U.S. Treasuries remain a cornerstone for investors in today’s financial landscape, reflecting a strong preference for safety amid economic uncertainties. With looming expectations of Federal Reserve rate cuts, the stability of Treasury yields becomes a focal point for those seeking reliable investment options. Analysts highlight how the resilience of the U.S. economy continues to bolster the attractiveness of these government-backed securities. Even in a fluctuating market, investors are drawn to Treasuries for their perceived security and favorable performance outlook. As foreign investment in U.S. assets evolves, Treasuries are likely to maintain a prominent position.

Government bonds, specifically U.S. Treasuries, have gained significant attention as a preferred investment vehicle in the face of economic unpredictabilities. Analysts have identified a notable trend where investors lean towards these securities, particularly with anticipated adjustments to the Federal Reserve’s interest rates. The consistency observed in Treasury yields amidst market fluctuations supports the notion of their reliability. Furthermore, the enduring strength of the U.S. economy adds to the appeal of holding these instruments. With ongoing shifts in foreign capital flows, the demand for government bonds remains robust, signaling a continued preference for these financial assets.

| Key Point | Details |

|---|---|

| Analyst Opinion | U.S. Treasuries remain favored by investors. |

| Market Outlook | The Federal Reserve is expected to cut interest rates, which should positively impact Treasury performance. |

| Economic Resilience | A strong U.S. economy enhances the attractiveness of Treasury assets. |

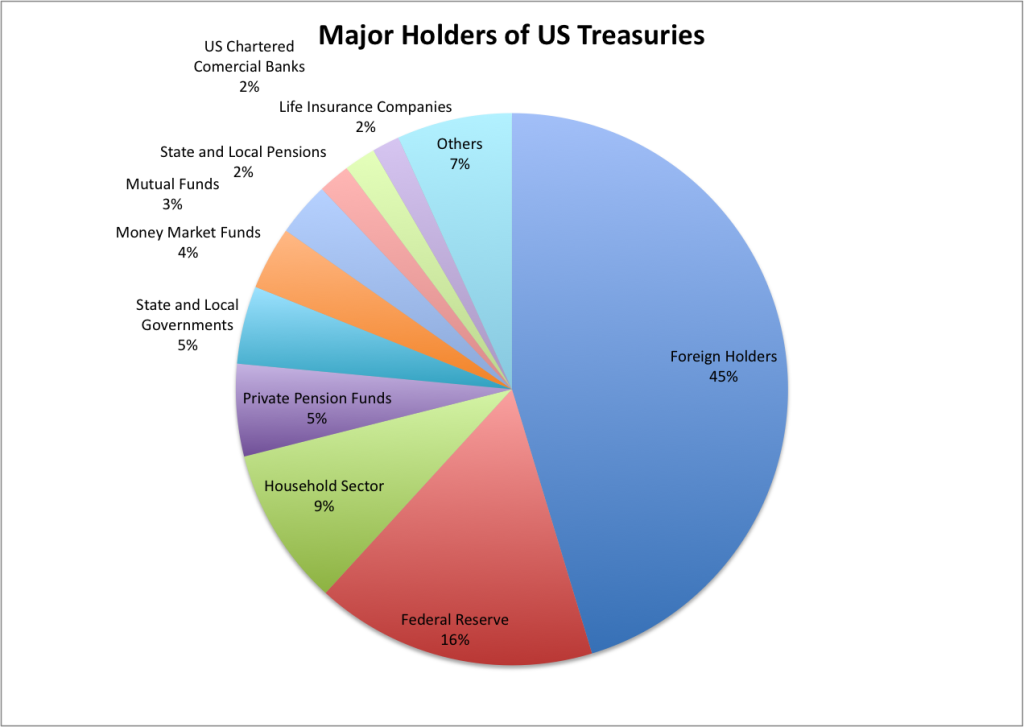

| Foreign Investment Trends | Foreign investments in U.S. Treasuries may decline over the medium to long term, but a significant short-term sell-off is unlikely. |

Summary

U.S. Treasuries continue to be a preferred investment choice amidst expectations of Federal Reserve rate cuts. Despite the political uncertainties in the U.S., the stability of Treasury yields highlights the strong investor confidence in these assets. The potential for the Federal Reserve to lower interest rates is likely to enhance the performance of U.S. Treasuries, making them an attractive option for those seeking reliable investments. Moreover, the resilience of the U.S. economy further bolsters the appeal of Treasuries, although foreign investment trends suggest a cautious outlook for the medium to long term.

