Tokenized deposits are emerging as a revolutionary development in the realm of blockchain finance, particularly for institutional clients. This innovative solution allows banks to issue digital assets that represent cash deposits on an in-house permissioned blockchain, enhancing liquidity and efficiency in capital markets. By leveraging tokenized bank deposits, institutions can streamline their collateral management processes while benefiting from the transparency and certainty that blockchain technology offers. The launch by BNY, a historic player in the financial sector, underscores the accelerating trend towards adopting blockchain technology in traditional finance. As global demand for 24/7 capital markets grows, tokenized deposits are poised to play a crucial role in reshaping how digital assets are managed and traded.

The concept of tokenized bank deposits, also referred to as on-chain cash balances or digital depositor claims, is becoming increasingly relevant as the financial sector evolves. By utilizing blockchain technology, financial institutions are redefining their operational frameworks to offer greater efficiency and speed in asset transactions. These digital representations of traditional assets are essential for improving collateral management and supporting a continuous trading environment that meets the needs of modern investors. As the landscape shifts towards more decentralized and automated systems, the integration of tokenization stands to enhance the overall functionality of capital markets. This transformation not only aligns with the trend towards always-on markets but also facilitates a broader understanding of digital finance and its implications for institutional clients.

The Rise of Tokenized Deposits in Blockchain Finance

The emergence of tokenized deposits is a groundbreaking development in the realm of blockchain finance. Financial institutions, particularly BNY, have recognized the potential of utilizing blockchain technology to enhance the efficiency and security of banking operations. Tokenized bank deposits represent a pivotal shift from traditional banking methods, allowing institutional clients to hold digital assets that serve as on-chain cash balances. This innovation not only streamlines the deposit process but also opens new avenues for liquidity management and collateral optimization.

As the demand for real-time transactions grows, the introduction of tokenized deposits can significantly address the limitations of the current banking infrastructure. By leveraging an in-house permissioned blockchain, BNY ensures that its institutional clients gain access to a reliable and secure platform for managing their digital assets. The implications of this technology extend far beyond mere convenience; they represent a fundamental reimagining of how financial transactions can occur in a 24/7 capital markets environment.

In the wake of BNY’s launch, other financial entities are likely to follow suit, further validating the trend towards integrating traditional finance with blockchain solutions. This collaborative approach signifies a willingness among institutional players to adapt to the evolving landscape of financial services. As tokenized deposits become ubiquitous across the industry, we can expect enhanced capabilities in collateral management and a more robust framework for digital asset transactions.

The future of banking is undoubtedly interwoven with the advancements in blockchain technology, enabling institutions to operate more efficiently while catering to the growing expectations of their clients. With BNY’s pioneering efforts in the tokenized deposit space, we are witnessing a significant turning point in financial services that promises to reshape the investment landscape.

Understanding the Benefits of 24/7 Capital Markets

The transition towards 24/7 capital markets represents a monumental shift in how trading and investment activities are conducted at a global scale. The joint statement from the SEC and CFTC highlights the necessity for markets to adapt to the realities of an always-on economy. By expanding trading hours, institutions can enhance market liquidity and responsiveness, reducing the risks associated with holding positions during non-trading hours. This is particularly beneficial for institutional clients who require adaptability in their investment strategies.

Moreover, the implementation of 24/7 capital markets can significantly lower the friction associated with trading, especially in international markets. Blockchain technology allows for real-time settlement, reducing transaction costs and eliminating the need for complex intermediaries that traditionally slow down the process. This not only facilitates smoother transactions but also increases transparency, as every trade can be tracked and verified on the blockchain.

The integration of real-world assets into these continuous markets can also pave the way for broader acceptance of tokenization as a viable solution for managing traditionally illiquid assets. Assets such as real estate and collectibles could become more accessible to a wider array of investors, owing to the improved liquidity that 24/7 trading facilitates. As more assets are tokenized, their value and the market’s overall efficiency could see a significant uptick, offering exciting prospects for both individual and institutional investors.

In conclusion, the establishment of 24/7 capital markets, underpinned by blockchain technology, presents a transformative opportunity for the financial industry. As institutional players embrace this new model, we anticipate a period of innovation and increased competition, ultimately benefiting investors through enhanced trading experiences and greater market access.

The Role of Collateral Management in Digital Asset Transactions

As the landscape of financial transactions evolves with the introduction of digital assets, the importance of effective collateral management has become more pronounced. BNY’s tokenized deposits are designed to streamline this aspect by providing a secure method for institutions to manage their collateral requirements. In traditional finance, collateral management often involves cumbersome processes and a multitude of intermediaries; however, by utilizing blockchain technology, these procedures can be simplified.

