Tether USDt stands at the forefront of the cryptocurrency landscape, with its dollar-pegged stablecoin achieving an impressive market capitalization of $187.3 billion by the end of 2025. Despite the broader decline in the crypto market following October’s liquidation cascade, Tether USDt demonstrated remarkable resilience, growing its USDt market cap by $12.4 billion during the fourth quarter. As market competitors retreated, Tether solidified its position, showcasing its stablecoin dominance and appealing to a wide array of users. The latest market data highlights significant trends in the crypto market, as on-chain activity surged, propelling USDt to become the preferred choice for various transactions, from remittances to decentralized finance. Tether has also taken strides to address concerns related to illicit stablecoin activity, actively collaborating to monitor usage and enhance compliance measures.

The dollar-backed cryptocurrency known as Tether USDt has become a pivotal player within the digital currency ecosystem, often referred to as a leading stablecoin. With an extraordinary growth trajectory reflected in its market cap, Tether’s influence continues to expand amidst shifting crypto market trends. As digital assets evolve, Tether’s USDt not only showcases stability but also exemplifies the increasing prominence of stablecoins in financial transactions. Additionally, the ongoing efforts to monitor and regulate illicit activities associated with stablecoins underline the importance of maintaining integrity within the digital finance realm. Tether’s adaptive strategies, including the recent launch of compliant alternatives like USAt, further highlight the brand’s commitment to innovation and user trust.

| Key Metrics | Q4 2025 Performance | Reserves and Holdings | Market Positioning | New Developments |

|---|---|---|---|---|

| Market Capitalization | $187.3 billion | Total Reserves: $192.9 billion (up $11.7 billion) | Dominance Growing; Competitors Retreated | Launched USAt for US Market (compliant with the GENIUS Act) |

| Growth in Market Cap | Increased by $12.4 billion in Q4 | $141.6 billion in US Treasuries | Tether leads stablecoin market share | Partnership with Opera for MiniPay wallet |

| Onchain Activity | 24.8 million average monthly active wallets | Net Equity: $6.3 billion | Largest holder of USD-backed assets | Focus on curbing illicit uses with TRM Labs and Tron |

| Transfer Volume | $4.4 trillion quarterly transfer volume | More than 70% of stablecoin transactions in illicit transfers come from USDt | Competitors like USDC and USDe underperformed | Integration of USDt in Opera’s MiniPay wallet |

Summary

Tether USDt continues to prove its supremacy in the stablecoin landscape, achieving a remarkable market capitalization of $187.3 billion in Q4 2025 despite a turbulent crypto market. This performance can be attributed to its increasing user activity with nearly 25 million active wallets and a massive quarterly transfer volume of $4.4 trillion. As competitors faltered, Tether USDt not only expanded its market presence but also fortified its reserves, becoming a leading holder of U.S. Treasuries globally. With strategic developments like the launch of the USAt stablecoin and partnerships aimed at improving digital payment access, Tether USDt is poised for continued growth and influence in the financial ecosystem.

The Rise of Tether USDt in the Cryptocurrency Market

Tether USDt has shown remarkable resilience in the volatile cryptocurrency landscape, expanding its market cap to an impressive $187.3 billion by the close of Q4 2025. This achievement is particularly noteworthy as it occurred during a broader market downturn triggered by significant liquidation events in October. The growth of USDt by $12.4 billion underscores its position as a dominant player among stablecoins, especially as many of its competitors faced challenges and losses, like Circle’s USDC and Ethena’s USDe.

As USDt continues to consolidate its leadership in the stablecoin sector, its utility is being recognized across various applications—from payments to remittances, and decentralized finance (DeFi). The upward trend in USDt’s market cap also reflects growing confidence among investors and users alike, creating a stable environment that encourages further adoption of this crucial dollar-pegged cryptocurrency. This dominance of Tether USDt illustrates not only its appeal but also the evolving trends within the crypto markets.

Tether USDt’s Impact on Stablecoin Dominance

With its significant market cap, Tether USDt has effectively positioned itself as a leader in the realm of stablecoins, driving its competitors into retreat. The crisis on October 10 revealed the vulnerabilities of other stablecoins, with USDt managing to thrive amidst this tumultuous environment. While USDC maintained a stable position, the dramatic plunge of USDe by 57% showcases the fluctuating nature of stablecoin markets and the external factors that influence them. Tether’s growth, therefore, can be viewed as a critical moment of consolidation in the stablecoin market.

However, the dominance of USDt also raises questions about market stability and the implications it has for users. With around 70% of all stablecoin wallets now holding USDt, there is an increasing concentration of financial power within this single entity. Coupled with the alarming statistic that USDt is commonly used for illicit activities, as evident from reports stating its prevalence in high-risk transactions, Tether must ensure it maintains transparency and adheres to compliance measures to safeguard its reputation and market position.