U.S. Treasuries: A Safe Haven for Investors

In times of economic uncertainty, U.S. Treasuries have consistently emerged as a preferred investment option for conservative investors. Analysts from UBS Investment Research highlight that despite ongoing fluctuations in the political landscape, the stability of Treasury yields continues to appeal to those seeking a secure asset. The expectation of further Federal Reserve rate cuts is contributing to this preference, as lower rates generally enhance the attractiveness of fixed-income securities like Treasuries. This stabilization in yields assures investors seeking safety amidst market volatility.

Moreover, the resilience of the U.S. economy plays a critical role in bolstering confidence in Treasury investments. As long as U.S. economic indicators remain strong, Treasury securities are likely to maintain their status as a safe haven. This dual factor of stable yields and economic strength reassures investors, solidifying their preference for U.S. Treasuries over other potential higher-risk options.

Impact of Federal Reserve Rate Cuts on Treasury Yields

The prospect of Federal Reserve rate cuts significantly influences Treasury yields, often leading to a decrease in yields as bond prices rise. Analysts suggest that as the Federal Reserve signals a more accommodative monetary policy, investors flock to Treasuries to lock in yields before they potentially decline further. This trend not only boosts the performance of Treasury securities but also reflects a broader shift in investor sentiment favoring lower-risk assets during periods of economic uncertainty.

Furthermore, if the Fed continues its trend of rate cuts, we could see a sustained period of low Treasury yields. Consequently, the appeal of these securities becomes even more pronounced for investors who prioritize stability over high returns. The interaction between monetary policy and Treasury yields highlights the dynamic nature of fixed-income investing and the critical role that interest rate expectations play in shaping investment strategies.

Investor Preferences Amid Economic Resilience

Despite uncertainties, investor preferences are increasingly leaning towards U.S. Treasuries, reflecting a broader confidence in the resilience of the U.S. economy. The analytical report from UBS reveals that, while some fear volatility due to political events, the fundamentals underlying the U.S. economy remain robust. This economic resilience provides a favorable backdrop for Treasuries, as stable economic conditions often translate into predictable performance for fixed-income securities.

Moreover, as global economic uncertainties persist, investors are keen on securing their capital in Treasuries to mitigate risks. This preference is further amplified by the belief that U.S. assets, including Treasuries, will continue to attract investment flows, even with the anticipated shifts in foreign investment balances. Such investor behavior underscores the reliability of Treasuries in uncertain times, reinforcing their status as a cornerstone of a well-balanced portfolio.

Foreign Investment Prospects in U.S. Assets

The landscape of foreign investments in U.S. assets is evolving, particularly concerning Treasuries. As some foreign investors reconsider their portfolio allocations amid global economic shifts, U.S. Treasuries still remain a favored asset class due to their liquidity and safety features. Analysts note that the cautious approach by foreign entities does not necessarily indicate a mass exodus from Treasuries; rather, many continue to see value in this enduringly stable investment.

Additionally, the enticing prospect of Federal Reserve rate cuts plays a role in drawing continued foreign interest in U.S. Treasuries. Even with some fluctuations, the stability offered by Treasuries, combined with attractive yields compared to international counterparts, enhances their appeal. Thus, while the medium to long-term outlook may present challenges, the immediate outlook for foreign investment in U.S. Treasuries remains positive.

Market Expectations and Treasury Performance

Market expectations surrounding Federal Reserve rate policy play a pivotal role in determining Treasury performance. With widespread anticipation of continued rate cuts, investor appetite for Treasuries continues to grow. This environment creates a constructive backdrop for Treasury securities, leading to stabilization in yields, which is especially attractive to risk-averse investors looking for reliable returns amid broader market turbulence.

The combination of anticipated rate cuts and the strong performance of the U.S. economy underpins a favorable outlook for Treasury investments. As investors seek to navigate the complexities of market dynamics, the ability of U.S. Treasuries to deliver consistent performance reinforces their position as a preferred asset in uncertain times.

Treasuries versus Other Fixed-Income Investments

When comparing U.S. Treasuries to other fixed-income investments, the former often emerges as a more attractive option for cautious investors. Given the current market outlook, characterized by anticipated Federal Reserve rate cuts, Treasuries maintain a compelling advantage over corporate bonds and other high-risk fixed-income securities. Their inherent security makes them the ideal choice for investors prioritizing capital preservation.

