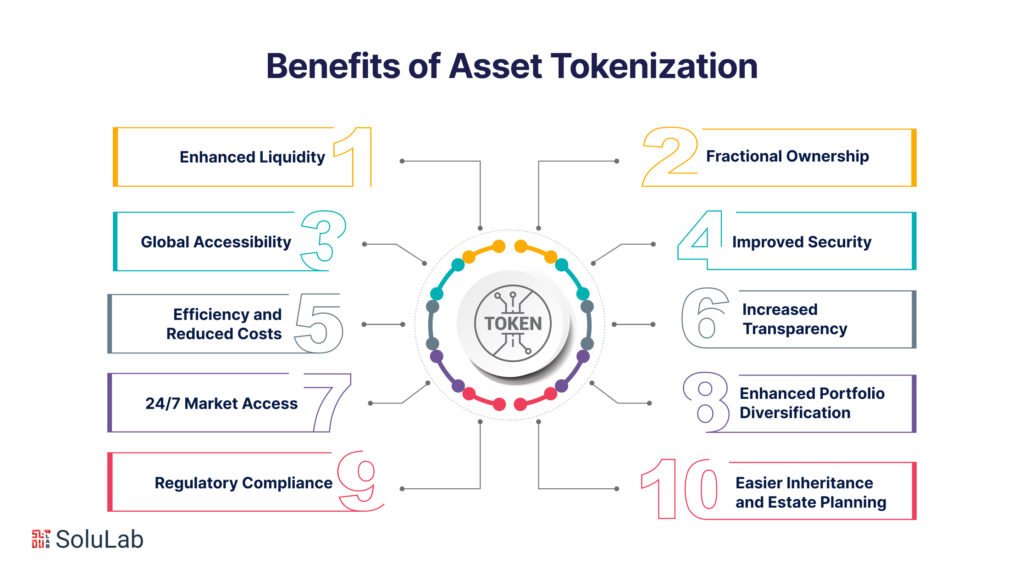

Tokenization benefits are revolutionizing the landscape of digital finance by bridging traditional and modern financial infrastructures. By transforming large, illiquid assets into smaller, manageable units, tokenization simplifies asset transactions while enhancing efficiency and transparency. Insights from industry leaders, like Larry Fink and Rob Goldstein of BlackRock, advocate for this innovative approach, highlighting its potential to reduce costs and streamline processes. As tokenization replaces outdated paper documentation with digital code, it not only modernizes financial transactions but also increases accessibility for a wider range of investors. This transformative technology promises to reshape how liquid assets are managed and traded in the evolving financial ecosystem.

The advantages of digital asset representation, commonly known as tokenization, are increasingly recognized in today’s financial market. By digitizing physical assets, this method enhances transaction efficiency while ensuring greater clarity and openness in asset dealings. Leaders in finance, such as BlackRock, emphasize the role of this innovative financial mechanism as it fosters seamless connectivity between conventional finance and the burgeoning digital finance sector. The practice of converting large, cumbersome assets into easily tradable units can significantly lower barriers to entry and improve liquidity. As we embrace this digital shift, the future of asset management appears poised for a dramatic reinvention.

Understanding Tokenization in Digital Finance

Tokenization is a revolutionary concept that is playing a pivotal role in the evolution of digital finance. By converting physical assets into digital tokens, we are not only streamlining asset transactions but also enhancing the overall financial infrastructure. This practice allows for the deconstruction of large, illiquid assets into smaller, liquid units, making them more appealing and accessible to a wider pool of investors. As noted by Larry Fink and Rob Goldstein, the capability to link traditional and digital finance is essential in modernizing market operations.

The impact of tokenization extends far beyond mere convenience. It signifies a paradigm shift in how we perceive asset ownership and transfer. Traditional barriers that typically hinder asset transactions, such as lengthy paperwork and bureaucracy, can be minimized or eliminated entirely. The effect of this innovation is profound: increasing market liquidity, promoting transparency, and ultimately driving the democratization of investing, which empowers more individuals to participate in the financial ecosystem.

The Role of BlackRock in Asset Tokenization

BlackRock, under the leadership of its CEO Larry Fink, is at the forefront of advocating for asset tokenization, recognizing its potential to fundamentally reshape financial markets. The adoption of tokenization can significantly reduce costs and processing time associated with asset transactions, making it a game-changer for institutional investors. With the world’s largest asset manager backing this initiative, it could catalyze widespread acceptance of digital finance solutions among traditional finance players.

