Browsing: on-chain analysis

In the dynamic world of cryptocurrency investments, ETH long positions have become a focal point for traders looking to capitalize on Ethereum’s price movements.Recently, prominent investor Ma Ji Da Ge has added a substantial margin of 250,000 USD, reflecting his bullish outlook on ETH.

In a dramatic shift in the cryptocurrency landscape, ETH liquidation is becoming a prominent topic among investors.An ICO participant, once proud owner of 254,900 ETH, has recently made headlines by selling off an additional 3,000 ETH, edging closer to a significant liquidation event.

In the realm of cryptocurrency, engaging in altcoin market analysis is crucial for investors looking to maximize their returns.This analysis encompasses assessing various altcoins, their performance, and potential profit margins, with many traders employing strategies such as shorting altcoins to capitalize on market fluctuations.

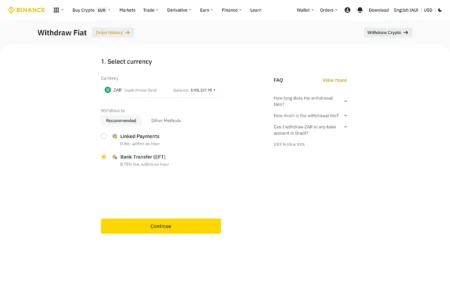

In a significant development in the cryptocurrency world, 56,291 ETH withdrawal from Binance has recently occurred, amounting to a staggering $160 million.This massive exit of Ethereum from the exchange within a mere two-hour window has raised eyebrows among traders and analysts alike, igniting discussions about potential implications for Ethereum market movements.

In the ever-evolving landscape of cryptocurrency, the recent surge in activity by the 1011 Insider Whale has turned heads, with a staggering deposit of $170 million in stablecoins to Binance within just seven hours.As reported by Odaily Planet Daily on December 1, 2025, at 11:03 AM, this significant transaction caught the attention of on-chain analysts, particularly Ai Yi, who has been tracking such whale activity closely.

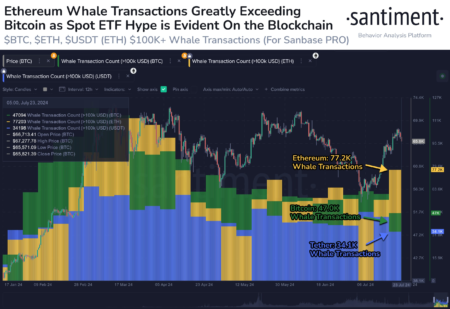

Ethereum Whale Transactions have captured the attention of the crypto community, especially given their significant impact on market dynamics.Recently, an address identified as ‘1011 Insider Whale’ made headlines by collateralizing 55,340 ETH, valued at approximately $157 million, to Aave just minutes before borrowing 50 million USDT.

The recent downturn in the cryptocurrency market has led to significant losses from WBTC investment, highlighting the risks associated with crypto trading.An alarming case surfaced when an address incurred an astonishing $316,000 loss while attempting to bottom-fish for Wrapped Bitcoin (WBTC) amid the volatility.

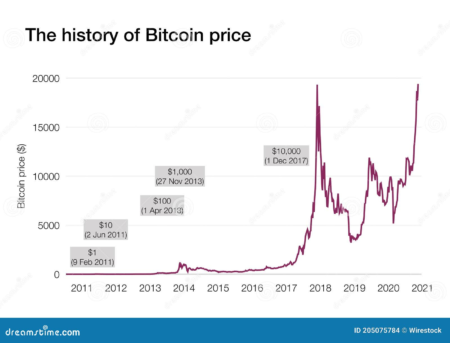

Bitcoin price trends have long been a focal point for investors keenly watching the shift of market dynamics.Notably, analysts like Negentropic from Glassnode have observed that when commodities such as copper, silver, and gold witness simultaneous price increases, it often signals positive momentum for Bitcoin, leading to enhanced altcoin performance and even bull market signals.

Bitcoin whale sales have become a hot topic in the crypto community, especially after recent reports indicated that over 50,000 BTC were sold by whales in just one week, totaling approximately $4.6 billion.Such significant transactions from major holders can influence market dynamics dramatically, making it crucial for investors to understand the implications of whale activity.

Recently, the cryptocurrency community has been abuzz with activity surrounding ETH deposits to Binance, as a notable address made headlines by depositing 5000 ETH worth $15.36 million.This significant transaction is part of a larger trend of large ETH deposits, where the same address has accumulated over 13,400 ETH in just two weeks.