Browsing: on-chain analysis

The recent increase in ETH holdings by a significant whale has drawn attention to the dynamics of whale trading activity in the cryptocurrency market.On-chain analysis reveals that this particular address, known for its strategic moves, converted WBTC back to WETH, leading to a remarkable 6.45% increase in ETH holdings.

In a striking development in the cryptocurrency market, an ETH whale transfer has occurred after nine years of dormancy, involving a massive 50,000 ETH being moved to the Gemini exchange.On-chain analysis revealed that this significant transaction, valued at approximately $145 million, has attracted the attention of investors and analysts alike.

In the world of cryptocurrency trading, a BTC short position is gaining significant attention among investors and analysts alike.Recent observations from on-chain analysis, particularly by Ai Yi, highlight the increasing trends in shorting Bitcoin, as the leading address on Hyperliquid has recently escalated its holdings by 14.5 BTC.

In a striking revelation for Ethereum enthusiasts, a notable whale transaction involving 6,300 ETH Coinbase has recently made headlines.This substantial deposit, valued at approximately $18.63 million, has raised eyebrows among on-chain analysts and market watchers alike.

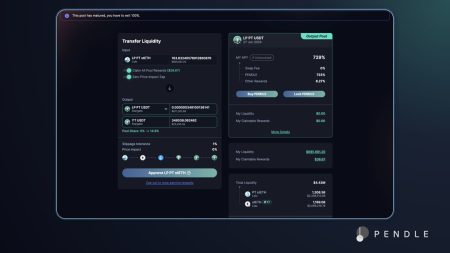

In recent **Pendle investor transfer** news, a notable transaction has caught the attention of the cryptocurrency community.A significant address associated with Pendle has moved 1.8 million PENDLE tokens to Bybit, representing a staggering value of approximately 3.83 million USD.

ETH trading analysis reveals a critical focus on the current price range of $2,920 to $3,020, where robust Ethereum support levels have emerged, suggesting potential stability as traders navigate the market.Recent on-chain analysis indicates a lull in trading activity, with the ETH trading volume falling significantly in the past 24 hours, signaling cautious investor sentiment during the holiday period.

Ethereum whale positions play a crucial role in shaping market dynamics, especially in the wake of significant events like the recent flash crash.According to on-chain analyst Ai Yi, after this downturn, whales capitalized by opening short positions while simultaneously amassing over 70,000 ETH in long positions.

The recent ETH purchase has captured the attention of both seasoned investors and newcomers alike, as a notable address just invested 8 million USDT to acquire 2,640 ETH, emphasizing vibrant Ethereum market trends.This transaction, which was monitored by on-chain analyst Ai Yi, revealed that the average price of ETH during this acquisition was approximately 3,027.33 USD.

In a significant movement within the cryptocurrency landscape, the Matrixport BTC transaction has made headlines as an address received a whopping 1001 BTC, contributing to an impressive total of 3000 BTC acquired within just 24 hours.This surge, valued at approximately 280 million dollars, underscores the growing momentum in the crypto market.

Whale investment in ETH has recently gained significant attention as savvy investors maneuver through the volatile landscape of cryptocurrencies.A noteworthy case involves a crypto whale who allocated a whopping $11.128 million to amass 3,468 ETH, revealing not just confidence in Ethereum investment but also strategic insight into ETH price strategy amid prevailing market fluctuations.