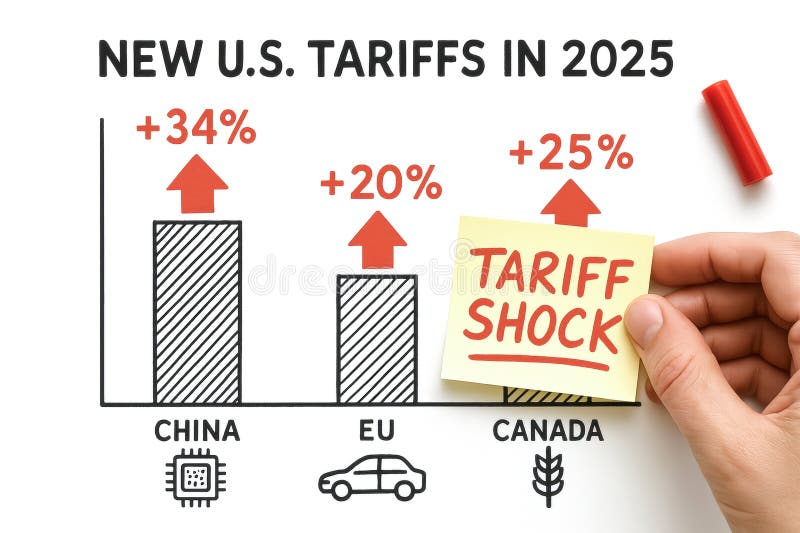

In the lead-up to a critical Supreme Court ruling, the term “tariff shock” is gaining traction as markets brace for potential chaos. With the possibility of the Court overturning tariffs that have influenced economic policies for years, Bitcoin is set to experience extreme volatility, mispricing the ramifications of this pivotal event. Prediction markets assign only a 23-30% chance of the government prevailing, but Bitcoin’s implied volatility is surprisingly low, suggesting traders may not be prepared for the fallout. As $60 billion in Bitcoin futures hangs in the balance, market reactions could lead to significant shifts, depending on the ruling’s outcome. Understanding the implications of the economic ruling on tariffs reveals how intertwined traditional finance and cryptocurrency markets have become, setting the stage for an unprecedented response to tariff-induced turbulence.

As discussions swirl around potential economic upheaval, many are referring to the looming Supreme Court case regarding tariffs as heralding a potential ‘tariff shock’. This term encapsulates the alarming reactions expected from financial markets, particularly in the wake of the government’s imposition of controversial tariffs that could reshape trade dynamics and currency stability. The situation underscores how intertwined myriad factors like Bitcoin volatility, market reactions, and prediction markets are, especially as traders anticipate the implications of this important economic ruling. Investors are faced with a landscape where even minor fluctuations could trigger pronounced effects across diverse assets, illuminating the urgency to comprehend the nuances of this momentous judicial decision.

Understanding Tariff Shock and Its Implications

The term ‘tariff shock’ refers to the sudden and significant impact on markets resulting from changes to tariffs, such as those discussed in the context of the Supreme Court ruling. As traders and investors await the decision, there’s a tightening of sentiment around Bitcoin’s price volatility. With a substantial amount of $60 billion in open interest tied up in crypto markets, any surprise ruling concerning tariffs can recalibrate existing expectations and sentiment, fuelling unpredictable price movements. Stakeholders must remain alert as the potential for a ‘tariff shock’ could lead to considerable financial implications for those trading in Bitcoin and other assets.

The integrated nature of economic systems implies that actions at the Supreme Court level are felt across a multitude of financial instruments, including cryptocurrencies like Bitcoin. Should the Court uphold tariffs that the prediction market suggests have only a 23% to 30% chance of survival, Bitcoin markets might experience severe volatility as traders react to the news. Any shifts in perceived future profitability can create knee-jerk reactions and abrupt price changes in Bitcoin, illustrating the interconnectedness of traditional and digital market assets.

The Role of Prediction Markets in Understanding Tariff Outcomes

Prediction markets harness the collective knowledge of participants to provide insights into potential outcomes of events like the Supreme Court’s ruling on tariffs. Currently, there is a perceived 23% to 30% chance that tariffs will be upheld. This low probability indicates widespread expectation that the tariffs will be challenged and potentially overturned, creating an interesting backdrop for Bitcoin investors. If predictions hold true and the ruling is indeed against the tariffs, markets, including Bitcoin, may see a positive uptick due to increased investor confidence and a potential easing of inflationary pressures.

Conversely, if tariffs are upheld, prediction markets may have underestimated the robustness of tariff enforcement, leading to heightened market reactions. The deviation between prediction market odds and actual occurrences underscores how traders preset their positions ahead of major events, highlighting the intricate dance between investor psychology and market realities. It’s essential for Bitcoin investors to monitor these markets closely, as a significant shift in outlook may trigger volatility and open new opportunities for investment.

