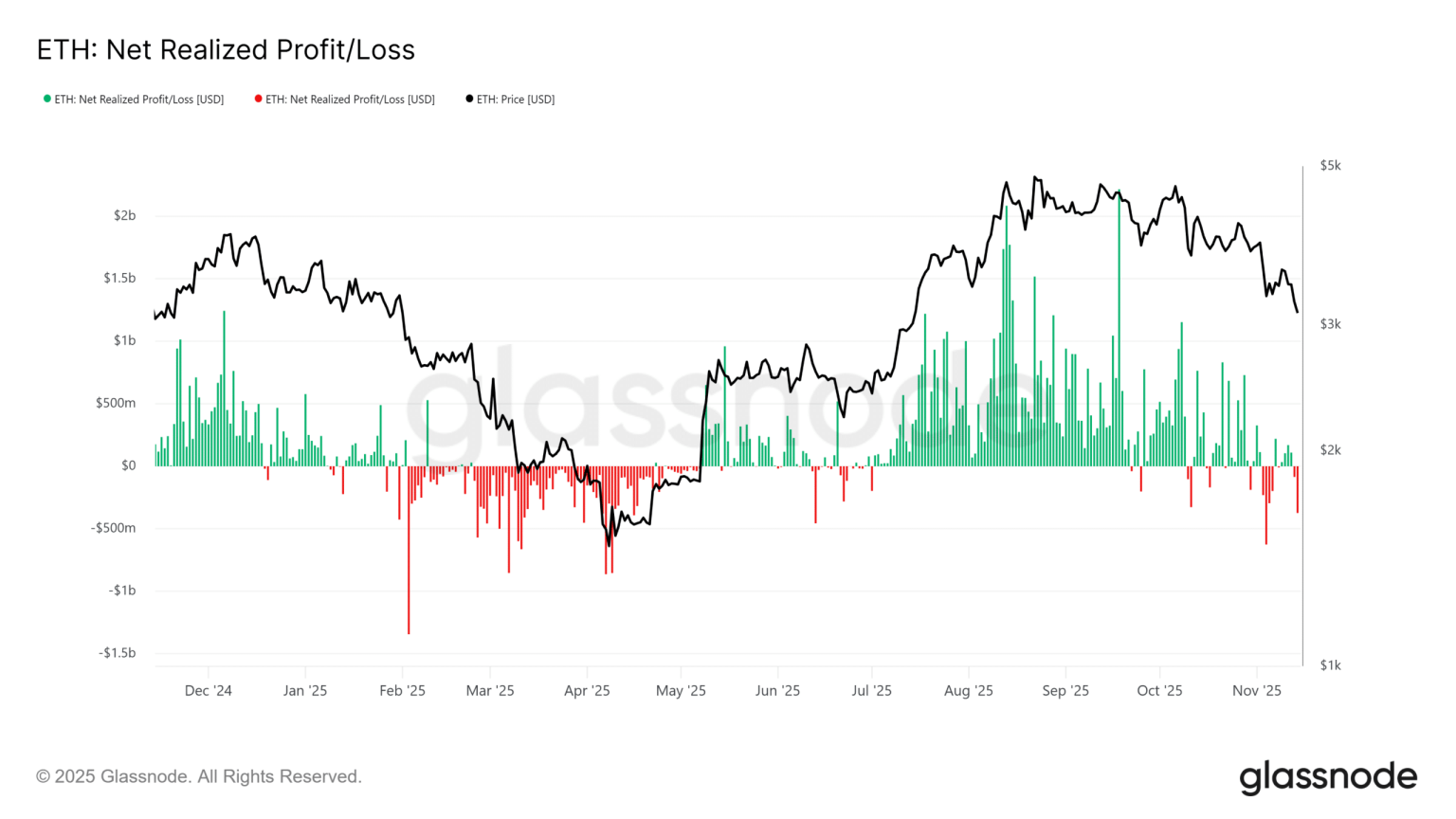

Trend Research ETH losses have become a crucial topic among investors as the firm, led by Yi Lihua, wraps up a significant liquidation process. The reported figures reveal a staggering total loss of approximately $734 million, primarily arising from the liquidation of their ETH holdings. On-chain analyst Yu Jin highlights that while the company previously capitalized on a long position that generated $315 million, their subsequent ETH trades led to substantial financial setbacks. This situation underlines the volatile nature of cryptocurrency investment losses, particularly in the context of the 2023 crypto market trends, where fluctuations have been pronounced. As analysts continue to assess the implications of these trading strategies, the focus on Trend Research liquidation and its impact on the broader cryptocurrency landscape remains essential for understanding today’s investment climate.

The recent developments surrounding the liquidation of positions by Trend Research have stirred discussions within the cryptocurrency investment community. At the heart of this situation lies a significant downturn in ETH values, culminating in notable losses that are emblematic of the challenges faced in this unpredictable market. With retention analysis showing a loss of about $734 million, observers are keen to evaluate how this impacts the overall performance of the firm beyond Ethereum. While the company has absorbed these losses, it has also experienced gains in other digital assets, making the analysis of their financial strategies all the more pertinent. As we navigate through 2023 crypto market trends, the spotlight on on-chain analysis trends provides valuable insights into investment behaviors and risk management in this digital era.

| Key Point | Details |

|---|---|

| Total Loss | Approximately $734 million from ETH liquidation. |

| Position Details | Entered long position on 231,000 ETH at $2,667, liquidated at $4,027, generating $315 million profit. |

| Major Loss | Entered long position on 651,500 ETH at $3,180, liquidated at $2,053, resulting in $734 million loss. |

| Overall Fund Performance | Despite ETH losses, overall fund profitable due to earnings from other cryptocurrencies. |

Summary

