Tron TRX performance has caught the attention of investors as it continues to display impressive resilience in the face of broader cryptocurrency market fluctuations. Over recent weeks, TRX has successfully outperformed Bitcoin (BTC), showcasing a modest decline of only 2.3% compared to Bitcoin’s steeper drop of 7.3%. At a trading range of approximately $0.2797, Tron maintains a critical position amid its resistance at $0.2846 and support at $0.2758. This notable performance is largely attributable to the proactive accumulation strategies executed by Tron Inc., bolstering confidence in the token. As we delve deeper into Tron price analysis and investigate the ongoing market trends, it’s evident that TRX remains a focal point in discussions about crypto accumulation strategies and institutional investments.

The recent developments surrounding TRX, the native token of the Tron blockchain, highlight its unique position within the cryptocurrency landscape. Compared to Bitcoin, TRX has shown a significant ability to navigate market challenges, often reflecting a more stable performance trajectory. With Tron Inc.’s strategic decisions to build its TRX reserves, we can observe increased investor confidence and a clear commitment to long-term growth. In the context of market trends, this dynamic illustrates the effective use of crypto accumulation strategies by corporate entities like Tron Inc. As we analyze TRX’s potential against BTC, it becomes clear that its resilience sets it apart in today’s competitive crypto environment.

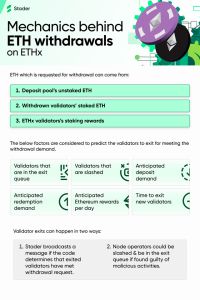

| Key Point | Details |

|---|---|

| Performance Comparison | TRX outperformed BTC, with only a 2.3% decline in the last 24 hours compared to Bitcoin’s 7.3% drop. |

| Tron Inc. Accumulation | Tron Inc. has accumulated approximately 680 million TRX tokens, showing long-term confidence in the asset. |

| Resistance and Support Levels | Key resistance is at $0.2846; immediate support is at $0.2758. |

| Technical Indicators | TRX is currently below its 50-day and 200-day EMAs, signaling short-term bearish momentum. |

| Market Sentiment | Cautiously optimistic sentiment driven by institutional accumulation and potential for consolidation. |

Summary

Tron TRX performance has shown remarkable resilience amid market volatility, primarily driven by ongoing accumulation by Tron Inc. Despite recent fluctuations and a modest decline, TRX’s ability to maintain crucial support levels highlights strong institutional backing and market confidence. As Tron Inc. continues to bolster its TRX holdings, market observers are optimistic about a potential upward breakout, reflecting a solid technical outlook for the token.

Tron TRX Performance: A Close Look at Recent Developments

Tron (TRX) has been making headlines recently, particularly due to its performance in comparison to Bitcoin (BTC). Despite the unpredictable nature of the cryptocurrency market, TRX has managed to hold its ground remarkably well. In recent weeks, TRX has seen a comparatively modest drop of just 2.3% over the past 24 hours, while Bitcoin has struggled with a notable decline of 7.3%. This differential showcases TRX’s resilience, making it an attractive option for investors looking at accumulation strategies. Investors are increasingly analyzing Tron price dynamics, particularly how they contrast with BTC, which further emphasizes the growing interest in TRX within the digital currency landscape.

The interest in TRX has surged, partly because of the strategic purchases by Tron Inc. which indicates a strong belief in long-term price appreciation. As TRX continues to show relative strength, traders are keen on turning their attention from BTC to potential opportunities within the TRX market. Analysts are looking at key levels—support near $0.2758 and resistance at $0.2846—as benchmarks that could dictate future movements for TRX. In this strategic environment, the focus on crypto accumulation strategies with an emphasis on TRX highlights a shift in trading psychology favoring tokens with strong fundamentals like Tron.

Tron Inc.’s Accumulation Strategy and Market Implications

The accumulation strategy adopted by Tron Inc. has profound implications for TRX and the broader cryptocurrency market. With nearly 680 million TRX tokens in their treasury, Tron Inc. stands as a robust bulwark against market fluctuations. This approach not only bolsters the token’s price stability but also demonstrates institutional confidence in its long-term viability. Justin Sun and the leadership team’s proactive measures to amass TRX are reminiscent of strategies employed by major players in the crypto space, such as MicroStrategy’s Bitcoin investments. Such accumulation strategies are crucial in the current volatile market, providing support dynamics that can potentially lead to price rebounds after significant retracements.

Additionally, the actions of Tron Inc. highlight the increasing importance of corporate treasury management in cryptocurrency. Companies are taking note of how strategic asset accumulation can influence market perceptions and investor sentiment. While BTC has historically been viewed as the leading digital asset, the performance of TRX under the stewardship of Tron Inc. shows that alternative cryptocurrencies can exhibit stability under institutional support. This steadiness serves as an important signal to potential investors contemplating entry into the market, now seeing TRX not just as a speculative asset but as one that holds real potential for growth amidst the current industry challenges.

Key Technical Indicators for TRX: Resistance and Support Levels

From a technical standpoint, prospective TRX investors must be aware of key resistance and support levels that could dictate market movements. The immediate resistance at $0.2846 is crucial, as a breakout above this level may signal renewed bullish momentum for TRX. Conversely, maintaining support at $0.2758 is critical to prevent a more significant decline. Navigating these technical thresholds will be essential for traders focused on short- to medium-term strategies, and they can serve as pivotal points around which trading decisions are made.

