U.S. Treasury debt has reached an unprecedented milestone, surging past the $30 trillion mark for the first time in history. This staggering figure reflects a significant increase, more than doubling since 2018, and plays a crucial role in the overarching U.S. national debt, which now totals approximately $38.4 trillion. The complexity of this financial landscape is evident as Treasury securities, including bills, notes, and bonds, contribute heavily to both government borrowing and the national fiscal deficit. With debt interest payments climbing to $1.2 trillion, the sustainability of this borrowing raises questions about the implications for taxpayers and future economic growth. Analysts, including Jason Williams of Citigroup, emphasize that managing these interest expenses will be a formidable challenge moving forward, reflecting a reality that the nation’s financial strategies must address urgently.

The burgeoning landscape of federal obligations, often encapsulated as government securities issued by the U.S. Treasury, has shown remarkable growth, with total liabilities exceeding $30 trillion. This debt profile encompasses various financial instruments such as bills, notes, and bonds, which are pivotal in understanding the broader implications for national financial health. The current fiscal environment, underscored by a significant national fiscal deficit, indicates a pressing need for strategies to curb mounting debt interest payments that currently exceed a trillion dollars annually. As experts point out, effective management of these burgeoning expenses is essential if the U.S. aims to secure a more stable economic future. With borrowing levels at historic highs, the financial choices made today will undoubtedly shape the nation’s economic outlook for generations.

The Current State of U.S. Treasury Debt

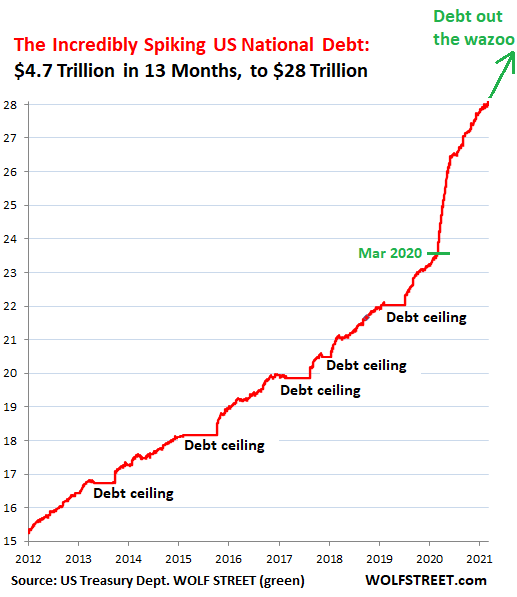

As of November, the outstanding debt issued by the U.S. Treasury has reached a staggering $30.2 trillion, setting a new record in the nation’s financial history. This figure reflects a significant increase from just a few years ago, having more than doubled since 2018. This surge in U.S. Treasury debt is not just a number; it signifies extensive government borrowing that is influencing economic policies and reforms aimed at tackling the national fiscal deficit. With every passing year, the burden of the debt grows, thereby raising concerns about the sustainability of government spending and future obligations.

The implications of this rapid increase in U.S. Treasury debt are profound. Each Treasury security issued—be it bills, notes, or bonds—represents a commitment that the government must meet, which can lead to higher debt interest payments. It’s essential to understand that as the total debt goes up, so does the amount of interest the government owes to creditors. Analysts warn that if the trend continues unchecked, it could strain future budgets, leaving less room for essential services and infrastructure improvements.

Understanding U.S. National Debt and its Components

The total U.S. national debt currently stands at approximately $38.4 trillion, encompassing more than just Treasury securities. This total includes obligations to various stakeholders, such as the Social Security Trust Fund and other federal mandates. The complexity of national debt underscores the critical need for effective management strategies. As obligations increase, the pressure on fiscal policies mounts, necessitating discussions about government spending priorities and potential reforms to the welfare system.

Delving into the specifics, the debt can be categorized into two primary segments: debt held by the public and intragovernmental holdings. While debt issued as U.S. Treasury securities represents a significant portion of the overall national debt credited to public borrowing, intragovernmental holdings consist of funds such as those earmarked for Social Security. Understanding these categories is crucial for assessing where fiscal deficits arise and how they can be addressed through better governance and financial discipline.

