Browsing: prediction markets

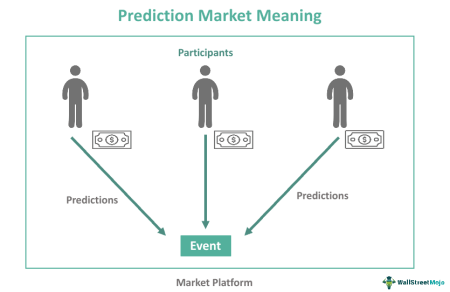

Prediction markets have emerged as an innovative frontier in the landscape of financial instruments, allowing participants to bet on the outcomes of future events, from election results to economic indicators.These markets leverage collective intelligence, enabling users to collaborate and pool their insights on various topics.

Gemini cryptocurrency exchange, founded in 2015, is a prominent player in the burgeoning digital asset landscape.Concentrating on growth within the United States, Gemini aims to leverage the country’s robust capital markets amidst ongoing challenges in international territories.

In a significant move for the cryptocurrency trading ecosystem, Polymarket is transitioning to USDC as its primary settlement currency, enhancing the overall integrity of its platform.This partnership with Circle Internet Group marks an important shift as Polymarket replaces previously used bridged stablecoin collateral.

Circle stablecoin collaboration has emerged as a pivotal partnership aimed at revolutionizing the landscape of prediction markets.By teaming up with Polymarket, Circle is set to enhance the stablecoin infrastructure, ensuring that users benefit from increased reliability and transparency.

AI adjudication in prediction markets is rapidly emerging as a game-changer, addressing key challenges in the determination of outcomes, which is essential for accurate pricing in these innovative financial environments.As highlighted in discussions around AI in finance, the effectiveness of prediction markets hinges not on merely forecasting future events but on accurately assessing what transpired post-event.

Key Point

Explanation

Importance of KYC in Prediction Markets

KYC measures are essential in prediction markets to prevent insider trading and ensure market integrity.Challenges with Non-KYC Markets

Non-KYC markets make it nearly impossible to track insider trading since there is no link between wallets and real identities.

Key Point

Details

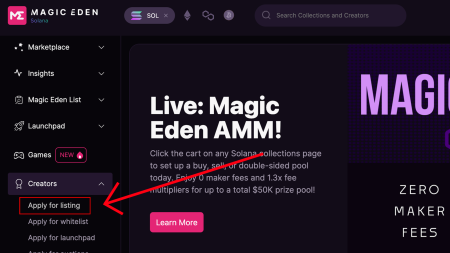

Speculation Supercycle

Magic Eden co-founder Jack Lu anticipates a phase where finance merges with entertainment, driven by rising trading volumes in prediction markets.Record Trading Volumes

Prediction markets have experienced a record trading volume of $814.2 million recently, surpassing the prior record of $701.7 million.

Prediction markets are revolutionizing how we gauge future events by allowing participants to buy and sell predictions on outcomes, creating a dynamic platform that generates real-time probabilities.Recent developments, such as the partnership between Polymarket and Dow Jones, signify a notable shift as these markets are increasingly recognized as valuable crypto data products.

Prediction markets are emerging platforms that harness collective knowledge to forecast future events, and they are increasingly drawing attention due to recent proposed legislation.Tarek Mansour, CEO of the prediction market platform Kalshi, has voiced strong support for the “2026 Public Integrity Financial Prediction Markets Act,” a bill aimed at banning insider trading within these markets.

In the ever-evolving landscape of crypto trading, Perp DEX has emerged as a pivotal player, capturing the attention of traders seeking innovative alternatives.The platform stands at the forefront of prediction markets, where users can engage in on-chain contracts that reflect real market dynamics.