On-Chain Activity and Usage Trends of Tether USDt

The on-chain activity surrounding Tether USDt has reached unprecedented heights, with statistics indicating an average of 24.8 million active wallets each month. This surge demonstrates USDt’s widespread acceptance and utility in the crypto ecosystem, reinforcing its role as a primary medium of exchange among stablecoins. Additionally, the increased transfer volume reaching $4.4 trillion highlights the growing reliance on Tether for diverse financial activities, from simple transactions to complex DeFi operations.

Moreover, the scale of on-chain transfers—which hit 2.2 billion—illustrates a robust and dynamic network utilizing Tether USDt. As users embrace this stablecoin for their everyday transactions and investment strategies, it solidifies USDt’s position at the center of the crypto industry’s operational framework. This trend not only promotes stablecoin adoption but also suggests a shift in how cryptocurrencies are viewed in contexts beyond speculative trading, emphasizing their practical usage in day-to-day finance.

Tether’s Strategy to Combat Illicit Activities

While Tether USDt’s growth is impressive, it also comes with challenges, particularly related to illicit activities within the crypto space. Reports have indicated that Tether is frequently used in high-risk transactions, which poses a threat to its legitimacy and the overall perception of stablecoins. Tether’s strategy to address this concern involves collaboration with organizations like TRM Labs and Tron to enhance monitoring capabilities and freeze illicit funds more effectively.

By proactively tackling the illegal use of USDt, Tether aims to reinforce trust and transparency within its operations. The stabilization of USDt’s market presence also hinges on its ability to cleanse any negative associations tied to criminal activities. This dual focus on growth and compliance is crucial for Tether’s long-term sustainability and for maintaining its status as a trusted stablecoin in the ever-evolving cryptocurrency market.

Future of Tether USDt and Emerging Market Trends

As Tether USDt progresses into the future, its recent launch of USAt, a dollar-pegged stablecoin designed specifically for the US market, indicates a strategic move to capture more localized demand. With its compliance to the US GENIUS Act, USAt aims to cater to the growing interest in regulatory-compliant digital currencies, expanding Tether’s product offerings beyond just USDt. This diversification could set Tether apart in a competitive landscape and establish it further as an integral player in the evolving stablecoin market.

The partnership between Tether and Opera to integrate USDt into digital payment solutions across emerging markets reflects an essential trend toward embracing technological advancements in financial services. By enhancing accessibility and usability of USDt through platforms like Opera’s MiniPay wallet, Tether is positioning itself to tap into new user demographics and foster wider financial inclusion. This commitment to innovation combined with strategic partnerships is crucial for Tether to solidify its leadership as market trends evolve.

Tether USDt’s Reserves: A Pillar of Stability

At the end of Q4, Tether reported total reserves of $192.9 billion, a notable increase from the preceding quarter. This substantial reserve base is a vital factor in maintaining the USDt’s peg to the US dollar, instilling confidence among users regarding the stability and backing of their assets. As Tether continues to amass reserves—particularly its significant holdings in US Treasuries—it positions itself as one of the largest holders globally, which is indicative of its robust financial foundation.

The increase of $11.7 billion in reserves not only supports Tether’s financial reliability but also contributes to a larger narrative of stability in the often volatile crypto market. Users are increasingly swayed by the assurance that their investments in USDt are fortified by a sound reserve system. In this increasingly competitive landscape, Tether’s ability to transparently manage and report its reserves will be crucial in attracting new users and ensuring existing ones remain confident in their choice of stablecoin.

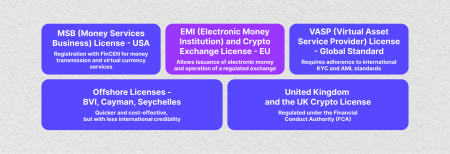

The Role of Regulation in Tether USDt’s Expansion

As Tether expands its reach with products like USAt, regulatory compliance becomes increasingly paramount. The recent emphasis on creating a stablecoin in alignment with the US GENIUS Act underscores Tether’s intention to navigate the complexities of cryptocurrency regulation proactively. By adhering to legal frameworks, Tether not only enhances its legitimacy but also positions itself favorably in a market that is moving steadily towards increased regulatory oversight.

Moreover, staying ahead of the curve in regulatory matters could provide Tether USDt with significant competitive advantages, especially as governments globally look to implement clearer guidelines for stablecoins. This proactive approach can help mitigate risks associated with illicit activities and ensure Tether’s operations align with the expectations of both regulators and users alike, thus fostering a safer environment for stablecoin transactions.

