The Tezos price outlook shows a complex landscape as momentum struggles to maintain its gains above critical levels. Recently, Tezos (XTZ) surged past $0.63, fueled by positive news, including TenX’s significant acquisition of XTZ tokens. However, this upward movement has been punctuated by a decline to below $0.59, raising concerns among investors about the sustainability of the price rally. Technical indicators suggest that a breach below the $0.50 support level could exacerbate the downward trend and trigger further challenges for bullish investors. As the crypto market remains volatile, understanding key factors such as Tezos price predictions and ongoing market trends is essential for gauging future performance.

In examining the recent trends influencing Tezos, the focus shifts to the broader XTZ market analysis and its potential trajectory. As various cryptocurrencies face headwinds, Tezos has drawn attention due to its unique developments, including strategic partnerships aimed at boosting ecosystem stability. The discussions around Tezos price support levels are becoming increasingly relevant, especially in light of market uncertainty that impacts trading patterns. Investors are keenly observing crypto market trends and news that affect altcoins, making it crucial to analyze the implications for Tezos specifically. As this narrative unfolds, keeping abreast of updates is vital for understanding Tezos’ role in the evolving cryptocurrency landscape.

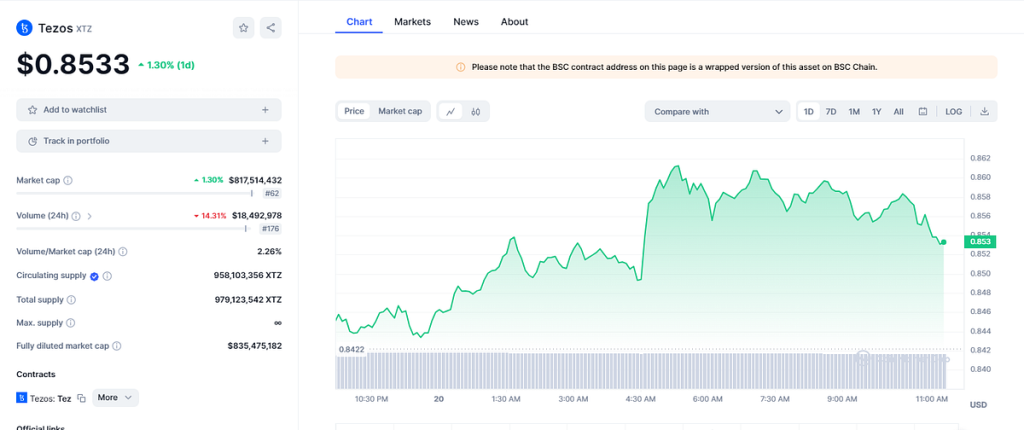

| Aspect | Detail |

|---|---|

| Current Price Movement | Tezos price rose above $0.63 then pulled back to below $0.59. |

| Market Response | Despite broader cryptocurrency market declines, Tezos showed short-term gains. |

| Key Support Levels | $0.50 is a critical support level; break below it may lead to further declines. |

| Technical Indicators | Daily RSI at 56 suggests potential for upward momentum; however, MACD shows sell pressure. |

| Corporate Adoption | TenX acquired 5.54 million XTZ tokens, bolstering Tezos’s market outlook. |

| Long-Term Outlook | Bullish long-term trend remains, but immediate challenges exist. |

Summary

Tezos price outlook is showing signs of cautious optimism, although momentum appears to have faded after recent highs. With critical support at the $0.50 level, bulls need to maintain this threshold to prevent further declines. The recent acquisition by TenX adds a layer of positivity to Tezos, but the broader cryptocurrency market’s volatility remains a concern. As market dynamics evolve, monitoring these key levels and developments will be essential for investors looking to gauge the Tezos price outlook in the coming weeks.

Tezos Price Outlook on Momentum and Support Levels

The current Tezos price outlook highlights the recent fluctuations in the XTZ market as momentum fades above key levels. After an impressive rise to $0.63 due to optimistic corporate news, the price has recently pulled back, settling below $0.59. This downturn raises concerns among investors, particularly in the face of bearish tendencies prevailing across the broader crypto market. If Tezos continues its descent and the price drops below the crucial support level of $0.50, it could trigger significant downward pressure for the bulls, potentially leading to further declines toward support zones historically observed around $0.42. Traders are keenly watching these levels, as breaking below $0.50 may lead to increased selling activity.

Moreover, the technical indicators paint a complex picture for XTZ. While the Relative Strength Index (RSI) signals some potential for bullish momentum, other indicators, such as the MACD, are suggestive of looming sell pressure. The interplay between these factors creates uncertainty among market participants, with many evaluating Tezos price predictions based on both its current technical setup and broader market trends. The strategic importance of maintaining support above $0.50 cannot be understated, as failure here might not only signify a loss of investor confidence but could establish a precedent for a prolonged period of bearish sentiment impacting the XTZ market.

Analyzing Tezos Price Prediction Amid Market Trends

In light of recent developments and Tezos price predictions, it’s evident that investors must remain vigilant about the shifting dynamics in the crypto market. While major cryptocurrencies such as Bitcoin and Ethereum face significant headwinds, Tezos has showcased its resilience, partly due to strategic initiatives like the recent acquisition by TenX. This partnership is poised to not only drive up demand for XTZ but also strengthen its use case within decentralized finance through staking, potentially yielding returns of 8-10%. Analysts suggest that continued institutional adoption could bolster Tezos’s position in the market, allowing it to sidestep some of the negative influences affecting other altcoins.

