| Key Point | Details |

|---|---|

| Interest Rates | Lowering interest rates by 100 basis points could stimulate economic growth. |

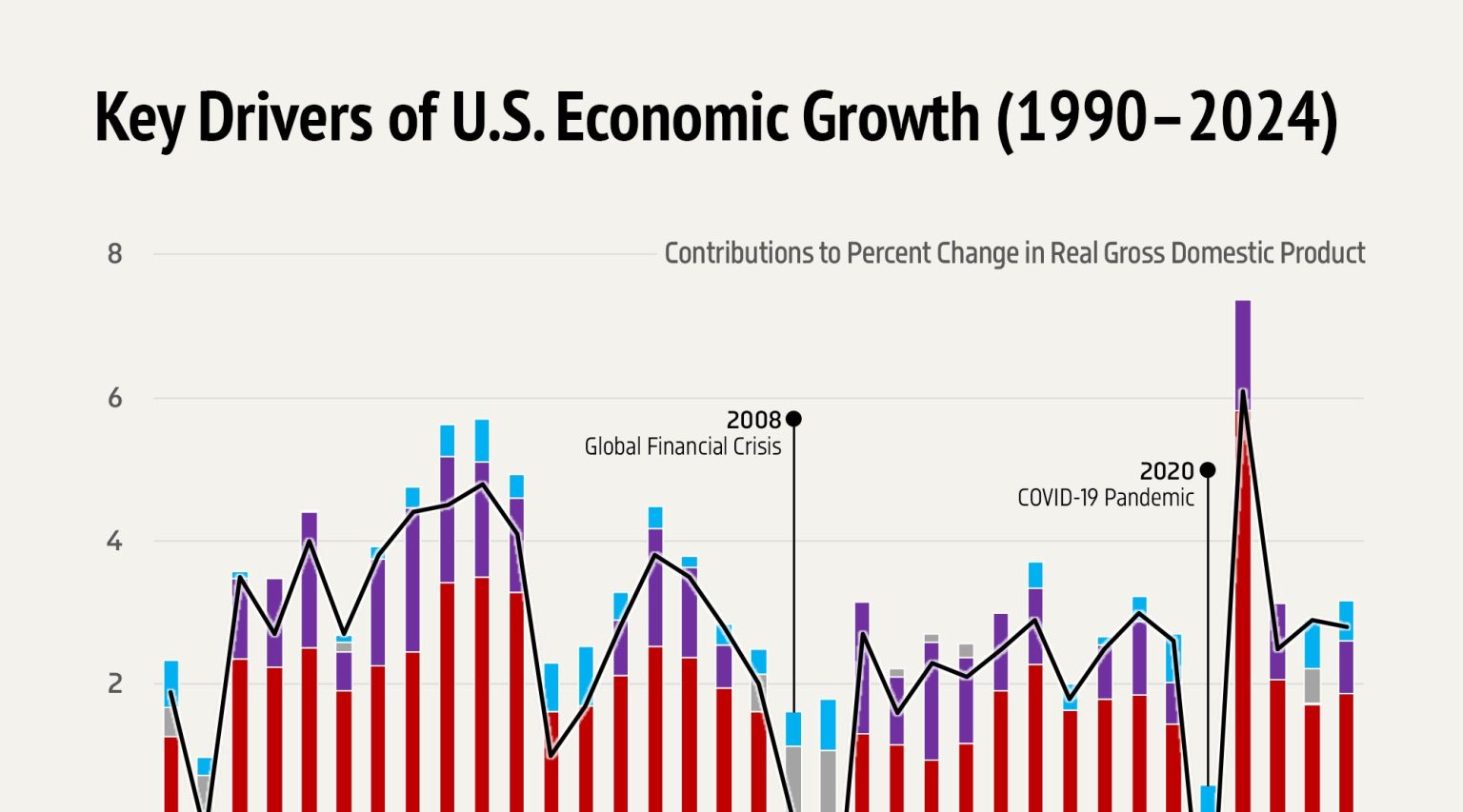

| Projected Economic Growth | This reduction could lead to U.S. economic growth reaching 6% or higher. |

| Impact on Housing | Lower rates would help young people afford homes, fostering long-term economic stability. |

Summary

U.S. economic growth is significantly influenced by the levels of interest rates. Secretary of Commerce Raimondo highlights that a reduction of 100 basis points in interest rates could propel growth to 6% or more, indicating a robust economic recovery. This strategy not only aims to enhance the affordability of homes for young buyers but also underscores the interconnectedness of housing market stability and overall economic health.

U.S. economic growth is poised for a significant boost, especially if recent forecasts hold true. As U.S. Secretary of Commerce Gina Raimondo highlighted, lowering interest rates by 100 basis points could propel growth to an impressive 6% or more. This potential surge not only signifies an enhanced economic landscape but also addresses the pressing issue of home affordability for young people. The impact of interest rate changes reverberates throughout the housing market, creating needed opportunities for first-time buyers. As we delve into the intricacies of economic growth forecasts, understanding the correlation between interest rates and economic vitality becomes essential.

