| Key Points | Description |

|---|---|

| Industry Shift | New standards for token launches emphasize transparency and trust, aiming to protect retail investors. |

| CoinTerminal’s Strategy | CoinTerminal’s refundable model and fundraising approach aims to ensure fair access for retail investors in early-stage token deals, supported by a large user community. |

| Market Trends | The token launch market is becoming more selective, with increased regulatory scrutiny and retail expectations for stronger business models. |

| Criteria for Launch Success | Factors for a successful token launch include social proof, KOL strategies, a clear narrative, and alignment with reputable exchanges. |

| Attention and Trust | With retail investors becoming more discerning, projects must effectively communicate their value propositions to maintain interest. |

Summary

Token launches are evolving amidst a landscape marked by increasing challenges and expectations. As highlighted in the discussion with Maximiliano Stochyk Duarte, the rise of new standards for token launches, particularly through initiatives like CoinTerminal’s refundable model, showcases a commitment to transparency and trust, essential for protecting retail investors. With a growing emphasis on sustainable business models and effective communication of value, projects entering the token market must prioritize building trust and attention from discerning retail investors as we approach 2026.

In the rapidly evolving landscape of cryptocurrency, **token launches** have become a focal point for investors and developers alike, especially with the market approaching 2026. The spotlight on retail investor protection is more significant than ever, as enthusiasts seek clarity and transparency amid the flurry of new projects. CoinTerminal, with its innovative strategies, promises to redefine token launch processes, placing an emphasis on refundability to safeguard investors’ interests. Industry leaders are acknowledging that successful token launch strategy incorporates solid business models and community engagement, aimed at building trust and excitement. As the countdown to 2026 continues, the mechanisms behind token sales will likely impact how retail investors perceive value and access in this dynamic environment.

As the crypto world braces for the upcoming token sales, it’s essential to understand the broader implications of these **token launches** and their impact on participants. Alternative financing methods, such as initial coin offerings (ICOs) and initial exchange offerings (IEOs), are reshaping how projects attract backing and engage users. Moreover, the conversation around ensuring investment safety has sparked discussions about retail investor protection and the need for transparency in token sales. With platforms like CoinTerminal navigating these complexities, the focus on establishing credible frameworks for investors is paramount. This evolving narrative on fundraising practices reflects an industry response to previous failures, aiming to foster higher standards of accountability in the face of a changing market.

The Importance of Token Launch Strategies in 2026

As we approach 2026, the cryptocurrency landscape demands more thoughtful and effective token launch strategies. CoinTerminal’s approach emphasizes transparency and reliability, addressing the concerns of retail investors while ensuring a structured entry into the competitive market. Token launches today cannot solely rely on hype; they must present real utility, a robust business model, and a well-defined narrative to capture investor interest. The scrutiny of retail investors has intensified, meaning projects that fail to articulate distinct value propositions may find themselves disregarded quickly.

Moreover, as the regulatory environment evolves, it becomes increasingly vital for projects to convey credibility during their token launch phases. A successful token launch strategy incorporates a blend of engaging storytelling, transparent communication, and demonstrable product-market fit. CoinTerminal’s refundable model reflects this trend, aiming to create a sense of security for investors who can feel overwhelmed by the plethora of options and potential risks in the 2026 crypto market.

