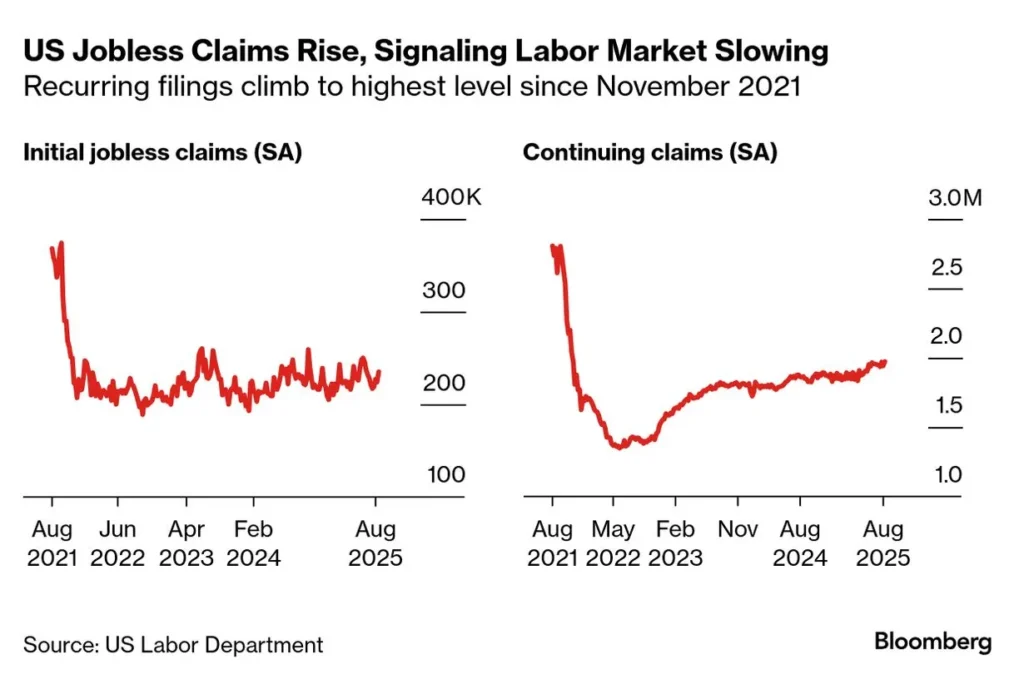

In a recent analysis by Goldman Sachs, the U.S. labor market has shown a slight uptick in initial jobless claims, reaching 224,000. This figure, while still relatively low in historical context, indicates a minor shift in the employment landscape as the economy navigates various challenges. Initial jobless claims are a critical economic indicator, reflecting the number of individuals filing for unemployment benefits for the first time.

The increase in claims can be attributed to several factors, including seasonal adjustments and ongoing economic uncertainties. Analysts suggest that this rise, though modest, may signal a cooling labor market as companies reassess their workforce needs amid fluctuating demand and inflationary pressures.

Historically, jobless claims have been a reliable gauge of economic health, and a sustained increase could prompt concerns about potential layoffs and a slowdown in hiring. However, experts caution against overreacting to a single week’s data, emphasizing the importance of observing trends over time.

As the Federal Reserve continues to monitor inflation and interest rates, the job market remains a focal point for policymakers. The balance between fostering job growth and managing inflationary pressures is delicate, and fluctuations in jobless claims will likely influence future economic strategies.

In summary, while the rise in initial jobless claims to 224,000 is noteworthy, it is essential to view it within the broader context of the economy’s ongoing recovery and the challenges it faces.