The current financial climate in America is marked by discussions around the pace of economic advancement. Analysts note that adjustments in monetary policy, particularly relating to interest rates, could greatly influence growth outcomes. A reduction in these rates not only stimulates spending but also plays a crucial role in making housing more accessible for younger demographics. Exploring how fiscal strategies and rate modifications shape market conditions can provide insights into the future trajectory of the economy. Ultimately, assessing these economic factors reveals a landscape ripe for potential transformation, urging stakeholders to consider the broader implications of interest rate dynamics.

The Impact of Lowering Interest Rates on U.S. Economic Growth

Lowering interest rates has a profound impact on U.S. economic growth. When interest rates are reduced, borrowing becomes cheaper, which stimulates spending and investment across various sectors. Businesses are more likely to take out loans for expansion, and consumers are encouraged to invest in big-ticket items, such as homes and vehicles. U.S. Secretary of Commerce Gina Raimondo suggests that a decrease of 100 basis points could potentially propel economic growth to an impressive 6% or more, highlighting the critical role of monetary policy in shaping economic outcomes.

However, the benefits of lower interest rates are not uniformly distributed. Although lower rates make mortgages more affordable, particularly helping first-time homebuyers and young families enter the housing market, this can also lead to increased demand which may push home prices higher. This phenomenon can ultimately affect home affordability for young people. As the economic growth forecast improves with reduced interest rates, policymakers must remain vigilant to balance stimulating growth with ensuring that housing remains accessible.

Interest Rate Changes and Their Impact on Home Affordability

Interest rate changes have a direct influence on home affordability, a critical issue for many young Americans looking to enter the real estate market. As interest rates drop, the cost of borrowing decreases, resulting in lower monthly mortgage payments. This makes it easier for young people, who often face financial hurdles such as student debt, to purchase their first home. Consequently, the decrease in interest rates is a double-edged sword; while it enhances home affordability, it may also lead to a surge in home prices as demand increases.

Furthermore, as the economic landscape shifts with changing interest rates, understanding their long-term implications is vital. While lower rates can boost home affordability in the short term, if rates remain low, we might see lending standards easing, potentially leading to a rise in housing demand that could inflate prices further. Therefore, it’s essential for millennials and Gen Zers to be informed about how these interest rate dynamics can affect their home buying capabilities and to plan accordingly.

Analyzing the Economic Growth Forecast Amid Interest Rate Fluctuations

The economic growth forecast for the U.S. is closely intertwined with interest rate fluctuations. Economists predict that as the Federal Reserve adjusts rates to combat inflation or stimulate growth, the overall economy will respond accordingly. A lower interest rate environment typically signals a more robust growth forecast, encouraging businesses and consumers to spend and invest. Such a scenario, as described by Secretary Raimondo, could catalyze a growth spurt towards 6% if a concerted effort is made to lower rates significantly.

However, these forecasts are not without uncertainty. While lower rates may spur short-term growth, they also invite scrutiny regarding the long-term sustainability of such economic conditions. If economic growth is overly reliant on low-interest financing, it may lead to financial imbalances. Therefore, it is critical for stakeholders—ranging from policymakers to private investors—to consider how interest rate changes can create ripples across various economic sectors and to prepare proactive strategies to leverage the accompanying opportunities.

Navigating Home Buying in a Changing Interest Rate Environment

As the interest rate landscape shifts, prospective homebuyers, particularly young people, must navigate the complexities of home purchasing with utmost care. With the potential for lowered interest rates, opportunities may arise that could make entering the housing market feasible. However, buyers must remain discerning about price trends that can accompany these interest rate adjustments. The importance of understanding how interest rates directly affect home affordability cannot be understated, as it plays a pivotal role in defining the overall cost of homeownership.

Moreover, first-time buyers should consider timing their purchase strategically. Research indicates that periods of declining interest rates often bring heightened competition in the housing market, driving up housing prices. Engaging with financial advisors and keeping abreast of market trends can help young buyers make informed decisions that align with their financial capabilities and future goals. Ultimately, knowledge and preparedness are key to successfully navigating the evolving landscape of home buying amid changing interest rates.

The Role of Policy in Shaping Interest Rate Changes

The relationship between U.S. policy and interest rate changes is crucial for understanding economic dynamics. Policymakers, particularly those in the Federal Reserve, influence interest rates through their decisions, which in turn shapes the entire economic framework. When they adjust rates in response to inflation or economic stagnation, the resulting shifts impact everything from consumer spending to business investment. Policymaker’s decisions have a significant effect on the economic growth forecast, especially in how those actions can encourage or discourage lending and borrowing.

Further, it is important for the public to stay informed about potential policy changes that could influence interest rates. The more aware individuals are of policy discussions and anticipated changes, the better prepared they can be to make informed financial decisions. For young people looking to buy homes, understanding the interplay between government policy, interest rate changes, and economic growth is essential in deciphering when to buy and how to manage future financial responsibilities.