Trend Research ETH losses have highlighted the volatility and risks associated with cryptocurrency investments. Under the leadership of Yi Lihua, the firm has faced a significant challenge, liquidating positions that resulted in a staggering loss of approximately $734 million in ETH. However, it is essential to note that while the losses from ETH were substantial, they did not negatively impact the overall profitability of Trend Research due to successful investments in other cryptocurrencies. These insights are crucial for understanding investment strategies in the current crypto landscape.

Analyzing Trend Research ETH Losses: A Case Study

Trend Research’s recent liquidation of their ETH holdings has become a critical point of discussion in cryptocurrency investment circles. The firm reported losses approximating $734 million due to their disastrous long positions. Specifically, their decision to enter a long position on 651,500 ETH at an average price of $3,180 only to liquidate at $2,053 underscores the volatile nature of crypto assets. The margin for error in such substantial investments is razor-thin, demonstrating the inherent risks involved in cryptocurrency trading.

This significant loss also emphasizes the importance of strategic risk management and up-to-date trend research in the cryptocurrency market. Analysts have pointed out that while Trend Research faced dramatic losses on ETH, these positions were part of a broader investment strategy. The analysis indicates that they had previously made notable gains from other cryptocurrencies, which helped cushion the blow from their ETH losses. The sheer magnitude of the losses has prompted investors and analysts to reassess their strategies and approaches to cryptocurrency investments.

Understanding 2023 Crypto Market Trends and Losses

The cryptocurrency market in 2023 has shown a diverse range of trends, with major shifts that impact trader strategies. Developments in technology, regulatory changes, and market behavior have collectively influenced investment performance. Cryptocurrency investment losses have been prevalent as many traders struggled with heightened volatility and a lack of favorable market conditions. Particularly, the observation of Trend Research’s ETH liquidation reinforces the trends of caution that many investors are taking in these uncertain times.

