Tokyo–Washington Call in Focus as Markets Weigh Xi–Trump Outreach and Japan’s Harder Line on China

Key Takeaways

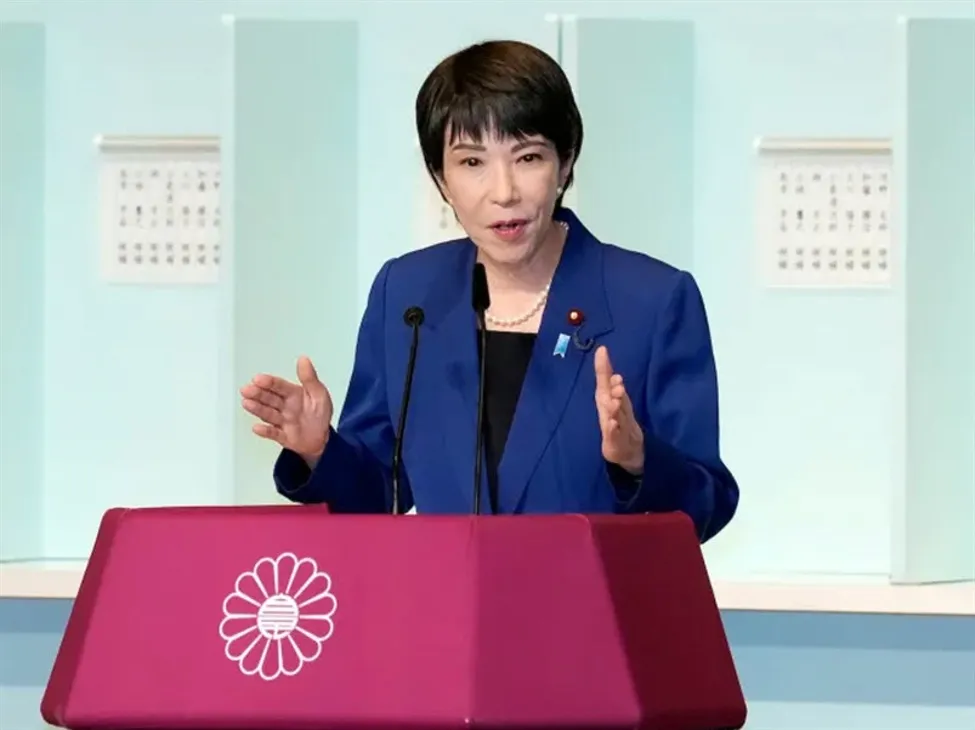

Japan’s Prime Minister Sanae Takaichi will speak by phone with U.S. President Donald Trump on Tuesday, according to FNN, with the discussion expected to center on Trump’s recent conversation with China’s President Xi Jinping. The call lands at a delicate juncture for regional security and financial markets as Tokyo signals a tougher stance on Beijing, including warnings that a Chinese attack on Taiwan could trigger a Japanese military response.

Regional stakes and policy signaling Takaichi’s remarks on Taiwan earlier this month sharpened the policy backdrop for investors calibrating geopolitical risk. The pending call is likely to clarify U.S.–Japan coordination and the contours of any response framework, elements that tend to influence risk appetite across Asia assets. According to the Wall Street Journal’s summary, Xi’s decision to reach out to Trump—after largely avoiding direct contact during the trade war—reflects Beijing’s effort to assess how firmly Washington will back Tokyo’s more confrontational posture.

For markets, the key question is whether the U.S. will explicitly endorse Japan’s red lines or pursue de-escalatory language. Clear alignment could lift defense-related equities and risk premia tied to cross-strait tensions, while a more tempered message may ease haven demand.

Implications for FX and rates The yen remains the principal barometer. Escalation risk often supports the currency via safe-haven inflows, although the balance with U.S. yield dynamics can complicate USD/JPY direction. Traders will track: – USD/JPY spot and options skew for signs of hedging demand and shifts in FX volatility. – Japanese government bond yields as markets parse any fiscal or defense-spending repercussions that might influence the Bank of Japan’s policy calculus. – U.S. Treasuries and dollar liquidity flows if the conversation shifts the perceived path of U.S.-Asia security commitments.

Equities and sector read-through Asia equity futures, particularly the Nikkei, will be sensitive to any guidance that affects export sentiment, supply-chain exposure to China, and currency pass-through. Defense and cybersecurity names could benefit from firmer alliance signals, while domestically exposed cyclicals may react to changes in growth and energy-security narratives. Conversely, signs of de-escalation typically support broader risk appetite and reduce hedging costs.

Strategic backdrop The WSJ framing suggests the Xi–Trump call was less about Washington–Beijing bilateral ties and more about delineating boundaries in a potential Japan–China standoff. Investors will scrutinize official readouts for language on “peace and stability across the Taiwan Strait,” the scope of U.S. support for Japanese security policies, and any references to confidence-building measures. In commentary tracked by BPayNews, strategists note that even modest shifts in phrasing can swing positioning across Asia FX and regional equities.

Market Highlights – Takaichi–Trump call expected Tuesday; focus on Trump’s recent conversation with Xi, per FNN. – Beijing seen probing the depth of U.S. backing for Tokyo’s tougher line, per WSJ summary. – Watch USD/JPY, JGB yields, and Asia FX volatility for immediate market read-through. – Equity sensitivity highest in Japan defense, exporters (via yen channel), and China-exposed supply chains. – Official readouts will guide risk premia around Taiwan-related scenarios.

What to watch next – Timing and content of post-call readouts from Tokyo and Washington. – Any mention of alliance commitments, extended deterrence, and Taiwan Strait stability. – Changes in options pricing and FX volatility as traders recalibrate hedges.

Q&A

What could move markets most from the call? – A clear U.S. pledge to back Japan’s hardened stance would likely lift defense-related equities and support haven flows, while conciliatory language could ease FX volatility and support risk assets.

Which assets are most sensitive? – USD/JPY, short-dated yen options, Japan sovereign yields, and Nikkei-linked futures. Sector-wise, defense, cybersecurity, and exporters are in focus.

How might this affect the Bank of Japan outlook? – Indirectly. If geopolitical risks spur fiscal outlays or persistently stronger yen dynamics, markets may reassess the balance of BOJ normalization versus financial stability considerations.

What signals would calm investors? – Joint references to transparency, crisis hotlines, or confidence-building mechanisms, along with reaffirmations of “peace and stability in the Taiwan Strait,” would typically reduce risk premia.

Context

Current positioning around Market Analysis remains sensitive to primary-source updates, policy interpretation, and execution risk across major venues.

What To Watch

Key confirmation signals include sustained spot demand, funding stability, and whether price can hold reclaimed levels after headline-driven volatility.

If momentum weakens, traders will likely prioritize downside liquidity zones and risk-control positioning before adding new directional exposure.

Related: More from Market Analysis | BANK LATEST QUARTER REPORT OUT NOW in Crypto Market | Tokenized Gold Surpasses CME Futures Prices This Weekend in Crypto Market