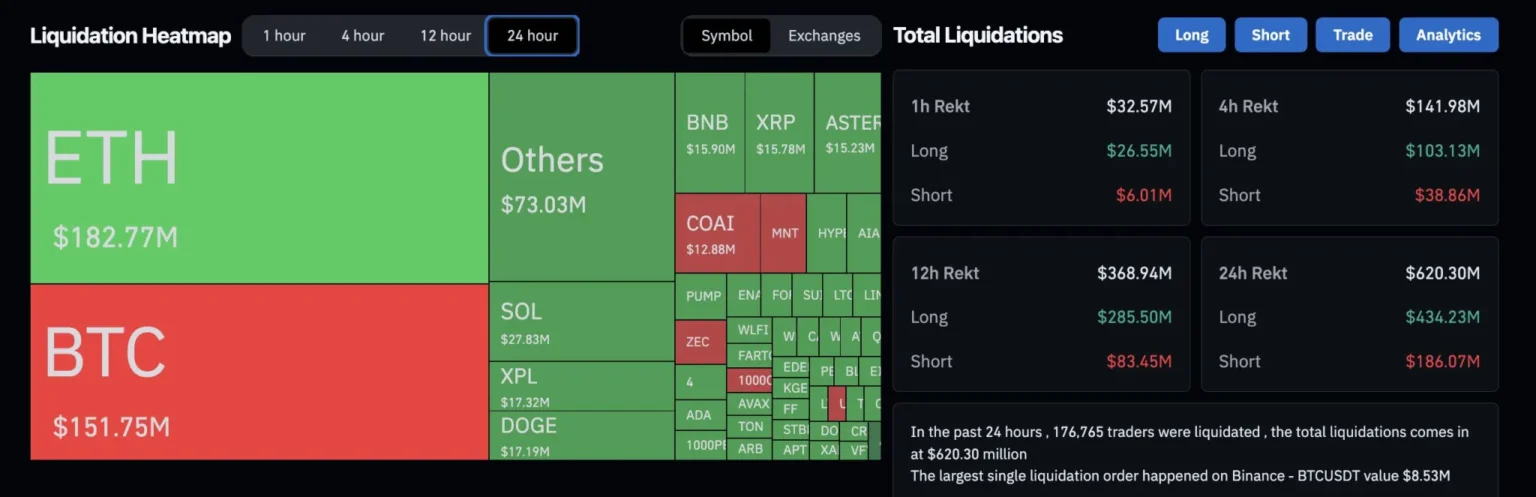

In a dramatic turn of events over the past 24 hours, the total amount of network liquidation has skyrocketed to a staggering $780 million. This significant figure reflects the liquidation of more than 200,000 positions within the network. Such a high volume of liquidations indicates a considerable shift in market dynamics, which can have far-reaching implications for traders and investors alike. The rapid increase in liquidations highlights the volatility and unpredictability of the current market environment. As positions are liquidated, it raises questions about the stability of the network and the potential for further fluctuations in the market. Understanding the factors that led to this surge in liquidations may provide insights into future market trends and investor behavior.