While some investors have faced substantial losses akin to those observed with Trend Research, others have successfully pivoted to adapt to market changes. On-chain analysis trends suggest an increasing reliance on data-driven insights among traders, allowing them to better gauge the market’s ebb and flow. Understanding such trends is crucial, as they can significantly impact future investment decisions and strategies. Through careful analysis and proactive adjustments, investors can mitigate losses and strategically position themselves for future gains.

The Role of On-Chain Analysis in Mitigating Cryptocurrency Losses

On-chain analysis has emerged as a cornerstone for informed decision-making in the cryptocurrency market. By examining blockchain data, analysts can trace transaction activities, monitor price movements, and assess market sentiment, which can provide critical insights for traders. For instance, in the case of Trend Research, on-chain analyst Yu Jin leveraged this analytical approach to detail the firm’s ETH engagement and subsequent liquidation, greatly enhancing the understanding of their losses and the broader implications for investors.

Moreover, on-chain analysis equips investors with the ability to anticipate potential market shifts. By identifying trends such as growing liquidity pools or the accumulation patterns of significant market players, traders can adjust their strategies accordingly. This proactive approach can significantly counteract the risks associated with large positions and help prevent scenarios similar to those experienced by Trend Research. As cryptocurrency investment continues to evolve, the integration of on-chain analytical tools stands poised to offer considerable advantages to informed traders.

Lessons Learned from Cryptocurrency Investment Losses

The recent experiences of Trend Research highlight several key lessons for investors in the cryptocurrency landscape. Firstly, the importance of diversification cannot be overstated—relying heavily on a single asset like ETH can expose investors to severe risks, as evidenced by the firm’s massive liquidity loss. By spreading investments across various cryptocurrencies, especially those showing resilience during downturns, investors can cushion their portfolios against unexpected fluctuations.

Secondly, the necessity of continuous trend research and market analysis is paramount. Investors must remain vigilant about market dynamics, adapting their strategies based on real-time data and emerging trends. The ability to pivot quickly to capitalize on profitable opportunities, as seen with Trend Research’s other successful cryptocurrency investments, can significantly mitigate risks. These lessons serve as a guide for both new and seasoned investors navigating the complexities of the crypto market.

Mitigating Risks: Effective Strategies for Cryptocurrency Investors

Navigating the volatile landscape of cryptocurrency investments requires well-defined strategies that mitigate risks. Implementing risk management techniques, such as setting stop-loss orders and regular portfolio assessments, can empower investors to protect their capital. Furthermore, leveraging on-chain analysis data can enhance an investor’s ability to make informed decisions, thus reducing exposure to significant losses like those experienced by Trend Research.

Additionally, continuous education and adherence to market trends are essential for successful investment strategies. Staying abreast with the latest developments in the cryptocurrency realm allows investors to anticipate market movements and adjust their portfolios accordingly. By employing a diversified approach alongside diligent market research, investors can create a buffer against the pitfalls exemplified by the losses in the 2023 market trends.

The Impact of Liquidation Events on Market Sentiment

Liquidation events, such as the one experienced by Trend Research, can have profound effects on market sentiment. When large entities liquidate their positions, it can trigger panic selling among retail investors, leading to further price declines. This cascading effect not only impacts individual assets like ETH but can also influence the broader cryptocurrency marketplace by undermining confidence among participants.

Understanding the psychology behind these events is crucial for traders aiming to outmaneuver market volatility. By analyzing the behavioral patterns of both individual and institutional investors through on-chain data, traders can better gauge market sentiment and adjust their strategies accordingly. As the cryptocurrency landscape evolves, recognizing the implications of liquidation events and their effects on market dynamics will be instrumental in developing robust investment approaches.

Exploring the Future of Cryptocurrency Investments Post-2023

As the cryptocurrency market progresses beyond 2023, numerous factors will shape investment prospects. The lessons learned from significant losses, such as those incurred by Trend Research, will undeniably influence how investors approach digital assets. Enhanced regulatory frameworks and technological advancements are anticipated to provide a more stable environment for cryptocurrency trading, potentially reducing the extreme volatility associated with this market.