The Impact of National Fiscal Deficit on Government Finance

One of the most pressing issues facing the U.S. economy today is the national fiscal deficit, which recorded a staggering exceedance of $3 trillion in 2020. This figure reflects how much more the government spends compared to its revenue generation. The ongoing fiscal deficit contributes substantially to overall national debt. Concerns about the sustainability of such high deficits lead to questions about whether current spending levels are maintainable, and what future measures may need to be taken to stabilize the financial outlook.

As the fiscal deficit narrows—with projections suggesting a drop to around $1.78 trillion in fiscal year 2025—questions about the issuance of Treasury securities become increasingly relevant. Managing this transition effectively will require balancing the need for government funding while minimizing further debt accumulation. Policymakers must strategically evaluate spending priorities and explore revenue-boosting reforms to enhance the financial equilibrium.

Debt Interest Payments: A Growing Concern

In this landscape of rising U.S. Treasury debt, debt interest payments have emerged as a critical concern, amounting to approximately $1.2 trillion annually. This substantial figure represents the cost of borrowing and the government’s commitment to honor its obligations on its existing debt. As interest rates potentially rise with inflationary pressures, these payments could increase, further straining the federal budget and leading to a reduced ability to fund essential programs.

Experts emphasize that despite expecting other forms of revenue, such as tariff revenues, which are projected to range between $300-400 billion, it falls significantly short of covering interest expenses. Jason Williams from Citigroup highlighted this precarious situation, indicating that while measures may be introduced to slow the fiscal decline, they are insufficient to combat the underlying issues related to rising debt levels and corresponding interest obligations.

Exploring the Role of Treasury Securities in National Finance

Treasury securities play a pivotal role in the financing of government operations. By issuing Treasury bills, notes, and bonds, the U.S. government raises capital to fund various projects and initiatives. For instance, in 2020 alone, the U.S. financed over $4.3 trillion through these instruments. Understanding the functionality of these securities is crucial for grasping how the government manages its debt and sustains fiscal health, especially in turbulent economic times.

Furthermore, investors worldwide view U.S. Treasury securities as a safe haven for their investments. This perception reinforces the demand for U.S. debt instruments, allowing the government to secure low-interest loans. However, this comfort can also create a false sense of security about the sustainability of ongoing government borrowing, making it vital to consider long-term economic implications alongside short-term financial benefits.

Government Borrowing: Balancing Growth and Debt Management

Government borrowing is often seen as a necessary tool for financing public services, infrastructure, and other essential projects. However, the implications of excessive borrowing must be carefully evaluated. As the U.S. Treasury debt exceeds $30 trillion, the challenge lies in ensuring that borrowing remains productive and does not lead to an unsustainable fiscal trajectory. The ongoing debate among economists focuses on finding the balance between fostering economic growth through borrowing and maintaining a prudent approach to debt accumulation.

As American society increasingly relies on government funding for various initiatives, it becomes critical to establish frameworks that promote responsible borrowing. This means prioritizing investments that offer long-term returns and bolster economic resilience while minimizing dependence on debt. By strategically managing borrowing, the government can create pathways for sustainable growth while mitigating risks associated with rising debt levels.

The Future of U.S. Debt Management Policies

Looking ahead, U.S. debt management policies must evolve to address the multifaceted challenges posed by increasing national debt and fiscal deficits. Policymakers need to introduce frameworks that not only tackle immediate financial concerns but also prioritize long-term economic stability. This includes reassessing spending priorities and exploring comprehensive reforms focused on enhancing revenue streams from taxation and investment.

Moreover, the government must engage in transparent dialogues about its fiscal practices with stakeholders and the public. By fostering trust and understanding of these complex issues, citizens can better appreciate the implications of national debt and fiscal policies on their lives. An informed populace is essential for supporting sustainable fiscal measures that ensure the nation’s financial health for future generations.

Understanding the Broader Economic Context of National Debt

The implications of U.S. Treasury debt extend beyond mere figures on a balance sheet; they ripple through the entire economy, influencing everything from interest rates to investment decisions. This interconnectedness underscores the importance of analyzing national debt within a broader economic context. The ramifications of rising debt levels are felt by businesses and consumers alike, as governments may need to adjust fiscal policies or implement austerity measures that could hinder economic growth.

Furthermore, the economic stability of the U.S. and its ability to uphold its debt obligations plays a significant role in shaping global financial markets. A strong U.S. economy fosters confidence in the dollar as a reserve currency, while concerns about rising national debt could lead to volatility. Thus, understanding the dynamics of national debt is crucial for stakeholders aiming to navigate the complexities of the financial landscape effectively.