Tokenized deposits, being part of the on-chain ecosystem, allow for real-time tracking and management of collateral, directly impacting liquidity and risk management strategies for institutions. Automation and smart contracts further enhance the collateral management process, minimizing the risks of counterparty defaults and inefficiencies inherent in traditional systems. This digital approach not only aligns with the needs of institutional clients but also fosters a more resilient and transparent financial environment.

Furthermore, as institutions explore the benefits of digital assets, enhanced collateral management will be essential in addressing regulatory and compliance challenges. The ability to monitor and adjust collateral dynamically within a blockchain framework enables institutions to respond swiftly to market changes, thereby maintaining compliance while optimizing capital allocation. This progressive approach to collateral management signifies a clear evolution in the financial sector.

In summary, as institutions delve deeper into the realm of digital assets and tokenization, effective collateral management will invariably play a crucial role in their operational success. The evolution from traditional to blockchain-based collateral management practices allows for increased efficiency, risk reduction, and ultimately, a stronger foundation for institutional participation in the growing digital economy.

The Future of Traditional Finance with Blockchain Integration

The integration of blockchain technology into traditional finance marks a new chapter in the evolution of financial services. Major financial institutions, like BNY, are leading this charge by reimagining their existing infrastructures to accommodate the performances and realities of a digital economy. By adopting solutions such as tokenized deposits, banks can enhance their service offerings, providing institutional clients with greater flexibility in managing their digital assets.

This transformation reflects a wider trend where traditional finance players recognize the necessity of embracing innovation to remain competitive. With blockchain’s potential to simplify cross-border transactions, reduce costs, and improve settlement times, institutions that invest in this technology will find themselves better equipped to meet the rapidly changing demands of their clients. The implementation of features like 24/7 capital markets further embodies this shift towards a continuously operating financial ecosystem.

As traditional finance entities continue to overhaul their legacy systems, the convergence of blockchain technology will produce more efficient, transparent, and accountable financial processes. This reformation could result in a newfound trust from consumers and investors alike, as the friction and opacity that have long characterized finance are mitigated through blockchain adoption.

In conclusion, the future of traditional finance intertwined with blockchain technology is not merely speculative; it is rapidly becoming a reality. As trends like tokenized deposits gain momentum, we can anticipate a more dynamic, interconnected financial landscape that is better suited for the demands of modern society.

The Challenges of Adopting Blockchain in Finance

While the advantages of blockchain integration into finance are significant, there are challenges that institutions must navigate in the adoption process. One of the primary hurdles is regulatory compliance, as entities must ensure that their use of blockchain technologies complies with existing financial regulations. The ever-evolving regulatory landscape adds complexity to the implementation of blockchain solutions like tokenized deposits.

Additionally, resistance to change within established financial organizations can stymie the adoption of innovative practices. Employees accustomed to traditional systems may present challenges in transitioning to a decentralized approach that blockchain necessitates. To counteract this resistance, institutions must invest in education and training to ensure that all stakeholders are aligned with the strategic vision of integrating blockchain technology.

Moreover, the technological infrastructure needed to support blockchain solutions may require substantial investment. Institutions must assess their current systems to determine how best to incorporate blockchain without causing disruptions to their existing operations. This balancing act is crucial for organizations seeking to innovate while maintaining the trust of their clients.

Despite these challenges, the push for transformation within the finance sector is unmistakable. As blockchain technology continues to mature, institutions that proactively address these obstacles will be well-positioned to capitalize on the benefits of tokenization and 24/7 capital markets. The journey might be fraught with difficulties, but the potential rewards are equally substantial.

Enhancing Client Experience with Digital Assets

The rise of digital assets, particularly in the form of tokenized deposits, is transforming the client experience in finance. Institutional clients are increasingly seeking enhanced services that deliver greater flexibility and quicker access to capital. By implementing blockchain technology, organizations like BNY are not only meeting these demands but also redefining the benchmarks for service excellence in financial transactions.

The on-chain nature of tokenized deposits allows for instantaneous transactions and real-time updates, significantly improving responsiveness for institutions managing large volumes of digital assets. Clients benefit from reduced settlement times, enhanced transparency, and the ability to effortlessly manage collateral as part of their investment strategies. Furthermore, the comprehensive view offered through these blockchain systems ensures that clients remain informed throughout the transaction process.

As digital assets become more integrated into financial services, the client experience will continue to evolve towards a more user-centric approach. Institutions that prioritize client needs by leveraging real-time data and seamless transaction capabilities will likely emerge as leaders in the industry. By focusing on customer satisfaction through technological advancements, financial institutions can build stronger relationships and ensure long-term loyalty.

In summary, the shift towards digital assets embedded within blockchain technology enhances the overall client experience, making financial services more responsive, efficient, and adaptable. As more institutions embrace these advancements, the expectations of institutional clients will also rise, pressing organizations to innovate continuously.

