The U.S. stock market decline has triggered a wave of concern among investors, as major indices struggled to maintain upward momentum. On this particular day, the Dow Jones performance slipped by 1.2%, while the S&P 500 and Nasdaq performance followed closely with declines of 1.23% and 1.59%, respectively. This downturn was exacerbated by a staggering drop in the cryptocurrency sector, leading many stocks associated with cryptocurrency to plummet over 15% in value. Notably, DFDV experienced a drastic decline of 25.12%, alongside UPXI and MARA, whose values dropped significantly. As the cryptocurrency market news continues to develop, investors are left grappling with the implications of both the stock market today and the cryptocurrency decline for their future strategies.

A recent downturn in financial markets has raised red flags for investors, particularly in the context of the U.S. stock market decline. With a substantial drop in key indices like the Dow and Nasdaq, the latest trends reveal a troubling landscape for both traditional equities and digital assets. Many stocks tied to the cryptocurrency domain are facing intense selling pressure, showcasing a broader trend of shakeouts across the trading spectrum. This scenario presents a unique confluence of declines, as market participants seek clarity amidst the uncertainty. As we navigate these fluctuations, understanding the intricate connections between stock performance and cryptocurrency developments will be essential.

| Index | Change (%) | Cryptocurrency Stocks | Decline (%) |

|---|---|---|---|

| Dow | -1.2 | DFDV | -25.12 |

| S&P 500 | -1.23 | UPXI | -19.85 |

| Nasdaq | -1.59 | MARA | -18.72 |

| Hut 8 | -17.89 | ||

| Strategy | -17.12 |

Summary

The U.S. stock market decline has raised concerns among investors, as major indices faced a notable downturn, highlighting the interconnectedness of traditional and cryptocurrency markets. With significant drops across various sectors, particularly in cryptocurrency concept stocks, the market’s performance reflects broader economic challenges and uncertainties.

U.S. Stock Market Decline: A Comprehensive Analysis

The recent downturn in the U.S. stock market has raised alarms across various sectors, particularly the technology-focused Nasdaq, which recorded a sharp 1.59% drop. This decline can be attributed to a multitude of factors, including rising inflation rates and concerns over interest rate hikes by the Federal Reserve. Moreover, significant losses were observed in key technology stocks, contributing to the overall bearish sentiment in the market today. Investors are on high alert, as this trend reflects broader economic uncertainties that could impact future market performance.

