Tradeweb Markets financial performance has captured significant attention following the release of its 2025 earnings report. The Nasdaq-listed electronic trading platform revealed a remarkable year-on-year revenue growth of 18.9%, bringing its total revenue to an impressive $2.1 billion. This growth reflects robust demand and innovation within the market, particularly highlighted by Tradeweb’s pioneering achievement of conducting the first on-chain broker auction. Additionally, the company reported holding around 1.6 billion Canton Coins, valued at approximately $242.7 million, further bolstering its financial prowess. These figures not only showcase Tradeweb Markets’ resilience but also underline its strategic positioning within the ever-evolving financial technology landscape.

In the latest financial disclosures, the operator known for its electronic trading services, Tradeweb Markets, has demonstrated remarkable success in its fiscal health. The company has reported a revenue spike of nearly 19% year-on-year, marking a significant milestone as it approaches 2025. Impressively, it pioneered the first electronic auction for broker certificates on the blockchain, setting it apart from competitors in the financial sector. Additionally, Tradeweb’s substantial investment in Canton Coins highlights its commitment to diversifying assets, with their holdings valued over $240 million. Such achievements emphasize Tradeweb’s position as a leader in integrating innovative technology into traditional finance.

| Key Point | Details |

|---|---|

| Total Revenue Growth | 18.9% year-on-year growth, reaching $2.1 billion |

| On-Chain Auction | Completed the industry’s first on-chain electronic broker certificate auction |

| Canton Coins Holdings | Held approximately 1.6 billion Canton Coins valued at $242.7 million |

Summary

Tradeweb Markets financial performance in 2025 has demonstrated significant growth and innovation within the electronic trading sector. With total revenue reaching $2.1 billion, representing an impressive 18.9% increase year-over-year, the company has solidified its position as a leader in the market. Furthermore, by successfully executing the industry’s first on-chain electronic broker certificate auction, Tradeweb showcases its commitment to embracing technological advancements, aimed at enhancing trading efficiency and transparency. The substantial holding of approximately 1.6 billion Canton Coins, valued around $242.7 million, further highlights the company’s strategic approach towards integrating cryptocurrency into its operations. Overall, Tradeweb Markets financial performance in 2025 underscores its robust business model and forward-thinking strategies.

Examining Tradeweb Markets Financial Performance in 2025

In its financial performance report for 2025, Tradeweb Markets reported a remarkable growth of 18.9% in total revenue year-on-year, culminating in an impressive $2.1 billion. This substantial increase underscores the platform’s strong position within the electronic trading sector. Various factors contributed to this growth, including enhanced user engagement on their electronic trading platform and the successful implementation of advanced technological solutions. The steady rise in Tradeweb Markets revenue reflects its resilience in a competitive landscape, as it adapts to the evolving demands of financial institutions.

The significance of this financial performance extends beyond mere figures. Tradeweb Markets’ ability to capture such a significant portion of the market speaks to the rising trend of digitalization in trading processes. As financial services increasingly shift towards electronic platforms, Tradeweb is strategically positioned to continue benefiting from this evolution. The company’s commitment to innovation, reflected in its development of new products and services, promises lucrative prospects for future growth as it aims for higher revenue in subsequent years.

