Three Tokens Initiate Buyback Schemes Following Cryptocurrency Market Downturn

Key Takeaways

In response to the recent downturn in the cryptocurrency market, three prominent digital tokens—Token A, Token B, and Token C—have announced plans to initiate buyback schemes. These schemes are designed not only to stabilize their token prices but also to instill confidence among holders and investors during these volatile periods.

The Market Context

The cryptocurrency market has been experiencing a significant downturn, characterized by declining token prices and market capitalization. This slump can be attributed to a variety of factors including economic uncertainties, regulatory news from major countries affecting crypto operations, and shifts in investor sentiment towards riskier assets.

Strategic Buybacks

In a strategic move to counteract declining prices and volatility, Token A, Token B, and Token C have each announced that they will undergo buyback schemes. Buybacks are a common financial maneuver in traditional markets, usually adopted by companies wishing to reinvest in themselves. This reduces the number of tokens or shares in circulation, ideally boosting the value of remaining tokens and showing a company’s confidence in its own value.

Token A: Bolstering the Ecosystem

Token A plans to implement a buyback that not only supports the price but also strengthens its user ecosystem. With a focus on long-term sustainability, funds allocated for the buyback will be sourced from a percentage of transaction fees collected on their platform. By reabsorbing tokens, Token A aims to reduce supply pressure and concurrently increase demand.

Token B: Reward and Reinforce

For Token B, the buyback approach focuses on rewarding loyal community members and reinforcing its market presence. Token B, primarily used in decentralized finance (DeFi), will conduct its buyback in phases, directly tying it to their operational milestones. Each phase of the buyback will be triggered by specific growth achievements, such as user base expansion or new feature rollouts, effectively linking token re-purchase with tangible platform progress.

Token C: Transparency and Trust

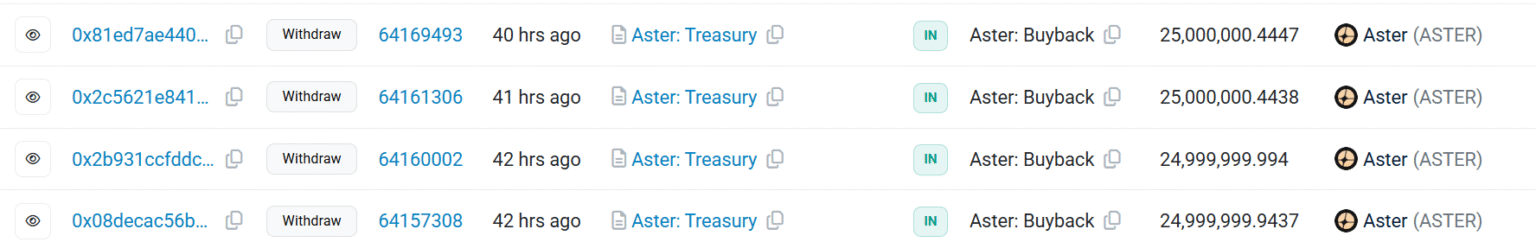

Token C’s strategy revolves around transparency and rebuilding trust amidst market uncertainties. In their approach, a predetermined amount of capital set aside for the buybacks will be used to purchase tokens systematically, ensuring a pre-announced schedule is followed to avoid market manipulation. Such transparency is aimed at building investor confidence and promoting a trustworthy trading environment.

Market Reactions and Expectations

The announcement of these buyback initiatives has already begun to influence the market positively, with preliminary reactions showing slight rebounds in the prices of Token A, B, and C. Analysts suggest cautious optimism, advising that while buybacks can provide short-term support, the long-term value and stability of these tokens will depend on broader market conditions and the successful execution of their respective business strategies.

Challenges Ahead

Despite these efforts, the tokens face numerous challenges ahead. Regulatory hurdles remain a significant concern, as governments around the world scrutinize the operations of cryptocurrency entities more closely. Furthermore, the effectiveness of these buyback plans will largely depend on the overall economic environment and investor sentiment in coming months.

Conclusion

As the cryptocurrency market continues to evolve, the moves by Token A, B, and C could serve as a template for other digital assets experiencing similar volatility. These buyback schemes underscore a proactive approach to market dynamics, showcasing a mix of resilience and strategic adaptation by these entities. Whether these initiatives will lead to a sustainable increase in token value remains to be seen, but they have undeniably added a new dimension to the strategies employed by cryptocurrency operators during market downturns.