Browsing: stablecoin market

Tether cryptocurrency, also known by its token USDT, has recently captured attention as it froze over half a billion dollars at the request of Turkish authorities.This action was taken in connection with an alleged illegal online betting and money laundering operation, highlighting the coin’s role in the burgeoning stablecoin market.

Tether and Circle minting has recently taken center stage in the crypto market, as these leading stablecoin issuers pumped a staggering $3 billion into the ecosystem.This massive influx highlights the ongoing dynamics within the stablecoin market, particularly in response to Bitcoin’s fluctuating price around the critical $60,000 threshold.

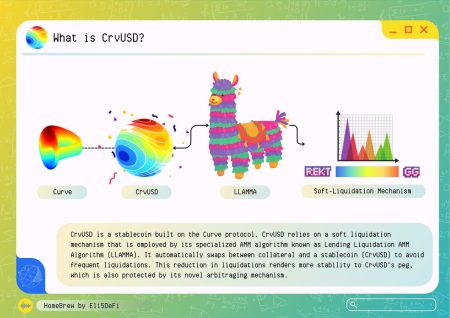

crvUSD stability is a critical component in the evolving landscape of the stablecoin market, particularly in relation to mainstream crypto assets such as Bitcoin.As highlighted by Michael Egorov, the founder of Curve, the substantial liquidity of crvUSD offers both opportunities and challenges, especially during periods of Bitcoin volatility.

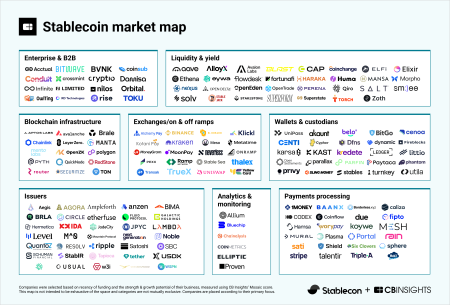

The stablecoin market has encountered significant changes, as institutional compliance costs and rising Treasury yields reshape the dynamics of stablecoin issuance.After a period characterized by rapid growth, the sector is now transitioning to a phase marked by increased scrutiny and balance-sheet discipline.

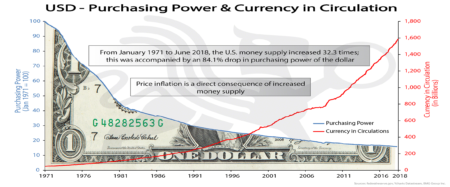

Stablecoins have become a pivotal force in the evolving landscape of digital finance, recently surpassing Bitcoin in a significant market metric.As these tokens mature, their impact on the global economy, particularly in facilitating cross-border transactions, is more pronounced than ever.

USDD circulation has officially exceeded $600 million, marking a historic milestone in the stablecoin market.This remarkable achievement highlights the growing trust and recognition of USDD as a leader in decentralized finance, contributing significantly to its ecological impact.

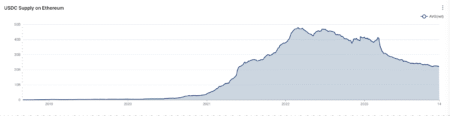

In recent developments, USDC minting has gained significant attention as Circle announces the minting of another 500 million USDC.This latest issuance brings the grand total for USDC and its competitor Tether to an impressive 18.25 billion USD since October 11.

USDC issuance has reached new heights as Circle announces the release of an additional 500 million USDC on the Solana blockchain.This significant move highlights the growing momentum in the stablecoin market, further consolidating USDC’s position as a leading digital currency.

In a significant move that has captured the attention of the cryptocurrency community, a notable whale recently placed a TWAT order that involved the accumulation of 141,000 HYPE, totaling approximately $4.91 million.This strategic investment demonstrates the growing interest in HYPE amid turbulent market conditions, as crypto whales often influence market trends through their substantial trading activities.

The Upbit merger between Dunamu and Naver Financial marks a significant moment in the evolution of South Korea’s financial landscape.As the operator of the country’s largest crypto exchange, Upbit is set to join forces with a prominent payments provider, creating a financial entity valued at roughly $13.8 billion.