The Impact of Tokenization on the Financial Ecosystem

Tokenization is poised to have a profound impact on the financial ecosystem, enabling a paradigm shift in the way assets are represented and traded. By converting traditional assets into digital tokens on a blockchain, institutions can leverage advantages never before possible in finance. Not only does tokenization unlock liquidity for previously illiquid assets such as real estate or collectibles, but it also fosters broader participation in capital markets.

The ability to efficiently tokenize assets means that smaller investors can participate in markets that were once only accessible to institutional players. This democratization of investment opportunities can lead to increased market competition and innovation, ultimately benefiting all stakeholders. With the SEC and CFTC signaling their openness to exploring 24/7 capital markets, the stage is set for tokenization to redefine asset classes and trading dynamics.

Moreover, tokenization enhances transparency and reduces the potential for fraud within the financial system. Each tokenized asset retains an immutable record of ownership and transaction history on the blockchain, providing investors with unequivocal proof of their holdings. This increased transparency instills greater confidence among participants and encourages more robust market activity.

In conclusion, the integration of tokenization into the financial ecosystem represents not just a technological advancement but also a fundamental shift in how assets are managed, traded, and perceived. As institutions like BNY continue to explore and implement tokenized solutions, the future of finance will likely see unprecedented levels of efficiency and inclusiveness.

Navigating Regulatory Frameworks for Blockchain Finance

As blockchain technology gains traction in the financial sector, navigating the associated regulatory frameworks becomes an essential focus for financial institutions. The adoption of innovations such as tokenized deposits must be aligned with current legal standards to ensure compliance and mitigate potential liabilities. Institutions must engage with regulatory bodies like the SEC and CFTC to clarify the legal status of digital assets and understand the obligations they entail.

Additionally, the rapid evolution of blockchain technology and its applications often outpaces regulatory developments, creating uncertainty for institutions keen on adopting these advancements. Stakeholders must remain vigilant, adapting their strategies in response to regulatory updates while actively participating in discussions that shape the future of blockchain finance. This proactive approach positions institutions favorably within the regulatory landscape.

Moreover, transparency and open communication with regulators can foster trust and facilitate collaborations aimed at creating robust regulatory frameworks. Institutions that prioritize regulatory engagement will not only enhance their operational integrity but also contribute to a more stable and secure environment for blockchain finance. This also reassures institutional clients, who seek to engage with technologies that comply with existing norms.

In summary, navigating the regulatory frameworks surrounding blockchain finance is a critical component for institutions aiming to leverage technologies like tokenized deposits. By staying informed and actively engaging with regulatory bodies, financial entities can successfully align their operations with compliance requirements while driving innovation in the sector.

The Future of Institutional Investment with Blockchain Solutions

The future of institutional investment is increasingly intertwined with blockchain solutions, where technology plays a pivotal role in shaping investment strategies and processes. As financial institutions like BNY embrace tokenized deposits and other blockchain innovations, investment approaches are evolving to meet the demands of a modern and dynamic market environment. Institutions are starting to recognize the potential for digital assets to enhance their portfolios and diversify their holdings.

Blockchain technology facilitates unmatched levels of transparency, efficiency, and liquidity that are attractive to institutional investors. The ability to access 24/7 capital markets through tokenization means that institutions can respond more quickly to market changes, making strategic decisions based on real-time data. This agility will become a key competitive advantage for institutions that adopt blockchain solutions.

As we look towards the future, institutional investors will likely prioritize partnerships with blockchain-savvy financial institutions, driving the demand for innovative solutions across the investment landscape. The potential for asset tokenization and the seamless management of digital assets will reshape conventional investment strategies, as institutions seek to leverage the benefits of faster, more efficient transactions within a constantly evolving market.

In conclusion, the trajectory of institutional investment is heading towards increased adoption of blockchain solutions, where tokenized deposits and 24/7 trading capabilities play critical roles. Those institutions that embrace these changes will not only stay ahead of the curve but will also redefine the very essence of investing in the digital age.

Frequently Asked Questions

What are tokenized deposits and how do they work in blockchain finance?