Impact of On-Chain Broker Auctions on Tradeweb Markets

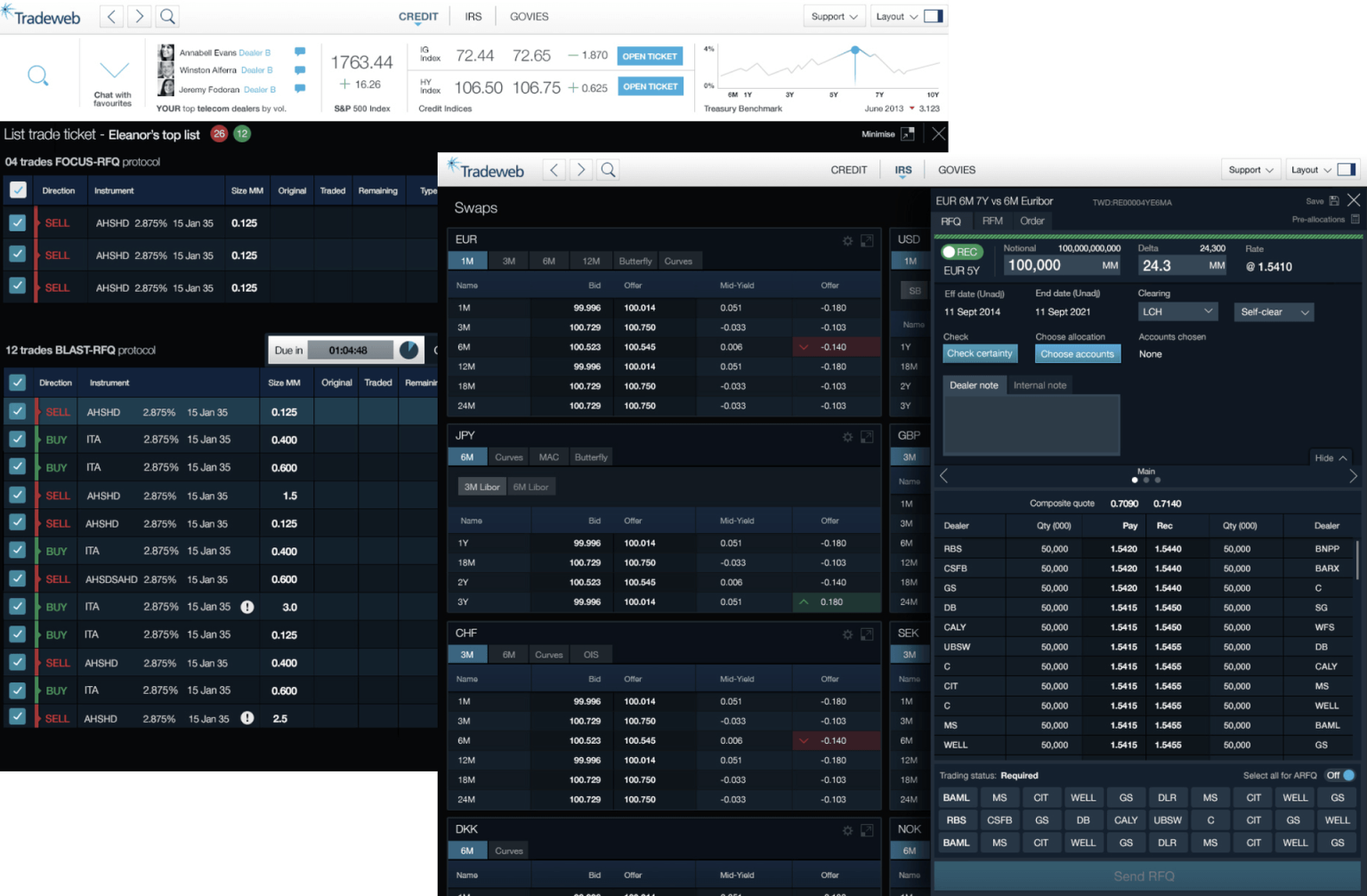

The completion of the industry’s first on-chain electronic broker certificate auction marks a significant milestone for Tradeweb Markets, highlighting its innovative capabilities in facilitating advanced trading solutions. This pioneering auction model represents Tradeweb’s commitment to incorporating blockchain technology into electronic trading, setting a new precedent in the industry. The innovative approach not only enhances transparency but also improves transaction efficiency, making it a valuable offering for traders seeking reliability in their operations.