Market Reactions Against the Backdrop of Bitcoin Volatility

As Bitcoin’s implied volatility hovers near multi-month lows, traders face an intriguing paradox; the calm before the potential storm of the Supreme Court’s ruling on tariffs could lead to explosive market reactions. Despite the current low levels of volatility, significant changes in market positioning can lead to pronounced swings in price movements once the ruling is delivered. Areas of uncertainty create fertile ground for realization of Bitcoin volatility as traders reassess their strategies and positions react to either an unexpected ruling or an expected outcome.

Investors and analysts are keeping a keen eye on Bitcoin’s historical reactions to macroeconomic events. If the Supreme Court’s ruling reflects unexpected tariff outcomes, we’re likely to see Bitcoin align with other high-beta assets, experiencing swift adjustments in its price. This interdependence of asset classes emphasizes the need for crypto investors to stay informed about external economic factors, particularly tariffs and their implications for inflation and dollar strength, as any change can lead to significant volatility in the cryptocurrency landscape.

Conveniently Priced In: The Market’s Current State

In financial markets, the concept of being ‘priced in’ suggests that investors have already accounted for certain anticipated events in asset pricing, such as the Supreme Court’s ruling on tariffs. Despite the indication from prediction markets of the tariffs’ upheld status potentially being a surprise, Bitcoin derivatives show diminishing signs of significant ‘tariff shock’ premiums. This indicates that the broader market perception may not entirely align with the expectation of a wild deviation due to the resolution of the tariff debate.

The ambiguity surrounding pricing in the context of Bitcoin shifts the focus from the binary outcome of the Supreme Court decision to how market participants will react post-decision. Should the decision overturn tariffs, traditional correlations between asset performance may re-establish, allowing Bitcoin to capitalize on the newly favorable economic conditions. Meanwhile, upholding the tariffs could lead to drastic volatility as Bitcoin adjusts to the new economic reality, underscoring how crucial the understanding of ‘priced in’ scenarios is for savvy crypto investors.

The Interplay Between Bitcoin and Economic Rulings

The Supreme Court’s economic ruling carries weight not only for traditional asset classes but also for cryptocurrencies like Bitcoin. Major legal decisions can shift financial landscapes, often in unexpected ways, impacting inflation expectations and investor confidence. For instance, an unfavorable ruling on tariffs might ignite concerns about persistent inflation, pushing investors toward Bitcoin as a hedge against currency depreciation, while an upholding could provide a larger advantage to the dollar, further solidifying Bitcoin’s role within the investment narrative.

As traders assess these implications, the reactionary nature of Bitcoin could momentarily overshadow its fundamental value propositions. The evolving relationship between Bitcoin and the influence of economic rulings demonstrates why investors must remain vigilant and adaptable to shifting tides within both the crypto realm and traditional finance. These interactions signal Bitcoin’s propensity to respond to macroeconomic indicators, suggesting that future price swings may increasingly depend on legal frameworks and governmental decisions.

The Potential for Amplified Volatility Post-Ruling

Regardless of the outcome of the Supreme Court’s ruling, the potential for amplified volatility in the Bitcoin market appears prominent. Should the Court maintain the tariffs against expectations, the ensuing shock could catalyze rapid sell-offs, as traders recalibrate prices based on newly established inflationary realities. Alternatively, should the tariffs be overturned, Bitcoin stands to benefit from increased liquidity and bullish sentiment if the macroeconomic climate improves.

Current Bitcoin market dynamics, characterized by a lack of clear directional bias and minimal volatility, could reset dramatically post-ruling, as traders re-evaluate risk appetites and revise their positions. The substantial open interest in Bitcoin futures means that once the ruling occurs, markets may react with swift and dramatic price evolution, reflecting not only the decision’s implications but also the substantial leverage and positioning present within the crypto trading ecosystem.

Anticipating Market Shifts in the Face of Uncertainty

Amid the uncertainty surrounding the impending Supreme Court ruling, Bitcoin traders confront a complex landscape of potential outcomes and market shifts. With current prediction markets reflecting varying degrees of likelihood regarding the tariff’s survival, traders must be prepared for sudden adjustments regardless of the anticipated direction. The scenario creates an environment ripe for volatility, as misaligned expectations can lead to rapid re-pricing across assets, highlighting Bitcoin’s sensitive nature to macroeconomic events.

Ultimately, how traders and investors respond to the eventual outcome of the ruling will dictate the broader narrative surrounding Bitcoin. A strong reaction, whether positive or negative, can lead to shifts in trading strategies across derivatives markets, amplifying price movements. Therefore, strategic foresight and a keen understanding of market sentiment will be essential for navigating the forthcoming pivotal event in an increasingly interconnected financial landscape.

Navigating the Digital Asset Landscape Amid Tariff Discussions

As discussions around tariffs ascend to the Supreme Court, the implications for digital assets such as Bitcoin demonstrate the intertwining realities of both traditional and evolving financial structures. As traders contend with economic rulings that have profound consequences, understanding the broader context becomes imperative. The experience serves as a crucial reminder of how external factors and legal precedents can reverberate through cryptocurrency markets, fundamentally altering trader sentiment and positioning.