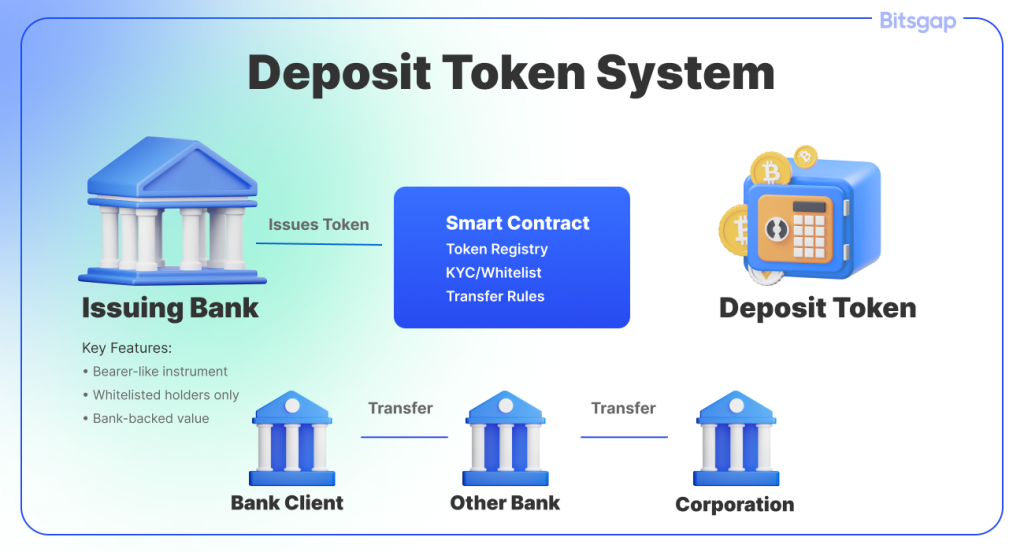

Tokenized deposits represent traditional bank deposits in the form of digital tokens on a blockchain. These assets serve as on-chain cash balances or claims against a bank, allowing institutions to enhance liquidity and streamline collateral management, especially in a world moving towards 24/7 capital markets.

How does BNY’s tokenized deposits service benefit institutional clients?

BNY’s tokenized deposits provide institutional clients with faster asset movement, greater settlement certainty, and improved transparency. By utilizing an in-house permissioned blockchain, these deposits enhance operational efficiency and help meet collateral and margin requirements in evolving financial markets.

What role do tokenized deposits play in facilitating 24/7 capital markets?

Tokenized deposits are pivotal for 24/7 capital markets as they eliminate the need for intermediaries, allowing transactions to occur anytime. This shift enables institutions to manage digital assets effectively, reinforcing liquidity in traditionally illiquid markets.

How does BNY’s move towards tokenized deposits reflect changes in traditional finance?

BNY’s launch of tokenized deposits showcases a broader trend in traditional finance, where legacy systems are being upgraded to accommodate blockchain technology. This transition is crucial for financial institutions aiming to operate in an increasingly digital and connected global economy.

What implications do tokenized deposits have for collateral management in the digital assets landscape?

Tokenized deposits significantly enhance collateral management by providing instant liquidity through on-chain transactions. This capability allows institutional clients to meet their collateral and margin requirements more efficiently, leveraging digital assets for enhanced financial performance.

Can traditional assets be tokenized using BNY’s tokenized deposits, and what are the benefits?

Yes, traditional assets can be tokenized alongside BNY’s tokenized deposits, enabling institutions to represent physical assets on a blockchain. The key benefits include unlocking liquidity for illiquid assets, reducing transaction costs, and increasing transparency across all asset classes.

How do tokenized deposits improve settlement processes in the financial markets?

Tokenized deposits streamline settlement processes by enabling instant transaction finality on a blockchain. This reduction in friction and time delays allows for faster capital movement and greater operational efficiency in the growing digital asset marketplaces.

What challenges do financial institutions face with tokenization and 24/7 capital markets?

While tokenization and 24/7 capital markets promise many benefits, financial institutions face challenges such as regulatory compliance, technological integration, and risk management associated with digital assets, requiring careful planning and strategy to overcome.

| Key Points |

|---|

| BNY launches tokenized deposits to enhance efficiency for institutional clients. |

| The service utilizes an in-house permissioned blockchain for transactions. |

| Tokenized bank deposits represent on-chain cash balances and bank claims. |

| The aim is to support collateral and margin requirements with future enhancements. |

| This initiative aligns with the shift towards 24/7 capital markets as per SEC and CFTC proposals. |

| Blockchain technology is seen as a solution to the limitations of the legacy financial system. |

| Tokenization can facilitate the trading of illiquid assets, enhancing market liquidity. |

Summary

Tokenized deposits are rapidly reshaping financial services by offering enhanced liquidity and efficiency for institutional clients. BNY’s recent launch of tokenized deposits on a permissioned blockchain network is a significant step towards modernizing financial transactions. This move not only addresses the need for faster transactions, but also supports the broader industry shift towards 24/7 capital markets. As traditional finance adopts blockchain technology, tokenization is set to revolutionize how assets, including traditionally illiquid ones, are traded and managed, paving the way for a more agile financial ecosystem.

Related: More from Regulation & Policy | EU Crypto Taxes: Practical Implications Explained | UK FCA to Consider Cryptos for Gambling Payments