Interest Rate Impacts on Investment Decisions

Interest rates play a pivotal role in shaping investment decisions for both individuals and businesses. Lowering interest rates makes borrowing cheaper, providing businesses with the incentive to invest in expansion or new projects. For young entrepreneurs, favorable interest rates can lessen the financial burden when securing loans to kickstart their ventures. As U.S. economic growth is projected positively with reduced rates, understanding the indirect benefits is critical for young investors and startup founders aiming to capitalize on this opportunity.

Conversely, rising interest rates can deter investment as the cost of borrowing increases. Business owners must weigh the pros and cons of taking on debt under varying interest environments. Additionally, young people looking to invest in stocks or real estate must adapt their strategies based on interest rate forecasts. Keeping a pulse on these fluctuations and analyzing their potential impacts can empower young adults to make informed investment choices that positively affect their financial futures.

Understanding the Link Between Economic Growth and Interest Rate Policies

Understanding the connection between economic growth and interest rate policies is essential for comprehending how these factors influence everyday life. Policymakers often adjust interest rates as a tool to stimulate economic activity. High rates can suppress consumer spending, while lower rates generally encourage spending and investment, fostering stronger economic growth. This direct connection was emphasized by Secretary Raimondo, highlighting that the right balance in interest rate policy can lead to growth rates of 6% or higher.

For the average American, this interplay can manifest in tangible ways, such as changes in job opportunities, wage growth, and consumer confidence. As economic growth depends significantly on interest rates, citizens should remain attentive to monetary debates and forecasts. An informed citizenry can engage in discussions and advocate for policies that promote sustainable economic growth while also considering the broader implications of interest rate changes on their personal finances and home affordability.

Interest Rate Trends: Predicting the Future of the Housing Market

Predicting the future of the housing market is increasingly tied to understanding interest rate trends. With interest rates currently in a state of flux, potential buyers must be vigilant about how these shifts could affect their purchasing power. If rates drop significantly, it would typically lead to increased competition for homes, which could drive prices up. Conversely, if rates are expected to rise, a sense of urgency may compel buyers to enter the market sooner, influenced by the need to secure more favorable mortgage terms.

Moreover, real estate investors are also keenly aware of interest rate movements. Lower rates often create a conducive environment for real estate investment, as financing becomes more accessible. Potential investors need to analyze historical trends in conjunction with current market data to make informed decisions about future property acquisitions. Overall, those engaged in the housing market must continuously assess how ongoing interest rate changes are likely to shape market conditions in the months and years ahead.

Preparing for Changes: How Young People Can Adapt to Market Fluctuations

As the economic conditions shift due to interest rate fluctuations, young people must prepare themselves to adapt to these market dynamics. Understanding how interest rates affect their purchasing power is crucial in making informed decisions regarding home buying and saving strategies. By educating themselves about the implications of interest rates on loans and mortgages, they can better navigate the challenges of affordability in today’s housing market.

Furthermore, young individuals should be proactive in establishing their financial health. This includes maintaining a good credit score, saving for a down payment, and staying informed about both market trends and potential interest rate adjustments. By employing sound financial practices, they will be better positioned to capitalize on opportunities that arise during periods of economic growth spurred by favorable interest rates, ultimately paving the way toward securing their dream homes.

Frequently Asked Questions

How do lowering interest rates influence U.S. economic growth?

Lowering interest rates can stimulate U.S. economic growth by making borrowing cheaper for consumers and businesses. When interest rates decrease, spending and investment often increase, leading to higher overall economic activity. This effect can contribute to a more robust economic growth forecast.

What is the potential impact of interest rate changes on U.S. economic growth?

Interest rate changes can significantly impact U.S. economic growth. A reduction in interest rates can drive growth by encouraging spending and investment, which are crucial for boosting the economy. As stated by U.S. Secretary of Commerce Raimondo, lowering rates by 100 basis points could potentially elevate U.S. economic growth to 6% or more.

Why is home affordability for young people important for U.S. economic growth?

Home affordability for young people is a critical factor in U.S. economic growth, as it enables a new generation to enter the housing market. Lower interest rates can enhance home affordability, allowing young buyers to secure mortgages more easily, thereby stimulating demand in the housing sector and contributing to overall economic expansion.

What does the economic growth forecast suggest if interest rates are lowered?

The economic growth forecast suggests that if interest rates are lowered, particularly by significant margins like 100 basis points, U.S. economic growth may increase markedly, potentially reaching 6% or higher. This projected growth reflects the stimulating effect of lower interest costs on consumer spending and business investment.

How do interest rate changes affect young home buyers and U.S. economic growth?

Interest rate changes play a vital role in the ability of young home buyers to afford homes. Lower rates ease mortgage payments, making homeownership more accessible, which not only supports the housing market but also drives U.S. economic growth as new purchases spurt related industry activity.