have done so under the belief that OpenSea’s continued growth and integration of SEA into its platform ecosystem would yield greater future rewards.

Long-term Considerations

Beyond immediate financial implications, October 15 holds long-term significance for SEA token holders and the OpenSea ecosystem. It is a test of the token’s utility and broader acceptance. Effective use cases within the platform, such as governance, fees payment, and rewards, can provide intrinsic value to SEA, stabilizing its price and ensuring its relevance in the marketplace.

Additionally, the response observed on October 15 can offer insights into handling future airdrops and token distributions not just for OpenSea, but for other platforms considering similar strategies. The balance between incentivizing early users and maintaining long-term token viability becomes a delicate dance of market psychology and economic strategy.

Conclusion

The events of October 15 around the OpenSea SEA airdrop are a microcosm of broader trends in the cryptocurrency and NFT industries, encapsulating the excitement, speculation, and strategic financial decisions that characterize these markets. Whether a participant benefited or incurred losses on this date, the lessons learned and strategies adjusted will undeniably contribute to the evolving narrative of crypto assets and decentralized finance.