BlackRock’s involvement in tokenization also highlights a critical synergy between innovation and regulatory compliance. As the framework for digital assets evolves, BlackRock’s strategies focus on minimizing risks while maximizing returns. This conservative yet progressive approach not only sets a precedent but also reassures investors about the reliability and security of tokenized assets, fostering greater trust in this emerging financial infrastructure.

Improvements in Financial Infrastructure through Tokenization

The ongoing transformation of financial infrastructure, driven by tokenization, promises enhanced efficiency across various facets of the financial system. By utilizing blockchain technology to create secure and transparent transactions, organizations can ensure faster asset transfers and reduced operational costs. This shift not only benefits financial institutions but also serves end-users with more efficient services and improved access to financial markets.

Moreover, the tokenization of assets offers a unique opportunity for fractional ownership, allowing investors to engage with high-value items such as real estate or art, which were previously beyond reach for many. This new model fosters inclusivity and creates a more equitable investment landscape, thereby enhancing overall economic participation. As the infrastructure evolves, the landscape of asset ownership and investment accessibility is set to change dramatically.

The Future of Liquid Assets in a Tokenized World

With the advent of tokenization, the concept of liquid assets is entering a new frontier. Liquid assets, which can easily be converted into cash or equivalents, will take on a new form as traditional assets become digitized. This shift allows for a more dynamic market where assets can be traded seamlessly in real-time, increasing liquidity and reducing market volatility. As asset managers like BlackRock explore these developments, the implications for liquidity in financial markets are significant.

In addition to enhanced liquidity, tokenization may lead to the creation of innovative financial products that cater to the unique needs of modern investors. By leveraging the flexibility and scalability of digital tokens, financial institutions will be able to craft customized investment vehicles that reflect the evolving demands of consumers. As such, the future of liquid assets in a tokenized context will likely usher in a wave of new investment opportunities, fundamentally altering how wealth is created and maintained.

Tokenization: A Key to Asset Transactions

The transformation of asset transactions through tokenization cannot be overstated. By using blockchain technology to tokenize physical items, the process becomes significantly streamlined, minimizing the time and costs typically associated with traditional asset transfers. This innovative approach provides a clear advantage in a competitive market landscape, allowing for quicker and more efficient transactions, which is particularly beneficial for assets that were previously considered illiquid.

As tokenization facilitates seamless asset transactions, it opens up avenues for smaller investors to participate in markets that were once reserved for high net worth individuals. This democratization enhances the overall market health by fostering diversity among investors and amplifying trading volumes. For institutional players, the efficiency gains realized through tokenization represent an opportunity to optimize portfolios and improve client offerings, demonstrating the profound implications of this technology on asset transaction processes.

Embracing Change: Traditional Finance Meets Digital Tokenization

As tokenization continues to gain traction, traditional financial institutions must adapt to the rapid changes occurring in the market landscape. Embracing digital finance alongside established practices will require a willingness to adopt new technologies and rethink existing business models. The challenge lies in striking a balance between maintaining stability and pursuing innovation, a task that organizations like BlackRock are actively addressing.

In this new environment, financial institutions that resist change may find themselves at a disadvantage, while those who embrace tokenization may reap substantial rewards. Successful integration of tokenized assets into traditional frameworks could lead to improved customer experiences and enhanced operational efficiencies. As such, the convergence of traditional finance and digital tokenization represents both a challenge and an opportunity for the industry.

Regulatory Landscape and Asset Tokenization

The regulatory landscape surrounding tokenization is complex and constantly evolving. Financial regulators are grappling with how to effectively oversee digital assets while ensuring consumer protection and market integrity. As tokenization of assets becomes a norm, regulators must establish clear guidelines to define the boundaries of this new market paradigm, addressing potential risks associated with fraud and market manipulation.

At the same time, regulators must balance the promotion of innovation in financial services with the imperative for investor safety. Institutions like BlackRock play a crucial role in advocating for sensible regulations that foster growth without compromising risk management. As the landscape continues to develop, the interplay between regulatory frameworks and tokenization will be decisive in shaping the future of asset transactions and digital finance.