This move towards on-chain broker auctions could potentially reshape how electronic trading platforms, including Tradeweb Markets, operate in the future. By leveraging blockchain technology, Tradeweb markets can ensure greater security and reduce risks associated with trading discrepancies. As trading environments evolve to accommodate digital assets, the integration of such auction mechanisms may not only attract more participants to Tradeweb’s offerings but also reinforce its status as an industry leader in technology-driven trading solutions.

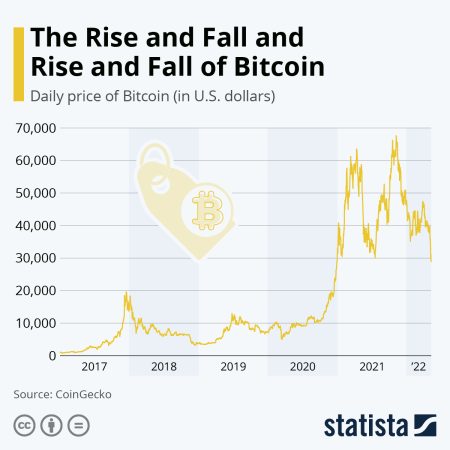

The Rising Value of Canton Coins in Tradeweb’s Portfolio

As of the end of 2025, Tradeweb Markets reported holding approximately 1.6 billion Canton Coins, valued at about $242.7 million. This significant holding illustrates Tradeweb’s strategic investment in digital currencies, which are becoming an increasingly vital asset in the financial ecosystem. The decision to include Canton Coins within its portfolio aligns with the company’s forward-thinking approach and enhances its financial resilience in a rapidly changing market.

The growing value of Canton Coins also reflects the broader trend of cryptocurrencies gaining traction among institutional investors. As Tradeweb continues to navigate the complexities of digital assets, its substantial investment in Canton Coins could provide a cushion against market volatility and strengthen its overall financial performance. This strategic allocation is indicative of Tradeweb’s commitment to integrating innovative financial instruments into its trading platforms, positioning itself for continued growth in future financial landscapes.

Tradeweb Markets: A Leader in Electronic Trading Platforms

Tradeweb Markets operates as a leading electronic trading platform, revolutionizing how financial transactions are conducted. The company’s state-of-the-art platform supports a diverse array of asset classes, enabling seamless trading experiences for institutional clients. By continuously enhancing its technological infrastructure, Tradeweb ensures that users benefit from cutting-edge tools and resources that optimize their trading strategies.

The future of electronic trading looks promising for Tradeweb Markets, with advancements in artificial intelligence and machine learning paving the way for more sophisticated trading solutions. As the demand for efficient and effective electronic trading platforms continues to grow, Tradeweb is well-equipped to address the dynamic needs of traders across various sectors, solidifying its position as a market leader.

Future Growth Projections for Tradeweb Markets

Looking ahead, Tradeweb Markets is poised for significant growth as it explores emerging trends within the financial landscape. With a forecasted expansion in electronic trading and the increasing popularity of digital currencies, the company is strategically aligned to capitalize on these opportunities. Analysts project that Tradeweb’s revenue could continue on a growth trajectory similar to its performance in 2025, supported by ongoing technological innovations and product developments.

Furthermore, Tradeweb’s expansion into new markets and its commitment to customer-centric services are set to enhance its market share. As traditional trading practices evolve and demand shifts towards more digital solutions, Tradeweb’s proactive strategies position it well for sustained success. The continued investment in technology and user experience will likely solidify Tradeweb Markets as a dominant player in the electronic trading realm.

Tradeweb Markets’ Innovations in Financial Technology

Innovations in financial technology are central to Tradeweb Markets’ operations and growth strategy. By focusing on streamlining the trading process through advanced algorithms and real-time data analytics, Tradeweb enhances the user experience on its electronic trading platform. This commitment to innovation not only benefits existing clients but also attracts new traders seeking robust trading solutions.

Tradeweb’s development of features that facilitate transactions like the on-chain broker certificate auction demonstrates its leadership in adopting new technologies. By integrating blockchain capabilities and improving accessibility, Tradeweb Markets is setting a benchmark for operational excellence in electronic trading that could influence the broader market to follow its lead.