Tether USDt: A Leading Indicator of Cryptocurrency Health

Tether USDt’s performance can often serve as a leading indicator for the overall health of the cryptocurrency market. As it maintains its dominance and market cap amidst fluctuating trends, shifts in USDt’s metrics can reflect broader market sentiments and investor confidence. Market analysts closely observe USDt’s activity levels, reserve stability, and transaction volumes to gauge future movements in the crypto ecosystem.

In particular, consistent growth in USDt’s market cap amid challenges faced by its competitors provides insights into the dynamic nature of investor behavior and trust in stablecoins. Should Tether continue on its growth trajectory, it can reinforce the notion of stablecoins as reliable instruments within the crypto space, potentially attracting more institutional interest and supporting broader adoption across financial sectors.

Conclusion: The Future Outlook for Tether USDt

In summary, Tether USDt’s impressive growth and expanding market presence indicate a robust future outlook for the stablecoin and its associated ecosystem. As the dominant player in the stablecoin market, Tether is well-positioned to leverage its competitive advantages, including a strong reserve base and strategic partnerships. Continued innovation, regulatory compliance, and a focus on mitigating illicit activities will be crucial for Tether’s long-term success.

As cryptocurrency trends evolve and the demand for stablecoins increases, Tether USDt is likely to maintain its status as a key player in this space. With a proactive approach to market changes and user needs, Tether has the potential to not only sustain its growth but also drive the future of digital currencies in a constantly changing landscape.

Frequently Asked Questions

What factors contributed to the growth of Tether USDt’s market cap in Q4 2025?

Tether USDt’s market cap expanded by $12.4 billion to a record $187.3 billion in Q4 2025, primarily driven by its widening dominance amidst a broader crypto market downturn. The average number of monthly active USDt wallets increased significantly, indicating strong user engagement, with quarterly transfer volumes surging to $4.4 trillion.

How does Tether USDt’s market cap compare to other stablecoins?

As of Q4 2025, Tether USDt has a dominant market cap of $187.3 billion, significantly outperforming competitors. For instance, while USDt expanded its reach, Circle’s USDC remained mostly unchanged in market cap, and Ethena’s synthetic dollar USDe saw a decline of 57% during the same period.

What is the role of Tether USDt in the crypto market trends of 2025?

Tether USDt played a pivotal role in 2025’s crypto market trends, maintaining its leading status amid fluctuations in market sentiment. Its stablecoin dominance grew as competitors faltered, with USDt being crucial for transactions and as a safe haven during volatile market periods.

What percentage of Tether USDt supply is held in savings wallets?

Approximately two-thirds of Tether USDt’s total supply is held in savings wallets and centralized exchanges. This stable user base supports various activities such as payments, remittances, and decentralized finance initiatives.

How is Tether USDt being used in illicit activities?

Tether USDt is notably the most commonly used stablecoin in illicit transfers, with a significant portion of stablecoin transaction volume linked to high-risk blockchain addresses. In 2024, more than 70% of illicit stablecoin activity involved Tron-based USDt, leading Tether to enhance monitoring efforts for illicit fund activities.

What measures is Tether taking to address illicit stablecoin activity?

Tether is actively combating illicit stablecoin activity by launching collaborative programs with TRM Labs and Tron to monitor transactions and freeze funds associated with illegal activities, reinforcing their commitment to compliance and responsible use.

What is USAt and how does it relate to Tether USDt?

USAt is a newly launched dollar-pegged stablecoin by Tether, designed for the US market, adhering to the US GENIUS Act. It complements Tether USDt by providing compliance-focused options for users in the United States, with an initial supply of $10 million issued on the Ethereum blockchain.

How did Tether USDt perform in terms of on-chain activity in Q4 2025?

In Q4 2025, Tether USDt saw exceptional on-chain activity with an average of 24.8 million monthly active wallets, accounting for nearly 70% of all stablecoin wallets. The number of on-chain transfers increased to 2.2 billion, reflecting USDt’s popularity and extensive usage within the crypto ecosystem.

What has been Tether USDt’s exposure to U.S. Treasuries?

As of the end of Q4 2025, Tether USDt’s exposure to US Treasuries rose to $141.6 billion, making it one of the largest holders of US Treasuries globally, surpassing many sovereign nations and emphasizing its strategic financial positioning.

How has Tether partnered with Opera for USDt digital payments?

Tether has partnered with Opera to enhance digital payment accessibility in emerging markets by integrating Tether USDt and Tether Gold into Opera’s MiniPay wallet, aiming to broaden its user base and facilitate transactions across various platforms.