Headline: Asia Market Brief: Japan plays down default risk, Australia jobless rate improves, PBOC fix eyed, Zcash surges

Asian markets opened to a wave of policy signals and data shaping sentiment across currencies and digital assets. Comments from Japan’s leadership, a stronger-than-expected Australian labor print, and expectations for China’s currency fixing set the tone, while a bold crypto-treasury move ignited a sharp rally in Zcash.

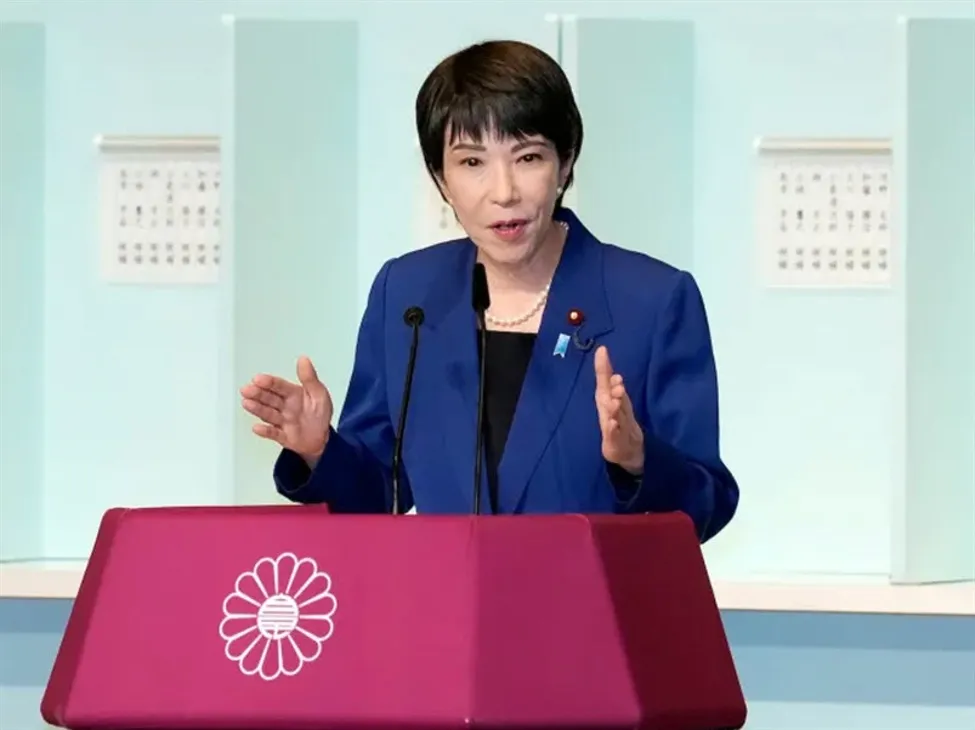

Japan’s finance minister said a sovereign default is hard to envisage, underscoring policy continuity and fiscal credibility. Prime Minister Takaichi reiterated a growth-first strategy aimed at lifting tax revenue without rate hikes, while Bank of Japan Governor Ueda emphasized the goal of moderate inflation alongside wage gains to support a durable expansion. The coordinated messaging points to a steady policy path focused on price stability and income growth, a backdrop closely watched by foreign exchange and fixed-income markets.

In Australia, the unemployment rate dipped to 4.3% in October 2025, beating expectations of 4.4% and improving from 4.5% previously. November inflation expectations eased to 4.5% from 4.8%, but the firmer labor market reduces the urgency for near-term Reserve Bank of Australia rate cuts. Meanwhile, currency traders are looking to China, where markets expect the PBOC to set the USD/CNY reference near 7.1156, a signal for short‑term yuan direction. In crypto, LPTX soared 369% after a $50 million purchase of Zcash and a pivot to a crypto‑treasury model under the CYPH banner. ZEC doubled as traders leaned into privacy coins as a hedge within the broader cryptocurrency market.

Key Points: – Japan’s finance minister downplays default risk; policy focus remains on stability and growth. – Prime Minister Takaichi targets higher revenues via economic expansion rather than tax increases. – BoJ Governor Ueda reiterates pursuit of moderate inflation and wage growth to support recovery. – Australia’s October 2025 unemployment falls to 4.3% (vs 4.4% expected; 4.5% prior). – Australian inflation expectations ease to 4.5% in November 2025 from 4.8%. – Markets expect the PBOC to set the USD/CNY midpoint near 7.1156; Zcash rallies as LPTX pivots to a crypto‑treasury strategy.