Tether over-collateralization has emerged as a topic of vital importance, especially in light of recent insights from industry figures like Arthur Hayes. With Tether reportedly earning around $500 million monthly from U.S. Treasury bonds, questions arise about the transparency and stability of Tether’s assets. If Tether’s portfolio includes illiquid assets, investors may start to question the viability of this over-collateralization strategy during market fluctuations. Ensuring that Tether is adequately backed by liquid assets is crucial to maintaining confidence in its ability to honor its liabilities. As discussions around Tether’s profits and asset management strategies continue, the implications of these factors on market dynamics cannot be overlooked.

The concept of collateralizing stablecoins has gained traction as users become increasingly aware of the nuances involved in financial backing. Tether’s asset management strategy plays a crucial role in determining its stability, particularly when scrutinizing the nature of its holdings. Insights from financial experts, such as those provided by figures like Arthur Hayes, highlight potential vulnerabilities, especially when it comes to holding illiquid assets. As the crypto market evolves, the question of Tether’s liquidity and its implications for over-collateralization play a central role in shaping user trust and market confidence. An ongoing assessment of how Tether manages its assets, particularly through interests in U.S. Treasury bonds and other investments, remains essential for informed discussions in the industry.

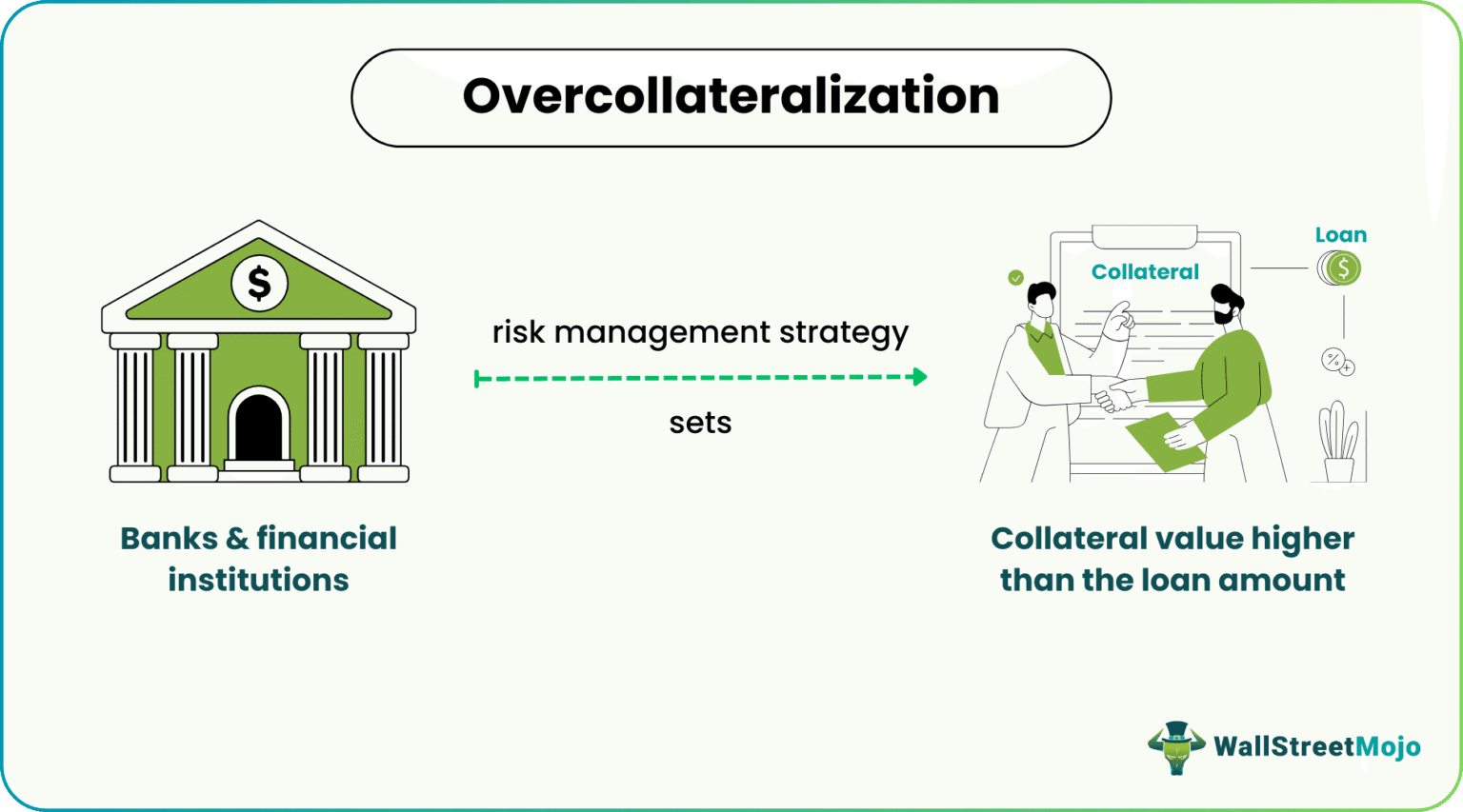

Understanding Tether’s Over-Collateralization Strategy

Tether’s over-collateralization strategy plays a crucial role in maintaining the stability of its stablecoin. By ensuring that each Tether token is backed by more than a dollar’s worth of assets, the company aims to instill confidence in its users. However, as Arthur Hayes recently pointed out, the nature of these assets is pivotal. If Tether is primarily holding U.S. Treasury bonds, the concerns about liquidity are minimal. In contrast, if a significant portion of their assets includes illiquid investments, such as private equity or other less liquid assets, this could raise alarms especially when market conditions fluctuate.

