Browsing: stablecoins

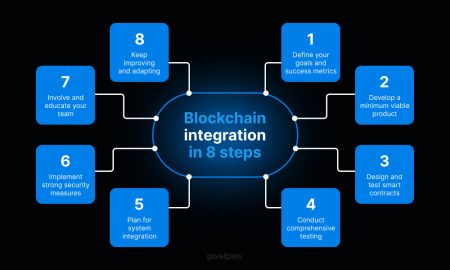

Blockchain integration is set to revolutionize the financial landscape as it becomes the foundational layer for modern finance.Ripple’s president, Monica Long, foresees a future where global balance sheets will hold over $1 trillion in digital assets, with many Fortune 500 companies embracing this shift.

Stablecoins have emerged as a pivotal force within the cryptocurrency ecosystem, redefined by their potential to combine the benefits of digital assets with the stability of traditional currencies.As we delve into 2025, the landscape of crypto regulation has shifted dramatically, casting stablecoins at the forefront of discussions surrounding financial stability and compliance.

Stablecoins are rapidly becoming a cornerstone of the cryptocurrency landscape, facilitating seamless transactions while bridging the gap between traditional finance and the digital economy.According to a recent BlackRock report, the importance of stablecoins has surged as they gain mainstream adoption, evolving from mere trading instruments to integral elements in financial ecosystems.

Stablecoins are rapidly changing the landscape of cryptocurrency access, offering a reliable bridge between the digital currency world and traditional finance.As Brian Armstrong, CEO of Coinbase, highlighted, stablecoins can play a pivotal role in enhancing financial inclusion, especially for the 96% of the global population who live outside the United States.

Stablecoins are revolutionizing the financial landscape by emerging as essential instruments in institutional finance, particularly as highlighted in Moody’s outlook for 2026.These digital assets offer a bridge between traditional currency and the world of cryptocurrency by providing stability in a volatile market.

Stablecoins are emerging as a pivotal element in the evolving landscape of the digital asset ecosystem, capturing the attention of both financial giants and innovative start-ups alike.Ham Young-joo, the Chairman and CEO of Hana Financial Group, highlighted their potential to transform financial technology by enabling smoother transactions and reducing volatility often associated with cryptocurrencies.

Stablecoins are rapidly gaining traction in the financial world, offering a digital alternative aimed at maintaining price stability in contrast to traditional fiat currencies.As highlighted in the “2026 Global Market Outlook” by BlackRock, stablecoin adoption is set to challenge the long-held control that governments have over their monetary systems, particularly in emerging markets.

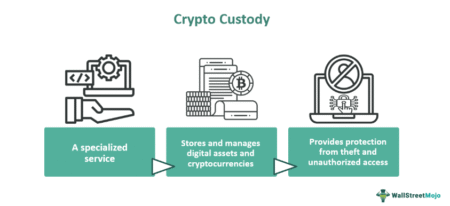

Crypto custody is becoming an essential focus within the evolving landscape of digital assets, as regulators and banking institutions grapple with its implications for innovation and stability.Recently, the Office of the Comptroller of the Currency (OCC) has emphasized that restricting national trust banks from engaging in crypto custody presents a “recipe for irrelevance.” This statement comes amidst a surge in interest regarding banking regulation and the role of stablecoins in the financial ecosystem.

Stablecoins have become a pivotal force in the evolving landscape of digital finance, recently surpassing Bitcoin in a significant market metric.As these tokens mature, their impact on the global economy, particularly in facilitating cross-border transactions, is more pronounced than ever.

In the ever-evolving landscape of Bitcoin market trends, recent fluctuations reveal a notable decline across major cryptocurrencies, with Bitcoin dipping 2% to $91,400.As investment strategies shift, institutional players, including BlackRock, are strategically accumulating Bitcoin, potentially signaling a bullish outlook despite current market volatility.