Browsing: stablecoin regulation

The stablecoin market has encountered significant changes, as institutional compliance costs and rising Treasury yields reshape the dynamics of stablecoin issuance.After a period characterized by rapid growth, the sector is now transitioning to a phase marked by increased scrutiny and balance-sheet discipline.

Stablecoin yields have emerged as a focal point of debate in the evolving cryptocurrency market, especially regarding their accessibility to retail investors.Christopher Perkins, President of CoinFund, has voiced strong opposition to proposed regulations that could restrict these yields, deeming such actions an unjust policy.

Stablecoin rewards have emerged as a pivotal topic in the evolving landscape of the crypto market, particularly as regulatory frameworks such as the GENIUS Act are considered.This piece of legislation seeks to establish guidelines around stablecoin transactions and their associated reward mechanisms.

The GENIUS Act is at the center of an urgent debate within the cryptocurrency industry, as executives raise concerns about potential amendments that could reshape stablecoin regulations.Recent discussions highlight how modifications, influenced by banking sector lobbyists, might not only limit returns for stablecoin holders but also threaten the financial competitiveness of the United States.

The GENIUS Act has emerged as a pivotal legislative measure aimed at regulating the burgeoning market of stablecoins, yet its current framework faces scrutiny from community bankers across the United States.As lawmakers gather to address a perceived “stablecoin loophole” that enables yield-generating stablecoins to compete unfairly with traditional banking systems, the call for amendments to the GENIUS Act has intensified.

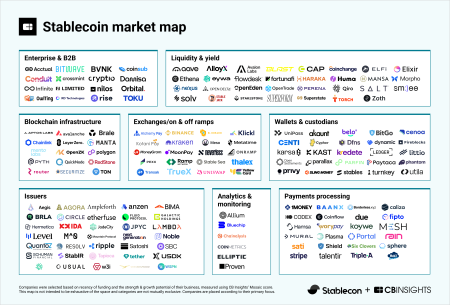

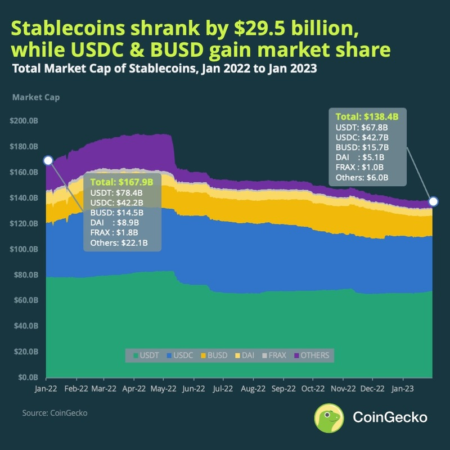

The stablecoin market growth is capturing significant attention as its size skyrockets from a mere $4 billion in early 2020 to an astonishing $272 billion projected by October 2025.This rapid expansion highlights the shift of stablecoins from their initial role as crypto trading instruments to pivotal players in decentralized finance and cross-border payments, demonstrating their versatility in modern finance.

Stablecoins have emerged as a pivotal element in the evolving landscape of cryptocurrency, with the European Central Bank issuing a notable warning about their associated risks.As their market capitalization reaches unprecedented heights, concerns regarding stablecoin financial risks are becoming more pronounced.

Bank of England Deputy Governor Ben Broadbent has expressed concerns that the weakening of stablecoin regulation may present significant risks to the financial system. Broadbent highlighted the potential dangers associated with a lack of robust…

Bank of England Deputy Governor Ben Broadbent stated that aligning stablecoin regulations between the US and UK is essential for effective oversight. Broadbent highlighted the importance of international cooperation in regulating digital currencies, particularly stablecoins,…

Canada is set to introduce legislation for stablecoin regulation, following similar initiatives in the United States. This move aims to establish a framework for digital currencies that are pegged to traditional assets. The Canadian government… (via Bpaynews real-time desk)