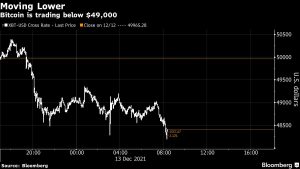

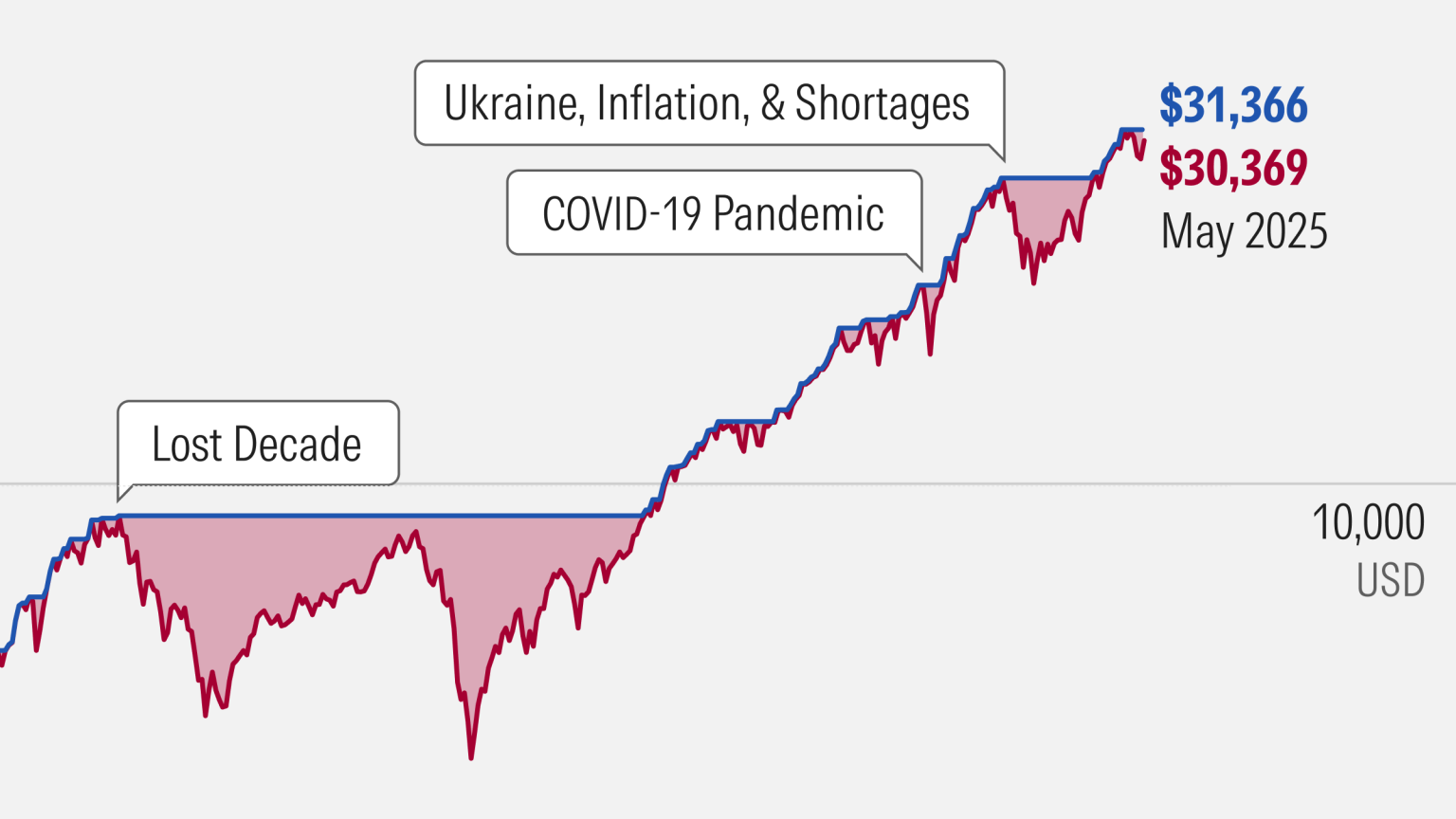

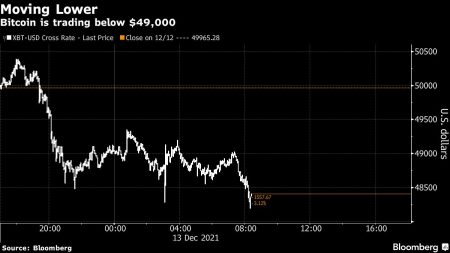

In addition to the Nasdaq’s struggle, the Dow Jones Industrial Average and the S&P 500 also faced setbacks, dropping 1.2% and 1.23%, respectively. While historical performance has shown resilience in the face of market corrections, this particular decline highlights the fragility of investor confidence. Analysts are closely monitoring these indices, as a continued downturn could signify a challenging economic environment ahead, impacting not just stocks but also the cryptocurrency market news, which has been intertwined with stock market fluctuations.

Cryptocurrency Market Impact and Decline

The interplay between the U.S. stock market and the cryptocurrency sector is increasingly evident, particularly during periods of market distress. In the current scenario, with significant declines in major cryptocurrencies, the overall sentiment in the cryptocurrency market has mirrored the stock market’s downturn. As cryptocurrencies like Bitcoin and Ethereum struggle to maintain their value, many altcoins are also experiencing dramatic declines. This correlation indicates not only investor behavior but also highlights how intertwined the two markets have become in recent years.

Notably, cryptocurrency concept stocks have faced severe losses, with declines as steep as 25.12% for DFDV and other notable drops across the sector. These losses are attributed to the general market pullback and further emphasize the volatility of investing in cryptocurrencies. As investors seek stability, many are re-evaluating their positions, leading to a ripple effect that compounds the cryptocurrency decline. Keeping an eye on Dow Jones performance or Nasdaq performance offers investors valuable insights into how these trends might develop in the future.

Sector-Wide Implications of the Market Decline

The implications of the recent U.S. stock market decline are far-reaching, impacting sectors beyond just technology and cryptocurrencies. For instance, industries reliant on consumer discretionary spending may also see downturns as market volatility affects consumer confidence. The performance of blue-chip stocks within the Dow, such as AAPL and AMZN, further reflects investor sentiment as market shifts influence long-term growth expectations. Companies that are heavily integrated into the technological landscape are particularly vulnerable in these circumstances, which could lead to broader job cuts or a slowdown in capital investment.