For Bitcoin investors, staying informed and prepared for sudden changes has always been essential, and this current discourse on tariffs emphasizes that importance. By recognizing the potential for both opportunity and volatility resulting from legal outcomes, traders can position themselves strategically within a dynamic market space. The immediate aftermath of the Supreme Court’s ruling serves not only as a crucial juncture for Bitcoin but also as a testament to the evolving narrative of cryptocurrencies amidst ongoing macroeconomic pressures.

Deciphering the Future of Bitcoin in Light of Upcoming Rulings

The future trajectory of Bitcoin hangs in the balance as traders brace for the Supreme Court’s decision on tariffs, serving as a reminder of just how intertwined digital currency can be with broader regulatory frameworks. With prediction markets looking uncertain and Bitcoin options showing minimal directional commitment, the soon-to-be-voiced decision will markedly influence risk perceptions and investment behaviors across the board. Depending on whether the ruling adheres to or diverges from current market expectations, Bitcoin could either solidify its status as a crisis hedge or struggle against elevated risks surrounding inflation.

As traders analyze probabilities and market dynamics leading up to the court date, the outlook for Bitcoin becomes multifaceted, expanding what it means to anticipate economic developments. The mercy of volatility, amplified by price adjustments and responses to macroeconomic conditions, poses ongoing considerations for the cryptocurrency’s trajectory. In this landscape, engaging with underlying themes of tariff implications and legal outcomes will be crucial in sculpting the future narrative for Bitcoin in the ever-changing world of financial markets.

Frequently Asked Questions

How will the Supreme Court’s economic ruling affect Bitcoin volatility and tariff shock?

The Supreme Court’s economic ruling on tariffs could significantly impact Bitcoin volatility. If the Court upholds the tariffs, it may lead to a ‘tariff shock’ that unsettles markets, potentially increasing Bitcoin’s price volatility as traders react to heightened inflation concerns and dollar resilience. Conversely, if the tariffs are struck down, Bitcoin could benefit as investors anticipate increased risk-on sentiment and a disinflationary supply shock.

What is ‘tariff shock’ and how does it relate to Bitcoin’s market reaction?

‘Tariff shock’ refers to the sudden market upheaval that occurs when unexpected tariff decisions are announced, leading to rapid adjustments in prices. This phenomenon affects Bitcoin as traders recalibrate their positions based on the anticipated impact of tariffs on inflation and market dynamics, especially when $60 billion in Bitcoin futures are involved.

What role do prediction markets play in forecasting ‘tariff shock’ impacts on Bitcoin?

Prediction markets suggest only a 23-30% survival chance for the tariffs, illustrating significant uncertainty surrounding the outcome. This uncertainty can lead to a ‘tariff shock’ when the Supreme Court announces its decision, as Bitcoin traders adjust their expectations and positioning in response to the ruling.

Why is there concern about Bitcoin’s reaction to the Supreme Court tariffs ruling?

There is concern about Bitcoin’s reaction due to its high implied volatility and the fact that current market positioning shows no clear ‘tariff shock’ pricing. If the Supreme Court’s decision surprises the market—either upholding or overturning the tariffs—traders may face a rapid and emotional adjustment, causing significant price shifts in Bitcoin.

How might the outcome of the Supreme Court tariffs case influence Bitcoin derivatives?

The outcome of the Supreme Court tariffs case could dramatically influence Bitcoin derivatives. If tariffs are upheld, volatility may spike as traders reassess their positions, while if they are overturned, Bitcoin could experience a positive ripple effect as liquidity and risk appetite return to the market, driving prices higher.

| Key Point | Details |

|---|---|

| Supreme Court Ruling | A decision on whether the Trump administration’s tariff imposition was legal will be made on January 9. |

| Tariff Survival Odds | Prediction markets show only a 23-30% chance that the government will win the case. |

| Impact on Bitcoin Volatility | Bitcoin’s implied volatility is at multi-month lows with open interest of $60 billion, showing little directional bias among traders. |

| Market Reactions | If tariffs are upheld, expect a firmer dollar and reduced inflation confidence; if struck down, it could lead to a stronger risk-on environment for Bitcoin. |

| Potential Financial Impact | Overturned tariffs could result in refunds amounting to hundreds of billions and would stimulate the market. |

| Current Economic Climate | The dollar index is significantly lower, and Treasury yields are moderate; overall market is balancing uncertainty. |

Summary

The recent Supreme Court ruling could lead to an immediate “tariff shock,” reshaping the economic landscape significantly. As the decision date approaches, prediction markets indicate an overwhelming sentiment questioning the legality of the tariffs imposed by the previous administration. This uncertainty sets the stage for volatility in Bitcoin and other financial markets, revealing a complex relationship tied to economic policy outcomes. Regardless of the ruling, the impact on market dynamics and investment strategies will be profound, as stakeholders recalibrate their positions based on the Court’s judgement.

Related: More from Bitcoin News | Gold, AI, Tech Stocks Lead as Bitcoin Fades | UBS Slides on US Stocks: Bitcoin’s Fate?