Browsing: trading strategies

In the dynamic world of trading strategies, understanding market trends is crucial for any investor looking to maximize their returns.Traders often employ diverse tactics, including the bottom-fishing strategy, which can lead to significant profits from undervalued stocks.

The buy and hold strategy is a time-tested investment approach that involves purchasing stocks and holding them for an extended period, regardless of market fluctuations.This strategy contrasts sharply with short-term trading tactics, as it encourages investors to focus on the long-term growth potential of their assets.

In the dynamic landscape of the cryptocurrency market, a trader has recently established a long position ASTER, amounting to a substantial 2.96 million tokens at an impressive 5x leverage.This strategic move, valued at 1.86 million dollars, showcases a bold approach to investing in ASTER, especially considering the current fluctuations in crypto market trends.

The “Cool and Calm King of Opening Long Positions” has experienced liquidation 10 times consecutively, leading to significant financial losses. This series of liquidations has resulted in an estimated total loss of approximately $12.92 million.…

Crypto leverage has reached a record high in the third quarter as decentralized finance (DeFi) continues to reshape market dynamics, according to Galaxy. The increase in leverage indicates a growing interest and participation in the…

Ethereum has dropped below the $3,000 mark, reflecting a significant decline in its market value. This downturn comes amid broader fluctuations in the cryptocurrency market. Investors are closely monitoring the situation as the price dip… (via Bpaynews real-time desk)

The Crypto Daybook Americas highlights current trends and developments in the cryptocurrency market across the Americas. This report provides insights into market movements and investor sentiment. It discusses the ongoing shifts in trading strategies as…

Ethereum experienced a temporary decline, falling below the $3200 mark as market conditions shifted. This drop reflects ongoing volatility in the cryptocurrency market. Investors are closely monitoring price movements, as fluctuations can impact trading strategies… (via Bpaynews real-time desk)

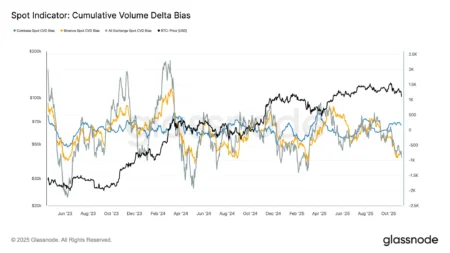

Open interest has declined by 21% over the past 90 days, reflecting a continuing process of deleveraging in the market. This decrease suggests a shift in market participant behavior, where traders are reducing their positions.…

ICP has experienced a decline while remaining within a consolidation phase that is holding above significant support levels. This development indicates a potential stabilization in the market despite the current slip. Analysts note that the… (via Bpaynews real-time desk)