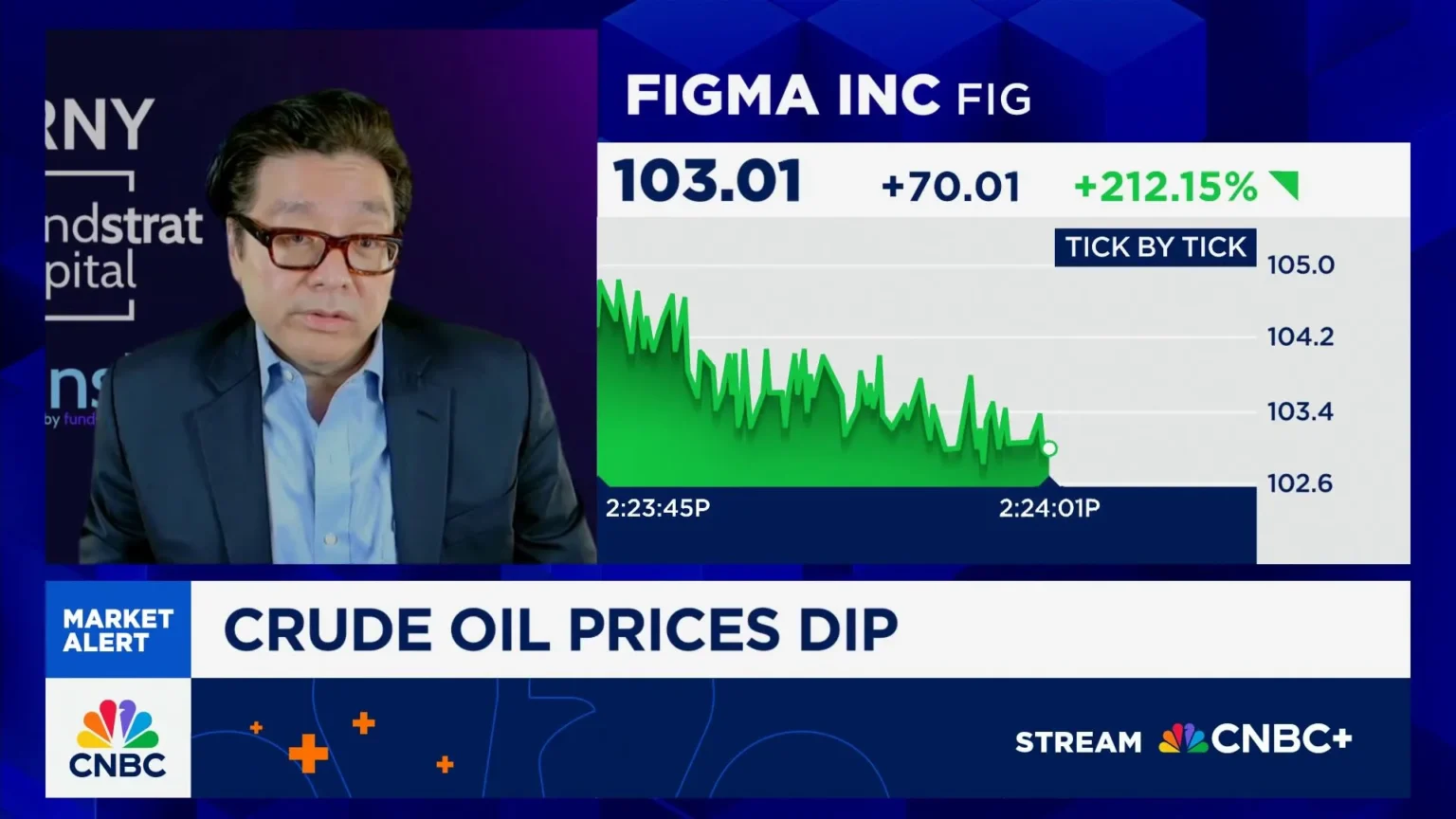

Tom Lee has stated that a recent market decline was caused by a liquidity shortage on October 11, leading market makers to sell off assets to address a significant financial gap. According to Lee, the lack of liquidity created pressure in the market, prompting these actions. He explained that the sell-off by market makers was essential in managing the financial issues arising from the liquidity drought. This situation signals deeper concerns within the market structure, as participants grapple with maintaining stability amid such financial challenges. The interplay between liquidity and market reactions highlights the crucial role of market makers during periods of financial strain. Observers are advised to monitor these trends as they may indicate further implications for future market dynamics.

Previous ArticleExploring Evolution of Crypto Wallet Technologies in Blockchain

Related Posts

Add A Comment