The UK crypto regulation landscape is poised for significant transformation as the government moves to integrate crypto assets into a robust financial services regulation framework by October 2027. In December 2025, HM Treasury introduced the “Financial Services and Markets Bill (Crypto Assets) Regulations 2025” to Parliament, which aims to formalize activities such as trading operations, custody services, staking, and lending under a comprehensive authorization system. This pivotal legislation is designed to align the regulatory treatment of cryptocurrency providers with established norms in traditional finance. Moreover, the Financial Conduct Authority (FCA) has published a series of consultation papers that propose essential measures targeting governance, disclosure practices, and safeguarding against market manipulation. As the UK’s cryptocurrency laws take shape, the focus remains on creating a secure environment for crypto assets UK, ensuring both investment safety and market integrity.

As the UK navigates its approach to digital currencies, the upcoming financial services framework signifies a concerted effort to regulate cryptocurrency activities effectively. The integration of crypto assets within the broader financial market will not only provide clarity but also enhance consumer protection and market transparency. Various sectors, including trading platforms and digital asset management, will soon operate under established guidelines, reflecting a shift towards more structured oversight in the realm of digital currencies. With key regulatory bodies like the FCA actively seeking public input through consultation papers, stakeholders are encouraged to contribute to the formation of these new standards. This proactive stance on UK cryptocurrency regulations showcases the government’s commitment to fostering innovation while ensuring that the financial ecosystem remains resilient against potential risks.

Understanding UK Cryptocurrency Laws

The current landscape of UK cryptocurrency laws is rapidly evolving, with significant developments anticipated by 2027. The government has recognized the need for a robust framework to regulate crypto assets effectively. This includes the forthcoming incorporation of various activities, such as operating trading platforms and custody services, under the Financial Services and Markets Bill. This regulation aims to not only protect consumers but also stabilize the financial ecosystem as cryptocurrencies become increasingly integrated into legitimate financial services.

Moreover, as part of the ongoing alignment with traditional financial systems, UK cryptocurrency laws seek to introduce formal authorization for businesses operating within the crypto space. This is a pivotal step for the UK, fostering a safer environment for both consumers and industry players. The comprehensive regulation will undoubtedly enhance trust in cryptographic assets, paving the way for broader adoption in the financial landscape.

HM Treasury’s Role in Crypto Regulation

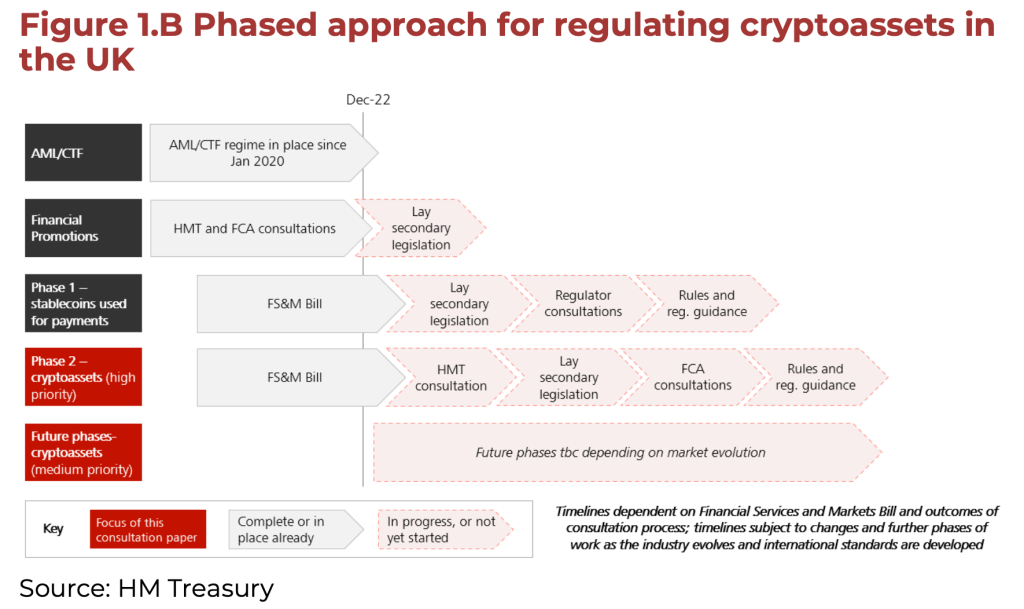

HM Treasury is at the forefront of the UK’s initiative to regulate crypto assets, having submitted the ‘Financial Services and Markets Bill (Crypto Assets) Regulations 2025’ to Parliament in December 2025. This legislation is designed to ensure that the operations surrounding crypto assets, such as lending and staking, adhere to standards akin to those established for traditional financial services. By doing so, HM Treasury aims to mitigate risks associated with the nascent crypto market while fostering innovation.