Moreover, this sector-wide impact is not confined to stock values alone; it reverberates through economic indicators. For example, decreased stock market performance can lead to lower consumer spending, which in turn affects GDP growth. As analysts dissect the nuances of the Dow Jones and Nasdaq performance, it becomes clear that each sector must develop strategies to withstand these fluctuations, making it essential for investors to remain strategically diversified. Failure to adapt could result in losses similar to those seen in the cryptocurrency space, reinforcing the interconnectedness of these financial markets.

Future Outlook: Navigating a Volatile Market

As the U.S. stock market continues to grapple with uncertainty, investors are faced with the daunting task of navigating a volatile landscape. Many industry experts suggest that an approach centered on diversification and sector rotation may be prudent. By reallocating investments across different markets, including stocks, bonds, and cryptocurrencies, investors can mitigate risks associated with sudden downturns. Keeping abreast of cryptocurrency market news may provide additional context, as shifts in this sector can foreshadow trends in the broader financial market.

The future outlook hinges on several critical factors, such as Federal Reserve policy, geopolitical tensions, and evolving economic conditions. Market watchers anticipate potential recovery phases, but these may be punctuated by further volatility, underscoring the importance of staying informed. Investors are being encouraged to analyze performance metrics like the Dow Jones and Nasdaq when making decisions, as these will offer crucial insights into not only market dynamics but also the expected rebound of sectors that have been hit hardest.

Investor Sentiment Amid Market Fluctuations

Investor sentiment plays a crucial role in shaping market dynamics, particularly during periods of significant decline. The recent downturn in the U.S. stock market has instilled a sense of caution and uncertainty among investors, many of whom are re-evaluating their portfolios. Fear of prolonged losses can lead to mass sell-offs, further exacerbating declines across both traditional stocks and the cryptocurrency market. Understanding the psychological factors that drive investor behavior is essential for anticipating potential market movements and reacting effectively.

Additionally, with the cryptocurrency sector experiencing its own set of challenges, disparities in market performance are increasingly noticeable. While some investors may look to capitalize on lower prices within the cryptocurrency space as a buying opportunity, others remain hesitant, fearing further declines. Hence, monitoring sentiment indicators, such as surveys reflecting investor confidence, can provide valuable context against the backdrop of the current stock market today. Recognizing when to enter or exit positions becomes critical in a market driven by fluctuating emotions.

Key Performance Metrics: Analyzing the Numbers

In times of market volatility, analyzing key performance metrics becomes critical for investors seeking clarity and potential areas for growth. For example, the Dow Jones’ performance serves as a barometer for assessing the overall health of large-cap stocks while the Nasdaq performance indicates trends within tech-heavy indices. Such insights allow investors to align their strategies with market realities, taking advantage of opportunities while hedging against risk. As a result, leveraging such performance metrics can greatly enhance an investor’s ability to make well-informed decisions.

Moreover, focusing on sector-specific performance, particularly in high-risk areas like the cryptocurrency market, enhances the depth of analysis. Tracking performance fluctuations in Bitcoin and Ethereum can reveal shifts that impact alternative investments. By recognizing the correlations between stock market performance and cryptocurrency declines, investors can better position themselves to weather any financial storms ahead. Utilizing a data-driven approach ensures that investment strategies remain adaptive and responsive to real-time market conditions.

The Ripple Effect: Interconnections Between Markets

The financial landscape is increasingly intertwined, with market movements in one sector often creating a ripple effect across others. This is particularly evident in the latest U.S. stock market decline, where the downturn in major indices has echoed through the cryptocurrency markets, causing declines for leading altcoins. Such interconnected behaviors suggest that investors must remain vigilant; trends in stock performance can significantly influence sentiments and decisions within the cryptocurrency market, fostering a cycle of fluctuating prices.

As the Dow continues to show weakness, particularly amidst macroeconomic pressures, cryptocurrencies can either act as a hedge or exacerbate losses, depending on investor behavior. Therefore, understanding how these markets influence each other is vital for developing robust investment strategies. By acknowledging the ripple effect at play, savvy investors can discern when to pivot their strategies — whether doubling down on cryptocurrency investments or shifting back into more stable equities, allowing for better risk management in volatile times.