Furthermore, with the U.S. economy showcasing resilience, the likelihood of default in Treasury bonds remains low, further enticing investors. The stability of Treasury yields, coupled with strong economic indicators, positions Treasuries favorably in the investment landscape, making them a cornerstone for diversified investment strategies.

Understanding Treasury Yields and Economic Indicators

Treasury yields, the returns on U.S. government bonds, are influenced by numerous economic indicators that shape investor expectations. As the Federal Reserve prepares for potential rate cuts, the relationship between Treasury yields and economic health gains prominence. Strong indicators such as employment data, inflation rates, and GDP growth can bolster Treasury yields, enhancing their investment attractiveness.

Moreover, understanding these yields is crucial for investors looking to navigate the fixed-income market effectively. As macroeconomic conditions fluctuate, the perceived stability of U.S. Treasuries can serve as a protective measure, allowing investors to manage their risk profiles strategically while remaining mindful of the economic signals that drive yield dynamics.

Long-Term Outlook for U.S. Treasuries

The long-term outlook for U.S. Treasuries remains bullish, especially in light of expected Federal Reserve rate cuts. As analysts predict an easing of interest rates, the potential for upward pressure on Treasury prices becomes pronounced. This suggests that over time, Treasuries may serve not only as a safety net but also as vehicles for capital appreciation as their yields decrease.

Furthermore, the long-term resilience of the U.S. economy only strengthens the case for investing in Treasuries. As global uncertainties loom, and with shifting foreign investment dynamics, the fundamental stability of U.S. government securities is likely to be a driving factor in their appeal for years to come.

Navigating Market Volatility with Treasuries

Market volatility often prompts investors to seek refuge in safe-haven assets, and U.S. Treasuries fit this role perfectly. With continuing concerns over geopolitical tensions and domestic economic fluctuations, the steady performance of Treasuries becomes increasingly attractive. Their stability is particularly beneficial during uncertain times, allowing investors to hedge against potential downturns in other asset classes.

As the Federal Reserve signals potential rate cuts, the demand for U.S. Treasuries is expected to remain strong. Investors recognize that these securities not only provide a steady return but also help to mitigate the effects of market fluctuations. Hence, in a world characterized by unpredictability, Treasuries stand out as a prudent investment choice.

Frequently Asked Questions

What are U.S. Treasuries and why are they favored by investors?

U.S. Treasuries are government debt securities issued by the U.S. Department of the Treasury. Investors favor Treasuries for their stability and safety, especially during economic uncertainties. Current expectations of Federal Reserve rate cuts further enhance their appeal, as lower interest rates typically boost Treasury prices.

How do Federal Reserve rate cuts influence U.S. Treasuries?

Federal Reserve rate cuts generally lead to lower yields on U.S. Treasuries, making them more attractive to investors seeking fixed-income securities. As the Fed decreases rates, the prices of existing Treasuries often increase, resulting in a favorable investment environment for these assets.

What factors contribute to the stability of U.S. Treasury yields?

U.S. Treasury yields are stable due to a combination of factors including strong investor preference for Treasuries, market expectations of Federal Reserve rate cuts, and the overall resilience of the U.S. economy. This stability is critical for maintaining investor confidence in U.S. government debt.

Why is foreign investment in U.S. Treasuries important?

Foreign investment in U.S. Treasuries is crucial as it helps finance the national debt and supports the dollar’s status as the world’s reserve currency. Despite some anticipated reductions in foreign investment over the medium term, Treasuries remain a preferred choice due to their perceived safety and the backing of the resilient U.S. economy.

How does the resilience of the U.S. economy affect U.S. Treasuries?

The resilience of the U.S. economy positively influences U.S. Treasuries by boosting investor confidence. A strong economy can lead to stable or increasing demand for Treasuries, especially when the Federal Reserve is expected to cut rates, reinforcing their attractiveness as a safe investment.

What should investors consider about the future of U.S. Treasuries amid market uncertainties?

Investors should consider the potential impact of Federal Reserve rate cuts, economic indicators reflecting U.S. economy resilience, and geopolitical factors influencing foreign investment in U.S. assets. Maintaining a balanced portfolio that includes U.S. Treasuries can provide stability amidst market volatility.