Furthermore, investing sentiment regarding TRX hinges on these technical indicators. Presently, the asset is resting below its 50-day and 200-day exponential moving averages (EMAs), suggesting a bearish sentiment in the short term. However, strong accumulation by Tron Inc. could bode well for overcoming these resistance points. Investors are advised to closely monitor the MACD and RSI, which are currently indicating selling pressure, to gauge the likelihood of a potential rebound in TRX price. A successful rally not only speaks to the strength of the technical foundation of TRX but would also resonate positively within the broader cryptocurrency community, influencing market trends.

Market Sentiment Surrounding Tron and Institutional Support

Market sentiment for TRX is exhibiting cautious optimism as recent trading patterns showcase institutional interest that goes beyond mere speculation. The accumulation strategies adopted by Tron Inc. and the overall reduced funding rates in derivatives indicate a transitioning market where institutions are looking to solidify their positions rather than gamble on short-term fluctuations. This developing sentiment is essential as investors gauge future performance, and many believe that the current landscape favors tokens with robust backing, such as Tron.

Moreover, as TRX remains an outperformer against Bitcoin, the collective sentiment surrounding the token’s durability during tumultuous market conditions enhances its appeal. Analysts predict that a positive shift in sentiment could emerge if TRX consistently holds above critical thresholds, sparking further institutional interest. Current market dynamics suggest that while speculative trading continues, the underlying support from entities like Tron Inc. serves as a counterbalance, fostering a more stable trading environment for TRX and encouraging investors to consider a long-term perspective.

Comparing Tron (TRX) to Bitcoin (BTC): A Performance Overview

When comparing Tron (TRX) to Bitcoin (BTC), the recent performance metrics reveal significant contrasts. TRX’s ability to maintain nearly flat performance amidst the broader cryptocurrency decline indicates an underlying strength that BTC does not exhibit at this moment. With TRX’s advantage in price stability, many anticipators are assessing the potential of investing in Tron over Bitcoin, particularly for those with a focus on risk management and value accumulation strategies. This comparison is becoming a focal point in crypto discussions as traders seek to diversify their portfolios.

Investing in TRX against BTC also highlights the evolving landscape of cryptocurrencies, where market participants increasingly recognize alternative options beyond the traditional leader. The analysis spans various factors such as market cap, transaction speed, and fundamental utility within blockchain applications. Given Tron’s active development and incorporation of latest technological advancements, the inclination among traders towards exploring TRX as a formidable alternative for longer-term benefits continues to grow. In essence, while Bitcoin has historically led the charge, the emergence of strong contenders like Tron suggests an diversifying investment environment.

Understanding Crypto Accumulation Strategies with Tron

Crypto accumulation strategies play a central role in how investors position themselves within the market, and Tron (TRX) serves as an excellent case study in this regard. By strategically acquiring TRX, especially in a market ripe with volatility, investors can harness the potential for long-term gains while minimizing risks. As engagement with TRX grows and its price stabilizes due to institutional accumulation mechanisms, investors are encouraged to formulate personalized accumulation strategies that align with their risk appetite and investment objectives.

Moreover, the trends observed in TRX accumulation indicate a broader institutional acknowledgement of cryptocurrencies as more than volatile assets, but as vehicles for sustained growth. Firms like Tron Inc. spearheading the accumulation exhibit the confidence and foresight necessary for navigating market uncertainties. Leveraging insights from TRX’s recent price movements can provide a template for how investors might adapt their own strategies to include key tokens showing strong institutional backing and positive market sentiment.

The Role of Tron Inc. Updates in Shaping TRX’s Future

Updates from Tron Inc. are pivotal in shaping the future landscape of TRX and instilling confidence among investors. Regular announcements about the company’s treasury strategies and acquisition efforts serve to inform the market and reassure stakeholders of the stability of TRX as an asset. Industry developments, such as partnerships and product launches within the Tron ecosystem, further enrich the narrative and underscore the company’s commitment to fostering a robust market environment for TRX.

Investors pay close attention to these updates not merely for immediate price impact but for the longer-term implications they have on the ecosystem as a whole. As Tron Inc. continues to navigate the intricacies of the cryptocurrency climate, the proactive dissemination of information showcases their strategic foresight, helping to solidify TRX’s position as a viable long-term token. The interconnectivity between organizational updates and market performance emphasizes the importance of transparency in the cryptocurrency space and how it can influence investor behavior.

Frequently Asked Questions

What factors are contributing to Tron TRX’s performance compared to BTC?

Tron TRX’s recent performance can be largely attributed to Tron Inc.’s accumulation strategy, where the company has been purchasing TRX tokens to bolster support. This strategy, along with TRX’s resilience against market volatility, has resulted in it outperforming Bitcoin (BTC) during recent downturns.

How does the recent Tron price analysis indicate its future performance?

The Tron price analysis suggests that TRX is maintaining critical support at $0.2758 while facing resistance at $0.2846. Its ability to hold these levels, paired with ongoing accumulation by Tron Inc., indicates potential for future upward momentum.

In what ways are crypto accumulation strategies affecting Tron TRX market trends?

Tron Inc.’s crypto accumulation strategies are enhancing market trends for TRX by instilling confidence among investors. This institutional backing is stabilizing the token and could lead to increased market interest, especially if TRX continues to show resilience compared to BTC.

What is the significance of the TRX vs BTC price movement?

The TRX vs BTC price movement highlights TRX’s relative strength in the cryptocurrency market. Despite Bitcoin facing a more significant decline, TRX only saw a modest drop, indicating its potential for strong performance in the face of weakness in the broader market.

What recent updates from Tron Inc. should investors know about TRX performance?

Recent updates from Tron Inc. reveal that the company has accumulated nearly 680 million TRX tokens, demonstrating a commitment to strengthening the TRX ecosystem. This accumulation can provide essential support for TRX, influencing its future price trajectories and overall market sentiment.