Strategies for Mitigating Losses in a Declining Market

In the face of declining markets, having a clear strategy in place to mitigate losses is essential for any investor. One effective approach is to implement stop-loss orders, which can help limit potential losses on volatile assets, including those in the cryptocurrency market. Additionally, diversifying investment portfolios across various sectors can cushion against sharp downturns, as not all areas may be affected in the same way. Being proactive in asset allocation allows investors to minimize their exposure to significant declines.

Furthermore, considering options trading can also provide a means of income generation during downturns. Investors might employ strategies such as covered calls to hedge against potential declines while still holding onto their assets. As observed with the recent cryptocurrency decline, innovative approaches to risk management become increasingly relevant as markets fluctuate. By enhancing their toolkit with diverse strategies, investors can be better poised to navigate uncertainties — whether in traditional stocks or the dynamic cryptocurrency market.

The Role of News and Market Sentiment in Shaping Trends

The impact of news on market sentiment cannot be overstated, especially during periods of volatility like the current U.S. stock market decline. Investors often react to headlines, shaping buying and selling behaviors, particularly in sentiment-driven markets like cryptocurrencies. Daily updates and analyses, such as those found in cryptocurrency market news, are instrumental in informing stakeholders about potential risks and opportunities, driving quick reactions that can influence trends.

Furthermore, understanding how news cycles operate and affect investor perception can provide a competitive edge. For instance, news regarding regulatory changes or economic policies can lead to immediate market reactions, prompting investors to adjust their strategies accordingly. As the relationship between stock market trends and cryptocurrency performances continues to evolve, paying attention to both sectors’ news can help shape informed investment decisions that navigate market fluctuations effectively.

Frequently Asked Questions

What factors are contributing to the recent U.S. stock market decline?

The recent U.S. stock market decline can be attributed to a combination of economic indicators, inflation concerns, and investor sentiment. Factors such as rising interest rates and disappointing earnings reports have negatively impacted key indices like the Dow Jones, S&P 500, and Nasdaq, leading to widespread sell-offs.

How did the cryptocurrency market fare during the U.S. stock market decline?

During the U.S. stock market decline, the cryptocurrency market also faced significant downturns. Many cryptocurrency-related stocks saw drastic losses, with major companies like DFDV dropping over 25% and UPXI down nearly 20%, reflecting investor apprehension amid broader market instability.

What does today’s performance of the U.S. stock market indicate for investors?

Today’s performance of the U.S. stock market, with the Dow Jones down 1.2% and Nasdaq down 1.59%, suggests a cautious outlook for investors. It may indicate a need for strategic repositioning or re-evaluation of investment portfolios, particularly for those holding cryptocurrency-related assets.

Are there risks associated with investing in cryptocurrency during a U.S. stock market decline?

Yes, investing in cryptocurrency during a U.S. stock market decline can be risky due to increased volatility. The correlation between the stock market and cryptocurrency sectors means that declines in the stock market can lead to significant drops in cryptocurrency assets, as seen with recent performance trends.

How does the U.S. stock market decline affect tech stocks like those in the Nasdaq?

The U.S. stock market decline particularly affects tech stocks, as many of these companies are valued based on future growth potential. With the Nasdaq down 1.59%, it reflects investor uncertainty, often leading to decreased market confidence in tech-driven investments, including those tied to the cryptocurrency market.

What insight can be gained from the falling prices of cryptocurrency stocks amid the U.S. stock market decline?

The falling prices of cryptocurrency stocks amid the U.S. stock market decline provide insight into market sensitivity. Companies such as MARA and Hut 8 have experienced losses upwards of 15%, highlighting the impact of broad market trends on niche sectors like cryptocurrency, signaling caution for potential investors.

How does today’s U.S. stock market decline impact future cryptocurrency investments?

Today’s U.S. stock market decline may lead investors to reconsider future cryptocurrency investments due to heightened volatility and risk. As seen with the substantial drops in related stocks, emerging trends indicate that the performance of traditional markets can heavily influence the cryptocurrency landscape.

What strategies can investors adopt during a U.S. stock market decline, especially regarding cryptocurrency?

During a U.S. stock market decline, investors should consider diversifying their portfolios, weighing the potential for a high-risk, high-reward cryptocurrency investment against established equities. Keeping abreast of market movements and focusing on long-term trends can help navigate short-term volatility effectively.