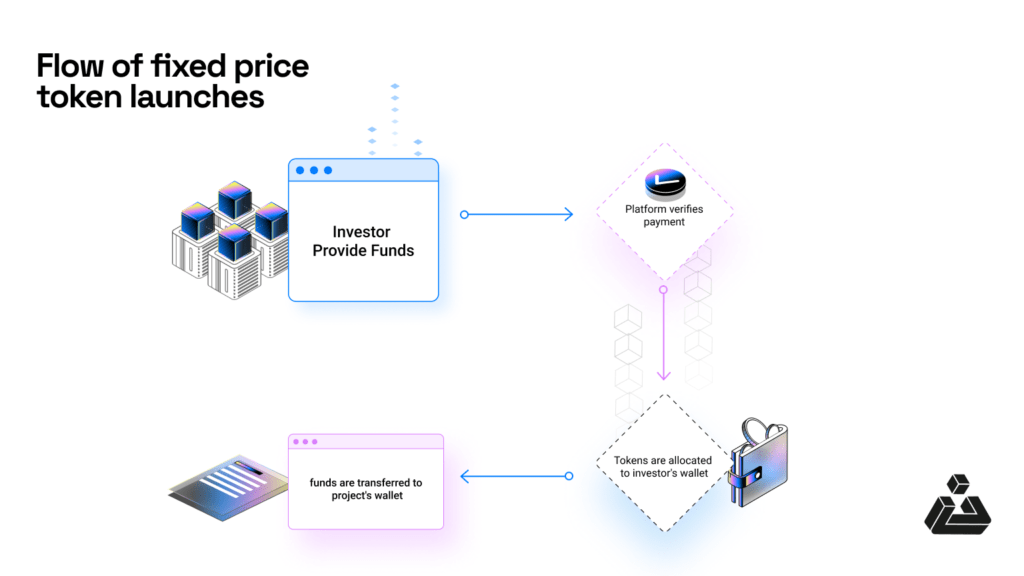

Creating Transparency in Token Sales

Transparency in token sales has emerged as a pivotal factor for gaining the trust of retail investors. CoinTerminal’s commitment to clear communication and accountability sets it apart in an industry often marred by uncertainty and speculation. By providing detailed roadmaps and insights into token distribution and fundraising goals, platforms can foster a more honest environment for new investors. The clarity around where funds will be allocated and how token values may be driven also plays a crucial role in attracting cautious retail participation.

In order to meet the growing demand for transparency, token launch platforms like CoinTerminal are implementing more stringent due diligence practices. They are now actively vetting projects not only for their potential profitability but also for their long-term sustainability. This shift marks a significant evolution in how token sales are structured and communicated, reinforcing retail investors’ need for assurance in the tokens they purchase, particularly in light of the anticipated challenges in the 2026 crypto market.

Retail Investors: Protecting Interests in Token Launches

As the cryptocurrency space continues to mature, retail investors face unique challenges when participating in token launches. Given the volatility and diverse motivations behind many projects, the necessity for robust protection mechanisms has never been more evident. CoinTerminal’s models aim to safeguard these investors by implementing refundable policies and extensive disclosures about the projects they list. Such measures seek to build trust and encourage responsible investment practices, minimizing risks associated with ill-fated token launches.

Education also plays a critical role in retail investor protection. As investors increasingly navigate the complex world of crypto, having access to informative resources that explain tokenomics, project viability, and potential pitfalls will empower them to make informed choices. By prioritizing investor education alongside transparency, platforms like CoinTerminal can cultivate a more knowledgeable community that understands the risks and rewards of token investments in the ever-evolving crypto space.

CoinTerminal Launches: A New Era of Fundraising

CoinTerminal is ushering in a new era of fundraising by redefining what token launches can achieve in terms of transparency and investor engagement. By actively involving their community of over 650,000 users, they facilitate a participatory approach to token sales, allowing early-stage projects to gain traction before even hitting exchanges. This model not only democratizes access to lucrative investment opportunities but also aligns the interests of both founders and investors, ensuring a more favorable environment for all parties involved in the token launch process.

Additionally, CoinTerminal recognizes the importance of market credibility and social proof in these launches. The platform focuses on fostering relationships with key opinion leaders (KOLs) who can lend their support to new projects, creating networks of trust and validation around token initiatives. This integration of community feedback and expert endorsements enhances the likelihood of successful outcomes for new tokens, setting a new benchmark for what effective fundraising looks like in 2026.

Challenges Ahead for Token Launches in 2026

While the prospects for token launches appear promising moving into 2026, significant challenges remain. Increased regulatory scrutiny is reshaping the landscape, forcing projects to adapt their approaches to compliance while still striving for rapid growth. This balancing act can overwhelm teams that lack deep expertise in navigating the complex legal requirements. Furthermore, market sentiment can shift abruptly, which makes maintaining investor confidence critical as teams roll out their token launches in an already cautious market.

Moreover, competition among projects is fiercer than ever; with countless alternatives vying for retail attention, projects must engage in standout marketing and community-building efforts to capture interest. As observed by Max Stochyk Duarte, only those demonstrating a clear path to sustainability and outstanding product-market fit will ultimately thrive amidst these pressures. Token launch platforms must be ready to offer rigorous support and guidance to help new projects succeed.

Navigating Volatility: Lessons from Past Token Launches

The past few years have provided invaluable lessons on navigating volatility during token launches. Projects that launched without solid foundations often struggled to maintain interest post-launch, leading to plummeting token values and investor disillusionment. These historical failures underscore the necessity of a well-considered launch strategy that incorporates thorough market research and an understanding of investor psychology. Such insights are vital for creating a resilient token launch that not only captures attention but also retains investor trust beyond the initial offering.

