In recent discussions surrounding large-scale liquidations, it has been suggested that the root cause may lie in what is referred to as the “USDE arbitrageur’s loop lending position forced liquidation.” This assertion points to a significant development within financial markets that requires attention.

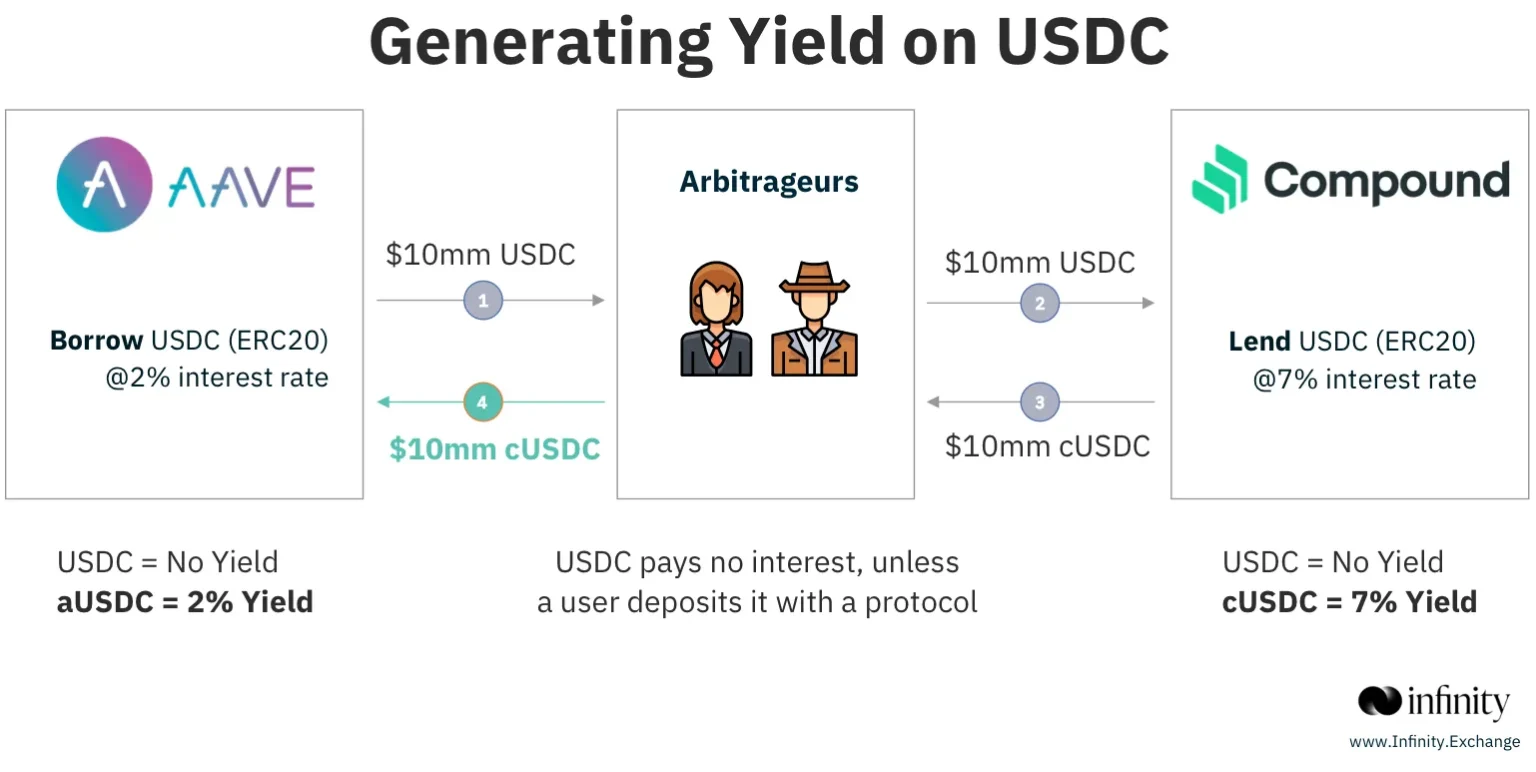

Liquidation on such a grand scale typically indicates a substantial shift in market dynamics, often triggered by external forces or internal miscalculations. In this instance, the forced liquidation stemming from the mentioned lending position suggests that particular trading strategies may have encountered unforeseen challenges. The use of arbitrage, which aims to exploit price differences in various markets, often carries inherent risks that can lead to dramatic financial consequences.

The notion of a “loop lending position” implies a complex network of loans and positions that may become vulnerable under certain market conditions. When such a position is forced into liquidation, it can have a cascading effect, impacting not only the involved parties but potentially creating wider repercussions throughout the financial landscape.

Understanding the mechanics behind this forced liquidation is essential for stakeholders, as it reveals how interconnected various trading strategies can be. Financial professionals and analysts must monitor these developments to gauge their implications for future market stability and investor confidence. The significance of this situation lies not only in the immediate financial impacts but also in the lessons it may impart on risk management and strategic planning within trading environments.

As the market continues to evolve, the story behind the USDE arbitrageur’s loop lending position serves as a reminder of the complexities and risks that underpin financial trading. Ongoing scrutiny and analysis will be crucial in navigating the aftermath of such large-scale liquidations.