The Impact of Technology on Financial Accessibility

Technology is a key driver of financial accessibility, and tokenization stands out as a leading innovation that exemplifies this shift. By breaking down traditional barriers to entry, tokenized assets can provide a pathway for a wider range of investors to access financial markets. This new approach not only democratizes investments but also encourages financial literacy and active participation among previously marginalized groups.

Enhanced accessibility through tokenization promotes financial inclusion, where individuals can invest even modest amounts in high-value assets. The result is a more diversified investor base and increased demand across various asset classes. As institutions like BlackRock continue to champion tokenization, they pave the way for a more inclusive financial landscape where everyone can work towards building wealth.

A Comparative Analysis: Tokenization vs. Traditional Asset Management

When comparing tokenization with traditional asset management, the disparities in efficiency and effectiveness are striking. Tokenization streamlines processes, reduces costs, and allows for real-time transactions, which stands in contrast to the often cumbersome nature of traditional asset management. These advancements not only enhance operational efficiencies but also enable better liquidity and quicker access to capital, fundamentally transforming how institutions manage and allocate their assets.

Additionally, the transparency provided by blockchain technology enhances trust in the management of tokenized assets. With traditional systems, concerns about data integrity and transaction transparency can create friction among stakeholders. Tokenization alleviates these fears by ensuring all transactions are recorded on a tamper-proof ledger, fostering a higher degree of confidence among investors and promoting a shift towards more modern, digitized asset management strategies.

Frequently Asked Questions

What are the benefits of tokenization in digital finance?

Tokenization in digital finance transforms conventional asset transactions by eliminating inefficiencies and enhancing transparency. As Larry Fink noted, it connects traditional finance with digital assets, making investments more accessible and reducing transaction costs. This modern financial infrastructure facilitates the fractional ownership of typically illiquid assets, increasing liquidity and providing broader participation options.

How does BlackRock’s approach to tokenization improve asset transactions?

BlackRock emphasizes that tokenization revolutionizes asset transactions by digitizing and streamlining processes. This approach minimizes reliance on cumbersome paper documentation, lowering costs, and accelerating transaction times. Enhanced transparency in financial infrastructure helps build trust among investors, fostering a more efficient marketplace.

Why is tokenization considered beneficial for transforming illiquid assets?

Tokenization offers significant benefits for illiquid assets, such as real estate, by breaking them into smaller, tradeable units. This process enhances liquidity and allows a broader range of investors to access previously unattainable markets, ultimately driving the adoption of financial innovations and expanding investment opportunities.

In what ways does tokenization enhance financial infrastructure?

Tokenization enhances financial infrastructure by creating a seamless connection between traditional and digital finance. This integration promotes efficiency through faster transaction speeds, reduced costs, and improved transparency, allowing investors to engage with assets in ways previously thought impossible, aligning with evolving market demands.

What future developments can we expect from tokenization in the asset management sector?

The future of tokenization in asset management is promising, as advancements are expected to rival the growth experienced during the internet’s inception. Tokenization will likely lead to the widespread ability to buy, sell, and hold various asset types through single digital wallets, significantly transforming investment strategies and market accessibility.

| Key Point | Details |

|---|---|

| Modernizing Infrastructure | Tokenization connects traditional and digital finance, enhancing the overall infrastructure. |

| Efficiency Improvements | It reduces transaction costs and time by replacing paper documents with code. |

| Increased Accessibility | Large, illiquid assets can be divided into smaller units for easier transaction. |

| Growth Comparison | Current tokenization development resembles the era before major Tech Giants emerged. |

| Future of Assets | In the future, a variety of assets will be manageable via a single digital wallet. |

Summary

Tokenization benefits are revolutionizing global finance by bridging traditional and digital markets. This innovative process enhances efficiency and transparency while making access to previously illiquid assets more straightforward. As we move towards a future where assets can be managed through digital wallets, the transformation fueled by tokenization is expected to mirror the rapid evolution of the internet. In conclusion, embracing tokenization will lead to significant advancements in how we transact and invest, showcasing its profound impact on the financial landscape.

Related: More from Regulation & Policy | Anthropic Founder Critiques Pentagons Choice as Unprecedented in Crypto Regulation | UK Gambling Regulator Examines Cryptocurrencies for Licensed Bettors in Crypto Regulation