Navigating Challenges in the Electronic Trading Industry

Despite its successes, Tradeweb Markets faces challenges within the electronic trading industry, including regulatory scrutiny and the need for robust cybersecurity measures. As financial regulations become more stringent globally, Tradeweb must continually adapt to ensure compliance without compromising its innovative edge. Balancing these demands is essential for maintaining investor confidence and upholding the integrity of its trading platform.

Additionally, with the rise of cyber threats, Tradeweb Markets must invest significantly in cybersecurity technologies to protect its users and assets. Proactive approaches in this area not only defend against potential breaches but also enhance client trust, a crucial factor when it comes to retaining market leadership. Addressing these challenges effectively will be key to Tradeweb’s sustained growth and competitive advantage in the electronic trading landscape.

The Role of Data Analytics in Tradeweb Markets’ Growth

Data analytics plays a pivotal role in Tradeweb Markets’ growth strategy, offering insights that drive decision-making and enhance trading performance. By leveraging big data, Tradeweb can identify trends, optimize pricing strategies, and tailor services to meet the specific needs of its clients. This analytical capacity not only fosters improved trading outcomes but also allows Tradeweb to remain agile in a rapidly evolving market.

Moreover, the integration of advanced analytics into its electronic trading platform provides users with real-time data insights, empowering them to make informed trading decisions. This data-driven approach ensures that Tradeweb Markets remains at the forefront of the electronic trading landscape, reinforcing its reputation as an innovative leader and a trusted partner for institutional clients.

Understanding the Competitive Landscape for Tradeweb Markets

Tradeweb Markets operates in a highly competitive environment, with various players vying for dominance in electronic trading. Understanding the competitive landscape is essential for Tradeweb to maintain its market position and achieve continued growth. By consistently assessing competitor strategies and market demands, Tradeweb can adjust its offerings to meet evolving customer needs, ensuring that it remains a preferred choice for institutional investors.

In this competitive arena, differentiation is crucial. Tradeweb’s focus on technological advancement, including its pioneering on-chain initiatives and investment in digital assets like Canton Coins, gives it a distinct advantage. As competition increases, Tradeweb’s commitment to innovation and customer-oriented services will be pivotal in sustaining its leadership position within the electronic trading platform sector.

Frequently Asked Questions

What was Tradeweb Markets’ revenue in 2025?

In 2025, Tradeweb Markets reported a total annual revenue of $2.1 billion, reflecting a remarkable growth of 18.9% year-on-year.

How did Tradeweb Markets perform financially in their latest report?

Tradeweb Markets demonstrated strong financial performance in 2025, with a revenue increase of 18.9% compared to the previous year, achieving $2.1 billion in total revenue.

What innovative auction did Tradeweb Markets complete recently?

Tradeweb Markets successfully completed the industry’s first on-chain electronic broker certificate auction, marking a significant milestone in electronic trading.

What is the significance of Canton Coins in Tradeweb Markets’ financial report?

By the end of 2025, Tradeweb Markets held approximately 1.6 billion Canton Coins, valued at around $242.7 million, indicating a strong position in the digital asset market.

How is Tradeweb Markets’ financial growth expected to trend in the coming years?

Given its impressive revenue growth of 18.9% in 2025 and strategic innovations such as on-chain broker auctions, Tradeweb Markets is well-positioned for continued growth in the electronic trading industry.

What role does the electronic trading platform play in Tradeweb Markets’ performance?

As an electronic trading platform, Tradeweb Markets facilitates efficient trading operations, contributing to their robust financial performance and generating significant revenue in 2025.

How does the value of Cantons Coins affect Tradeweb Markets’ overall performance?

The approximately $242.7 million valuation of Tradeweb Markets’ 1.6 billion Canton Coins enhances its balance sheet and reflects the company’s engagement with emerging digital assets.