The efforts of HM Treasury reflect an understanding that as the cryptocurrency landscape evolves, comprehensive oversight is crucial to prevent market abuses and to protect investors. Their commitment to developing a sophisticated regulatory framework illustrates the importance of proactive governance amidst growing concerns about financial security and the potential for market manipulation within the crypto sector.

Impact of FCA Consultation Papers on the Crypto Market

The Financial Conduct Authority (FCA) has taken significant strides to shape the regulatory environment for cryptocurrencies through the release of several consultation papers. These documents propose essential governance and disclosure requirements, alongside measures to combat market manipulation and ensure sufficient capital reserves for crypto firms. This initiative aligns the crypto industry more closely with conventional financial practices, thereby enhancing transparency and accountability.

Implementing these proposals would require crypto asset service providers to adhere to strict operational standards, similar to those found in the traditional financial services sector. By detailing the responsibilities of token issuers and service platforms, the FCA aims to establish a safer and more reliable marketplace for crypto assets in the UK, promoting sustainable growth and increasing investor confidence.

The Future of Financial Services Regulation in the UK

The future trajectory of financial services regulation in the UK is increasingly intertwined with cryptocurrency governance. As regulators prepare to formalize the legal framework for crypto assets, the emphasis will likely be on creating a comprehensive regulatory environment that balances innovation with stability. Policymakers are keenly aware of both the risks posed by unregulated crypto activities and the transformative benefits of integrating cryptocurrency into the wider financial services framework.

The planned regulations are expected not only to encompass existing financial services but also to adapt quickly to the changing dynamics of the crypto market. As regulatory bodies work towards enhancing consumer protection and operational integrity in crypto transactions, the aim is to create an environment that fosters responsible innovation while mitigating potential risks associated with this burgeoning asset class.

Navigating Financial Interference in Crypto Donations

In light of increasing concerns about foreign financial interference, the UK government has initiated an independent review focusing on political financing risks linked to cryptocurrency donations. The findings from this review, due by March 2026, will play a critical role in informing how crypto donations are regulated within the broader framework of political finance. This initiative underlines the urgent need to understand the implications of cryptocurrency in the political arena and ensure that such contributions are transparent and accountable.

This scrutiny highlights that while cryptocurrency offers new avenues for political fundraising, it also poses unique challenges regarding accountability and transparency. Establishing clear guidelines for crypto donations is crucial to safeguard against potential abuses, ensuring that the integrity of the democratic process is maintained. Hence, navigating the complexities of financial regulations will be pivotal as the UK seeks to balance innovation with vigilance against potential threats.

The Rise of Custody Solutions in Crypto Assets

As regulatory frameworks evolve, the necessity for reliable custody solutions in the handling of crypto assets has become increasingly apparent. Custodians play a vital role in securing digital assets, particularly as more institutional investors look to enter the cryptocurrency market. In this context, proper regulation of custody services will be crucial in ensuring that these assets are managed safely and comply with financial regulations.

The proposed regulations under HM Treasury’s framework emphasize the importance of custody providers in maintaining the security and integrity of digital assets. By establishing stringent requirements around custodianship, the UK aims to protect investors’ interests and enhance overall market stability, assuring stakeholders that crypto assets are handled with the same diligence as traditional financial assets.

Exploring Staking and Lending Activities in UK Law

The introduction of staking and lending activities into the regulatory framework is another innovative aspect of the proposed financial services regulation concerning crypto assets. As these practices become more popular among crypto investors, regulatory clarity is essential in ensuring that participants understand their rights and responsibilities. Proper governance and oversight of these activities can help prevent potential fraud while fostering a more robust market environment.

By incorporating staking and lending under the auspices of financial services regulation, the UK is acknowledging the growing significance of these activities in generating yield for investors. This regulatory focus will not only protect consumers but also encourage more widespread participation in the cryptocurrency ecosystem, driving innovation and growth in the sector.

The Role of Transparency in Crypto Market Regulation

One of the core pillars of effective crypto market regulation is transparency. The FCA’s consultation papers emphasize the necessity for clear disclosure norms for crypto asset providers. Providing potential investors with reliable information about the risks and rewards associated with different crypto assets is fundamental to building trust within the market. Enhanced transparency measures will empower consumers to make informed decisions about their investments.