However, the uncertainty in crypto market trends means that caution is warranted when considering future Tezos price predictions. Analysts highlight that while Tezos may hold advantages due to corporate partnerships, the volatility observed across altcoins can quickly turn the tide for any cryptocurrency, including XTZ. Investors are urged to monitor relevant news, such as developments in the staking operations linked to TenX and announcements from major figures in the Tezos ecosystem, as these factors could significantly impact both short-term and long-term price trajectories.

Understanding Tezos News and Its Impact on XTZ Pricing

Recent Tezos news has brought attention to the cryptocurrency’s potential for investment, particularly in the context of corporate adoption and infrastructure integration. The recent announcement of TenX’s acquisition of 5.54 million XTZ tokens not only signifies a bullish move by a well-positioned firm but also points to the increasing institutional interest in Tezos. Such developments underpin Tezos’s positioning as a viable option for sustainable blockchain solutions within the crypto market, thereby impacting demand and, consequently, pricing dynamics.

Furthermore, as news continues to circulate regarding partnerships and organizational support for Tezos, investors may find themselves more optimistic about the cryptocurrency’s future. Such positive sentiment can create a feedback loop where increased interest stimulates buying pressure, helping to stabilize or even propel XTZ’s price higher, despite the bearish trends affecting its competitors. However, it remains essential for investors to dissect the nuances of Tezos news, as not all announcements may lead to immediate price increases and each development must be evaluated critically in light of market sentiment.

Tezos Market Analysis: Navigating Through Volatility

Tezos market analysis requires a keen understanding of both technical indicators and macroeconomic factors affecting the crypto space. This year has seen wild fluctuations across multiple cryptocurrencies, with Tezos recently experiencing a brief rally followed by a reality check as it retreated below the $0.59 mark. The influx of positive news surrounding corporate investments into Tezos offers a glimmer of hope, yet the overarching volatility of the crypto environment can lead to unpredictable swings in the price of XTZ. As seasoned traders often state, being aware of market sentiment is crucial for navigating these bounds.

In this context, analysts believe that thorough market analysis can uncover potential trading opportunities for both daily and long-term investors. For example, if Tezos retains its position above the pivotal $0.50 support, it may attract new buyers looking to capitalize on the ongoing developments. Conversely, a significant drop below this level could indicate broader fears among investors, leading to a sell-off. Therefore, continuously monitoring market trends and technical signals will be imperative for forecasting future movements in the Tezos price, especially as it continues to navigate through an evolving crypto landscape.

The Future of Tezos Amidst Evolving Crypto Market Trends

Looking forward at the future of Tezos, it is essential to consider the evolving trends in the broader cryptocurrency market. As institutional investors flock towards sustainable blockchain solutions, Tezos stands out due to its design and capabilities. The recent partnerships, like the one with TenX, highlight a confidence in the long-term viability of Tezos, hinting at a potential growth trajectory that could set it apart from more volatile competitors. However, projecting Tezos price futures involves accounting for the unpredictable nature of the crypto market, which remains susceptible to sharp corrections or unexpected bullish runs.

Furthermore, monitoring shifts in regulatory approaches and technological advancements will be crucial for determining how Tezos continues to adapt. As the market matures and stabilizes, Tezos may find itself at a strategic advantage if it can leverage its unique features effectively. The integration of staking opportunities and continued collaboration with established institutions could catalyze significant price appreciation for XTZ in response to favorable market conditions. Thus, while the immediate outlook presents challenges, the long-term future of Tezos may remain bright as it carves out its niche within the dynamic landscape of cryptocurrencies.

Frequently Asked Questions

What is the Tezos price outlook for 2023?

The Tezos price outlook for 2023 remains cautious as recent trends indicate fading momentum, particularly after briefly rising above $0.63 before pulling back to below $0.59. Technical analysis points to $0.50 as a critical support level that needs to be defended by bulls to avoid further declines.

How does the recent Tezos price prediction affect investor sentiment?

The recent Tezos price prediction, fueled by corporate adoption news such as TenX acquiring XTZ tokens, has created a temporary boost in investor sentiment. However, the pullback below key technical levels indicates that caution is warranted in the face of broader crypto market trends.

What technical indicators are influencing the Tezos price outlook?

In analyzing the Tezos price outlook, key technical indicators include the relative strength index (RSI) at 56, which shows potential for bullish movement, and the MACD, indicating potential sell pressure. Together, they highlight the precarious nature of the current XTZ market analysis.

What are the critical support levels for Tezos price?

The critical support level for Tezos price stands at $0.50, which serves as both a psychological and structural level in the XTZ market analysis. A break below this level could suggest further downside, with targets potentially lowering to $0.42.

How do crypto market trends affect Tezos price?

Crypto market trends significantly affect Tezos price, as demonstrated by its recent rise amidst negative market pressures affecting major cryptocurrencies like Bitcoin and Ethereum. The Tezos price outlook shows resilience but is still vulnerable to the overarching dynamics of the crypto market.

What impact did TenX’s acquisition of XTZ have on the Tezos price outlook?

TenX’s acquisition of 5.54 million XTZ tokens has positively impacted the Tezos price outlook by demonstrating strong corporate interest and potential for future adoption, temporarily lifting the price above $0.63 despite the overall market decline.

Can Tezos maintain its price above $0.50?

Whether Tezos can maintain its price above $0.50 hinges on its ability to hold key support levels and counteract sell pressure from broader market volatility, making this a crucial area for bulls in the Tezos price outlook.

What should investors watch for regarding Tezos price support levels?

Investors should closely monitor the $0.50 support level in the Tezos price outlook, as breaking below this could lead to significant downside risk. Additionally, the $0.54 area acts as another support, valuable for gauging future price movements.