Date: [Today’s Date]

Title: Trump’s China Tariffs Drive Bitcoin ETPs to Record $10 Billion Trading Volume

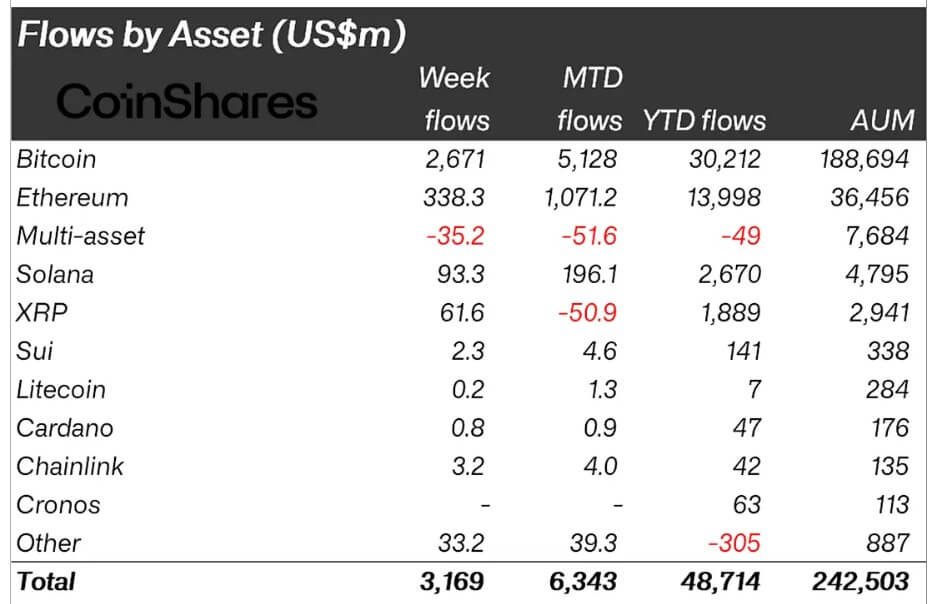

In a recent and unexpected financial twist, trading volumes for Bitcoin Exchange Traded Products (ETPs) surged to a record high of $10 billion. This dramatic spike is largely attributed to the intensifying trade tensions between the United States and China, instigated by President Donald Trump’s imposition of additional tariffs on Chinese goods.

Background on Trade Tensions

The U.S.-China trade war escalated further after President Trump announced a new series of tariffs on Chinese imports, attempting to pressure China into renegotiating trade terms perceived by the Trump administration as unfavorable. The move aims to promote domestic manufacturing and reduce the U.S. trade deficit with China. However, the tariffs have had broad ripple effects across global markets, enhancing volatility and uncertainty.

Impact on Bitcoin ETPs

In reaction to these geopolitical tensions, investors have turned increasingly towards Bitcoin and other cryptocurrencies as alternative investments. Bitcoin ETPs, which offer exposure to Bitcoin in the form of a security that trades on traditional exchanges similar to stocks, have seen unprecedented trading volumes amid this turmoil.

The surge in trading volume not only underscores the growing mainstream acceptance of Bitcoin as a legitimate asset class but also highlights its perceived role as a ‘safe haven’ during times of economic uncertainty. This shift is underscored by the move of institutional and retail investors to hedge against potential losses in other asset classes affected by the trade tensions.

Analysis from industry experts suggests that the allure of Bitcoin ETPs lies in their ability to combine the traditional trading mechanisms familiar to investors with exposure to the emerging asset class of cryptocurrencies. This blend of old and new investment paradigms offers a bridge for more conservative investors looking to diversify their portfolios without stepping entirely away from the regulated environment of traditional exchanges.

Future Implications

The record-setting trading volumes in Bitcoin ETPs pose significant questions about the future trajectory of both digital assets and global trade. If the trade war persists, we may observe a continued rise in the popularity of such financial instruments, potentially leading to more robust market structures and enhanced liquidity for cryptocurrencies.

Furthermore, this trend could prompt regulators to accelerate their efforts in defining and standardizing the rules surrounding the trade of digital asset securities, ensuring a more stable and secure landscape for investors.

Conclusion

The link between geopolitical volatility and the rise in Bitcoin ETP trading volumes illustrates a broadening perspective on what constitutes a safe haven in contemporary markets. As traditional economic models face challenges from global political decisions and events, alternative assets like Bitcoin are playing an increasingly significant role in the strategies of individual and institutional investors alike.

As the scenario unfolds, the financial sector may witness a transformative shift in how assets are perceived and managed in a globally interconnected market, with digital assets front and center in this evolving narrative.

End of Article.