Browsing: stablecoins

Stablecoins are rapidly emerging as a significant tool in the cryptocurrency landscape, capturing the attention of financial regulators like the South African Reserve Bank.As the Governor, Lesetja Kganyago, pointed out, the rising popularity of these digital assets not only presents innovative ways for transactions but also introduces potential cryptocurrency risks that could impact economic stability.

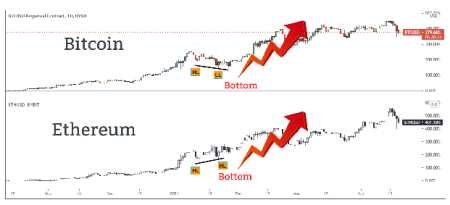

As discussions around the crypto market bottom intensify, investors are eager to identify the signs of a potential rebound.Understanding this critical phase in the cryptocurrency landscape can unlock opportunities for savvy investment strategies.

The crypto market 2026 is poised to be a watershed moment for the digital finance landscape, as industry leaders emphasize the need for robust financial infrastructure.Experts like André Casterman predict that the focus will move beyond just the adoption of cryptocurrency, shifting towards tangible frameworks that support the growth of digital assets.

Stablecoins have emerged as a pivotal innovation in the world of finance, rapidly becoming a cornerstone in the global payment system.These cryptocurrency assets are designed to maintain a stable value, offering a bridge between traditional financial infrastructures and digital currencies.

Stablecoins have emerged as vital instruments in the evolving cryptocurrency landscape, especially amid exchange rate fluctuations like those recently seen with the Korean won.As the won broke the significant 1480 mark against the US dollar, trading volume for Tether surged to an impressive 378.2 billion won, reflecting a 62% increase since the start of the year.

In the evolving landscape of global finance, **de-dollarization** emerges as a significant trend reshaping how nations engage with the U.S.dollar and its influence over international markets.

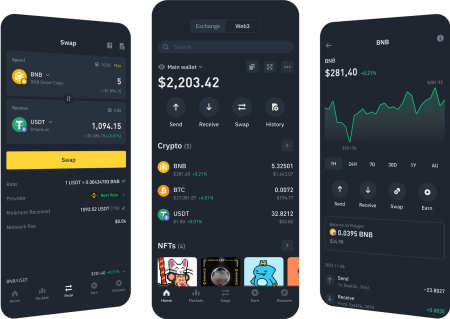

Binance Wallet is revolutionizing the way users engage in cryptocurrency trading by seamlessly integrating the support for direct trading of meme coins with stablecoins.With this innovative tool, traders can quickly and easily switch their payment methods, allowing them to purchase popular MEME tokens such as Dogecoin and Shiba Inu without hassle.

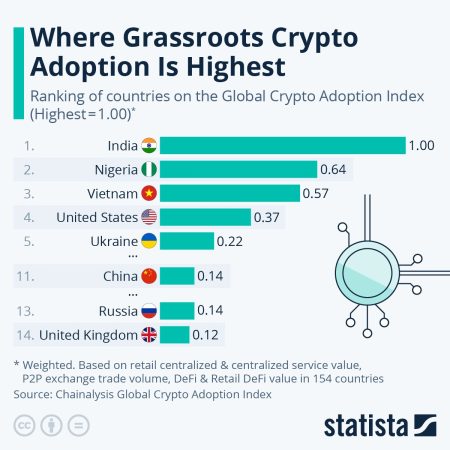

Cryptocurrency adoption is rapidly gaining momentum, demonstrating a significant shift in how institutions view and utilize digital assets.As highlighted in PwC’s “2026 Global Cryptocurrency Regulatory Report,” the moment has arrived when institutions are no longer debating the merits of cryptocurrency assets but are instead focused on the practicalities of their integration into the financial system.

Stablecoins are gaining significant traction in the world of cryptocurrency, capturing the attention of both investors and financial technology enthusiasts alike.During a recent interview on Squawk Box at Davos, Circle’s founder and CEO Jeremy Allaire highlighted the importance of these digital assets, noting that they could experience a remarkable compound annual growth rate of 40%.

Crypto payments are rapidly gaining traction, reshaping how transactions are conducted in today’s digital economy.As blockchain technology continues to evolve, the integration of cryptocurrencies into everyday financial activities is becoming more seamless and efficient.