Moreover, as market participants become increasingly educated about investment strategies, there could be a shift toward more data-driven decision-making processes. The use of on-chain analysis tools may become standard practice, empowering investors to make informed choices and enhancing their ability to mitigate risks. The future of cryptocurrency investments will likely depend on the collective move towards responsible trading practices and thorough understanding of market dynamics.

How Profits from Other Cryptocurrencies Can Offset Losses

Despite the staggering losses incurred by Trend Research on their ETH investments, reports indicate that the overall performance of their fund remained positive, attributed to gains from other cryptocurrencies. This illustrates a common phenomenon in cryptocurrency investing, where profits from successful trades or positions can help offset losses in downturns. Following a diversified approach can lead to a more resilient portfolio, enabling investors to weather adverse market conditions.

Investors should actively seek opportunities to identify promising low-cap or mid-cap cryptocurrencies that may yield substantial returns. By monitoring the performance and potential of various digital assets, traders can replicate Trend Research’s success with coins such as WLFI and FORM, which helped cushion their ETH losses. A balanced portfolio that encompasses a mix of both high-risk and stable investments can enhance long-term profitability within the volatile landscape of cryptocurrency.

The Importance of Strategic Timing in Cryptocurrency Trading

In cryptocurrency trading, timing can mean the difference between substantial profits and overwhelming losses. The unfortunate situation faced by Trend Research emphasizes how entering or exiting a position at the wrong time can result in significant financial setbacks. Their experience serves as a case study in understanding market trends and signals before making investment decisions.

Strategies involving market timing, augmented by rigorous on-chain analysis, can equip investors with the insights needed to improve their trading timing. By studying fluctuations and patterns within the market, traders can formulate entry and exit strategies that maximize profits while minimizing exposure to setbacks. Navigating the complexities of market timing will continue to be an essential skill for investors as they seek success in the dynamic world of cryptocurrency.

Frequently Asked Questions

What are the implications of the Trend Research ETH losses for cryptocurrency investors?

The Trend Research ETH losses highlight the risks involved in cryptocurrency investments, particularly in volatile markets like those seen in 2023. Investors should be cautious of the potential for investment losses in similar positions, especially when leveraging assets.

How did Trend Research’s liquidation affect their overall cryptocurrency investment strategy?

Despite the significant ETH position loss of approximately $734 million during their liquidation phase, Trend Research managed to mitigate their overall losses through profitable trades in other cryptocurrencies like WLFI and FORM. This indicates a diversified investment strategy may help cushion potential setbacks.

Can the ETH position losses by Trend Research be seen as a trend in the 2023 crypto market?

Yes, the ETH position losses by Trend Research reflect broader trends within the 2023 crypto market, where volatility can lead to substantial losses for major players. Observing similar trends may inform future investment decisions for others in the cryptocurrency space.

What lessons can be learned from Trend Research’s ETH liquidation?

Trend Research’s experience emphasizes the importance of risk management and diversification in cryptocurrency investments. Investors may learn to avoid over-leveraging and to consider potential losses when entering long positions on high-risk assets like ETH.

What is the role of on-chain analysis trends in understanding ETH position losses?

On-chain analysis trends provide valuable insights into the behavior of market participants, including liquidation events. Understanding these trends can help investors gauge market movements and make more informed decisions regarding their own cryptocurrency investments and positions.

What factors contributed to the $734 million loss during Trend Research’s ETH liquidation?

The substantial $734 million ETH position loss resulted from entering a long position at an average price of $3,180 and liquidating at a much lower price of $2,053. This stark difference illustrates the risks inherent in timing the market and leveraging positions.

How can investors protect themselves from ETH position losses like those experienced by Trend Research?

Investors can protect themselves from potential ETH position losses by employing strategies such as setting stop-loss orders, diversifying their crypto portfolio, and conducting thorough research on market trends prior to making investment decisions.