Additionally, the experiences of previous token launches demonstrate the importance of adaptability in the face of changing market conditions. As the crypto landscape evolves, projects that remain responsive to market signals, investor feedback, and regulatory developments will have a strategic advantage. By learning from successes and failures, teams can refine their token launch practices, striving for greater effectiveness in communication, transparency, and value delivery in the dynamic 2026 market.

Tokenomics and Its Role in Successful Launches

Understanding tokenomics is crucial for the success of any token launch. Strong tokenomic structures provide clarity on how tokens will be utilized within an ecosystem, ensuring that investors see real utility and value in what they are purchasing. CoinTerminal emphasizes the importance of aligning token supply and demand mechanisms to create a balanced and sustainable economy. A well-defined token distribution model, utility roadmap, and incentive structures are essential components that influence investor enthusiasm during token sales.

Moreover, the relationship between tokenomics and long-term sustainability cannot be overstated. Projects must outline clear pathways for token growth and use cases that resonate with their target audiences. As Duarte notes, merely having a superior product isn’t enough to secure funding; the token’s economic model must also support the project’s vision. By focusing on comprehensible, transparent tokenomics from the outset, projects can significantly improve their chances of successful launches and robust post-launch performance.

The Evolving Role of Community in Token Launches

Community engagement has become increasingly vital in the context of effective token launches. The rise of social platforms and decentralized communication channels has shifted the way potential investors interact with projects. CoinTerminal recognizes that building a strong, engaged community is not just beneficial; it’s essential for the success of token launches. An active community can provide direct feedback, foster enthusiasm, and offer much-needed advocacy during and after the launch process.

Furthermore, as retail investors become more discerning, projects that prioritize community involvement will naturally gain favor. By leveraging the collective knowledge and experiences of their community members, token projects can gain insights into investor sentiment and preferences, which can shape their future strategies. This two-way relationship not only enhances transparency but also cultivates loyalty and long-term investment, solidifying the foundation for robust token launches in 2026 and beyond.

Preparing for Market Dynamics in 2026

As we look ahead to 2026, token projects must be prepared for dynamic market conditions. Economic indicators, regulatory changes, and investor behavior will continuously shift, impacting the viability of token launches. Successful projects will need to implement advanced analytics and market forecasting methods to adapt their strategies proactively. Understanding these market dynamics will allow project teams to remain agile, making adjustments that align with current investor sentiments and preferences.

Moreover, fostering resilience will be essential for teams navigating these unpredictable environments. Projects that cultivate adaptable operations, inclusive of diversified funding sources and investor engagement strategies, will be well-positioned to thrive. By anticipating changes and preparing accordingly, token projects can mitigate risks and harness new opportunities, thereby setting themselves up for success in the evolving landscape of 2026.

Frequently Asked Questions

What are the key components of a successful token launch strategy?

A successful token launch strategy involves several key components, including a clear business model, effective fundraising methods, and transparency to attract retail investors. Engaging with communities and providing social proof can enhance trust and improve launch outcomes.

How does CoinTerminal ensure retail investors’ protection during token launches?

CoinTerminal enhances retail investor protection during token launches through a refundable model, ensuring that investors have safeguards in place. This approach fosters transparency in token sales and helps build trust among potential backers.

What changes can we expect in the 2026 crypto market regarding token launches?

The 2026 crypto market is anticipated to prioritize transparency and regulatory compliance in token launches. Retail investors are becoming more discerning, requiring projects to demonstrate clear utility and sustainable business models before participating in token sales.

How does transparency in token sales impact investor trust?

Transparency in token sales is crucial for fostering investor trust. Clear communication about project goals, financials, and community engagement contributes to investor confidence, particularly during token launches where retail participation is vital.

What role do exchanges play in the success of token launches?

Exchanges significantly influence the success of token launches by determining how a token is perceived and traded post-launch. Successful projects typically align their token valuations with appropriate exchanges to ensure visibility and attract retail investment.

What vetting processes does CoinTerminal utilize for token launches?

CoinTerminal employs rigorous vetting processes for token launches, assessing factors like product-market fit, the presence of reputable backers, and sustainable business plans. This thorough approach is designed to ensure that only legitimate projects enter the market.

How can projects ensure they stand out during competitive token launches?

To stand out during competitive token launches, projects should develop a robust narrative, leverage Key Opinion Leaders (KOLs) for visibility, and demonstrate genuine backer support. Engaging directly with the community can also create buzz and increase investor interest.

Why is understanding the market landscape important for token launches in 2026?

Understanding the market landscape is vital for token launches in 2026 as it helps projects navigate regulatory changes and identify potential investor concerns. A solid grasp of competitor strategies and market dynamics can lead to more effective launch strategies.