The Challenges of Sustaining Economic Growth Amid Rising Debt

Sustaining economic growth amidst rising U.S. Treasury debt poses a significant challenge for policymakers. As obligations skyrocket, it’s critical to strike a balance between encouraging growth and managing fiscal responsibilities. Innovative strategies are required to promote robust economic activity while keeping debt levels under control, ensuring that the immediate needs of society do not compromise future financial stability.

Moreover, as interest payments on the debt rise, this could consume an increasing portion of the federal budget, limiting spending on essential services such as education and healthcare. Policymakers must adopt a holistic approach to economic planning that considers the long-term impacts of debt management while fostering an environment conducive to sustainable growth. This includes reevaluating spending practices and exploring alternative fiscal policies that prioritize economic resilience for future generations.

Frequently Asked Questions

What is the current status of U.S. Treasury debt?

As of November, the total U.S. Treasury debt has surpassed $30.2 trillion, a significant increase that has doubled since 2018. This amount is a major component of the total federal debt, which stands at approximately $38.4 trillion.

How do U.S. Treasury securities relate to national fiscal deficit?

U.S. Treasury securities, which include Treasury bills, notes, and bonds, are used to finance the national fiscal deficit. In 2020, the fiscal deficit exceeded $3 trillion, and these securities were instrumental in raising $4.3 trillion for the U.S. Treasury.

What are the implications of high debt interest payments on U.S. Treasury debt?

High debt interest payments, which currently amount to about $1.2 trillion, pose a significant challenge for managing U.S. Treasury debt. This pressure is compounded by insufficient revenues, leading to concerns about sustainability and future borrowing.

How does the U.S. national debt affect government borrowing?

The U.S. national debt directly influences government borrowing decisions. As the national debt rises, the U.S. Treasury must issue more securities to finance its obligations, potentially leading to increased interest rates and economic challenges.

What role do Treasury securities play in financing the national debt?

Treasury securities are critical in financing the U.S. national debt. They are sold to investors to raise funds, which helps the government meet its financial obligations and manage the fiscal deficit.

Why has U.S. Treasury debt increased significantly since 2018?

The increase in U.S. Treasury debt since 2018 can be attributed to various factors, including rising fiscal deficits, increased government spending, and the economic impacts of crises such as the COVID-19 pandemic.

What are the future projections for U.S. Treasury debt?

Future projections indicate that while the fiscal deficit may narrow to around $1.78 trillion by 2025, the overall U.S. Treasury debt is likely to continue growing due to persistent debt interest payments and government borrowing needs.

How does the interest on U.S. Treasury debt compare to tariff revenues?

Currently, interest payments on existing U.S. Treasury debt significantly outweigh tariff revenues, which range between $300-400 billion. This disparity highlights the ongoing fiscal challenges the government faces.

| Key Point | Details |

|---|---|

| Total Sovereign Debt | The U.S. Treasury’s total debt has surpassed $30 trillion, reaching $30.2 trillion by November. |

| Growth Rate | The debt has more than doubled since 2018. |

| National Total Debt | As of November, the overall national debt is at $38.4 trillion. |

| Debt Components | This includes obligations to entities like the Social Security Trust Fund and holders of savings bonds. |

| 2020 Financing | In 2020, the U.S. financed $4.3 trillion through Treasury securities, while the fiscal deficit exceeded $3 trillion. |

| Projected Fiscal Deficit | The fiscal deficit is projected to decrease to around $1.78 trillion by fiscal year 2025. |

| Interest Payments | Debt interest payments are estimated to be $1.2 trillion. |

| Challenges Ahead | The existing interest expenses exceed tariff revenues, leading to concerns regarding fiscal sustainability. |

Summary

U.S. Treasury debt has now exceeded $30 trillion, marking a significant milestone in fiscal history. The rapid increase in debt since 2018 raises concerns about the sustainability of national finances. With the total national debt at $38.4 trillion, including extensive obligations to various funds, it remains crucial for policymakers to address the growing interest liabilities, which are projected at $1.2 trillion. As the fiscal deficit narrows, the challenges of managing such massive debt levels will continue to demand strategic financial oversight to prevent jeopardizing economic stability.