Tether and Circle minting has recently taken center stage in the crypto market, as these leading stablecoin issuers pumped a staggering $3 billion into the ecosystem. This massive influx highlights the ongoing dynamics within the stablecoin market, particularly in response to Bitcoin‘s fluctuating price around the critical $60,000 threshold. Investors are closely monitoring how this digital dollar supply is affecting liquidity and overall market sentiment, especially as volatility looms in the Bitcoin price analysis. The surge in Tether USDT minting cannot be overlooked, as it serves as a lifeline in a market where every movement counts. As traders navigate the intricate crypto market dynamics, the implications of these developments on both liquidity and price action will be crucial for future trends in the sector.

The recent activities of Tether and Circle in minting stablecoins signify a noteworthy event in the cryptocurrency landscape, casting a spotlight on the creation of new digital dollars within the ecosystem. In essence, these companies play a pivotal role in bolstering liquidity, particularly as Bitcoin grapples with significant price points. With the minting of billions in stablecoins, it becomes essential to examine the resulting shifts in market behavior and how their use influences trading strategies. By creating additional dollar-pegged assets, market participants are better positioned to manage risk while they await clearer signs of market direction. Such actions not only reflect investor sentiment but also highlight the critical importance of stablecoin issuance in maintaining equilibrium within an ever-volatile environment.

| Key Points |

|---|

| Tether and Circle minted $3 billion in stablecoins amid Bitcoin’s struggle around $60,000. |

| The stablecoin market shows signs of defensive liquidity rather than active deployment. |

| Stablecoin issuance increased during Bitcoin’s price volatility, indicating caution among traders. |

| Net stablecoin outflows from exchanges have been observed, suggesting risk aversion. |

| Despite an increase in stablecoin supply, Bitcoin struggles to gain upward momentum due to a lack of deployment. |

| A divergence between minting and exchange activity highlights cautious market sentiment. |

| Future market movements depend on the return of stablecoin flows to exchanges. |

Summary

Tether and Circle minting plays a crucial role in the current state of the crypto market, particularly as Bitcoin attempts to stabilize around $60,000. The minting of $3 billion in stablecoins reflects a defensive liquidity posture, as traders seek to preserve capital amid volatile market conditions. While increased stablecoin supply suggests potential liquidity, the lack of deployment highlights a market waiting for clarity rather than actively investing. Therefore, Tether and Circle’s activities will be critical to watch as they impact trading dynamics and Bitcoin’s recovery trajectory.

The Impact of Tether and Circle Minting on Liquidity

Tether and Circle’s recent minting activities, which saw over $3 billion in stablecoins injected into the crypto market, have created notable shifts in liquidity dynamics. The stablecoin market plays a critical role in facilitating transactions within the crypto ecosystem, and this sizable minting spree indicates a ramping up of protective liquidity measures rather than a surge in immediate market confidence. By minting tokens like USDT and USDC, these companies are positioning themselves to meet potential trading demands, but the current market trajectory suggests that this liquidity is being accumulated defensively.

The influx of newly minted stablecoins has the potential to stabilize the crypto market during periods of volatility. However, despite these enhancements to the digital dollar supply, the actual deployment of this liquidity remains uncertain. Traders are exercising caution, resulting in a liquidity buildup that serves as a buffer against potential market downturns. As demand for Bitcoin hovers precariously around the $60,000 mark, the minting activities of Tether and Circle highlight a market sentiment prioritizing preservation over aggressive investment.

Understanding the Role of Stablecoins in a Volatile Market

In an inherently volatile environment like cryptocurrency, stablecoins emerge as pivotal players, offering traders a means to hedge against sudden price fluctuations. The rapid minting of these digital dollar equivalents serves to offer a semblance of stability when other major cryptocurrencies, such as Bitcoin, face price pressures. The liquidity mobility facilitated by stablecoins allows traders to remain active in the market without exposing themselves to greater risks. Consequently, the recent increases in stablecoin issuance by both Tether and Circle might appear to be a sign that the crypto markets are bracing for significant moves.

However, a thorough examination of the recent trends reveals a more cautious strategy among traders, where above-average stablecoin minting does not correlate with a willingness to engage heavily in asset accumulation. This behavior underscores the complex interplay of factors within the crypto market dynamics. Even as the stablecoin market capitalization expands, enhanced liquidity through stablecoins does not guarantee increased buying pressure on Bitcoin or other cryptocurrencies, hence the observed decoupling of stablecoin issuance from immediate market movement.

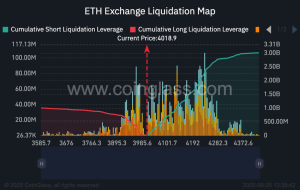

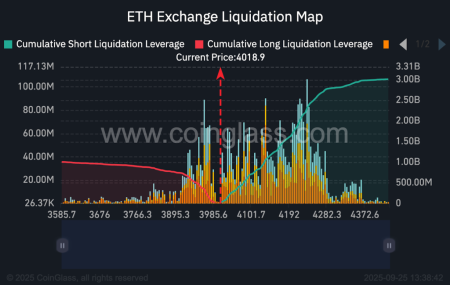

Analyzing Exchange Flows and Market Sentiment

A deeper analysis of exchange flows exposes a growing risk aversion among cryptocurrency traders. After witnessing substantial inflows earlier this year, the second half of 2025 marked a significant pivot, with stablecoins flowing out of exchanges rather than being used to leverage positions in Bitcoin and other assets. This trend signifies that many traders are prioritizing capital preservation over aggressive trading strategies, opting to remove assets from exchanges and holding them in self-custody solutions.

