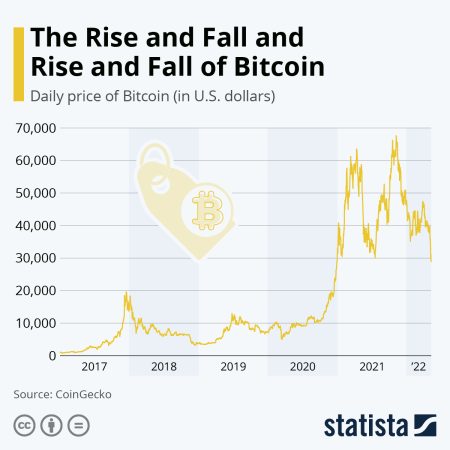

A prominent figure linked to Trump has made a significant $653 million investment in Bitcoin, raising questions about Wall Street’s hesitance to embrace such bold moves. This investment reflects a growing interest in cryptocurrencies, yet many financial experts remain skeptical about their long-term viability. Despite the potential for high returns, Wall Street analysts express concerns regarding the volatility and regulatory challenges that surround the cryptocurrency market.

The mentor’s large bet on Bitcoin comes amid a broader discussion about the future of digital currencies and their place in traditional finance. As institutional investors look for alternative assets, the cryptocurrency market continues to attract attention, although it has yet to gain widespread acceptance among major financial institutions. Analysts suggest that while there is potential for profit, the risks associated with investing in cryptocurrencies cannot be overlooked.

Market sentiment remains mixed, as some investors are drawn to the perceived opportunities presented by Bitcoin and other digital assets. However, others caution that the lack of regulation and the unpredictable nature of these markets could lead to significant losses. Wall Street’s reluctance to fully embrace cryptocurrency investments underscores the need for further clarity and stability in the sector.

In summary, while the $653 million Bitcoin investment by Trump’s mentor demonstrates confidence in the cryptocurrency’s potential, it also highlights the barriers that still exist in gaining traction on Wall Street.