The implications of Tether’s over-collateralization extend beyond mere asset management. In cases where unexpected events occur—be it economic downturns or shifts in market demand—Tether’s ability to rapidly convert illiquid assets into cash becomes critical. Any failure to do so would prompt investors to reconsider the risk associated with holding Tether tokens, challenging their trust in the company’s claims of adequate collateralization.

The Impact of U.S. Treasury Bonds on Tether’s Stability

Tether’s decision to invest in U.S. Treasury bonds as a primary source of assets has significant implications for its operational stability. U.S. Treasury bonds are considered one of the safest investments available, with minimal risk of default. This reliability ensures that Tether can maintain its promise to users, providing a consistent value tied to the U.S. dollar. Arthur Hayes recognizes this advantage, noting that Tether’s monthly earnings of approximately $500 million from these bonds underline the effective use of safe-haven assets to generate profits.

However, reliance solely on U.S. Treasury bonds might not fully mitigate risks associated with the broader investment portfolio. If Tether’s overall asset mix leans heavily on illiquid investments, their performance during market volatility becomes a question mark. Thus, while U.S. Treasury bonds solidify a part of Tether’s asset base, a more balanced approach including liquid assets could better shield the company from potential liquidity crises.

Concerns About Illiquid Assets in Tether’s Portfolio

Arthur Hayes’ insights bring to light the possible risks associated with Tether holding illiquid assets. While the idea of diversifying beyond U.S. Treasury bonds might seem appealing, these investments can produce complications, especially during times of economic stress. If Tether were to face a sudden demand for liquidity, the inability to easily sell these illiquid assets could lead to a substantial shortfall against its obligations, raising questions about their over-collateralization strategy.

The challenge of managing illiquid assets is multi-faceted. Not only do these assets often fluctuate in value based on market sentiment, but their transaction costs can also escalate in turbulent financial climates. Investors may perceive Tether’s position as increasingly precarious if they suspect a significant portion of its collateral is tied up in illiquid investments. Therefore, enhancing transparency around these assets and ensuring adequate layers of collateral can help maintain trust among Tether users.

Arthur Hayes’ Perspective on Tether’s Financial Practices

Arthur Hayes’ commentary on Tether provides a vital perspective concerning the broader implications of their financial practices. According to Hayes, while Tether’s returns from U.S. Treasury bonds are impressive, the underlying asset type and its performance under stress are crucial for evaluating the company’s true collateralization status. Hayes advocates for a clearer understanding of Tether’s financial framework to mitigate concerns over its liquidity and asset management.

Furthermore, by discussing these financial practices openly, Tether could bolster investor confidence. Hayes emphasizes the need for Tether to establish and clearly communicate a robust dividend policy or governance framework that dictates how their profits will be managed. This transparency could alleviate fears regarding how the fluctuating nature of collateral—especially with illiquid assets—might influence their claims of over-collateralization.

Evaluating Tether’s Profitability Amidst Market Volatility

With Tether generating approximately $500 million in profits monthly, understanding how these gains are derived is critical. The primary driver of these profits appears to stem from their significant holdings in U.S. Treasury bonds, which are known for being secure and providing stable returns. However, as Arthur Hayes suggests, this profitability should not overshadow the risks associated with other asset types, particularly illiquid ones, that may prove detrimental in turbulent markets.

By continuously evaluating Tether’s profitability through the lens of market changes, investors can better gauge the effectiveness of its asset management strategy. The challenge lies in balancing the pursuit of higher returns from various investments while also ensuring that a stable portion remains liquid enough to manage withdrawal demands. A transparent analysis of how much profit is derived from liquid versus illiquid assets could clarify Tether’s financial stability to current and potential users.

The Role of Asset Type in Tether’s Collateralization

The type of assets held by Tether is integral to understanding its collateralization status. As mentioned by Arthur Hayes, having a significant amount of U.S. Treasury bonds can simplify the collateralization narrative, but what happens when those holdings are supplemented with illiquid investments? This dynamic raises important questions about how well Tether can respond to sudden market shifts, which could challenge the company’s stability and reliability.

Investors must consider the broader implications of Tether’s asset allocation strategies. A diverse but judicious mix of both liquid and illiquid assets might enhance potential returns, yet it equally introduces complications in maintaining a robust over-collateralization scenario. If unexpected events test Tether’s capacity to liquidate investments quickly, stakeholders might view the entity as riskier, undermining its perceived financial health.

Market Sentiment: Trust in Tether’s Financial Health

Market sentiment plays a pivotal role in the perception of Tether’s financial health. As highlighted by Arthur Hayes, any doubts about Tether’s asset backing—especially if involving illiquid investments—could result in significant confidence erosion among users. Tether’s primary challenge is managing public perception alongside its financial strategies to ensure users remain assured of the stability tethered to their tokens.