Furthermore, a transparent market environment can mitigate risks associated with market manipulation and fraudulent activities. As regulatory frameworks advance in the UK crypto landscape, ensuring that all actors within the ecosystem comply with clear standards of disclosure and reporting will be fundamental to safeguarding market integrity and fostering sustainable growth.

Strengthening Investor Protection in Cryptocurrency

Investor protection is becoming an increasingly vital component of the UK’s regulatory strategy for cryptocurrencies. As digital assets gain traction among diverse investor demographics, the responsibility to instill confidence in the market is paramount. Regulatory bodies must develop frameworks that not only protect consumers from potential scams but also ensure that firms operate fairly and transparently.

This includes establishing clear guidelines around advertising practices, handling customer funds, and managing the risk associated with cryptocurrency investments. By focusing on investor protection, the UK can foster an investment environment that encourages responsible participation in cryptocurrency, thus promoting longevity and credibility within the crypto asset sector.

Frequently Asked Questions

What is the current state of UK crypto regulation?

The current state of UK crypto regulation is evolving, with plans to bring crypto assets under financial services regulation by October 2027. HM Treasury submitted the ‘Financial Services and Markets Bill (Crypto Assets) Regulations 2025’ to Parliament, aiming to formalize regulations for activities like trading platforms and custodial services.

How are crypto assets regulated under UK cryptocurrency laws?

UK cryptocurrency laws are set to be integrated into financial services regulation by October 2027. This will include significant provisions for governance, disclosure, and risk management for crypto assets, as outlined in the FCA’s consultation papers.

What does the FCA’s consultation paper on UK crypto regulation entail?

The FCA’s consultation papers propose implementing governance, anti-market manipulation, and prudential capital requirements for crypto service providers and trading platforms, mirroring regulations found in traditional finance to enhance the security and stability of the crypto market.

What are the implications of HM Treasury crypto regulations for cryptocurrency businesses?

HM Treasury crypto regulations will require cryptocurrency businesses in the UK to obtain formal authorization and comply with new governance and risk management standards, significantly impacting how they operate and interact with customers.

When can we expect a report on foreign financial interference related to cryptocurrency donations in the UK?

An independent review initiated by the UK government to assess the risks of foreign financial interference, including cryptocurrency donations, is expected to produce a report by March 2026, which will inform future UK crypto regulation.

How will UK crypto regulation affect trading platforms and custodial services?

UK crypto regulation intends to incorporate trading platforms, custody, staking, and lending into a formal authorization framework. This will impose strict regulatory obligations on these entities, enhancing consumer protection and market integrity.

What risks are associated with the current UK cryptocurrency laws?

The current UK cryptocurrency laws face risks such as inadequate governance and potential market manipulation. However, ongoing regulatory developments aim to mitigate these risks by introducing comprehensive frameworks similar to traditional financial services.

Are there specific compliance requirements for token issuers under UK financial services regulation?

Yes, as part of the forthcoming UK financial services regulation, token issuers will need to adhere to various compliance requirements, including governance structures and disclosure standards, to ensure transparency and protect investors.

What issues is the UK government reviewing related to crypto assets and political financing?

The UK government is reviewing political financing risks associated with crypto assets, specifically examining how cryptocurrency donations can expose the financial system to foreign interference, with outcomes expected in March 2026.

Will UK crypto regulations align with international standards?

The UK aims to align its crypto regulations with international standards as it implements the Financial Services and Markets Bill (Crypto Assets) Regulations, ensuring that measures like governance and capital requirements are consistent with global practices.

| Key Point | Details |

|---|---|

| Regulatory Timeline | UK plans to regulate crypto assets by October 2027. |

| Legislation | The ‘Financial Services and Markets Bill (Crypto Assets) Regulations 2025’ submitted to Parliament. |

| Scope of Regulation | Regulations will cover trading platforms, custody, staking, and lending activities. |

| FCA Consultations | Three consultation papers released proposing governance, disclosure, anti-market manipulation, and capital requirements. |

| Political Financing Review | An independent review of foreign interference is assessing risks related to cryptocurrency donations. |

| Expected Report Completion | The related report on political financing risks is expected by March 2026. |

Summary

UK crypto regulation is set to undergo significant changes by 2027 as the government seeks to establish a comprehensive regulatory framework for crypto assets. The Financial Services and Markets Bill aims to formalize various activities associated with crypto, including trading and lending, bringing them in line with traditional financial services regulations. With ongoing consultations from the FCA and an independent review on political financing, the UK is taking important steps to ensure the crypto market operates within a robust regulatory environment.