Despite the ongoing minting by Tether and Circle, which are indicators of increased stability and liquidity readiness in the crypto ecosystem, many investors are exercising extreme caution. The visible withdrawal of stablecoins from exchanges, particularly with over $4 billion reported since November, reflects a sentiment of uncertainty about market conditions. Understanding these flows is crucial for investors as it provides insight into whether the crypto market is poised for a recovery or further consolidation.

The Relationship between Stablecoin Issuance and Market Trends

It’s essential to discern the difference between the rise in stablecoin issuance and its impact on market dynamics. While Tether and Circle have minted significant amounts of USDT and USDC, allowing for greater liquidity within the crypto space, this influx does not automatically translate into bullish momentum for Bitcoin and other cryptocurrencies. The increase in supply might suggest a readiness for traders to capitalize on future opportunities, but current behaviors indicate a stance of waiting and observing rather than making aggressive trades.

This disconnection raises important questions about market confidence; with high levels of stablecoin liquidity, one might expect an upward price movement. However, the prevailing trend shows that traders are storing these assets as safeguards against volatility. Until there is a shift in market sentiment that encourages the redeployment of stablecoin assets back into exchanges, significant price movements, particularly upward, may remain constrained.

What Lies Ahead for Tether, Circle, and Bitcoin?

Looking forward, the long-term viability of stablecoins like USDT and USDC is promising, even as they face current market challenges. Tether and Circle continue to play dominant roles in the stablecoin market landscape, providing essential liquidity that supports ongoing trading activities and cross-border transactions. However, despite this structural growth, Bitcoin’s performance remains tied to trader sentiment and market confidence, which currently appear cautious.

As market participants assess whether to embrace risk or retreat to safer options, the strategies adopted by Tether and Circle will be crucial to shaping the future landscape of the crypto market. Investors will need to closely monitor how these stablecoins are used, whether they translate into increased purchasing power for Bitcoin, or whether they continue to act simply as a buffer against market volatility.

Frequently Asked Questions

How does Tether and Circle minting impact the stablecoin market?

Tether and Circle minting significantly influences the stablecoin market by increasing the digital dollar supply, which aids liquidity in the crypto economy. Their actions provide traders with immediate access to stable assets, facilitating trading dynamics and potentially stabilizing prices during volatile phases.

What effect do Tether USDT minting activities have on Bitcoin’s price analysis?

Tether USDT minting activities can affect Bitcoin’s price analysis by increasing liquidity, which may support price stability or potential upward momentum. However, if minting does not translate to active buying on exchanges, it may signal defensive accumulation rather than a strong market rally.

What trends are observed with Tether and Circle minting amid crypto market dynamics?

Recent trends show that Tether and Circle minting is increasing even when Bitcoin’s price struggles. This suggests that while liquidity might be rising, the market is exhibiting caution. High minting levels paired with declining exchange flows indicate traders are prioritizing capital preservation.

How do Tether and Circle minting activities correlate with the supply of digital dollars?

Tether and Circle minting activities directly correlate with the increase in the supply of digital dollars, essential for maintaining liquidity in the crypto market. This reflects traders’ movements towards stablecoins during times of uncertainty, reinforcing their role in the overall financial ecosystem.

Are Tether and Circle minting trends linked to Bitcoin’s volatility?

Yes, Tether and Circle minting trends are often linked to Bitcoin’s volatility. Typically, stablecoin minting increases during market fluctuations as traders shift to stable assets to mitigate risk, indicating a reaction to Bitcoin’s price movements and the broader crypto market dynamics.

What are the implications of Tether and Circle’s minting strategy for the future of stablecoins?

The minting strategies of Tether and Circle suggest a foundational growth for stablecoins, as they adapt to market conditions. Their ongoing issuance supports a growing ecosystem that helps sustain trading and cross-border transactions, reinforcing the importance of stablecoins in the future of digital finance.

In what ways can the minting of stablecoins by Tether and Circle influence Bitcoin price predictions?

The minting of stablecoins by Tether and Circle can significantly influence Bitcoin price predictions. Increased stablecoin supply may indicate that investors are prepared to enter or exit the market, impacting price movements. However, if minting does not lead to increased trading on exchanges, it could suggest a wait-and-see approach among traders.

How does the increase in Tether and Circle minting affect liquidity in the crypto market?

The increase in Tether and Circle minting enhances liquidity in the crypto market by providing additional capital for trading and investment. However, if this liquidity is not actively deployed into risk assets like Bitcoin, it may contribute to a defensive market posture, where traders are waiting for clearer signals before investing.