In an environment where financial stability is paramount, Tether must proactively address concerns related to asset type and potential risks. Clear communication of their asset management strategy and the reasoning behind their investment choices can help reinforce investor confidence. Establishing a framework where users can easily comprehend Tether’s over-collateralization—particularly in relation to the liquidity and market conditions—would foster a stronger trust in the brand.

Tether’s Future: Balancing Safety and Profitability

Looking toward the future, Tether faces the significant challenge of ensuring safety while maximizing profitability. The insights from Arthur Hayes compel Tether to reconsider its asset management strategy continually, ensuring that a balanced proportion of their investments is both liquid and profitable. Striking the right balance will be vital in preserving trust while navigating market oscillations that might affect their portfolio.

As Tether navigates this landscape, adopting a proactive approach to transparency and regulatory compliance could strengthen its position in the market. By reinforcing its commitment to over-collateralization through strategic asset choices—especially in the balance between liquidity and higher-yield assets like U.S. Treasury bonds—Tether can enhance its credibility and secure its status as a leader in the stablecoin arena.

Frequently Asked Questions

What is Tether over-collateralization, and why is it important for Tether assets?

Tether over-collateralization refers to the practice of backing Tether tokens with more assets than the liabilities owed. This is crucial for ensuring that Tether remains stable and trustworthy, particularly amid concerns regarding the nature of Tether assets. A robust over-collateralization rate helps mitigate risks associated with illiquid assets Tether might hold.

How do U.S. Treasury bonds affect Tether’s over-collateralization strategy?

U.S. Treasury bonds are considered safe, liquid assets, which positively impact Tether’s over-collateralization. When Tether holds these bonds, it minimizes the risk of insolvency or liquidity crises, thus reinforcing Tether’s reputation in the market as a stable digital currency.

What are the implications of holding illiquid assets for Tether over-collateralization?

If Tether holds illiquid assets, it raises concerns about its over-collateralization. Unexpected market events could lead to questions regarding Tether’s ability to meet its obligations. Such scenarios might prompt scrutiny from investors if the assets cannot be quickly liquidated without loss.

What insights has Arthur Hayes provided regarding Tether’s profits and over-collateralization?

Arthur Hayes has highlighted that although Tether generates significant profits from U.S. Treasury bonds, the absence of a clear dividend policy raises questions about how over-collateralization rates are determined, especially in relation to the liquidity and volatility of Tether’s underlying assets.

How does Tether ensure its over-collateralization principles are adhered to?

Tether ensures its over-collateralization principles through regular audits of its reserves and maintaining a significant portion of its assets in liquid, stable investments. By focusing on transparent asset management, especially U.S. Treasury bonds, Tether aims to uphold trust and stability in its operations.

What risks does Tether face if it invests heavily in illiquid assets?

If Tether significantly invests in illiquid assets, it risks being unable to respond promptly to redemption demands or market fluctuations. This could lead to concerns around its over-collateralization and may trigger a loss of confidence among holders, ultimately affecting Tether’s stability.

Can Tether’s over-collateralization be improved through its asset management strategy?

Yes, Tether’s over-collateralization can be enhanced by adopting a diversified asset management strategy that focuses on liquid assets, such as U.S. Treasury bonds, while carefully managing any exposure to illiquid assets. This strategic balance can help mitigate risks and strengthen Tether’s financial foundations.

What is the relationship between Tether profits and its over-collateralization policies?

Tether’s profits, primarily derived from holding U.S. Treasury bonds, play a role in supporting its over-collateralization policies. A profitable asset base allows Tether to maintain higher reserves, thereby ensuring it can meet its obligations, particularly in volatile market conditions.

What measures are taken to validate Tether’s over-collateralization claims?

Validation of Tether’s over-collateralization claims typically involves third-party audits and transparency reports that outline the assets held. These measures help assure stakeholders that Tether’s asset base sufficiently covers its liabilities, thus maintaining trust in its stability.

| Key Point | Details |

|---|---|

| Tether’s Profitability | Tether earns approximately $500 million monthly primarily from U.S. Treasury bonds. |

| Over-Collateralization Rates | Uncertainty exists regarding Tether’s dividend policy and potential over-collateralization targets depending on asset type. |

| Asset Types and Their Impact | If Tether holds liquid U.S. Treasury bonds, it minimizes risks; if investments are illiquid, this raises concerns regarding stability. |

Summary

Tether over-collateralization is a critical topic in the cryptocurrency market, especially in light of recent statements by Arthur Hayes regarding potential risks associated with Tether’s asset types. While Tether’s financial model appears strong on paper, relying on liquid assets like U.S. Treasury bonds, the presence of illiquid investments could jeopardize market confidence if unexpected events arise. Thus, it is essential for investors to be aware of these risks as they relate to the stability and credibility of Tether.

Related: More from Ethereum News | Vitalik Buterin Shares Vision for Ethereum Scaling Solution | Tether Freezes Over $4B Linked to Crime in Three Years in Ethereum